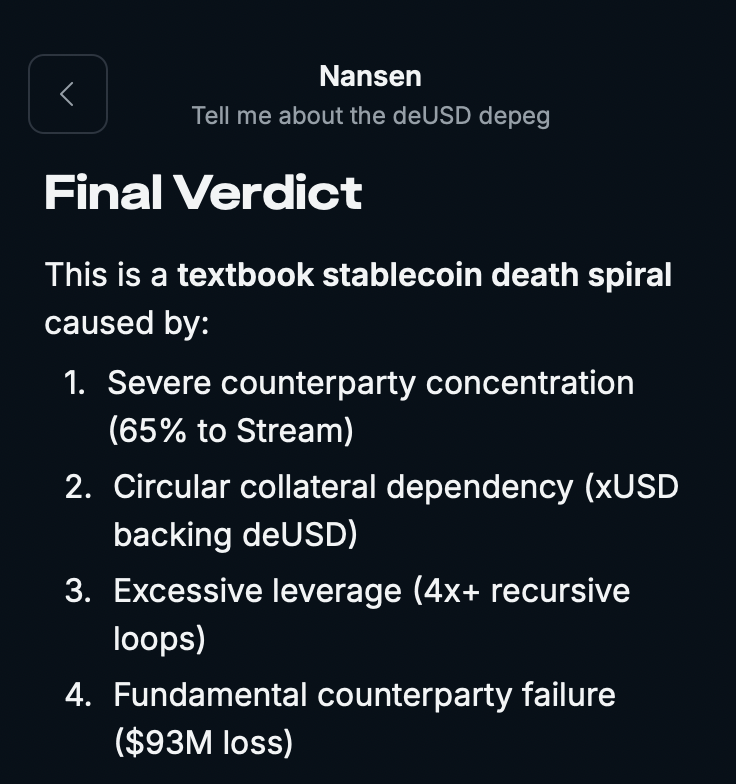

In the volatile theater of DeFi, few events expose the fragility of synthetic stablecoins like the deUSD collapse. As of the latest data, Elixir’s deUSD trades at $0.001976, a stark reminder of how quickly deUSD depeg crash risks can erase value. What began as a $93 million loss at Stream Finance snowballed into a protocol-wide meltdown, with deUSD plunging over 95% in days. This wasn’t mere market whimsy; it was a textbook liquidity crunch amplified by overleveraged collateral ties. Investors watching their positions evaporate now face a sobering question: how do you hedge against such DeFi chain reaction depeg protection scenarios before they cascade?

[price_widget: Real-time price display for Elixir deUSD (DEUSD) with 24h change, high/low at $0.001976 level]

Stream Finance’s troubles started with a rogue external fund manager’s trades gone awry, wiping out $93 million in assets. This left Stream with $285 million in debt, including $68 million to Elixir-roughly 65% of deUSD’s backing. xUSD, Stream’s yield-bearing stablecoin, depegged to $0.11 almost instantly, triggering liquidations that rippled outward. Elixir, caught in the crossfire, halted support, processed redemptions for 80% of holders, and shuttered deUSD permanently. CoinGecko tracked the freefall to $0.015 at its nadir, but today’s $0.001976 price underscores lingering distress sales.

Unraveling the Perpetual Motion Myth in Yield Strategies

DeFi’s allure often lies in these yield-bearing stablecoin machines: borrow against collateral, mint stablecoins, loop yields endlessly. Stream intertwined with deUSD to chase perpetual returns, but concentration risk turned it into a house of cards. Nansen analysis highlighted how concentrated collateralization fueled the chain reaction-one protocol’s failure yanked liquidity from another, echoing Jenga blocks tumbling. MEV Capital got obliterated, Compound felt aftershocks, and the ecosystem bled over $500 million in market cap.

Stream’s xUSD collapse wiped out MEV Capital, crashed Elixir’s deUSD, and damaged Compound. One failed protocol triggered chain liquidations. Tiger Research Reports

This exposes a deeper flaw: synthetic stablecoins like deUSD prioritize yield over resilience. Without diversified, transparent backing, they invite stablecoin liquidity crunch hedging dilemmas. Central bank policies tightening globally only heighten these pressures, as off-chain yields falter and on-chain loops overheat.

Systemic Vulnerabilities: Collateral Ties That Bind and Break

Examine the anatomy: Stream owed Elixir 65% of deUSD’s collateral. When withdrawals froze, Elixir faced a redemption run it couldn’t meet. PeckShield reported xUSD’s 77% crash, but deUSD’s descent to $0.001976 today reveals unresolved tail risks. This deUSD stablecoin failure mirrors past depegs, yet synthetic designs amplify contagion. Overreliance on a handful of borrowers creates single points of failure, where one liquidity crunch ignites protocol failures across chains.

From a macro lens, this interplay between DeFi cycles and broader markets demands scrutiny. With deUSD’s 24-hour range barely budging between $0.001962 and $0.001984, volatility has ossified into irrelevance-a warning for holders in similar setups. Portfolio resilience isn’t about chasing yields; it’s fortifying against these black swans through deliberate protocol risk insurance deUSD measures.

| Protocol | Loss Impact | Depeg Trigger |

|---|---|---|

| Stream Finance | $93M trading loss | xUSD to $0.11 |

| Elixir deUSD | 95% value loss | Collateral shortfall |

| Compound | Indirect liquidations | Chain reaction |

Strategic Hedging: Navigating Liquidity Crunches Preemptively

Hedging deUSD depeg crash isn’t reactive firefighting; it’s embedding safeguards into your core strategy. Start with diversification: cap exposure to any single synthetic stablecoin at 10-15% of stables allocation. Layer in derivatives like put options on stablecoin indices or perp shorts against yield protocols. For institutions, protocol risk insurance wrappers now offer tailored coverage against depegs below 90%.

Monitor collateral ratios rigorously-via tools tracking borrower concentrations. When Stream’s debt hit 65%, alarms should have blared. Pair this with dynamic position sizing: reduce leverage as TVL concentrates. These tactics transform potential wipeouts into managed drawdowns.

deUSD Stablecoin Price Prediction 2027-2032

Post-depeg and shutdown forecast: Short-term floor near $0.001, trending to long-term zero amid project closure, liquidity crunch, and DeFi chain reaction risks

| Year | Minimum Price | Average Price | Maximum Price | YoY Change % (Avg) |

|---|---|---|---|---|

| 2027 | $0.0010 | $0.0013 | $0.0016 | -35% |

| 2028 | $0.0007 | $0.0009 | $0.0012 | -31% |

| 2029 | $0.0004 | $0.0005 | $0.0008 | -44% |

| 2030 | $0.0002 | $0.0003 | $0.0005 | -40% |

| 2031 | $0.0001 | $0.00015 | $0.00025 | -50% |

| 2032 | $0.00001 | $0.00003 | $0.00008 | -80% |

Price Prediction Summary

deUSD is projected to stabilize briefly near a $0.001 floor in 2027 before inexorably declining to near-zero by 2032, driven by Elixir’s permanent project shutdown, collateral wipeout from Stream Finance’s collapse, and vanishing liquidity. Bullish scenarios offer negligible recovery; bearish paths accelerate to zero amid DeFi risks—no viable path to $1 peg restoration.

Key Factors Affecting deUSD Stablecoin Price

- Permanent closure of deUSD by Elixir after 95%+ depeg and 80% redemptions

- 65% collateral loss from Stream Finance’s $93M debacle and $285M debt

- Systemic DeFi interconnectedness amplifying chain liquidations and Jenga-like collapses

- Minimal trading volume and liquidity post-shutdown, trending to illiquid relic status

- Regulatory scrutiny on synthetic stablecoins curbing any revival prospects

- No technology upgrades, adoption, or market cap recovery potential in bull cycles

- Hedging implications: Serves as cautionary asset for liquidity crunch and contagion risks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Retail users can replicate this through platforms offering hedge deUSD risks perps or automated vaults that unwind at peg deviation thresholds. Consider opacity in Stream’s external manager trades; transparency mandates could have flagged the $93 million hole earlier. Yet DeFi’s permissionless ethos resists such oversight, placing the onus on users to deploy vigilant stablecoin liquidity crunch hedging frameworks.

From my two decades navigating markets, this underscores a timeless truth: leverage amplifies upside until it doesn’t. Central banks’ pivot toward normalization, post-2025 easing cycles, squeezes DeFi’s yield mirage. Stablecoins unmoored from real-economy anchors face amplified depeg vectors, demanding hedges that span on-chain and traditional realms.

DepegWatch equips you with real-time collateral dashboards and depeg probability scores, flagging risks like Stream’s debt buildup. Pair these with off-chain treasuries in T-bills for ballast. Institutions layering protocol risk insurance deUSD have contained drawdowns to single digits in simulations of similar crunches.

Building Resilient Portfolios: Beyond the deUSD Wreckage

Strategic allocation evolves here. Allocate 40-50% to battle-tested stables like USDC, with transparent reserves. Dedicate 20% to yield strategies vetted for decentralization-no single borrower dominance. The remainder? Dynamic hedges via DepegWatch derivatives, auto-triggering shorts on perp DEXes when pegs waver beyond 2%.

Opinionated take: Dismiss yield sirens promising 20% APY on synthetics; true alpha lies in asymmetry-upside capture with floored downside. deUSD holders redeeming 80% dodged total loss, but the final 20% stranded at $0.001976 illustrates tail exposure. Forward protocols must embed circuit breakers, pausing mints at undercollateralization.

Zoom out to decades: DeFi matures amid regulatory tides and monetary shifts. Elixir’s shutdown, processing redemptions amid chaos, sets a precedent for graceful exits. Yet without proactive DeFi chain reaction depeg protection, cycles of boom-bust persist. Cultivate positions that weather liquidity famines, collateral quakes, and peg fractures. DepegWatch’s analytics illuminate these paths, turning systemic threats into arbitraged opportunities.

Stream’s perpetual motion unraveled, but savvier architects await. Position accordingly-not for the next deUSD, but the ecosystem that outlives it.

[price_comparison: deUSD at $0.001976 vs USDC/USDT stability metrics, collateral ratios, and depeg risk scores for hedging insights]