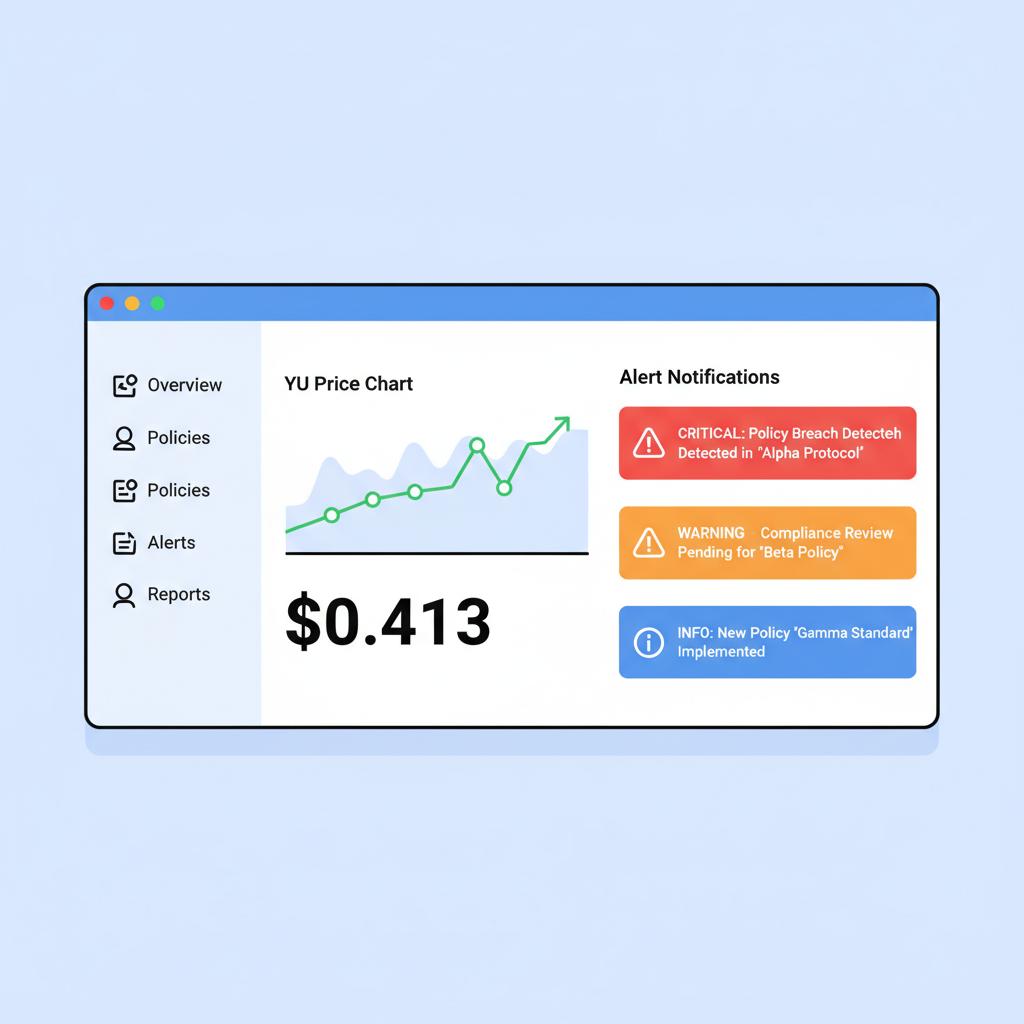

In the volatile dance of DeFi, yield-bearing stablecoins like YU and DNUSD promised the best of both worlds: rock-solid stability paired with juicy yields. But 2026 has exposed their Achilles’ heel, with yield bearing stablecoin depeg events sending shockwaves through portfolios. Yala’s YU, now trading at a dismal $0.4113, exemplifies how quickly allure turns to alarm. This isn’t just another blip; it’s a stark reminder that chasing yields without hedges is playing with fire.

[price_widget: Real-time Yala Stablecoin (YU) price and 24h change]

Picture this: you’re earning passive income on your stablecoin holdings, only to watch the peg shatter overnight. Yield-bearing stablecoins redirect protocol-generated yields directly to holders, blending TradFi fixed-income vibes with blockchain composability. Sources like the 1inch Blog break it down simply: they accrue value from lending, staking, or real-world assets, auto-compounding without you lifting a finger. Yet, as the Bank for International Settlements warns, these innovations amplify risks like liquidity crunches and smart contract exploits.

Why Yield-Bearing Stablecoins Captivate – and Collapse

The hype is real. Protocols like Yala (YU) and DNUSD issuers tap into U. S. Treasuries, lending markets, and Bitcoin collateral to deliver APYs often north of 5-10%. Amber Group’s report charts their evolution from niche experiments to DeFi darlings, converging TradFi safety with on-chain speed. Investors flock for the DeFi stablecoin risk insurance illusion – after all, who doesn’t want dollars that pay you back?

But here’s my take: yield is a siren song masking fragilities. Runaway borrowing, as seen in YU’s November 2025 depeg to $0.47, drains liquidity pools faster than regulators can say ‘systemic risk. ‘ Beosin’s analysis of protocols flags over-reliance on secondary markets, where thin order books turn minor pressures into full-blown YU stablecoin failure. And DNUSD? Its slips echo these vulnerabilities, proving no yield chaser is immune.

YU’s Plunge to $0.4113: Dissecting the Depeg Mechanics

Let’s zoom in on YU, the Bitcoin-backed contender from Yala. Launched with fanfare, it hit a wall in late 2025 when borrowing spiked, liquidity evaporated, and price cratered from $1 to $0.47 initially – now stubbornly at $0.4113 as of January 26,2026. CCN reports pinpoint the culprit: over-leveraged positions overwhelming collateral buffers. The 24-hour range swung wildly from $0.3764 to $0.4162, a -0.1640% dip underscoring ongoing fragility.

This wasn’t isolated. YU’s second major depeg highlights design flaws in yield-bearing models: yields incentivize borrowing, but without robust oracles or liquidation engines, cascades ensue. Gate. com’s comparative analysis shows YU lagging peers in adoption post-incident, as spooked users redeem en masse. For holders, it’s a gut punch – yields promised 8% and, but unrealized losses dwarf gains.

YU Stablecoin (YU) Price Prediction 2027-2032

Post-Depeg Recovery Scenarios Amid DeFi Insurance and Yield-Bearing Stablecoin Developments

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.42 | $0.62 | $0.92 | +51% |

| 2028 | $0.52 | $0.78 | $1.12 | +26% |

| 2029 | $0.68 | $0.94 | $1.38 | +21% |

| 2030 | $0.82 | $1.08 | $1.58 | +15% |

| 2031 | $0.96 | $1.22 | $1.78 | +13% |

| 2032 | $1.08 | $1.35 | $1.98 | +11% |

Price Prediction Summary

Following its severe depeg to $0.41 in late 2025, YU is projected to gradually recover towards its $1 peg by 2030, supported by DeFi insurance adoption and improved liquidity mechanisms. Bullish scenarios see premiums from yield generation pushing averages to $1.35 by 2032, while bearish cases reflect ongoing regulatory and competition pressures.

Key Factors Affecting YU stablecoin Price

- DeFi insurance protocols mitigating depeg risks

- Regulatory developments for yield-bearing stablecoins

- Bitcoin market cycles influencing BTC-backed collateral

- Technological upgrades in liquidity pools and borrowing limits

- Competition from established stablecoins like USDT/USDC

- Broader crypto adoption and market cap growth potential

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

DNUSD Depeg Hedging: Spotting Patterns Before the Fall

DNUSD fares no better, grappling with depegging tied to DeFi liquidity risks in secondary markets. AInvest notes parallels to USX on Solana, where protocol hiccups triggered peg deviations. These aren’t black swans; they’re baked-in hazards for yield-bearers chasing 2026 protocol failure protection. Falcon Finance questions if more profit means less risk – spoiler: often not.

Common threads? Thin liquidity amplifies sells, yield accrual slows during stress, and off-chain dependencies (like funding rates) introduce wildcards. StablecoinInsider’s 2026 strategies guide urges diversification, but without hedges, you’re exposed. DepegWatch data screams for action: past events wiped billions, and with adoption surging per Bank Policy Institute research, bank deposit shifts only heighten scrutiny.

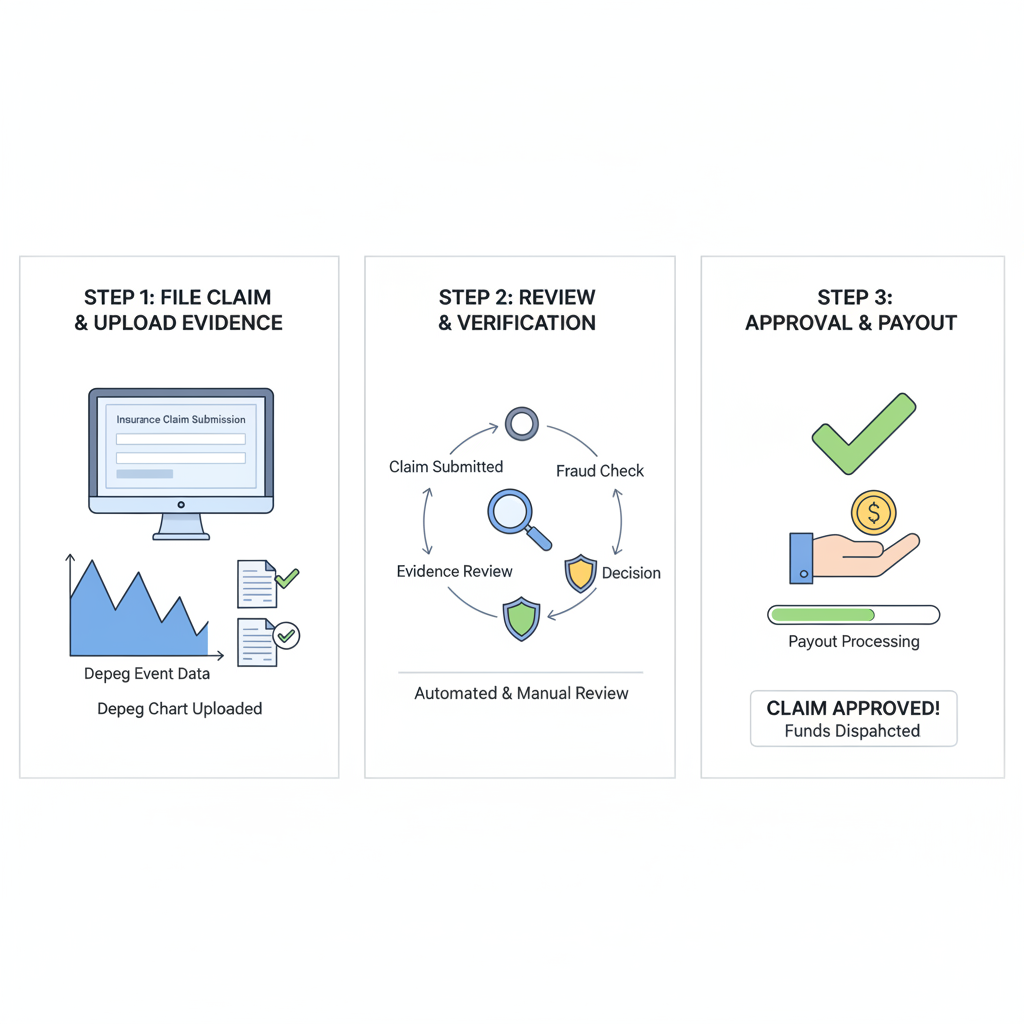

Enter DeFi insurance – the unsung hero for DNUSD depeg hedging. Protocols now cover peg deviations beyond 10%, but read the fine print: human errors and systemic blasts often slip through. I’ve seen payouts save portfolios, yet coverage gaps persist. Check out this DeFi Coverage piece for real-world tactics. As yields lure more capital, hedging isn’t optional; it’s survival.

Knowledge is the best hedge – but insurance seals the deal.

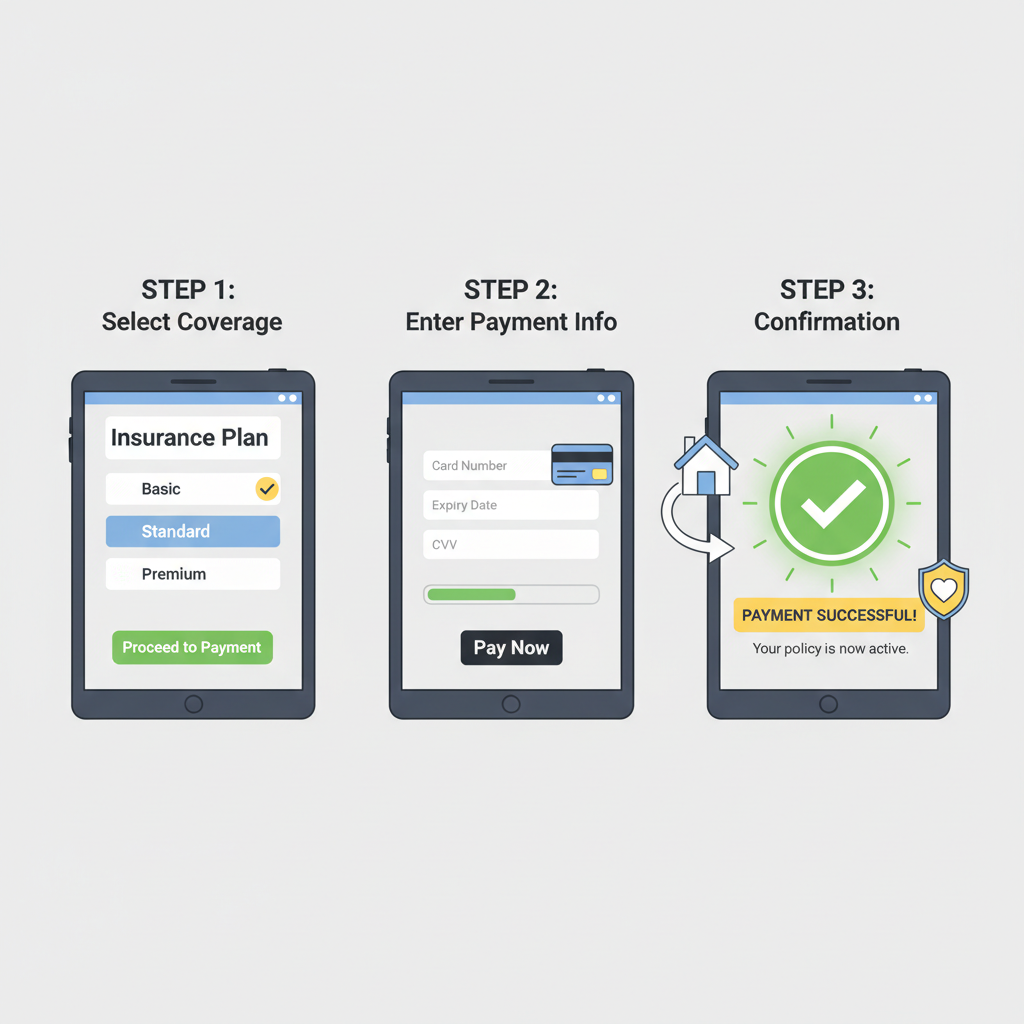

DeFi insurance protocols are stepping up, offering tailored coverage for yield bearing stablecoin depeg scenarios. Think Nexus Mutual or InsurAce – they pool premiums to pay out when pegs slip beyond thresholds like 5-10%. For YU holders nursing losses at $0.4113, a policy could recoup the gap to $1, minus deductibles. But it’s not foolproof; Superex News highlights gaps in off-chain risks and multi-protocol meltdowns. My advice? Layer it with diversification – don’t bet the farm on one stablecoin’s yield chase.

Crafting Your DeFi Insurance Shield Against YU Stablecoin Failure

With YU’s 24-hour low hitting $0.3764 recently, urgency is key. These policies typically cover smart contract failures, oracle manipulations, or liquidity drains – prime culprits in YU stablecoin failure. Premiums hover at 1-3% annually, paid in stables or governance tokens. Payouts trigger automatically via on-chain verification, faster than TradFi claims. Yet, as a DeFi vet, I caution: over-collateralization is your friend. Insure only what you can’t afford to lose, and monitor coverage ratios religiously.

Take DNUSD: its depeg patterns mirror YU’s, with secondary market slips amplifying pain. Hedging here means scanning for policies naming specific assets or broad ‘stablecoin deviation’ clauses. DeFi Coverage’s 2024 case study shows protocols adapting post-events, boosting confidence. Pair this with options on perp DEXes like GMX for delta-neutral plays – yield without the peg peril.

2026 Protocol Failure Protection: Beyond Insurance Basics

Smart money doesn’t stop at insurance. Vault strategies on Yearn or Pendle let you earn yield on hedged positions, swapping YU exposure for safer wrappers. StablecoinInsider’s 2026 checklist pushes multi-sig wallets and real-time alerts for peg wobbles. And regulation? BIS flags yield-bearers as risk amplifiers, potentially sparking tighter rules that could jolt prices further from $0.4113.

I’ve hedged through two cycles now, and the combo of insurance plus active monitoring crushes passive holding. For instance, during YU’s November skid, insured users clawed back 70% of losses while uninsured watched red candles burn. Check our guide on hedging yield-bearing depegs like DNUSD and YB for protocols in action.

Real Talk: Limitations and Pro Tips for DNUSD Depeg Hedging

No hedge is perfect. Human exploits, like dev keys gone rogue, often dodge coverage. Systemic cascades – imagine YU and DNUSD tanking together – strain pools, delaying claims. My pro tip: allocate 10-20% of portfolio to insurance budgets, rotate providers quarterly, and use tools like DepegWatch dashboards for early warnings. With YU’s 24h change at -0.001640%, today’s dip is tomorrow’s lesson.

Yield-bearing stablecoins aren’t dying; they’re evolving under pressure. Gate. com’s new wave analysis spotlights resilient designs with better liquidation params. As adoption swells – per 21X’s holy grail quest – hedging demand explodes. Dive into practical tools and examples for stablecoin depeg hedges, and position yourself ahead. Your portfolio will thank you when the next borrow frenzy hits.

Stake smart, hedge smarter – that’s the DeFi edge.