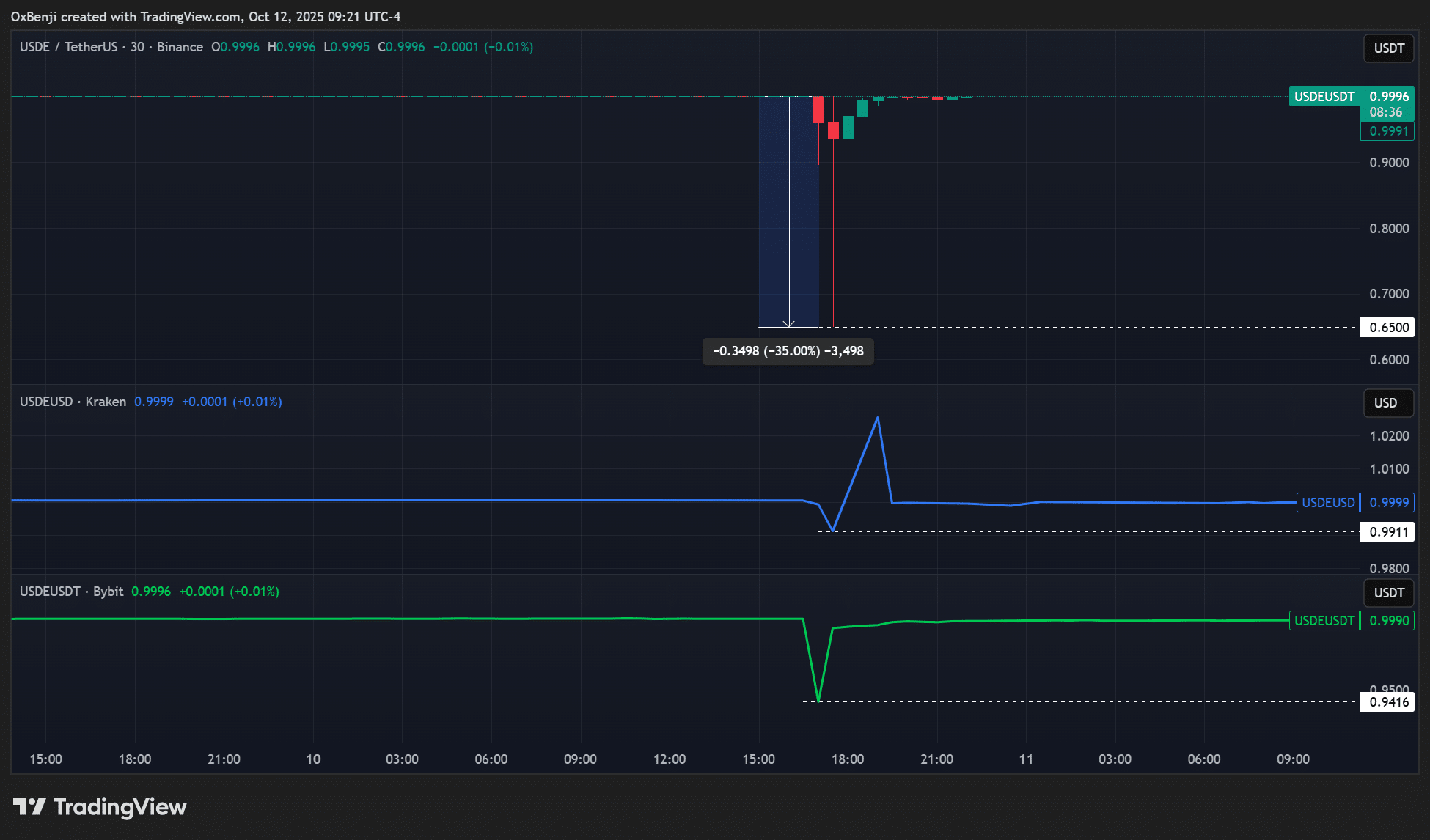

Stablecoins are the backbone of decentralized finance (DeFi), acting as the closest thing crypto has to “cash in the bank. ” Yet, their stability is not a given. Recent events have shown that even the most sophisticated stablecoin protocols can falter under certain conditions, exposing users to abrupt losses and systemic risk. The October 2025 USDe incident on Binance, where prices plummeted to $0.65, is a fresh reminder that depegs are not theoretical risks, they are real, recurring events with tangible consequences.

USDe’s $0.65 Binance Incident: Market Liquidity and Oracle Risk in Action

The Ethena USDe event stands out as a textbook case of how liquidity shocks and technical design flaws can converge into a dramatic depeg. On October 11,2025, USDe, a synthetic stablecoin designed to track the dollar, briefly traded as low as $0.65 on Binance. This was not merely a fleeting price blip; it was a microcosm of modern DeFi fragility.

What triggered this extreme move? First, market-wide panic sent crypto into risk-off mode after global macro headlines rattled investor confidence. Heavy selling pressure overwhelmed available liquidity on centralized venues like Binance. At the same time, oracles feeding price data into DeFi protocols lagged behind actual market movements, compounding volatility and triggering automated liquidations across lending platforms.

While some argue that this was not a “true” depeg, since off-chain liquidity dried up faster than on-chain mechanisms could respond, the reality for traders was stark: those who needed to exit quickly faced steep losses well below $1 per token. The episode underscores how market structure and oracle design can create short-term but severe dislocations in stablecoin pricing.

Protocol-Level Vulnerabilities: Flawed Delta-Neutral Hedging and Inadequate Reserves

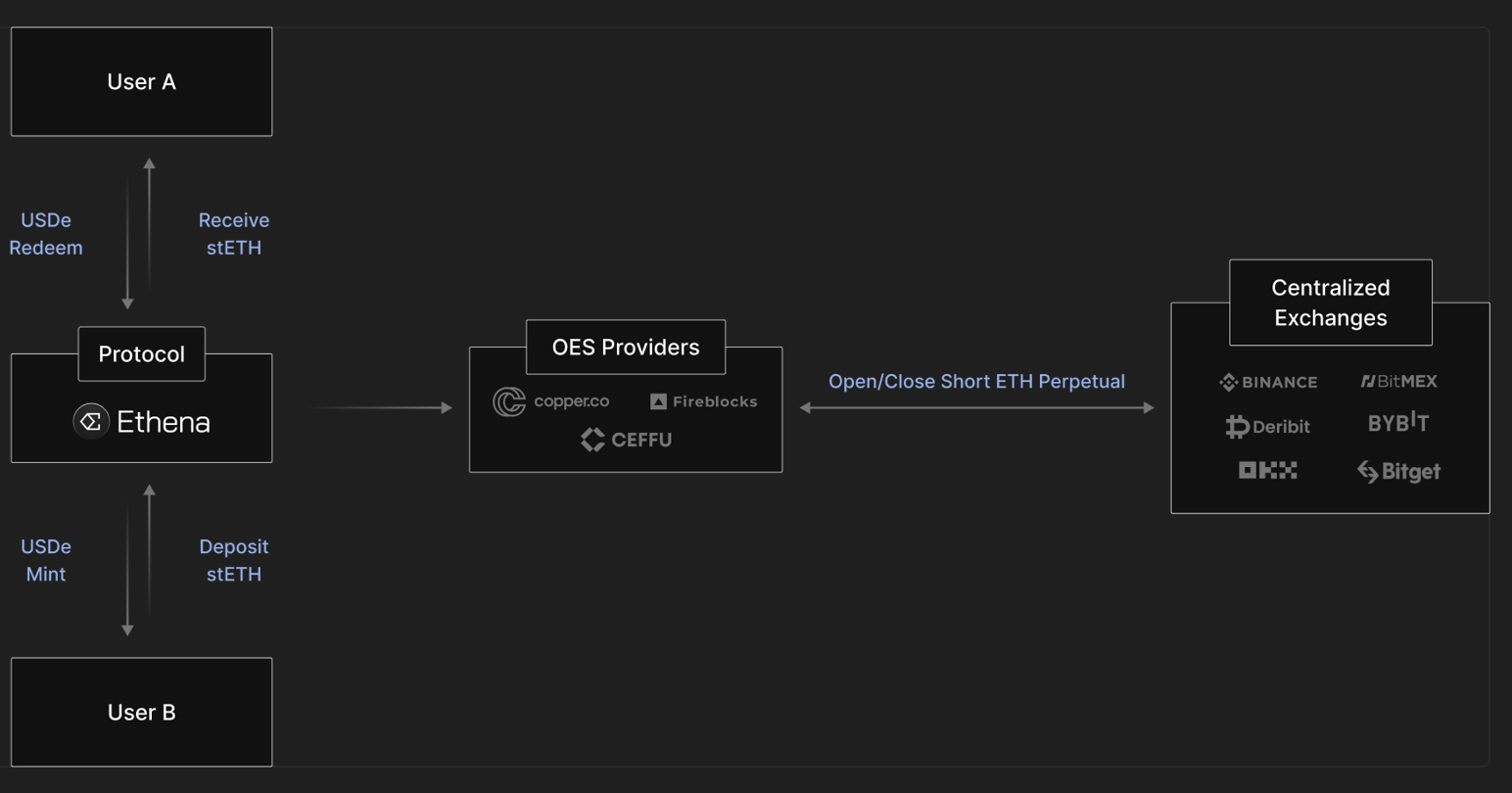

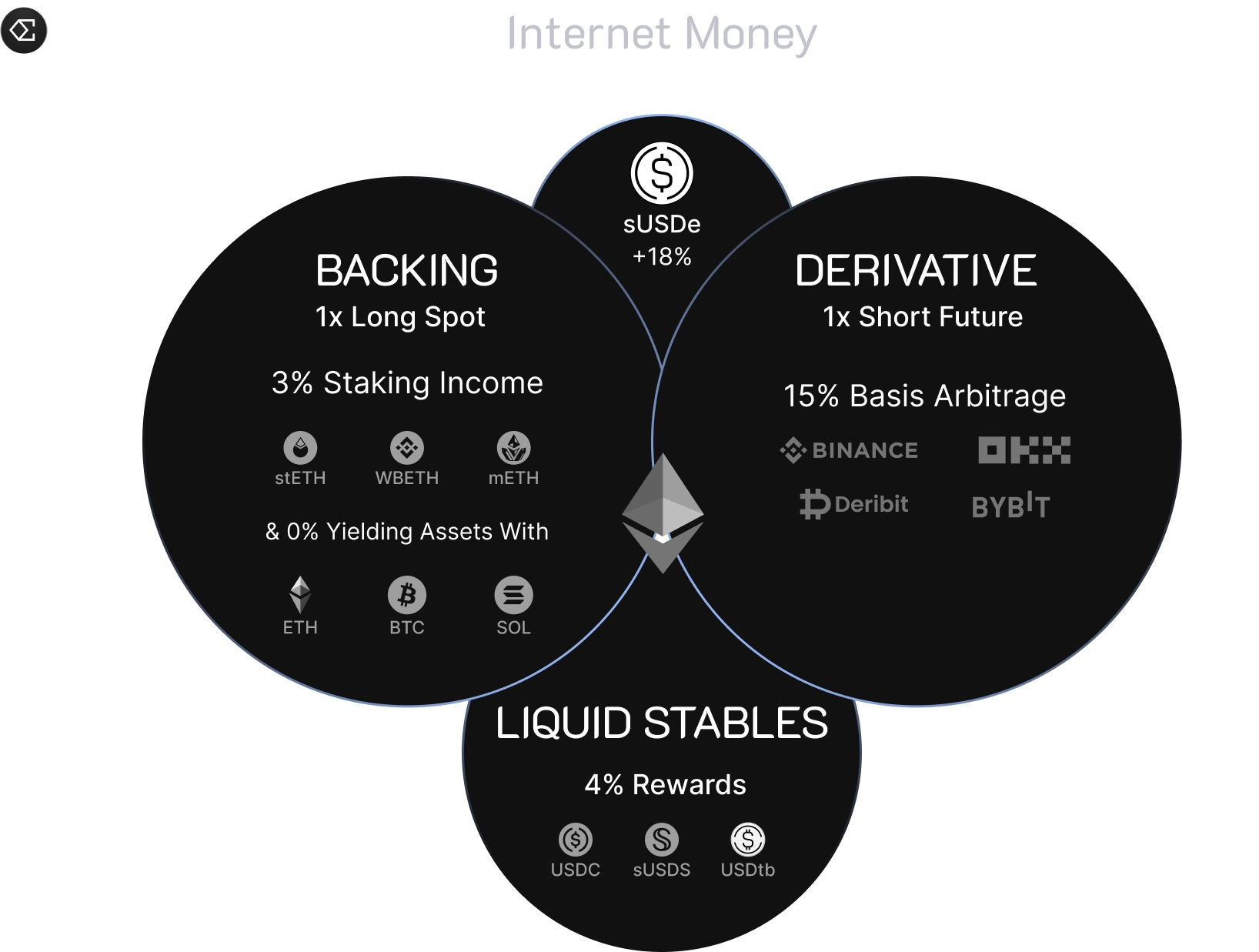

Diving deeper into protocol mechanics reveals why USDe’s design became its Achilles’ heel during stress conditions. Unlike fiat-backed coins such as USDC or overcollateralized models like DAI, USDe relied heavily on delta-neutral hedging strategies using Ethereum derivatives. In theory, this approach should insulate its peg from market swings by balancing spot ETH holdings with short positions in perpetual futures.

The flaw? Delta-neutral hedging is only as robust as its underlying assumptions about liquidity and funding rates. When panic swept through markets and large institutional players were liquidated en masse, derivative markets themselves became unstable, causing slippage in hedges and draining reserves meant to backstop redemptions. As reserves thinned out and hedges failed to keep pace with real-world price action, confidence evaporated, amplifying redemptions and fueling further depegging pressure.

This isn’t just academic hindsight; it’s a lesson echoed by previous algorithmic stablecoin failures such as TerraUSD (UST). Protocol-level vulnerabilities, especially around reserve management and dynamic hedging, remain an existential risk for any synthetic stablecoin model operating at scale.

Hedging Stablecoin Depeg Risk: Using DeFi Insurance and Derivative Products

If there’s one takeaway for investors navigating these turbulent waters, it’s that proactive risk mitigation is essential. Fortunately, DeFi now offers an expanding toolkit for hedging against stablecoin depegs:

Top DeFi Solutions for Stablecoin Depeg Protection

-

USDe’s $0.65 Binance Incident: Market Liquidity and Oracle RiskIn October 2025, Ethena’s USDe stablecoin briefly plunged to $0.65 on Binance during a sharp market sell-off. This event was triggered by a cascade of liquidations and highlighted the dangers of thin order book liquidity and oracle price discrepancies—where the reported price diverges from true market value. Even though USDe later recovered, this incident underscores the urgent need for robust liquidity and accurate price feeds in DeFi.

-

Protocol-Level Vulnerabilities: Flawed Delta-Neutral Hedging and Inadequate ReservesAlgorithmic stablecoins like USDe and TerraUSD (UST) have suffered from flawed delta-neutral hedging strategies and insufficient reserves. When collateral or hedging mechanisms fail—due to market volatility or design flaws—protocols can’t maintain their peg, leading to rapid devaluation. The collapse of UST in 2022 and the USDe incident in 2025 both illustrate how protocol-level weaknesses can destabilize entire ecosystems.

-

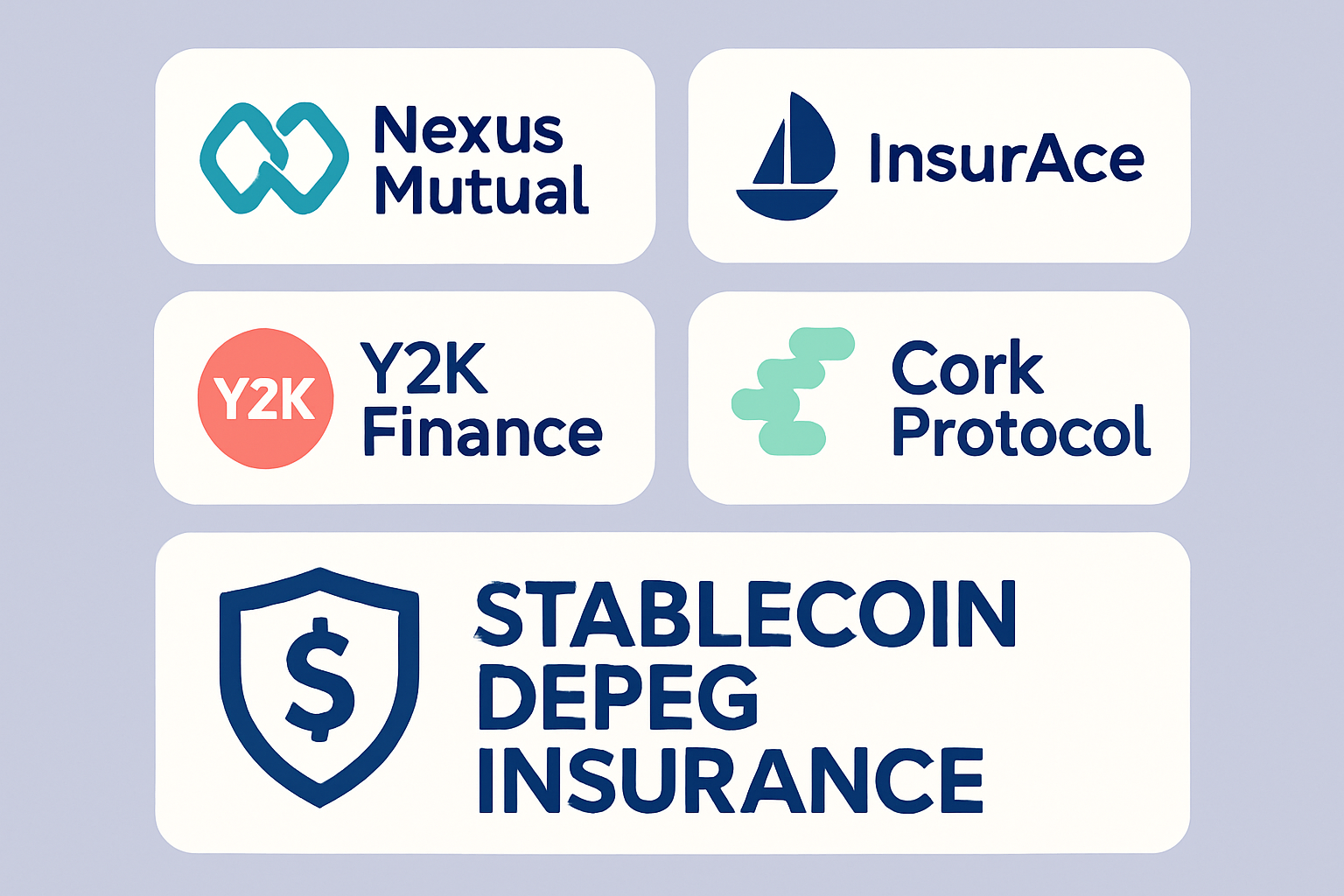

Hedging Stablecoin Depeg Risk: Using DeFi Insurance and Derivative ProductsDeFi users can mitigate depeg risks by leveraging on-chain insurance protocols such as Nexus Mutual, InsurAce, and Unslashed, which offer coverage for stablecoin depeg events. Additionally, depeg derivatives and structured products from platforms like Y2K Finance and Cork Protocol allow users to hedge or speculate on stablecoin stability, providing strategic protection against sudden peg losses.

- On-chain insurance providers: Platforms like Nexus Mutual or InsurAce allow users to purchase coverage against specific depeg events, offering compensation if a covered incident occurs.

- Structured derivatives: Protocols such as Y2K Finance or Cork Protocol enable users to buy options or participate in prediction markets tied directly to the probability of a stablecoin losing its peg.

By leveraging these tools, and staying vigilant through analytics platforms like DepegWatch. com, investors can build resilience into their portfolios even when protocol-level risks emerge without warning. For further reading on actionable strategies tailored to current market realities, see this guide on hedging against stablecoin depeg risk.

But the real edge comes from understanding that no single hedge is a panacea. Even the most sophisticated insurance contracts or derivatives are only as reliable as the protocols and counterparties behind them. During the USDe incident, for example, some on-chain insurance pools saw their own liquidity strained, and derivative pricing models struggled to keep up with the pace of volatility. This highlights the need for a multi-layered approach to stablecoin risk mitigation, one that combines risk transfer, active monitoring, and dynamic rebalancing.

Dynamic Risk Management in Practice

Seasoned DeFi users now routinely blend several strategies to protect against depeg shocks. Diversification across stablecoins with different collateral models, fiat-backed, crypto-backed, and algorithmic, remains foundational. But increasingly, users are layering on predictive analytics, automated alerts, and active participation in insurance and derivative markets. The goal: to spot early warning signs and act before liquidity evaporates or redemptions are gated.

It’s also important to recognize that risk is not static. Protocol-level parameters, reserve transparency, and even regulatory actions can shift overnight. The October 2025 USDe event, with its $0.65 print on Binance, was preceded by subtle signals: widening spreads, abnormal funding rates, and spikes in on-chain redemption requests. Platforms like DepegWatch. com aggregate these signals, empowering users to take preemptive action, whether that means rotating into more resilient stablecoins or purchasing short-term depeg protection.

Strategic Takeaway: The best defense isn’t just buying insurance after the fact, it’s building a system for continuous risk assessment and rapid response.

Lessons for the Next Cycle: Portfolio Resilience and Market Discipline

The USDe episode is a wake-up call for all participants in DeFi. Liquidity can vanish in minutes, oracles can misfire, and protocol-level hedges can unravel just when they are needed most. For institutions and retail users alike, the path forward requires humility: assume every peg can break, and structure your portfolio accordingly.

To recap, here are the critical lessons from recent events:

Key Takeaways from the USDe Depeg & Hedging Steps

-

USDe’s $0.65 Binance Incident: On October 11, 2025, Ethena’s USDe stablecoin briefly dropped to $0.65 on Binance during a sharp crypto market sell-off. This dramatic price swing was triggered by market liquidity shocks and oracle price update delays, highlighting how even algorithmic stablecoins can experience severe, if temporary, deviations from their intended $1 peg.

-

Protocol-Level Vulnerabilities: The USDe event exposed critical risks in delta-neutral hedging strategies and inadequate reserve management. Ethena’s reliance on spot Ethereum and derivatives failed to maintain stability under stress, showing that flawed protocol design or insufficient collateral can quickly unravel a stablecoin’s peg.

-

Hedging Stablecoin Depeg Risk: DeFi users can mitigate depeg exposure by using on-chain insurance platforms like Nexus Mutual and InsurAce, or by trading depeg derivatives on platforms such as Y2K Finance and Cork Protocol. These tools provide coverage or profit opportunities if a stablecoin loses its peg, empowering users to actively manage risk.

- Monitor liquidity and oracle health in real time, don’t wait for headlines.

- Favor stablecoins with transparent, auditable reserves and robust, stress-tested hedging mechanisms.

- Actively use DeFi insurance and depeg derivatives to transfer risk before volatility strikes.

- Stay informed with analytics platforms like DepegWatch. com to enable rapid, data-driven decisions.

For those seeking a deeper dive into hands-on strategies and protocol-specific risk profiles, explore our comprehensive analysis at How to Hedge Against Stablecoin Depegs in DeFi: Tools, Strategies, and Real-World Examples.

Ultimately, the future of stablecoin investing will be shaped by those who treat risk management not as an afterthought, but as a discipline. As DeFi matures, so too must our approach to safeguarding capital, because in crypto, stability is always earned, never assumed.