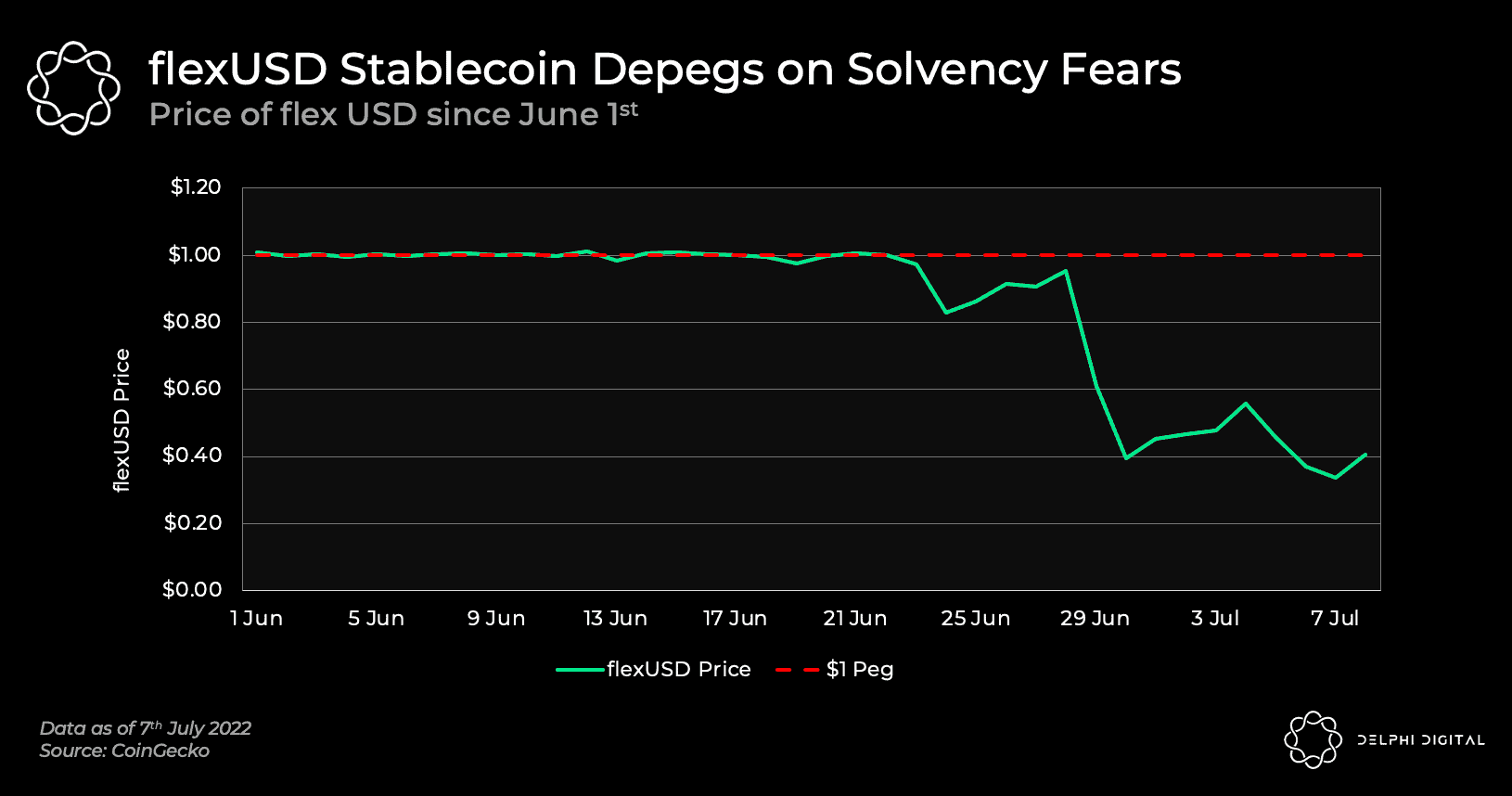

Stablecoins are the backbone of DeFi, but their perceived safety can mask deep structural risk. When a stablecoin like USDT, USDC, or DAI loses its peg, the consequences ripple across protocols, portfolios, and even the broader crypto market. In the wake of the TerraUSD (UST) collapse, the market has become acutely aware that stablecoin depeg hedging is not just an academic exercise but a necessity for resilient DeFi participation.

Why Hedging Stablecoin Depeg Risk Matters in 2025

Despite improvements in transparency and collateral management, stablecoins remain vulnerable to market panic, regulatory shocks, or protocol failures. Recent market events have shown that even “safer” stablecoins can briefly slip below $1.00, triggering liquidations and portfolio drawdowns. For DeFi users, having a toolkit of DeFi risk management tools is no longer optional.

Let’s examine three actionable strategies to hedge against stablecoin depegs, with a focus on practical tools, insurance protocols, and a real-world trading example that every serious DeFi participant should understand.

1. Trading Depeg Risk Derivatives on Synthetix and Cork Protocol

Prediction markets and derivatives are emerging as the most direct way to hedge stablecoin risk in DeFi. Platforms like Synthetix and Cork Protocol now offer contracts that pay out if a stablecoin (such as USDT) falls below its $1.00 peg. These contracts function similarly to credit default swaps in traditional finance, allowing users to price and trade depeg risk in real time.

- Suppose you’re concerned about USDT stability following regulatory news. You can take a short position on a USDT/USD perpetual contract. If USDT trades at $0.97, your hedge pays off, offsetting portfolio losses.

- Cork Protocol, for example, lets users both speculate on and hedge against depeg scenarios, creating a market-driven consensus on the probability of a depeg event.

This approach is especially valuable for sophisticated investors and DAOs managing large treasuries. For a deeper dive, see our guide on using crypto derivatives for depeg risk.

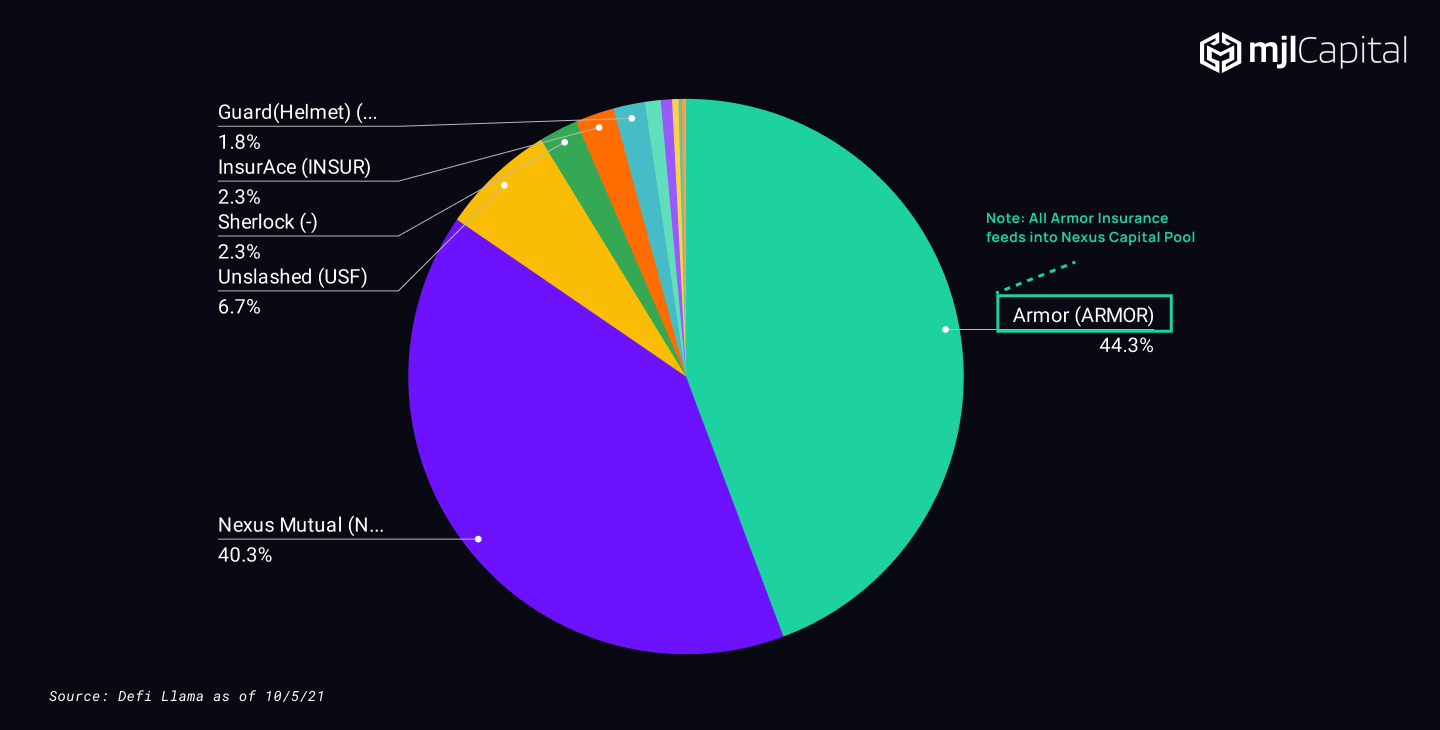

2. Stablecoin Depeg Insurance: Nexus Mutual and InsurAce

For those seeking a more passive, hands-off approach, crypto insurance for depegs is increasingly accessible. Protocols like Nexus Mutual and InsurAce offer decentralized insurance policies that compensate users if a covered stablecoin loses its peg beyond a set threshold (e. g. , below $0.98 for more than 24 hours). These products are available to both retail and institutional investors, providing a safety net for yield farmers, DAOs, and anyone with significant stablecoin exposure.

- Policies are underwritten by decentralized pools, reducing counterparty risk.

- Payouts are typically automated and verifiable on-chain, ensuring transparency.

- Premiums reflect real-time market risk, so costs may spike during periods of stress, timing matters.

Insurance alone is not a silver bullet, but it’s a crucial layer in a comprehensive stablecoin depeg risk management stack.

Top 3 Stablecoin Depeg Hedging Tools in DeFi

-

Depeg Risk Derivatives on Platforms like Synthetix and Cork Protocol: Trade or hedge against stablecoin depegs using derivatives contracts that pay out if a stablecoin (e.g., USDT) falls below its peg. These markets enable users to price depeg risk in real time and take protective positions, offering both speculation and portfolio insurance for advanced DeFi users.

-

Stablecoin Depeg Insurance via Nexus Mutual or InsurAce: Purchase decentralized insurance policies that compensate for losses if a covered stablecoin depegs beyond a certain threshold. Nexus Mutual and InsurAce provide on-chain coverage, offering peace of mind and portfolio protection for both retail and institutional users.

-

Real-World Hedging Example – Borrow-and-Swap Strategy: In the event of a suspected depeg (e.g., USDT), borrow the at-risk stablecoin, immediately swap it for a safer asset (like USDC or DAI), and repay the loan after the depeg, profiting from the price difference. This tactical strategy was widely discussed during the UST collapse in 2022 as a way to turn risk into opportunity.

3. Real-World Hedging Example: The Borrow-and-Swap Playbook

During the UST depeg crisis in 2022, savvy traders employed a classic borrow-and-swap strategy. Here’s how it works:

- Borrow the at-risk stablecoin (e. g. , USDT) on a lending protocol.

- Immediately swap it for a more robust asset (such as USDC or DAI) while the peg holds.

- If the depeg materializes (USDT drops to $0.95), repurchase USDT at the lower price to repay the loan, locking in the spread as profit.

This approach is not without risks (liquidity, slippage, protocol reliability), but it remains the most direct way to profit from or hedge against a stablecoin peg failure. For a step-by-step breakdown, see our detailed strategy guide.

The borrow-and-swap maneuver is a staple in the playbook of advanced DeFi users, especially during periods of market stress. It’s a strategy that requires speed, discipline, and a deep understanding of protocol mechanics, but when executed correctly, it can provide a meaningful hedge or even generate alpha during a depeg event.

“In the UST collapse, those who borrowed UST and swapped to USDC before the panic fully set in were able to cover their loans at a significant discount post-depeg. The key was acting before the market consensus shifted. “

Notably, this isn’t just theory: the borrow-and-swap was discussed extensively on DeFi forums and Twitter as the TerraUSD crisis unfolded. It’s a testament to the creativity and adaptability of the DeFi community in the face of extreme volatility.

Putting It All Together: Building a Robust Depeg Hedging Stack

No single tool or strategy is sufficient in isolation. The most resilient DeFi portfolios layer multiple forms of protection:

- Derivatives provide real-time, market-driven hedging and are ideal for active risk managers.

- Insurance protocols offer peace of mind and passive coverage for longer-term holders.

- Tactical trading strategies like borrow-and-swap allow for dynamic responses to emerging threats.

Combining these approaches creates a diversified risk shield that can absorb shocks from both unexpected depeg events and broader market contagion. The goal is not just to survive the next stablecoin crisis but to emerge stronger and more opportunistic when others are forced to sell in panic.

Staying Ahead: Monitoring and Execution

Effective hedging is as much about timing and vigilance as it is about the tools themselves. Real-time analytics platforms, such as DepegWatch. com, can alert you to early signs of peg instability, allowing you to deploy your hedges before the crowd reacts. Automated execution, pre-set alerts, and on-chain monitoring are vital for reducing response time and slippage.

As stablecoins continue to serve as the settlement layer of DeFi, the sophistication of depeg risk management will only grow. The lessons from UST are clear: don’t wait for the headlines. Proactive hedging is now table stakes for anyone serious about protecting capital in this ecosystem.

For an in-depth comparison of these approaches, and more real-world examples, visit our resource hub: How to Hedge Against Stablecoin Depeg Events: Tools, Strategies, and Real-World Examples.