Stablecoins have become the backbone of decentralized finance (DeFi) in 2025, powering everything from lending protocols to on-chain payments. Yet with over 600 depeg incidents for major fiat-backed stablecoins recorded last year, risk management is no longer optional, it’s essential. As the DeFi landscape matures, investors are turning to a new generation of tools and protocols designed specifically to hedge stablecoin depeg risk. This guide spotlights three of the most effective solutions available today: DeFi insurance protocols, advanced liquidity pools with real-time peg monitoring, and decentralized derivatives platforms. Whether you’re a retail user or an institution managing significant capital, these strategies are foundational for navigating the evolving world of crypto risk.

Why Stablecoin Depeg Risk Demands Proactive Hedging in 2025

Stablecoins are engineered to hold their value, usually at $1, but market shocks, regulatory changes, or protocol failures can trigger sudden depegs. In 2025, even the biggest names aren’t immune. A single depeg event can cascade through interconnected DeFi protocols, impacting lending markets, liquidity pools, and collateralized positions across multiple chains.

Recent research highlights several persistent threats: algorithmic instability in certain coins, liquidity crunches during market stress, and smart contract exploits targeting stablecoin treasuries. For those seeking to hedge stablecoin depeg exposure or build robust stablecoin depeg risk management frameworks, it’s critical to leverage purpose-built tools rather than rely on luck or simple diversification.

Nexus Mutual and InsurAce: DeFi Insurance Protocols for Stablecoin Depeg Risk

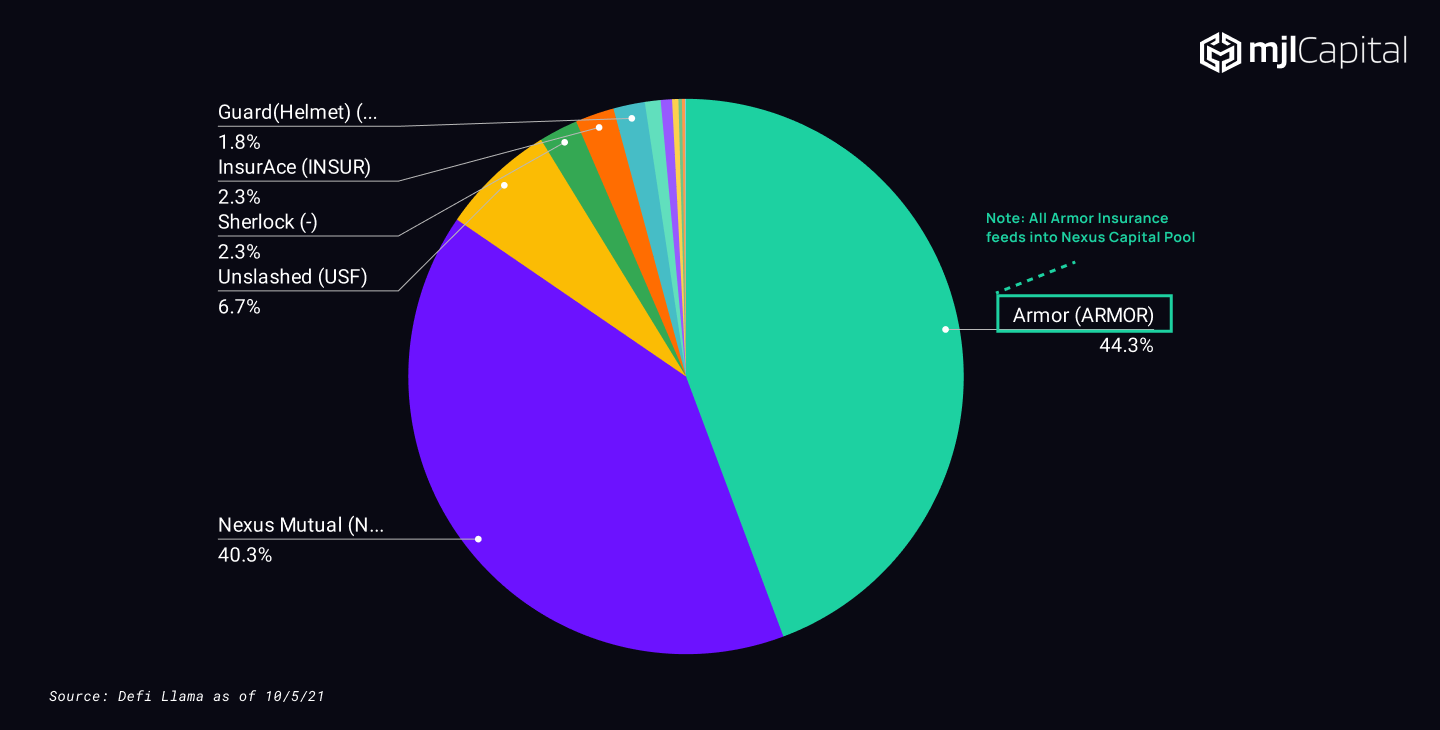

The rise of DeFi insurance protocols marks a turning point in how investors protect themselves from catastrophic events like stablecoin depegs. Nexus Mutual and InsurAce have emerged as industry leaders by offering customizable coverage against both protocol failures and specific depeg risks.

- Nexus Mutual: Provides claim-based insurance products that compensate users if a covered stablecoin loses its peg below a predefined threshold (e. g. , below $0.98 for more than 24 hours). Policies can be tailored by amount and duration, ideal for those with large USDT or USDC holdings locked in DeFi strategies.

- InsurAce: Offers pooled coverage for multiple assets including DAI, USDT, USDC, and even algorithmic coins. Its transparent claims process is governed by token holders who vote on payout legitimacy, a strong fit for DAOs or institutions seeking risk transfer without centralized intermediaries.

The cost of coverage is typically calculated as a percentage of insured value per year (for example: insuring $10,000 worth of USDC might cost $50-$100 annually depending on prevailing risk levels). While not every event will result in a payout, claims must meet specific criteria, these protocols add an invaluable layer of security atop your core portfolio.

Curve Finance’s 3Pool/4Pool: Advanced Liquidity Pools with Peg Monitoring and Automated Rebalancing

If you’re looking to earn yield while actively mitigating depeg exposure, Curve Finance’s flagship pools are essential tools for 2025. The 3Pool (USDT/USDC/DAI) and 4Pool (USDT/USDC/DAI/TUSD) aggregate massive liquidity across multiple leading stablecoins, and now feature built-in peg monitoring dashboards that alert users when any coin drifts off target.

How does this help you hedge?

- Peg Monitoring: Real-time analytics flag deviations from $1 so you can rebalance your holdings or exit positions before losses compound.

- Automated Rebalancing: Curve’s smart contracts automatically adjust pool weights to maintain optimal balance, if one coin starts losing its peg, your exposure is dynamically reduced without manual intervention.

- Earning Fees: By providing liquidity to these pools, you collect trading fees that can offset minor losses during brief dislocations, a passive yet powerful way to enhance overall returns while reducing downside risk.

This approach works especially well when combined with other hedging solutions like insurance or derivatives. For more on constructing diversified strategies using Curve’s pools alongside other DeFi primitives, see our deep dive at this link.

Top 3 Hedging Solutions Against Stablecoin Depegs (2025)

-

Nexus Mutual & InsurAce: Leading DeFi insurance protocols offering specialized coverage for stablecoin depeg events. Users can purchase policies that pay out if a covered stablecoin (like USDT or USDC) loses its peg, providing direct financial protection against sudden losses. Both platforms feature transparent claim processes and on-chain policy management, making them essential risk mitigation tools for DeFi investors.

-

Curve Finance’s 3Pool/4Pool: Advanced stablecoin liquidity pools with built-in peg monitoring and automated rebalancing. Curve’s pools aggregate liquidity for major stablecoins (like USDT, USDC, DAI, and TUSD), allowing users to earn trading fees while benefiting from real-time peg analytics and rebalancing mechanisms that help maintain stability during volatility.

-

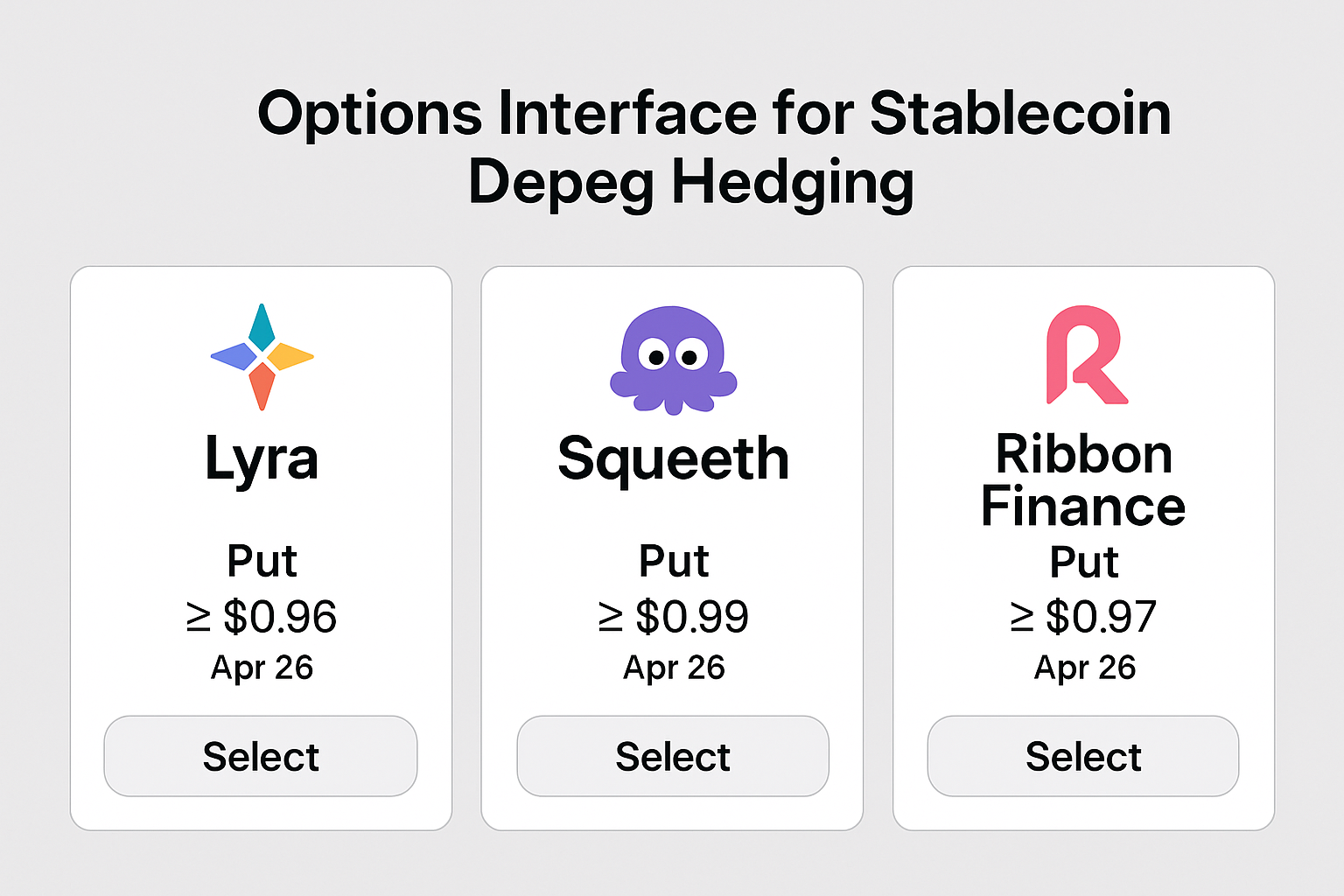

Stablecoin Depeg Hedging Derivatives: Decentralized platforms such as Lyra, Squeeth, and Ribbon Finance offer structured options and derivatives markets specifically designed to hedge against stablecoin depeg risk. These products enable investors to take positions that pay out if a stablecoin falls below a set threshold, providing a market-driven, customizable hedge against instability.

Stablecoin Depeg Hedging Derivatives: Lyra, Squeeth and Ribbon Finance Options Markets

The final pillar of modern stablecoin risk management is the use of decentralized derivatives platforms built specifically for hedging against price instability. Platforms like Lyra (options AMM), Squeeth (power perpetuals), and Ribbon Finance (structured options vaults) let you construct market-driven hedges that pay out if a given stablecoin falls below its peg.

Unlike traditional insurance, these derivatives allow you to actively manage your exposure in real time. For example, you might buy a put option on USDC using Lyra, which increases in value if USDC drops below $1. Squeeth’s power perpetuals provide leveraged downside protection, while Ribbon Finance offers automated options strategies that can be tailored to stablecoin depeg scenarios. This flexibility lets sophisticated users set precise risk thresholds and profit from volatility, rather than simply hoping for the best.

What sets these platforms apart in 2025 is their integration with on-chain price oracles and advanced analytics. Users can monitor implied depeg probabilities and adjust positions accordingly, no more flying blind during periods of market stress. For those interested in step-by-step guides on deploying these hedging instruments, check out our resource on how to hedge against stablecoin depegs using on-chain derivatives.

Building a Resilient DeFi Portfolio: Best Practices for 2025

The most effective defense against stablecoin depeg risk is a layered approach that combines insurance coverage, smart liquidity provisioning, and dynamic hedging with derivatives. Here are some practical tips for integrating these tools into your portfolio:

Top Tools & Strategies for Stablecoin Depeg Protection (2025)

-

Nexus Mutual & InsurAce: Leading DeFi insurance protocols offering specialized coverage against stablecoin depeg events. Both platforms let users purchase protection for specific stablecoins, providing payouts if a depeg is detected according to on-chain oracles. This insurance adds an extra layer of security for DeFi investors seeking peace of mind in volatile markets.

-

Curve Finance’s 3Pool/4Pool: Advanced stablecoin liquidity pools featuring built-in peg monitoring and automated rebalancing. By providing liquidity to Curve’s flagship pools (such as 3Pool or 4Pool), users can earn trading fees while benefiting from real-time peg analytics and smart contract mechanisms that help maintain stablecoin parity, even during market stress.

-

Stablecoin Depeg Hedging Derivatives: Decentralized derivatives platforms like Lyra, Squeeth, and Ribbon Finance offer structured products and options markets designed to hedge against stablecoin depeg risk. These tools enable users to take positions that pay out if a stablecoin loses its peg, providing a direct and flexible way to manage depeg exposure within a DeFi portfolio.

Adopting this multi-pronged strategy not only reduces the chance of catastrophic loss but also positions you to take advantage of yield opportunities safely. Stay vigilant by regularly reviewing peg health dashboards and adjusting coverage or derivative positions as market conditions evolve.

Pro tip: For institutional users managing large treasuries or DAOs with pooled assets, consider automating rebalancing and coverage renewals through smart contract integrations with Nexus Mutual, InsurAce, and Curve’s APIs.

The Future of Stablecoin Risk Management

As DeFi matures in 2025 and beyond, expect further innovation at the intersection of insurance protocols, liquidity engineering, and decentralized derivatives. AI-powered monitoring tools are already enhancing peg surveillance across major pools, while new synthetic assets are emerging to let users hedge even more granular risks.

Ultimately, whether you’re a retail investor or an institutional allocator, proactively managing stablecoin depeg risk is now table stakes for participating in DeFi’s next chapter. By leveraging Nexus Mutual and amp; InsurAce’s insurance products, Curve’s automated liquidity pools with peg monitoring, and structured hedges via Lyra/Squeeth/Ribbon Finance options markets, you can safeguard your capital, and sleep better at night, even as the crypto landscape continues to evolve.