Stablecoins are supposed to be the bedrock of DeFi stability, but as recent history has shown, a single depeg event can set off a chain reaction of liquidations, arbitrage frenzies, and protocol stress. When $1-pegged coins like USDC or UST trade significantly away from $1, the consequences ripple through lending markets, DEXs, and the entire ecosystem. The collapse of UST and the 13% USDC depeg in March 2023 are not outliers – they’re warnings of systemic weaknesses and the need for robust, actionable hedging.

What Triggers a Stablecoin Depeg?

A stablecoin depeg is simple in definition but complex in cause. It happens when a stablecoin loses (or rarely, exceeds) its peg to the underlying asset, most commonly the US dollar. The triggers are diverse:

- Liquidity shocks: Sudden redemption waves drain reserves and force issuers to sell collateral at a loss.

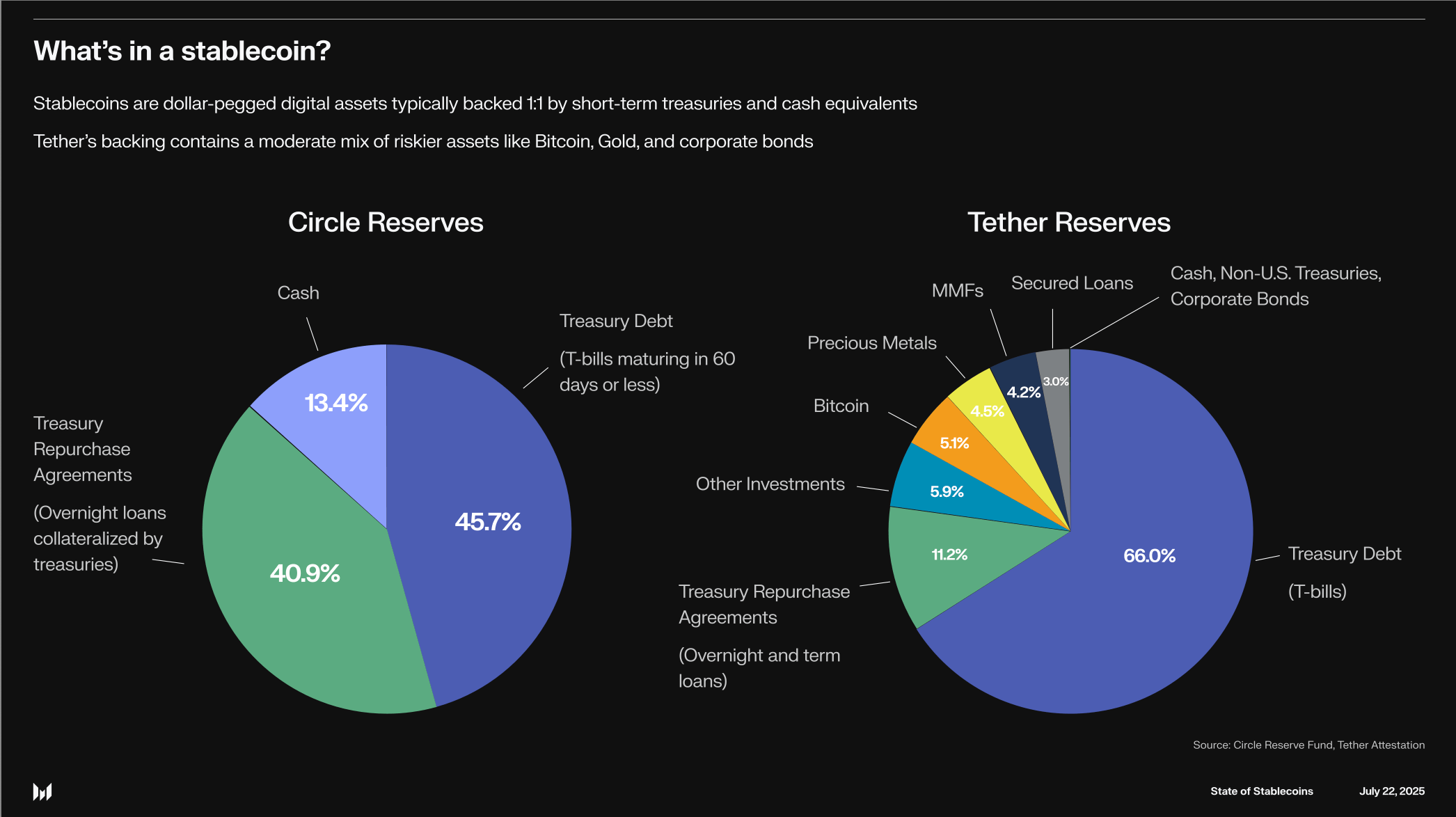

- Reserve mismanagement: If backing assets are volatile, illiquid, or held with risky counterparties, confidence evaporates quickly.

- Protocol exploits or governance failures: Smart contract bugs or misaligned incentives can break redemption mechanisms.

- Market contagion: Broader crypto sell-offs or banking crises can spill into stablecoin markets, as seen with SVB’s collapse impacting USDC.

For a deep dive on these triggers and real-world case studies, see this analysis.

DeFi Liquidations: The Domino Effect of Depegging

DeFi protocols treat stablecoins as reliable collateral. But when that assumption fails, automated liquidation engines are ruthless. Here’s how the cascade unfolds:

How Stablecoin Depegs Trigger DeFi Liquidations

-

1. Stablecoin Value Deviates from PegMarket events, such as liquidity shocks or reserve concerns, cause a stablecoin like USDC to trade below its $1 peg. For example, USDC dropped 13% below $1 in March 2023 after news of reserves at Silicon Valley Bank.

-

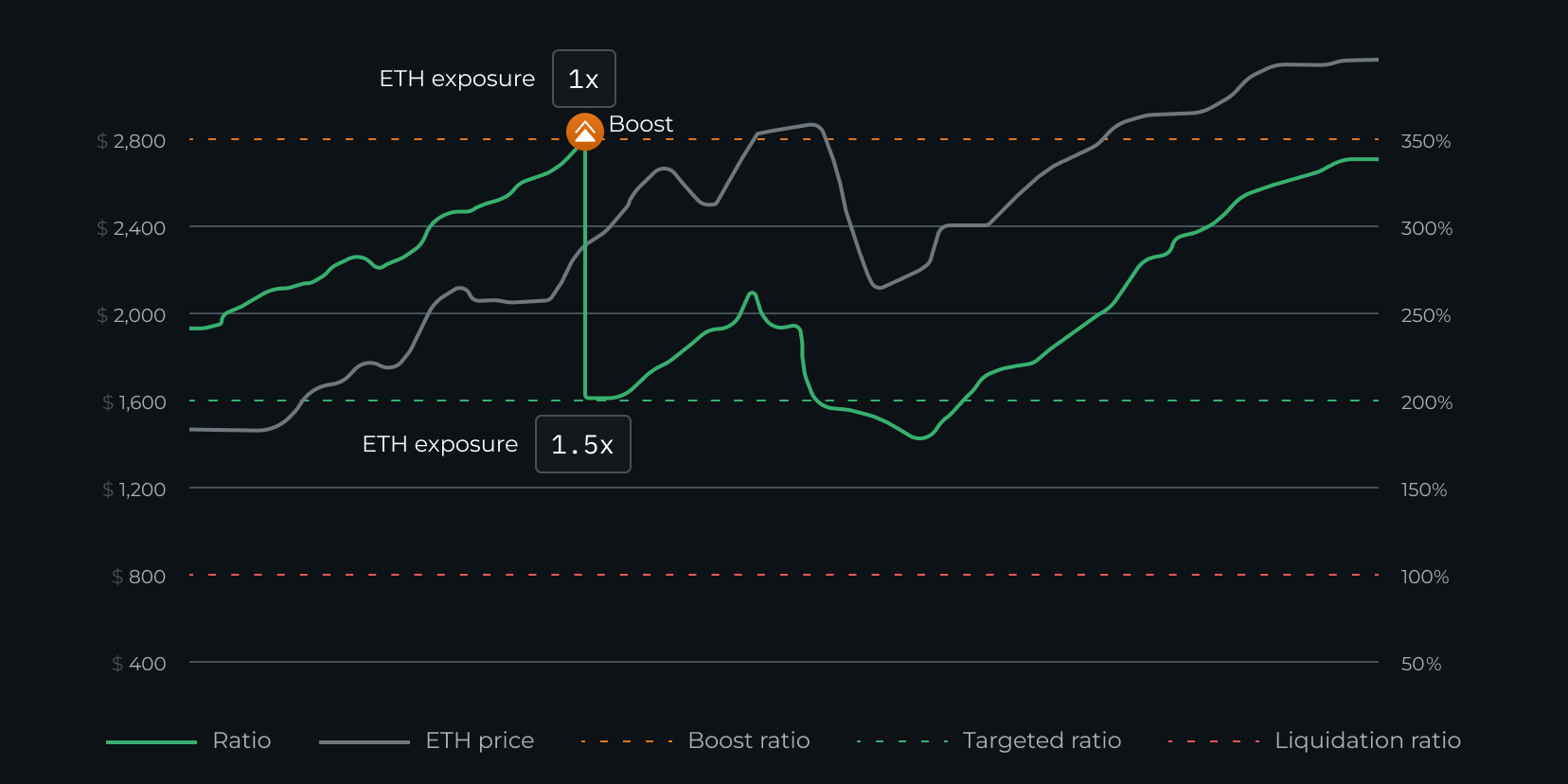

2. Collateral Value Drops on DeFi PlatformsStablecoins are often used as collateral on DeFi protocols like Aave and MakerDAO. When the stablecoin depegs, the USD value of users’ collateral decreases, reducing their collateralization ratios.

-

3. Collateralization Ratios Fall Below Liquidation ThresholdsAs the value of the collateral drops, borrowers’ positions fall below the required minimum collateralization ratio set by the protocol, triggering liquidation bots to act.

-

4. Automated Liquidation is TriggeredDeFi smart contracts automatically liquidate undercollateralized positions to protect protocol solvency. Liquidators repay the debt and seize the discounted collateral, often causing further price pressure.

-

5. Cascade Effect and Market InstabilityLarge-scale liquidations can cascade across protocols, intensifying sell-offs and causing liquidity crunches throughout the DeFi ecosystem. This amplifies volatility and can destabilize other assets.

Imagine you’ve posted $100,000 of USDC as collateral for a loan. If USDC drops to $0.87, your collateral is now worth just $87,000. If your loan’s health factor dips below protocol thresholds (often 1.0), your position is liquidated to keep the system solvent. Liquidators rush in, selling off your assets, often at a discount. The result? Forced sales drive prices down further, triggering more liquidations in a feedback loop.

This isn’t theoretical. The USDC depeg saw hundreds of millions of dollars in DeFi liquidations within hours. Arbitrageurs exploited price discrepancies, but many users were wiped out before they could react. In high-frequency markets, speed is survival.

Portfolio Hedging: Proactive Strategies for Depeg Risk

Smart investors don’t wait for the next depeg headline – they build layered hedges in advance. Here are actionable risk management tactics to consider:

- Diversify stablecoin exposure: Don’t keep all funds in a single stablecoin or collateral model. Spread risk across DAI, USDC, LUSD, and others with different backings.

- Utilize DeFi derivatives: Perpetuals and options allow you to short a stablecoin or hedge downside if depegging occurs. Platforms like Synthetix or GMX offer these tools. For more on using derivatives as a hedge, see our guide.

- Buy depeg insurance: Protocols like Risk Harbor and InsurAce pay out if a stablecoin falls below a set threshold. This can cap your downside during black swan events.

- Leverage analytics and alerts: Set up automated monitoring for abnormal on-chain flows or pool imbalances. Real-time data is your edge in fast-moving markets.

For a comprehensive breakdown of these strategies and more, check out our full strategy guide.

But even the best-laid hedges demand vigilance. Depegs can unfold in minutes, and protocol-specific risks mean no single strategy fits all. For example, AMM liquidity providers might suffer impermanent loss if a stablecoin price diverges sharply, while borrowers in lending protocols face sudden collateral shortfalls. The key is to combine multiple layers of protection and adapt as market conditions evolve.

Advanced Hedging: Real-Time Tools and On-Chain Tactics

Top traders are now leveraging real-time analytics dashboards to track liquidity flows, whale movements, and reserve changes across major stablecoins. Platforms like DepegWatch aggregate data from Curve, Uniswap, and lending protocols, issuing alerts when peg stability is at risk. Automated bots can be programmed to rebalance portfolios or execute hedges the moment a depeg is detected, sidestepping manual lag.

Another emerging tactic: on-chain derivatives. Protocols like Lyra and Synthetix enable users to take positions on stablecoin volatility directly from their wallets. By buying put options or opening short perpetuals on USDC or USDT, investors can lock in protection against price drops below $1. For a detailed walkthrough of these tools, see our on-chain derivatives guide.

For those providing liquidity on AMMs, concentrated liquidity positions (like Uniswap v3) allow for tighter risk controls. By focusing liquidity around the $1 mark and using impermanent loss protection features, LPs can maximize fee income while limiting depeg downside. However, if the peg breaks hard, exit strategies must be pre-programmed.

Risk Management Checklist for DeFi Stablecoin Exposure

The bottom line: DeFi liquidations are merciless when stablecoins depeg. The only edge is speed, data, and layered risk management. Institutional players deploy automated hedging bots; retail users must at least set alerts and diversify exposure. If you’re not actively managing stablecoin risk, you’re betting against both history and math.

For further reading on the mechanics of depegs and how to protect your assets across protocols, dive into this deep-dive.