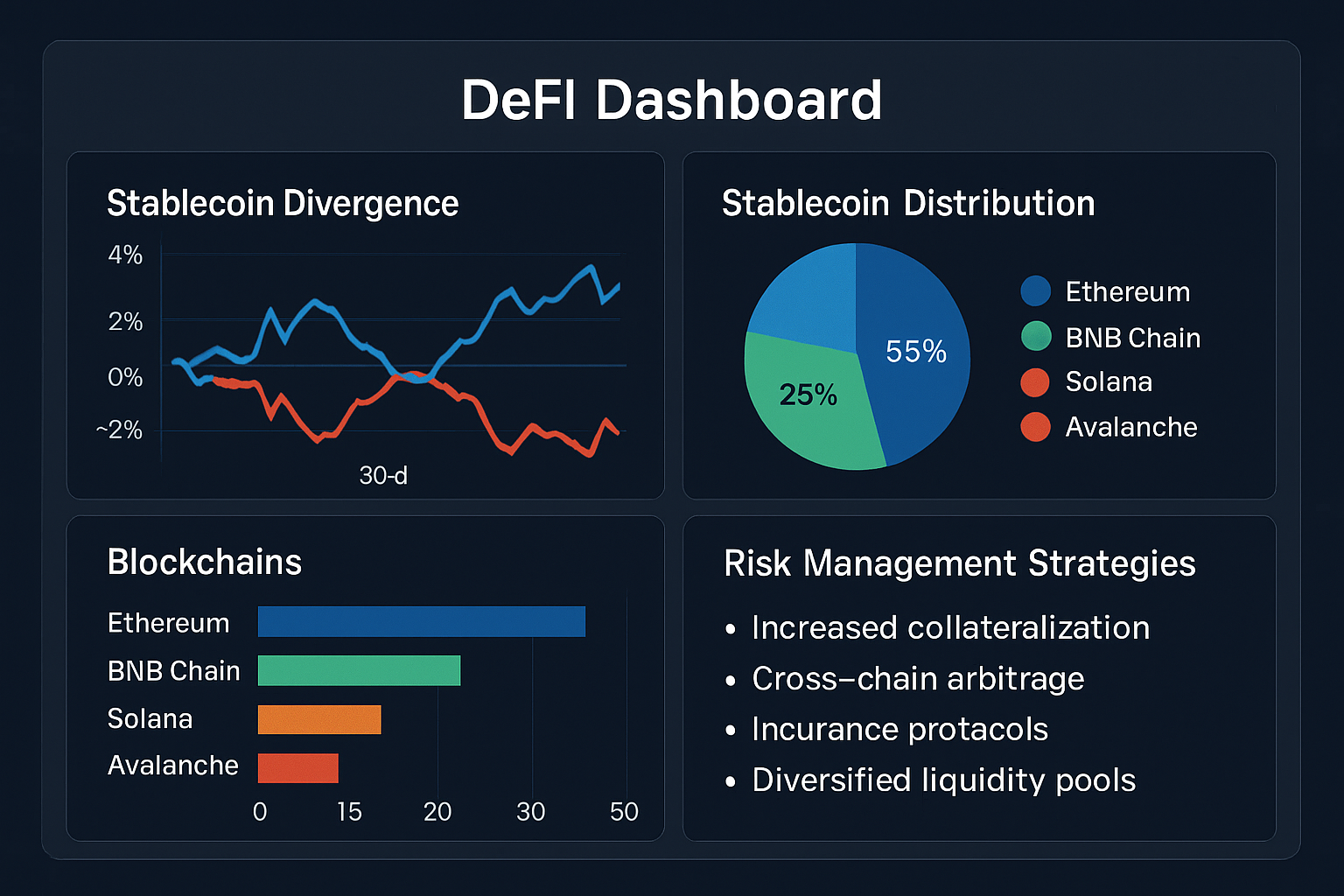

Stablecoins have become the backbone of decentralized finance, powering everything from liquidity pools to lending protocols. Yet, as the events of March 2025 demonstrated, with USDC temporarily trading at $0.976 on Solana and $0.991 on Arbitrum, even the most trusted stablecoins are not immune to depegging risk. For DeFi investors, the challenge is clear: how do you protect your portfolio from sudden, unpredictable losses if a stablecoin slips its peg?

Why Hedging Stablecoin Depeg Risk Is Essential in 2024

As DeFi adoption accelerates and new stablecoin models emerge, risk management is no longer optional, it’s a necessity. The reality is that depegging events can be triggered by a range of factors: collateral shortfalls, smart contract exploits, regulatory shocks, or even a loss of market confidence. With capital at stake and protocols interconnected, a single depeg can have ripple effects across your entire DeFi exposure.

To address these challenges, sophisticated hedging strategies have evolved, moving far beyond simple diversification. In 2024, both retail and institutional investors are adopting four core strategies to mitigate stablecoin depeg risk:

Top Strategies to Hedge Stablecoin Depeg Risk in 2024

-

Utilize Depeg Derivatives and Depeg Swaps: Engage with protocols like Cork Protocol or Squeeth that offer depeg swaps or options. These platforms allow investors to hedge against the risk of a specific stablecoin losing its peg by purchasing protection contracts that pay out if a depeg event occurs.

-

Diversify Across Multiple Stablecoins and Collateral Types: Reduce exposure to any single stablecoin by spreading funds across a basket of stablecoins—such as USDC, USDT, DAI, LUSD, and GUSD—and favoring those with transparent, overcollateralized, or decentralized backing.

-

Leverage On-Chain Stablecoin Insurance Protocols: Use decentralized insurance platforms such as Nexus Mutual, InsurAce, or Unslashed to purchase coverage specifically for stablecoin depeg events or protocol failures, providing compensation if a covered event is triggered.

-

Monitor and Participate in Prediction Markets for Early Risk Signals: Track and, if desired, trade on platforms like Polymarket or Zeitgeist, where market odds can provide early warning signals of potential depegs, enabling timely portfolio adjustments or hedging actions.

1. Utilize Depeg Derivatives and Depeg Swaps

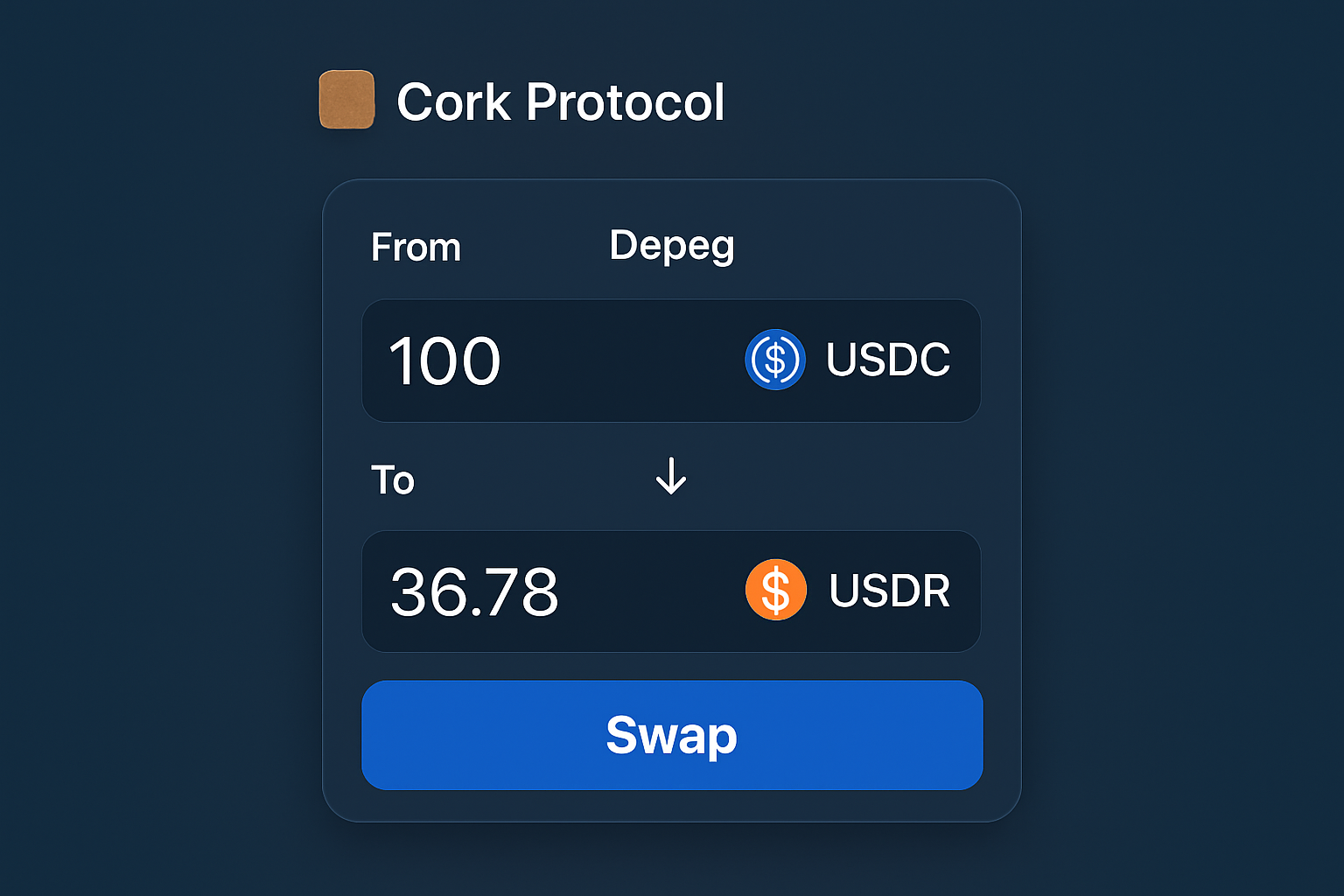

One of the most direct ways to hedge against stablecoin depegging is through depeg derivatives. Protocols like Cork Protocol and Squeeth offer specialized depeg swaps or options contracts. By purchasing a depeg swap, you gain a payout if a specified stablecoin falls below a defined price threshold, effectively insuring yourself against a loss of peg.

For example, if you are holding USDC and concerned about a potential depeg event, you can buy a USDC depeg swap on Cork Protocol. Should USDC drop below $0.98 (as it did on Solana in March 2025, hitting $0.976), your contract would pay out, offsetting your losses. This approach is gaining traction among both sophisticated traders and DAOs managing large treasuries.

For a deep dive into using crypto derivatives for depeg protection, see our guide: How to Hedge Against Stablecoin Depegs Using Crypto Derivatives in 2024.

2. Diversify Across Multiple Stablecoins and Collateral Types

“Don’t put all your eggs in one basket” is especially true in DeFi. By spreading your capital across a range of stablecoins, including fiat-backed (USDC, USDT), overcollateralized (DAI, LUSD), and decentralized options (GUSD): you reduce your exposure to any single asset’s failure. This strategy also involves favoring stablecoins with transparent reserves, robust governance, and decentralized collateralization.

For instance, allocating funds between USDC (fiat-backed), DAI (overcollateralized by crypto assets), and LUSD (backed by ETH) can help cushion the impact if one stablecoin experiences a depeg. Investors are also increasingly scrutinizing collateral types and on-chain proof-of-reserves to assess risk before allocating capital.

To learn more about constructing a diversified stablecoin portfolio, explore our resource: How to Hedge Against Stablecoin Depeg Risk: Strategies for DeFi Investors in 2024.

3. Leverage On-Chain Stablecoin Insurance Protocols

Decentralized insurance protocols like Nexus Mutual, InsurAce, and Unslashed are now offering products specifically designed to cover stablecoin depeg events or protocol failures. By purchasing coverage, investors can receive compensation if their assets are affected by a covered depeg event, providing a much-needed safety net in volatile markets.

Insurance policies typically specify a trigger condition (e. g. , a stablecoin trading below $0.97 for 24 hours) and pay out claims if that threshold is breached. These protocols use a combination of on-chain oracles and community governance to validate claims, offering transparency and trustless execution.

For more on insurance-based risk mitigation, see our comprehensive guide: Stablecoin Depeg Risks: How to Protect Your Crypto Portfolio in 2024.

While insurance products are not a panacea, they provide an additional layer of security for both individuals and DAOs managing significant capital. As the DeFi insurance market matures, expect to see more tailored products, dynamic pricing, and integrations with portfolio management tools. This evolution is making it easier for investors to build resilient risk management frameworks that automatically adjust coverage as market conditions shift.

4. Monitor and Participate in Prediction Markets for Early Risk Signals

Prediction markets such as Polymarket and Zeitgeist have emerged as powerful tools for gauging market sentiment around stablecoin pegs. These platforms allow users to speculate on the likelihood of a depeg event, with market odds often moving ahead of public news or oracle updates. By tracking these odds, investors gain an early warning system, if the market suddenly prices in a higher risk of depeg, it’s time to review your exposure and consider hedging or reallocating.

Active participation in prediction markets can also serve as a form of hedging. For example, if you believe a depeg is likely, you can take a position that pays out if the event occurs. Even if you don’t trade, simply monitoring these markets provides actionable intelligence for risk management. Combining prediction market data with real-time analytics from platforms like DepegWatch. com creates a robust early-alert system for portfolio defense.

Building Your 2024 Stablecoin Depeg Protection Playbook

In today’s interconnected DeFi landscape, robust risk management is not just about avoiding losses, it’s about staying agile and informed. The four strategies outlined above, utilizing depeg derivatives and swaps, diversifying across stablecoins and collateral types, leveraging on-chain insurance protocols, and monitoring prediction markets, form the foundation for effective stablecoin depeg risk hedging in 2024.

To maximize protection:

- Combine strategies: Don’t rely on a single hedge. Layering derivatives, insurance, and diversification multiplies your safety net.

- Stay proactive: Use real-time analytics and alerts to spot risks early. Market conditions can change rapidly.

- Review coverage regularly: As new protocols and products launch, revisit your approach to ensure optimal protection for your portfolio’s size and risk profile.

Which stablecoin depeg risk strategy do you use most often?

Stablecoin depegging remains a real risk in DeFi, as seen with USDC’s recent price fluctuations ($0.976 on Solana, $0.991 on Arbitrum). To protect your capital, which of these four strategies do you rely on most?

By embracing these approaches, both retail and institutional investors are better equipped to navigate the unpredictable waters of DeFi. The future will bring new risks, but also new tools for managing them. For more actionable insights and up-to-date analytics on depeg risk management, explore our latest resources: