Stablecoins are the backbone of DeFi, providing a reliable unit of account and liquidity for trading, lending, and on-chain settlements. Yet, the events of 2024-2025 have shown that even the most robust stablecoins are not immune to depegging risks. Understanding why stablecoins depeg, how peg mechanisms work, and which risk mitigation strategies are most effective is essential for every crypto investor seeking true portfolio protection.

Case Study: USST and Other 2024-2025 Stablecoin Depegs, Causes, Consequences, and Lessons Learned

The recent depegging of USST in June 2025 sent shockwaves through the DeFi ecosystem. Triggered by a combination of collateral shortfalls and market panic, USST’s price dropped from $1.00 to as low as $0.61 within hours. This event mirrored earlier failures like Terra’s UST but also introduced new complexities tied to evolving regulatory pressures and liquidity fragmentation across chains.

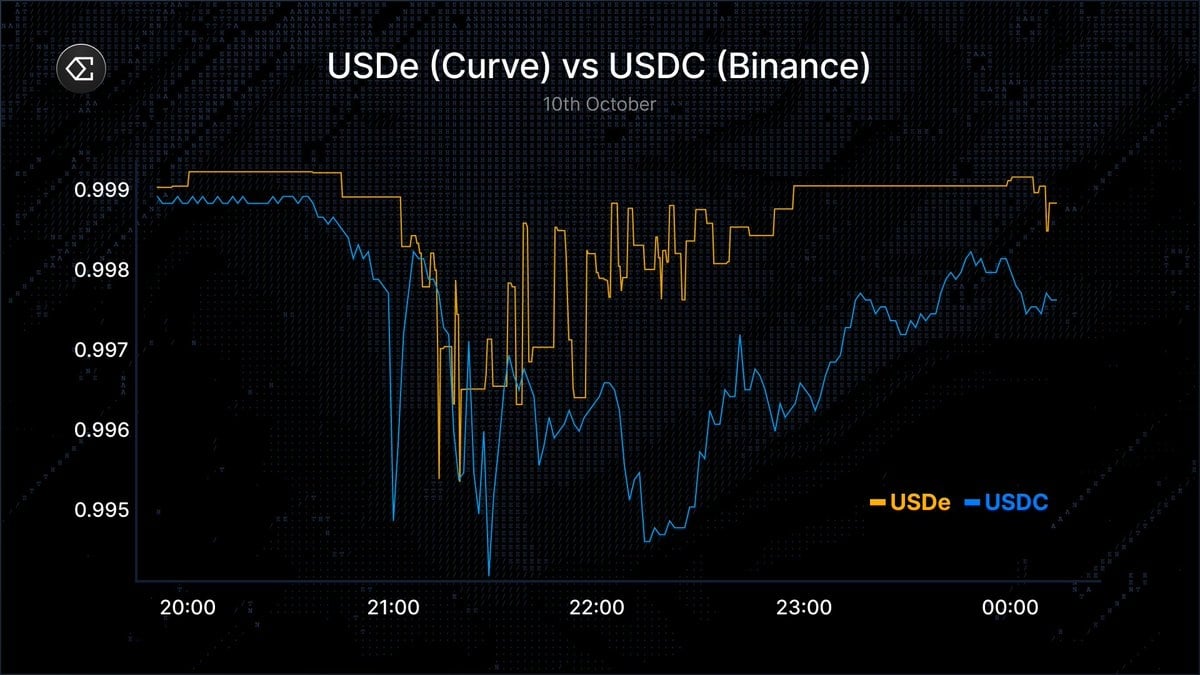

Several other stablecoins experienced similar fates during this period. For example, Real USD (USDR) lost its peg in October 2023 due to mass redemptions draining DAI reserves while illiquid tokenized real estate collateral failed to cover withdrawals in time. These incidents underscore a hard truth: no stablecoin model is entirely immune to systemic shocks.

Major 2024-2025 Stablecoin Depeg Events & Key Insights

-

Case Study: USST and Other 2024-2025 Stablecoin Depegs—Causes, Consequences, and Lessons LearnedIn 2024-2025, stablecoins like USST and USDR experienced significant depegging events. For example, USDR lost its peg in October 2023 due to a liquidity crisis when mass redemptions drained DAI reserves and illiquid tokenized real estate collateral failed to cover withdrawals. These cases highlight how collateral shortfalls, market panic, and loss of confidence can trigger rapid devaluations, underscoring the importance of robust collateral management and transparency.

-

Stablecoin Peg Mechanisms: Comparing Algorithmic, Overcollateralized, and Fiat-Backed Models for ResilienceStablecoins use different mechanisms to maintain their pegs. Algorithmic stablecoins (e.g., Terra UST) rely on smart contracts to balance supply and demand but can fail catastrophically, as seen in 2022. Overcollateralized models like DAI use excess crypto collateral, while fiat-backed stablecoins such as USDC and USDT are backed by cash or equivalents. Each model has unique strengths and vulnerabilities, influencing their resilience during market stress.

-

Risk Mitigation Strategies for DeFi Users: Early Warning Analytics, On-Chain Hedging Tools, and Portfolio DiversificationDeFi users can protect against depegging risks by diversifying stablecoin holdings (e.g., USDC, DAI, LUSD), using analytics platforms like Nansen and Dune Analytics to monitor liquidity and collateral ratios, and leveraging on-chain hedging tools such as Cork Protocol and Y2K Finance. Staying informed about regulatory changes, like the EU’s MiCA regulation, further enhances portfolio security.

The consequences were far-reaching, protocols reliant on these assets faced cascading liquidations, while users with undiversified exposure suffered significant losses. The primary lessons? Monitor reserve transparency rigorously, diversify stablecoin holdings, and never underestimate the speed at which market sentiment can turn against even well-established projects.

Stablecoin Peg Mechanisms: Comparing Algorithmic, Overcollateralized, and Fiat-Backed Models for Resilience

To understand why depegs occur, it’s crucial to examine how different stablecoin models attempt to maintain their peg:

- Algorithmic Stablecoins: Use smart contracts to expand or contract supply based on price signals. While innovative, these models (e. g. , UST) have proven highly vulnerable when confidence erodes or arbitrage incentives break down.

- Overcollateralized Stablecoins: Assets like DAI require excess crypto collateral locked in smart contracts. This design offers resilience against moderate volatility but can still fail if collateral value crashes or becomes illiquid under stress.

- Fiat-Backed Stablecoins: Coins such as USDC and USDT claim full backing by off-chain fiat reserves. Their stability hinges on transparent audits and banking relationships, vulnerabilities exposed during events like the Silicon Valley Bank collapse that impacted USDC reserves in March 2023.

The choice of mechanism fundamentally shapes each coin’s risk profile. As regulatory scrutiny increases, especially under frameworks like MiCA, algorithmic coins face existential threats while asset-backed models must double down on transparency and compliance.

Risk Mitigation Strategies for DeFi Users: Early Warning Analytics, On-Chain Hedging Tools, and Portfolio Diversification

No matter how well-designed a stablecoin appears on paper, prudent DeFi users must take proactive steps to manage risk:

- Diversify Stablecoin Holdings: Avoid concentration by holding a mix of coins with different peg mechanisms (e. g. , DAI for overcollateralization; LUSD for decentralized backing; USDC for fiat linkage). This reduces exposure to any single failure mode.

- Monitor On-Chain Analytics: Leverage dashboards from Nansen or Dune Analytics to track whale movements, shifts in collateral ratios, or sudden liquidity drains, key early indicators of potential instability.

- Implement Hedging Tools: Platforms such as Cork Protocol or Y2K Finance now offer specialized products like depeg swaps or hedge vaults that let users cap downside if a specific stablecoin falls below its peg threshold.

This multi-layered approach is rapidly becoming standard practice among sophisticated DeFi participants seeking robust stablecoin risk mitigation. For further practical strategies tailored to current market conditions, including real-time alerts and advanced hedging workflows, see our dedicated guide here.

It’s clear from recent events that risk management in stablecoins is not a set-and-forget exercise. The landscape evolves quickly, with new vulnerabilities emerging as protocols innovate and regulators intervene. For DeFi users, the difference between weathering a depeg and suffering major losses often comes down to preparation, vigilance, and the use of advanced tools.

How Early Warning Analytics and On-Chain Tools Change the Game

One of the most actionable lessons from the USST depeg is the value of real-time analytics. Platforms now aggregate on-chain data to surface red flags, such as sudden drops in backing collateral or abnormal redemption flows, before a crisis fully unfolds. By setting up automated alerts or monitoring dashboards, users can respond quickly to deteriorating conditions rather than reacting after a peg has broken.

DeFi-native hedging tools have also matured. Products like depeg swaps allow users to buy protection against specific events (e. g. , USDT falling below $0.98). These instruments function similarly to insurance contracts: if a trigger event occurs, payouts are automatic and on-chain. Hedge vaults go further by pooling risk among participants, offering scalable protection for larger portfolios.

Top Topics for Stablecoin Depeg Risk Mitigation (2025)

-

Case Study: USST and Other 2024-2025 Stablecoin Depegs—Causes, Consequences, and Lessons LearnedRecent depegging events, including the USST incident and the 2023 USDC depeg, highlight how collateral shortfalls, algorithmic failures, and liquidity crises can destabilize even major stablecoins. These cases underscore the importance of transparent reserves and robust risk management for both issuers and DeFi users.

-

Stablecoin Peg Mechanisms: Comparing Algorithmic, Overcollateralized, and Fiat-Backed Models for ResilienceUnderstanding the differences between algorithmic (e.g., UST), overcollateralized (e.g., DAI), and fiat-backed (e.g., USDC, USDT) stablecoins is crucial. Each model has unique strengths and vulnerabilities; recent failures have shown overcollateralized and fiat-backed coins tend to be more resilient under stress than purely algorithmic designs.

-

Risk Mitigation Strategies for DeFi Users: Early Warning Analytics, On-Chain Hedging Tools, and Portfolio DiversificationProactive DeFi users leverage platforms like Nansen and Dune Analytics for real-time monitoring, and hedge risk with tools such as Y2K Finance and Cork Protocol. Diversifying across stablecoins with different collateral models further enhances portfolio security against depegging events.

Portfolio Diversification: The First Line of Defense

Diversification remains foundational for crypto portfolio protection. By spreading assets across stablecoins with different peg mechanisms, algorithmic, overcollateralized, fiat-backed, users minimize single-point-of-failure risk. It’s equally important to stay agile; as regulatory frameworks like MiCA reshape which coins are viable, regularly reassessing your holdings is essential.

For those seeking more detailed guidance on building resilient portfolios and using derivatives for stablecoin risk mitigation, explore our comprehensive walkthrough at this resource.

Key Takeaways for 2025:

- No stablecoin model is failproof: Even well-capitalized projects can experience rapid depegs under stress.

- Transparency and analytics are non-negotiable: Use every tool available to monitor reserve health and market sentiment.

- Diversify and hedge proactively: Don’t wait for volatility, implement risk controls before markets turn turbulent.

The next generation of DeFi will likely see even stricter regulatory oversight alongside technical innovation in both stablecoin design and user-facing protection tools. For those navigating these waters, understanding both historical failures like USST’s collapse and emerging strategies for defense isn’t just prudent, it’s essential for long-term success.

If you’re looking for more in-depth analysis of recent depeg events or want to compare leading hedging solutions side by side, visit our detailed breakdown at DefiCoverage.org. Staying informed and prepared is your best hedge in an unpredictable market.