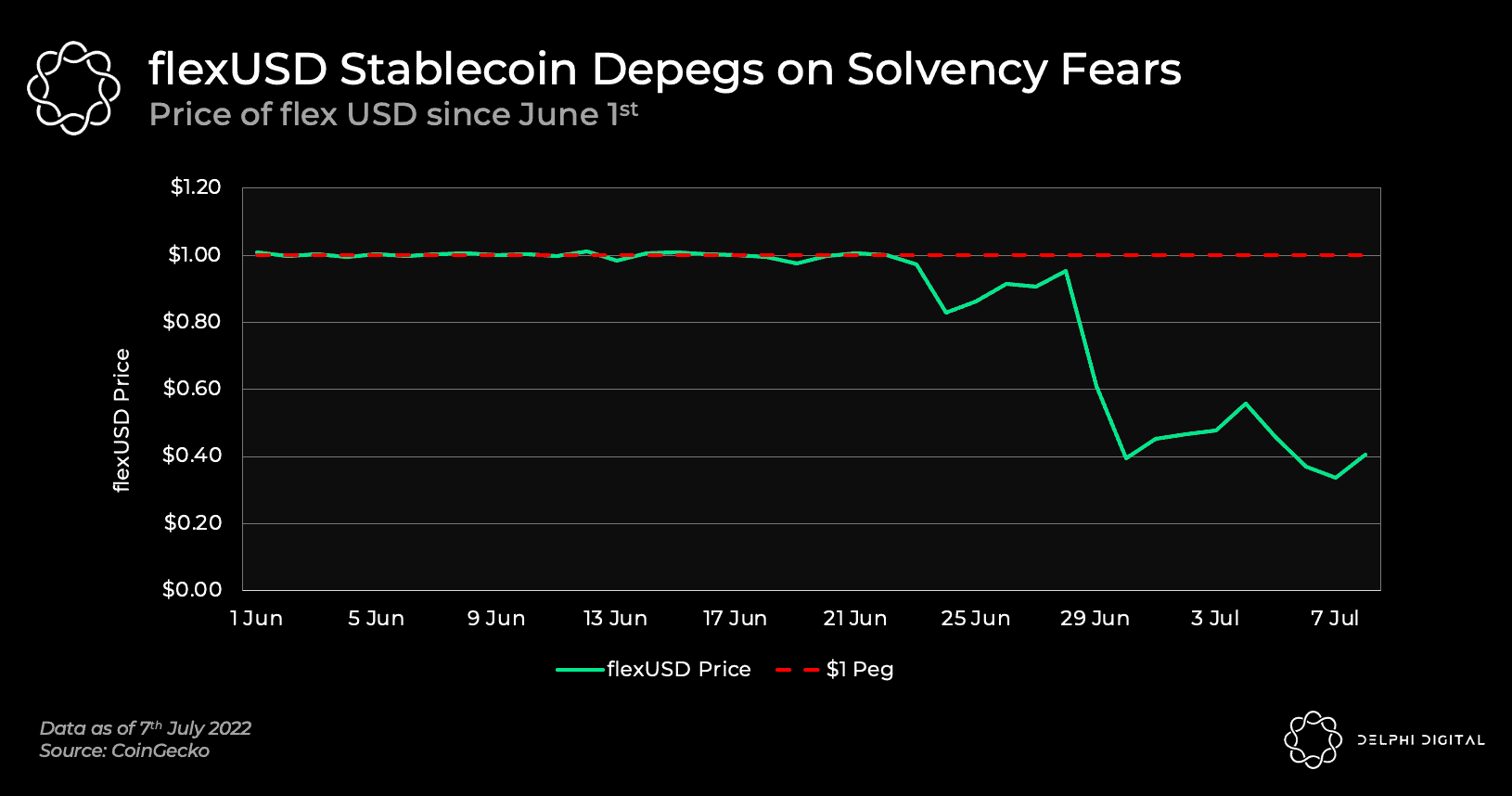

Stablecoins are the backbone of DeFi, but as we’ve seen with high-profile depegs, even the most trusted dollar-pegged assets can slip. Whether you’re a seasoned DeFi strategist or just starting to explore crypto risk management, understanding how to hedge against stablecoin depeg risk is essential for portfolio resilience.

Why Stablecoin Depeg Risk Matters in DeFi

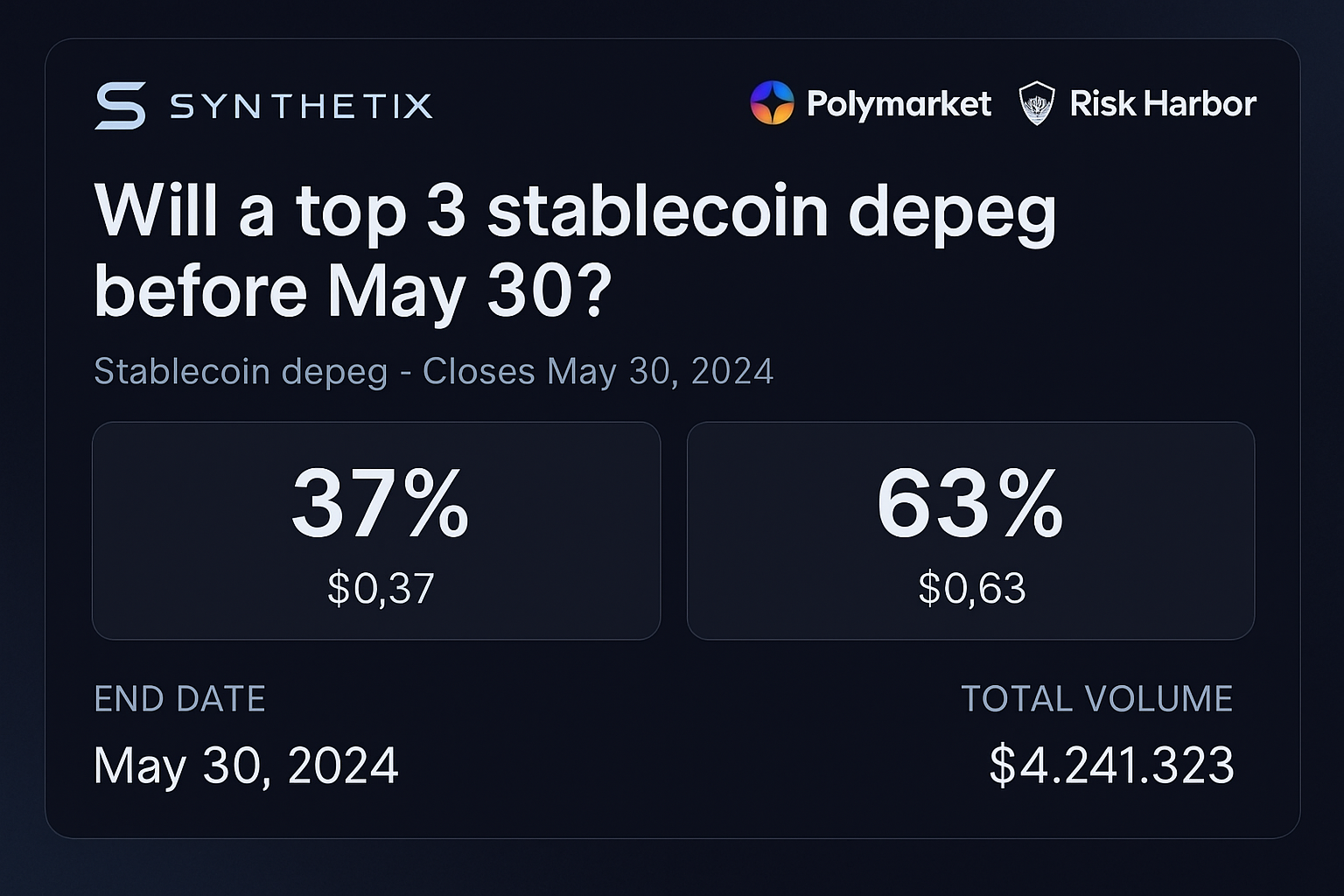

Stablecoins like USDC, DAI, and LUSD are designed to track $1. But market shocks, smart contract bugs, regulatory news, or liquidity crunches can cause them to lose their peg, sometimes dramatically. Remember UST’s infamous collapse? The fallout rippled across protocols and portfolios worldwide. Today’s market recognizes this risk: pricing mechanisms on platforms like Synthetix and Polymarket now let traders see real-time odds of a depeg event.

So how do you actually hedge? Let’s break down three actionable strategies every DeFi investor should consider:

1. Utilize Depeg Derivatives and Prediction Markets

The first line of defense against stablecoin depegs is leveraging derivatives and prediction markets purpose-built for this scenario. Platforms like Synthetix, Polymarket, and Risk Harbor allow you to buy depeg protection or take short positions on at-risk stablecoins. Here’s how it works:

- Synthetix: Trade synthetic assets that mirror stablecoin prices. If you believe USDT might lose its peg, you can take a position that profits if it drops below $1.

- Polymarket: Participate in markets predicting whether a stablecoin will remain at $1 by a certain date, market odds reflect real-time sentiment and risk.

- Risk Harbor: Buy coverage that pays out automatically if a specific depeg threshold is breached.

This approach not only hedges your holdings but also lets you tap into the collective intelligence, and fear, of the market itself.

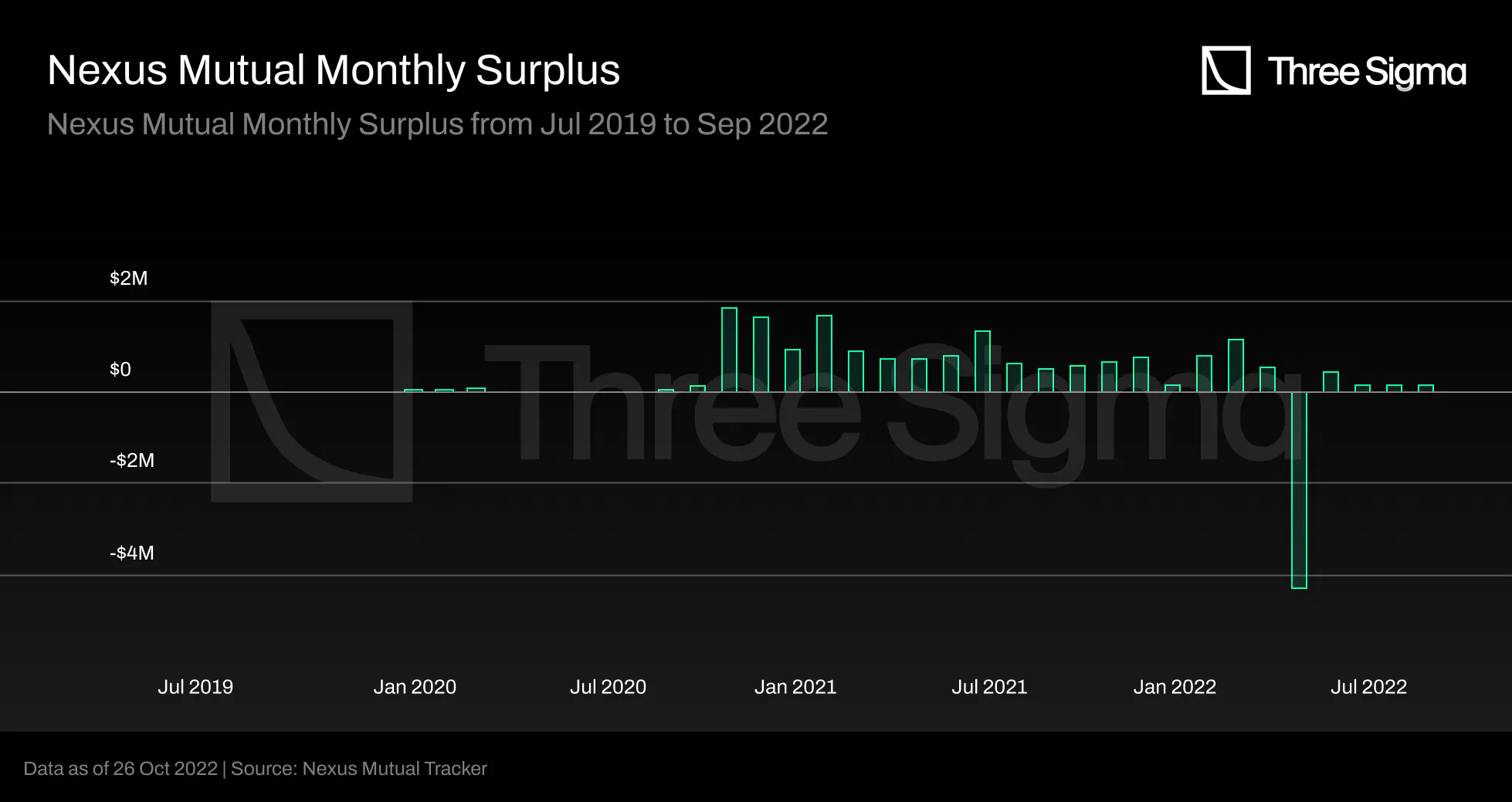

2. Purchase Protocol-Based Stablecoin Insurance

If derivatives aren’t your style or you want an extra layer of protection, decentralized insurance protocols offer targeted coverage for depeg events. Nexus Mutual, InsurAce, and Unslashed Finance all provide products that pay out if your covered stablecoin drops below a set value (for example, $0.98) for a defined period.

This means if USDC were to suddenly drop to $0.95 due to an unforeseen shock, and stay there, you’d receive compensation based on your policy terms. These insurance products are becoming more transparent and user-friendly by the month; claims can be verified on-chain using price oracles without lengthy disputes.

Top Decentralized Insurance Protocols for Stablecoin Depeg Cover

-

Utilize Depeg Derivatives and Prediction Markets: Trade on platforms like Synthetix, Polymarket, or Risk Harbor to buy depeg protection or short positions on at-risk stablecoins. These instruments let you hedge against potential depegs by profiting if a stablecoin loses its peg, with pricing often reflecting real-time market sentiment and risk.

-

Purchase Protocol-Based Stablecoin Insurance: Use decentralized insurance protocols such as Nexus Mutual, InsurAce, or Unslashed Finance to obtain coverage specifically for stablecoin depeg events. These products pay out if a covered stablecoin drops below a certain threshold for a defined period, providing direct compensation in the event of a depeg.

-

Diversify Stablecoin Holdings Across Multiple Issuers and Collateral Types: Reduce exposure to any single point of failure by holding a basket of stablecoins (e.g., USDC, DAI, LUSD, sUSD) with different collateral mechanisms and issuers. This strategy minimizes the impact of any one stablecoin depegging and leverages the strengths of both fiat-backed and crypto-collateralized models.

3. Diversify Stablecoin Holdings Across Multiple Issuers and Collateral Types

No matter how sophisticated your hedging tools are, nothing beats good old diversification for reducing single-point-of-failure risk. By holding a basket of stablecoins, such as fiat-backed USDC and crypto-collateralized DAI or LUSD, you spread exposure across different issuers and collateral mechanisms.

This way, if one asset wobbles (say USDT faces regulatory scrutiny), your portfolio won’t be wiped out overnight because other assets like sUSD or LUSD may remain steady thanks to distinct collateral models or governance structures.

- USDC: Fully backed by fiat reserves held by regulated entities

- DAI: Overcollateralized with crypto assets via MakerDAO protocol

- LUSD: Backed solely by ETH through Liquity protocol’s non-custodial design

- sUSD: Synthetic USD pegged via Synthetix protocol mechanisms

Diversification isn’t just about safety, it also gives you flexibility to move funds quickly if one ecosystem shows signs of stress.

If you’re looking for deeper dives into these strategies, including protocol walkthroughs and real-world case studies, check out our detailed guides at How to Hedge Against Stablecoin Depeg Events: Tools and Strategies.

Let’s get practical: how do you actually put these strategies into play? Start by assessing your current exposure. Are you all-in on one stablecoin, or do you already have some diversification? If you’re sitting heavy in a single asset, consider rebalancing toward a mix of USDC, DAI, LUSD, and sUSD. This not only helps manage depeg risk but also positions you to take advantage of protocol-specific incentives and yield opportunities.

Putting Depeg Hedging Strategies Into Action

1. Trading Depeg Derivatives and Prediction Markets: Suppose there’s chatter about USDT facing regulatory headwinds. On Synthetix or Polymarket, you can take a short position on USDT or participate in a market that pays out if it trades below $1 by month’s end. Risk Harbor lets you buy automated coverage, no need to wait for claim approvals if the price dips below the agreed threshold. These tools are designed for nimble execution and can be adjusted as market sentiment shifts.

2. Securing Protocol-Based Stablecoin Insurance: Platforms like Nexus Mutual and InsurAce have made it surprisingly simple to buy tailored depeg insurance. You choose the stablecoin, set your coverage amount, and define the trigger (e. g. , payout if DAI falls under $0.98 for 24 hours). The premiums reflect real-time risk assessment, higher during turbulent periods, lower when markets are calm. This approach is especially powerful for larger portfolios or DAOs managing treasury funds who want certainty in their risk framework.

Learn more about using DeFi derivatives for hedging stablecoin depegs.

Practical Steps for Stablecoin Depeg Insurance

-

Utilize Depeg Derivatives and Prediction Markets: Trade on established platforms like Synthetix, Polymarket, or Risk Harbor to buy depeg protection or take short positions on at-risk stablecoins. These tools let investors hedge by profiting if a stablecoin loses its peg, with pricing that reflects real-time market sentiment and risk.

-

Purchase Protocol-Based Stablecoin Insurance: Obtain coverage for depeg events using decentralized insurance protocols such as Nexus Mutual, InsurAce, or Unslashed Finance. These products pay out if a covered stablecoin drops below a set threshold for a defined period, providing direct financial protection against depegs.

-

Diversify Stablecoin Holdings Across Multiple Issuers and Collateral Types: Reduce risk by holding a mix of stablecoins such as USDC, DAI, LUSD, and sUSD, each backed by different collateral mechanisms and issuers. This diversification minimizes the impact of any one stablecoin depegging and leverages the strengths of both fiat-backed and crypto-collateralized models.

3. Diversifying Stablecoin Holdings: Don’t just diversify across stablecoins, pay attention to how each is collateralized and governed. For example, holding both fiat-backed USDC and crypto-collateralized LUSD means you’re not reliant on any one system’s solvency or regulatory status. If you’re using these assets in DeFi lending protocols (like Aave or Compound), regularly monitor liquidity levels and protocol health dashboards so you can react quickly to early warning signs.

This multi-pronged approach is what separates resilient portfolios from those caught flat-footed during market shocks. And with real-time analytics from platforms like DepegWatch. com, you can set up alerts for price deviations or sudden liquidity drains, giving yourself precious minutes (or hours) to act before losses mount.

Key Takeaways for Crypto Risk Management

- Stay proactive: Set up price alerts and monitor governance forums for your chosen stablecoins.

- Mix your tools: Combine derivatives, insurance products, and diversification for layered protection.

- Review regularly: As new protocols emerge, revisit your hedging strategy to incorporate improved products or better pricing.

The landscape of DeFi hedging strategies is evolving fast, and so are the risks. By using prediction markets, decentralized insurance protocols, and robust diversification across issuers/collateral types, investors can build a safety net against even the most dramatic depeg events.

If this topic piqued your interest, check out our hands-on walkthroughs at How to Hedge Against Stablecoin Depegs Using On-Chain Derivatives.