Stablecoins are the backbone of DeFi, designed to offer price stability in a volatile market. But as recent events have shown, even the most trusted stablecoins can lose their peg, exposing investors to sudden losses. Whether due to liquidity crunches, market panics, or protocol-specific vulnerabilities, stablecoin depeg risk is now a core concern for both retail and institutional crypto holders.

Fortunately, the rise of sophisticated on-chain derivatives has armed investors with powerful tools for managing these risks. Let’s explore three actionable strategies that leverage current DeFi protocols and market mechanics to hedge against stablecoin depegs, so you can stay protected when every cent counts.

1. Purchase Depeg Protection via On-Chain Depeg Swaps

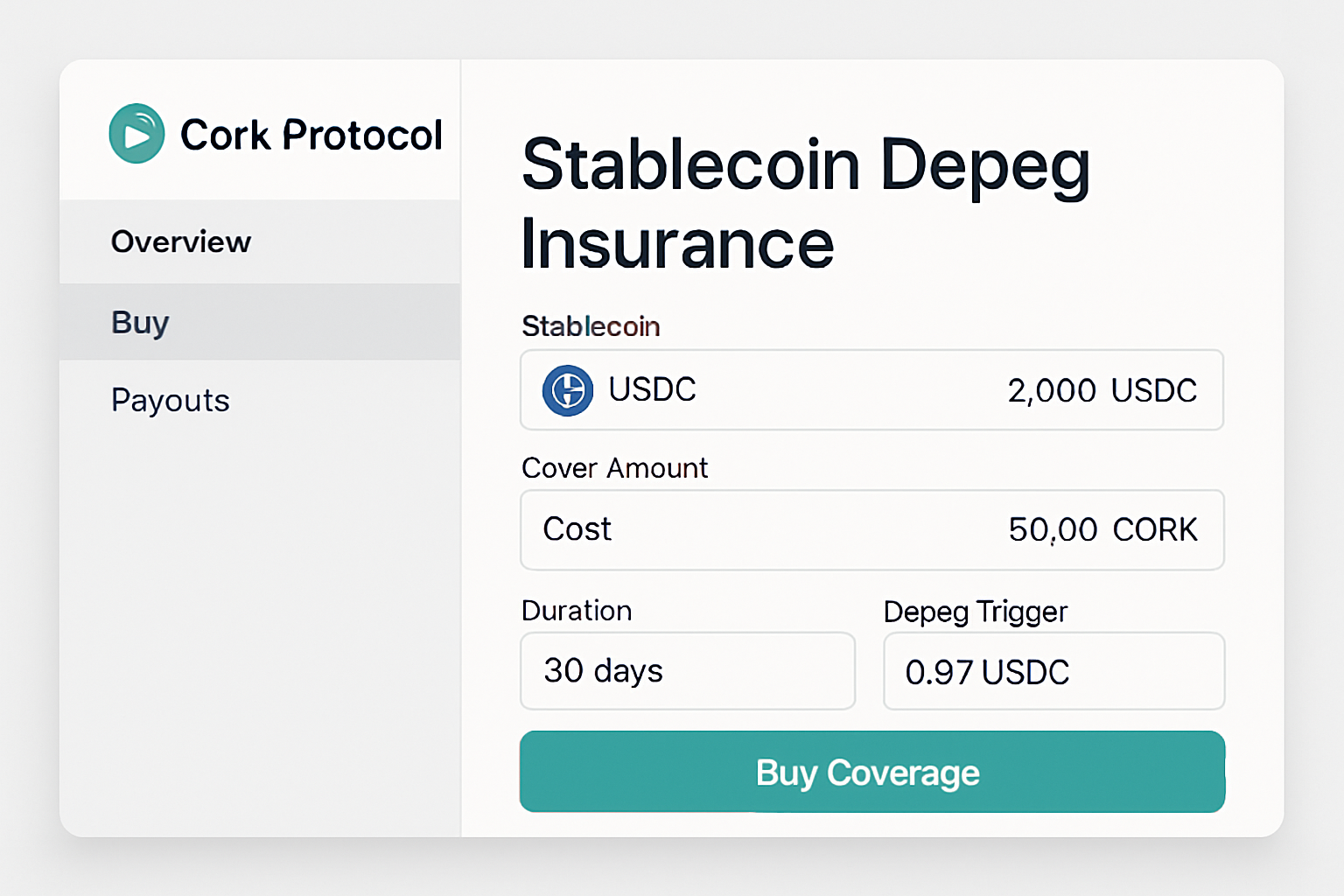

The first and most direct method for hedging stablecoin depeg risk is to buy specialized insurance using on-chain depeg swaps. Protocols like Cork Protocol and Risk Harbor have pioneered this approach, letting users purchase coverage against specific depeg events.

Here’s how it works: You select your stablecoin (say USDC or USDT), define the threshold at which you want protection (e. g. , if USDC falls below $0.98), and pay a premium in crypto. If the depeg event occurs within your specified window, you’re automatically compensated according to the protocol’s rules, no paperwork or claims process required.

This approach is transparent and trust-minimized. All terms are enforced by smart contracts on-chain, and payout logic is visible in advance. For active traders or DAOs with significant treasury exposure to stablecoins, this form of on-chain insurance can be an essential layer of defense.

2. Hedge Stablecoin Exposure Using Perpetual Futures on Decentralized Derivatives Platforms

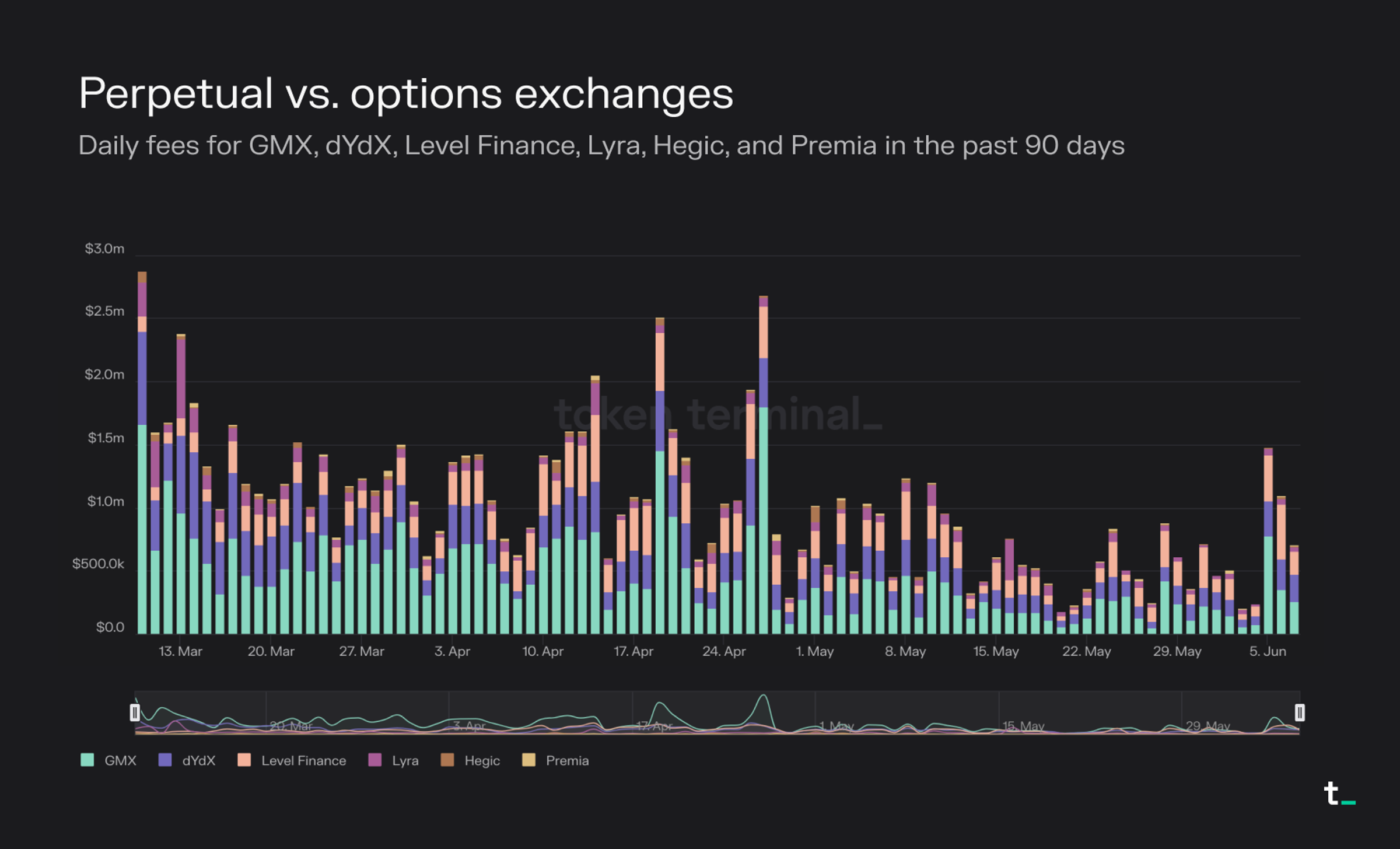

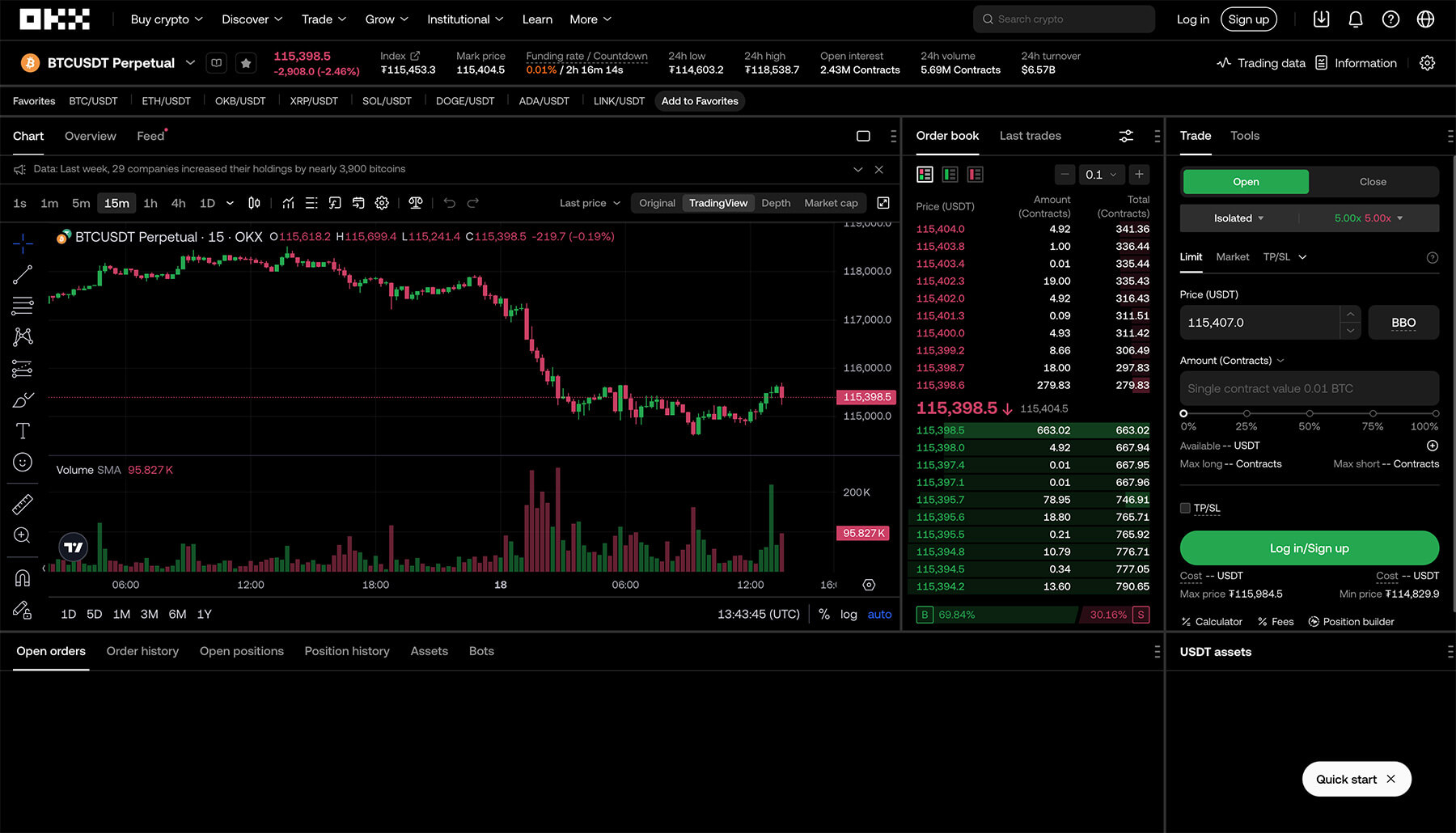

If you’re comfortable with derivatives trading, decentralized perpetual futures platforms like GMX, dYdX, and Synthetix offer flexible ways to hedge against potential stablecoin losses. The concept is simple: open a short position on the at-risk stablecoin using perps contracts.

If the stablecoin drops below its peg (for example, DAI falls from $1.00 to $0.96), your short position will gain value, offsetting losses from your spot holdings. Since perpetual contracts don’t expire, you can maintain this hedge as long as needed without rolling over positions or worrying about expiry dates.

The advantage here is customizability: you can size your hedge precisely based on portfolio exposure and risk tolerance. And because these markets are decentralized and on-chain, there’s no need for KYC or centralized intermediaries, just connect your wallet and trade directly from your preferred platform.

3 Ways to Hedge Stablecoin Depeg Risk On-Chain

-

Purchase Depeg Protection via On-Chain Depeg Swaps (e.g., Cork Protocol, Risk Harbor): Platforms like Cork Protocol and Risk Harbor allow users to buy specialized depeg insurance. By paying a premium, you receive automatic payouts if a stablecoin like USDC or USDT drops below a set threshold, providing direct protection against depegging events.

-

Hedge Stablecoin Exposure Using Perpetual Futures on Decentralized Derivatives Platforms (e.g., GMX, dYdX, Synthetix): Take short positions on stablecoins via perpetual futures contracts. If the stablecoin loses its peg, the short position gains value, offsetting losses in your holdings. This approach is flexible and can be tailored to different market conditions.

-

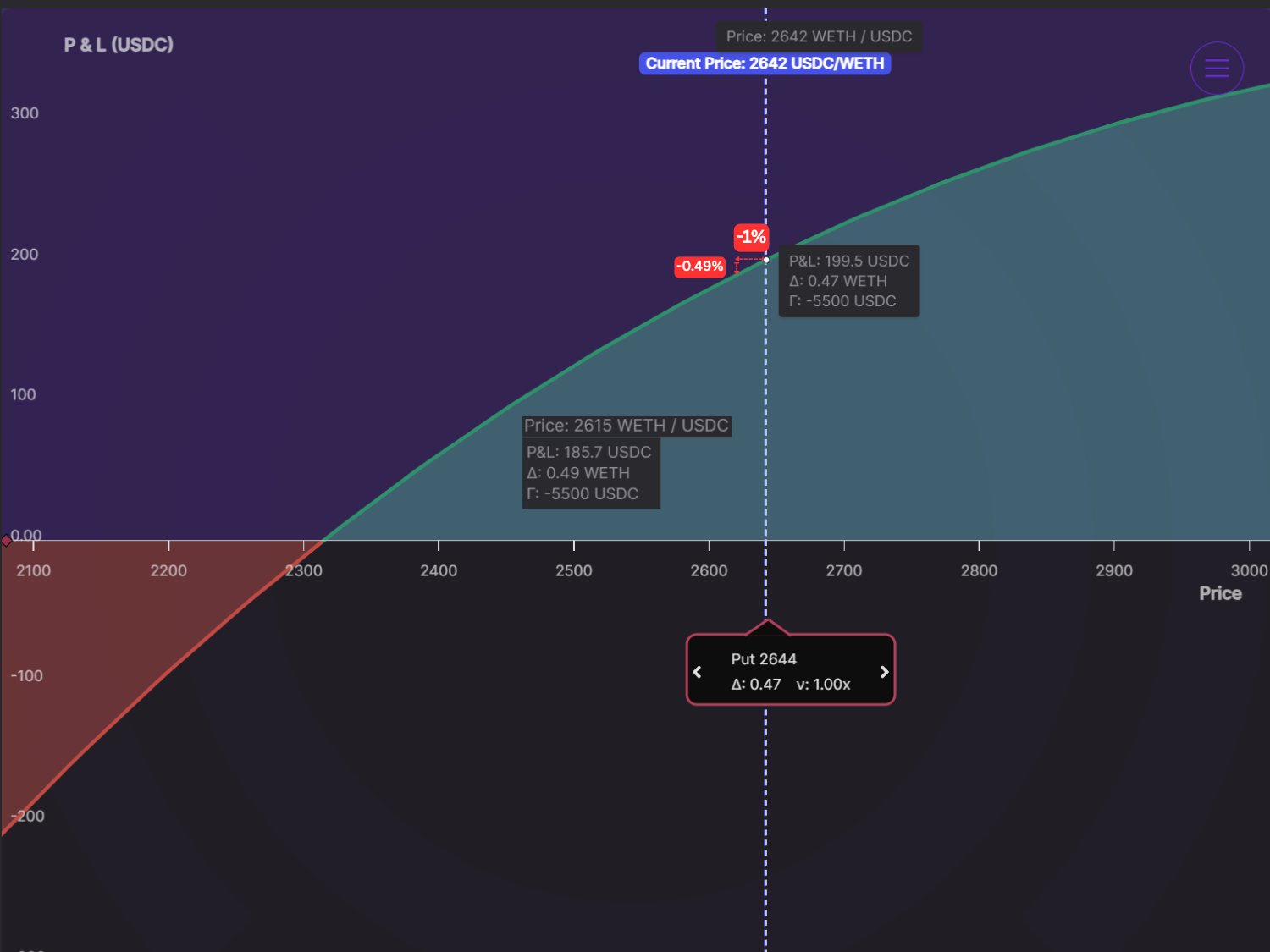

Deploy Automated Delta-Neutral Strategies Combining Lending and Short Derivatives Positions: Use DeFi protocols to lend stablecoins and simultaneously open short derivative positions. This delta-neutral setup aims to balance gains and losses, minimizing net exposure to depegging risk while still earning yield from lending activities.

3. Deploy Automated Delta-Neutral Strategies Combining Lending and Short Derivatives Positions

The third strategy takes things a step further by combining lending protocols with derivatives trading for an automated delta-neutral approach, a favorite among advanced DeFi users seeking passive protection with minimal intervention.

The mechanics are straightforward but powerful: deposit your stablecoins into a lending protocol (like Aave or Compound) to earn interest while simultaneously opening an equivalent short position via perpetual futures or options contracts on platforms such as GMX or dYdX. This way, if a depeg occurs and your spot holdings decrease in value, gains from the short position will offset those losses, keeping your net exposure close to zero regardless of market swings.

This strategy can be automated using smart contract vaults or bots that continuously rebalance positions based on real-time price feeds, a true set-and-forget solution for savvy investors who want robust protection without constant monitoring.

While delta-neutral strategies are not entirely risk-free, smart contract bugs, liquidation risks, or sudden market gaps can still pose threats, they offer a sophisticated layer of defense when combined with careful protocol selection and active monitoring. For those managing larger portfolios or DAO treasuries, automating these hedges can save time and reduce emotional decision-making during periods of volatility.

Choosing the Right Approach for Your Portfolio

Each of these three strategies offers a distinct blend of protection, flexibility, and complexity. On-chain depeg swaps like Cork Protocol or Risk Harbor are ideal for users seeking straightforward insurance with clear terms and automated payouts. They’re particularly valuable for those who want protection but prefer to avoid active trading.

Perpetual futures hedging on platforms such as GMX, dYdX, or Synthetix appeals to traders who are comfortable managing positions and want granular control over their risk exposure. This approach is effective in fast-moving markets where stablecoins can lose their peg quickly, and where being nimble pays off.

Delta-neutral strategies, meanwhile, suit investors with larger or more complex portfolios who want to automate their risk management. By combining lending yields with derivatives hedges, you can potentially earn passive income while maintaining robust downside protection against depegs.

Pros & Cons of Key Stablecoin Depeg Hedging Strategies

-

Purchase Depeg Protection via On-Chain Depeg Swaps (e.g., Cork Protocol, Risk Harbor)Pros: Simple to use; provides direct insurance against depeg events; automatic payouts if depeg criteria are met; no need for active position management.Cons: Requires payment of premiums; protection is only as strong as the protocol’s solvency and smart contract security; limited to supported stablecoins and platforms.

-

Hedge Stablecoin Exposure Using Perpetual Futures on Decentralized Derivatives Platforms (e.g., GMX, dYdX, Synthetix)Pros: Flexible hedging; can profit from both minor and major depegs; supports advanced strategies; high liquidity on major platforms.Cons: Requires active management and monitoring; risks of liquidation and funding fees; complexity may be challenging for beginners; exposure to smart contract and platform risks.

-

Deploy Automated Delta-Neutral Strategies Combining Lending and Short Derivatives PositionsPros: Can generate yield while minimizing directional price risk; automation reduces manual intervention; adaptable to various market conditions.Cons: Complex to set up and monitor; relies on robust automation and risk management; potential for smart contract failures or unexpected market volatility; may require significant capital to be effective.

Best Practices for On-Chain Derivatives Risk Management

No matter which method you choose, several best practices apply:

- Diversify your stablecoin holdings: Don’t rely solely on one asset, spread risk across multiple reputable stablecoins.

- Monitor protocol health: Use analytics dashboards and on-chain data to track liquidity, collateralization ratios, and governance changes in real time.

- Stay informed about market events: Rapid regulatory shifts or news-driven panics can lead to sudden depegs, set up alerts for early warning signals.

- Understand liquidation mechanics: When using leverage or shorting perps, know exactly when your position could be liquidated if the market moves against you.

- Review smart contract audits: Only interact with protocols that have undergone thorough security reviews and maintain a strong track record in the DeFi space.

The future of DeFi is not just about yield, it’s about resilience. By actively managing your stablecoin exposure using these proven on-chain derivatives strategies, you’re building a portfolio that’s prepared for the unexpected twists of crypto markets.

If you’re ready to get started, explore the protocols mentioned here, Cork Protocol for depeg swaps, GMX/dYdX/Synthetix for perps trading, and leading lending platforms for yield stacking. Remember: knowledge is the best hedge. Stay curious and keep learning as new tools emerge in the ever-evolving landscape of crypto risk management.