Stablecoins remain the backbone of decentralized finance, providing liquidity, stability, and a transactional bridge between volatile crypto assets. As of September 23,2025, Polygon-bridged USDT is holding steady at $1.00, a testament to the sector’s resilience. Yet even with such price stability, the specter of depegging looms large for DeFi investors. Flashbacks to USDC’s temporary drop to $0.95 in 2023 are a sharp reminder: robust risk management is not optional, it’s essential.

Stablecoin and Major Crypto Price Stability Comparison (Polygon, 6-Month View)

Illustrating price stability and depeg risk of major stablecoins (USDT, USDC, DAI) vs. leading cryptocurrencies on Polygon over the past 6 months (as of 2025-09-23).

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

| USD Coin (USDC) | $1.00 | $1.00 | +0.0% |

| Dai (DAI) | $1.00 | $1.00 | +0.0% |

| Frax (FRAX) | $1.00 | $1.00 | +0.0% |

| Binance USD (BUSD) | $1.00 | $1.00 | +0.0% |

| Liquity USD (LUSD) | $1.00 | $1.00 | +0.0% |

| Bitcoin (BTC) | $112,476.00 | $65,000.00 | +73.0% |

| Ethereum (ETH) | $4,192.43 | $3,500.00 | +19.8% |

Analysis Summary

Over the past six months, major stablecoins on Polygon—including USDT, USDC, and DAI—have maintained their $1.00 peg with no significant price fluctuations, demonstrating strong price stability. In contrast, major cryptocurrencies like Bitcoin and Ethereum have experienced substantial price appreciation, highlighting the unique risk and return profiles of stablecoins versus volatile crypto assets.

Key Insights

- Stablecoins (USDT, USDC, DAI, FRAX, BUSD, LUSD) have shown perfect price stability, maintaining their $1.00 peg over the past six months.

- There were no depeg events or notable volatility for these stablecoins on Polygon during this period.

- Bitcoin and Ethereum exhibited significant positive price movement (+73.0% and +19.8%, respectively), underscoring the volatility and growth potential of non-stablecoin assets.

- Stablecoins continue to serve as a reliable store of value and a hedge against crypto market volatility, but depeg risk remains a theoretical concern for DeFi investors.

This comparison uses real-time market data as of September 23, 2025, with historical prices from six months prior. All prices and changes are sourced directly from the provided data, ensuring accuracy and relevance for DeFi risk assessment.

Data Sources:

- Main Asset: https://www.investing.com/crypto/tether/historical-data

- USD Coin: https://www.investing.com/crypto/usd-coin/historical-data

- Dai: https://www.investing.com/crypto/dai/historical-data

- Frax: https://www.investing.com/crypto/frax/historical-data

- Binance USD: https://www.investing.com/crypto/binance-usd/historical-data

- Bitcoin: https://www.investing.com/crypto/bitcoin/historical-data

- Ethereum: https://www.investing.com/crypto/ethereum/historical-data

- Liquity USD: https://www.investing.com/crypto/liquity-usd/historical-data

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Why Stablecoin Depeg Risk Remains Top-of-Mind in 2024

The risk of stablecoin depegs is not theoretical. It’s a lived market reality shaped by technical failures, regulatory shifts, collateral crises, and loss of confidence. The consequences can be swift and severe: slippage in pools, cascading liquidations in lending protocols, and portfolio drawdowns that catch even sophisticated investors off guard.

Today’s DeFi landscape offers more sophisticated tools than ever before for hedging stablecoin depeg risk, if you know where to look and how to use them effectively.

Strategy 1: Utilize Depeg Derivatives and Prediction Markets

One of the most direct ways to hedge against stablecoin depeg risk is through depeg derivatives. Platforms like Y2K Finance and Cork Protocol have pioneered structured products that allow users to either hedge or speculate on the probability of a stablecoin losing its peg.

- Y2K Finance: Offers vaults where users can purchase protection against specific depeg scenarios for assets like USDT or USDC. By depositing ETH or another asset into these vaults, you receive compensation if a depeg event occurs within a defined window.

- Cork Protocol: Hosts prediction markets where investors can trade contracts reflecting market-implied probabilities of depegging events. This not only provides actionable hedges but also valuable pricing signals for those monitoring systemic risk.

The advantage? If you’re holding $10,000 in USDT at $1.00 and fear a sudden drop below parity, purchasing protection via these platforms can offset losses if the worst-case scenario materializes.

If you want to learn more about how on-chain derivatives work in these contexts, see our guide: How to Hedge Against Stablecoin Depegs Using On-Chain Derivatives.

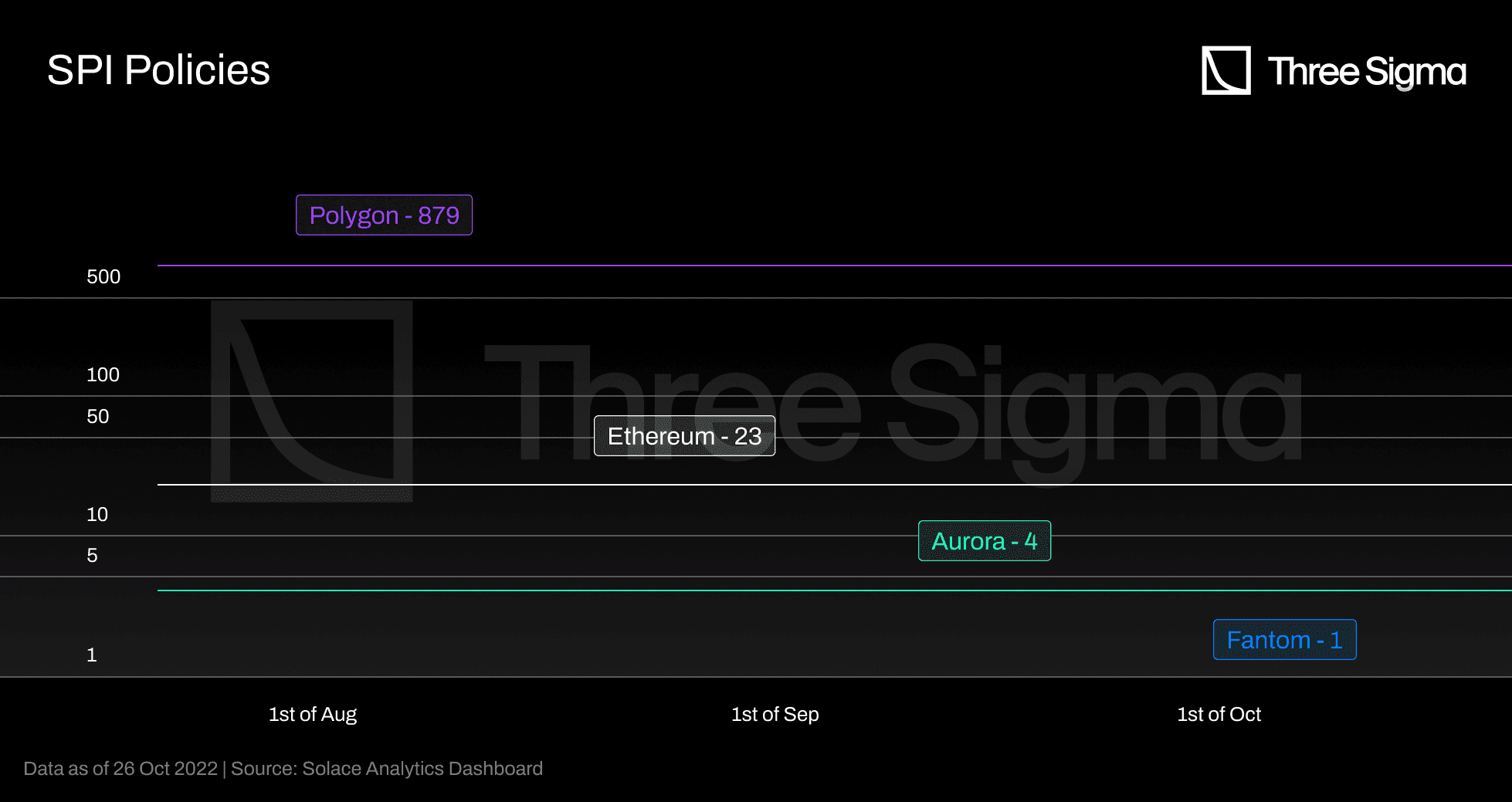

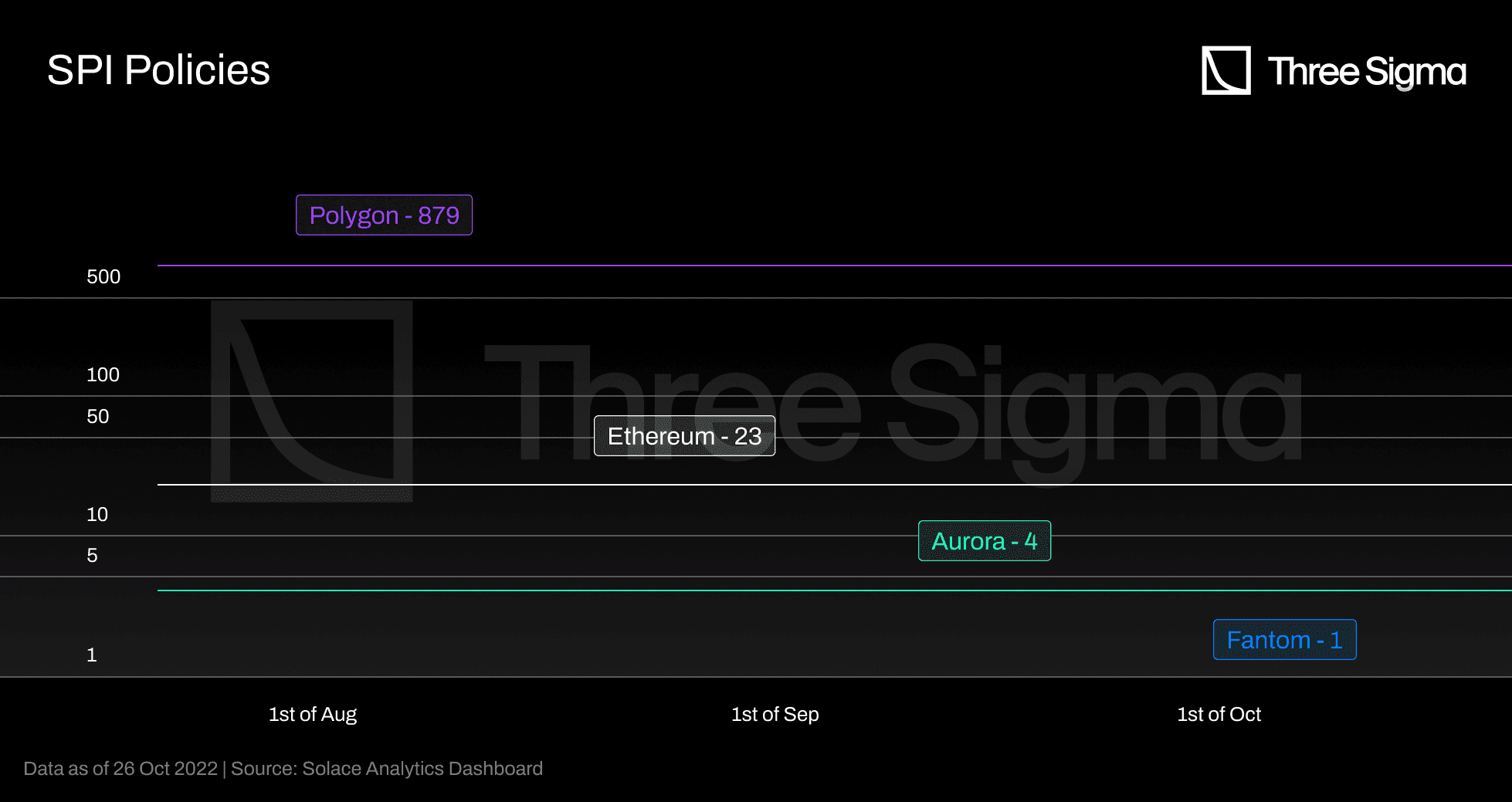

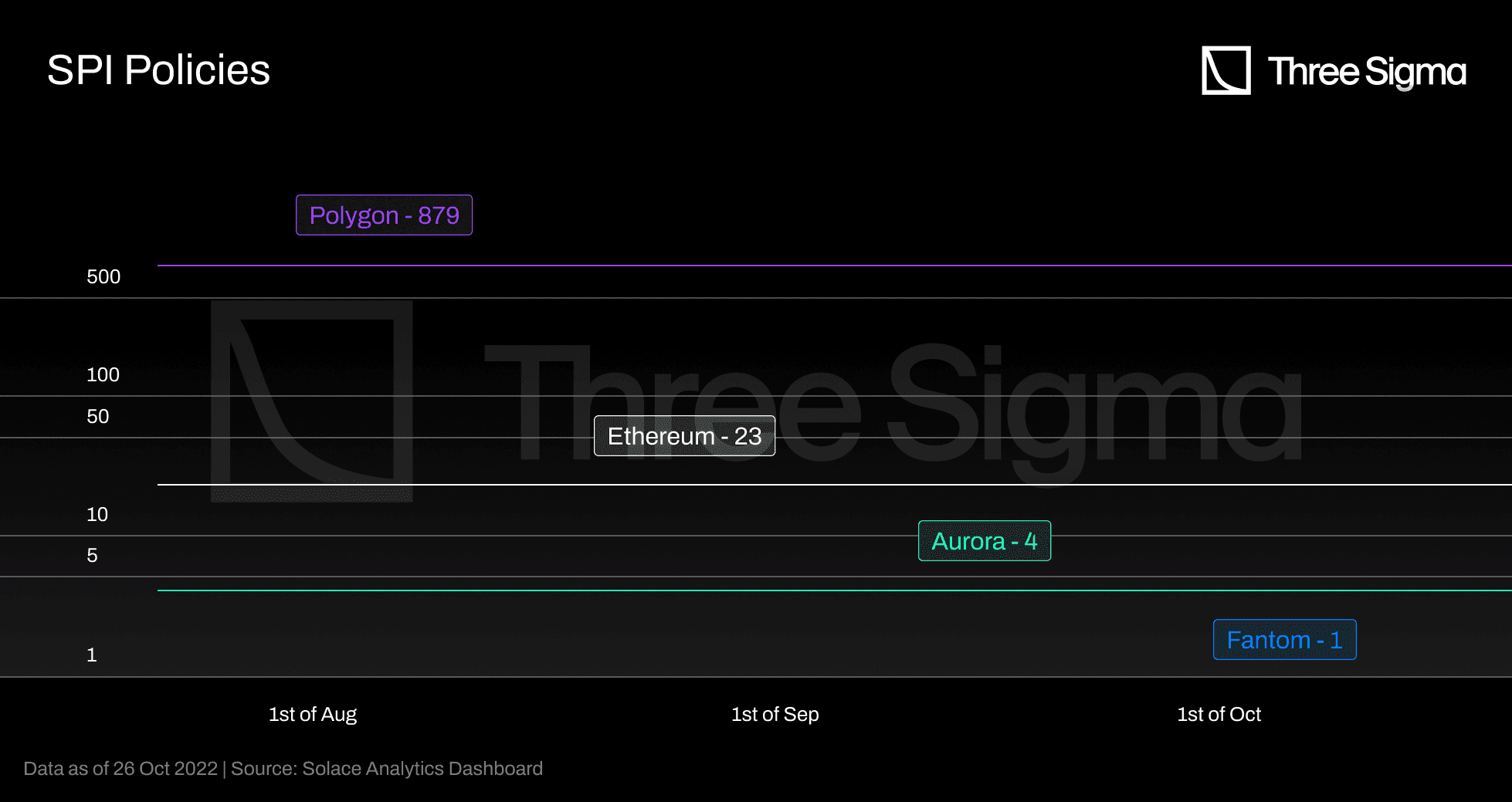

Strategy 2: Purchase Protocol Risk Insurance

The rise of on-chain insurance providers has introduced another line of defense against depegs and protocol failures. Platforms such as Nexus Mutual, InsurAce, and Unslashed allow users to purchase coverage against smart contract exploits or stablecoin-specific risks by paying an upfront premium.

- Nexus Mutual: Offers bespoke coverage for losses stemming from smart contract vulnerabilities or defined depeg triggers in major stablecoins.

- InsurAce and Unslashed: Provide pooled risk products covering both technical failures and market-based events affecting stablecoins like USDC or DAI.

If your assets are held within lending protocols or AMMs that rely on stablecoins priced at $1.00 (such as current Polygon Bridged USDT), protocol insurance can serve as an effective backstop, compensating you if an adverse event disrupts the peg or underlying protocol security.

Tether (USDT) Price Peg Probability & Depeg Risk Outlook (2026-2031)

Market-Implied Price Predictions for USDT Maintaining $1.00 Peg

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | Market Scenario/Notes |

|---|---|---|---|---|

| 2026 | $0.97 | $1.00 | $1.01 | Stable peg expected; minor volatility possible during market stress |

| 2027 | $0.96 | $1.00 | $1.02 | Increased regulatory scrutiny; possible short-lived depegs during crypto selloffs |

| 2028 | $0.95 | $0.99 | $1.02 | Competition from new stablecoins & tech upgrades; isolated depeg risks |

| 2029 | $0.94 | $0.99 | $1.03 | Potential systemic shocks or black swan events; robust recovery mechanisms in place |

| 2030 | $0.93 | $0.98 | $1.03 | Long-term regulatory clarity; risk of rare, brief depegs |

| 2031 | $0.92 | $0.98 | $1.04 | Mature market, with depeg risk tied to macro events or Tether reserve transparency |

Price Prediction Summary

USDT is expected to largely maintain its $1.00 peg through 2031, with minor deviations possible during periods of market stress, regulatory shifts, or systemic shocks. The average price is projected to remain close to $1.00, but investors should be aware of rare but possible brief depegs below $0.95 in extreme bearish scenarios. Technological improvements, diversification, and robust risk management are likely to support peg stability, while increased competition and evolving regulations could introduce new risks.

Key Factors Affecting Tether Price

- Regulatory changes impacting stablecoin reserves and operations

- Transparency and auditability of Tether’s reserves

- Emergence of new, competitive stablecoins

- Adoption of DeFi hedging solutions and insurance protocols

- General crypto market volatility and macroeconomic events

- Technological improvements in stablecoin mechanisms

- Adoption trends and integration with institutional finance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

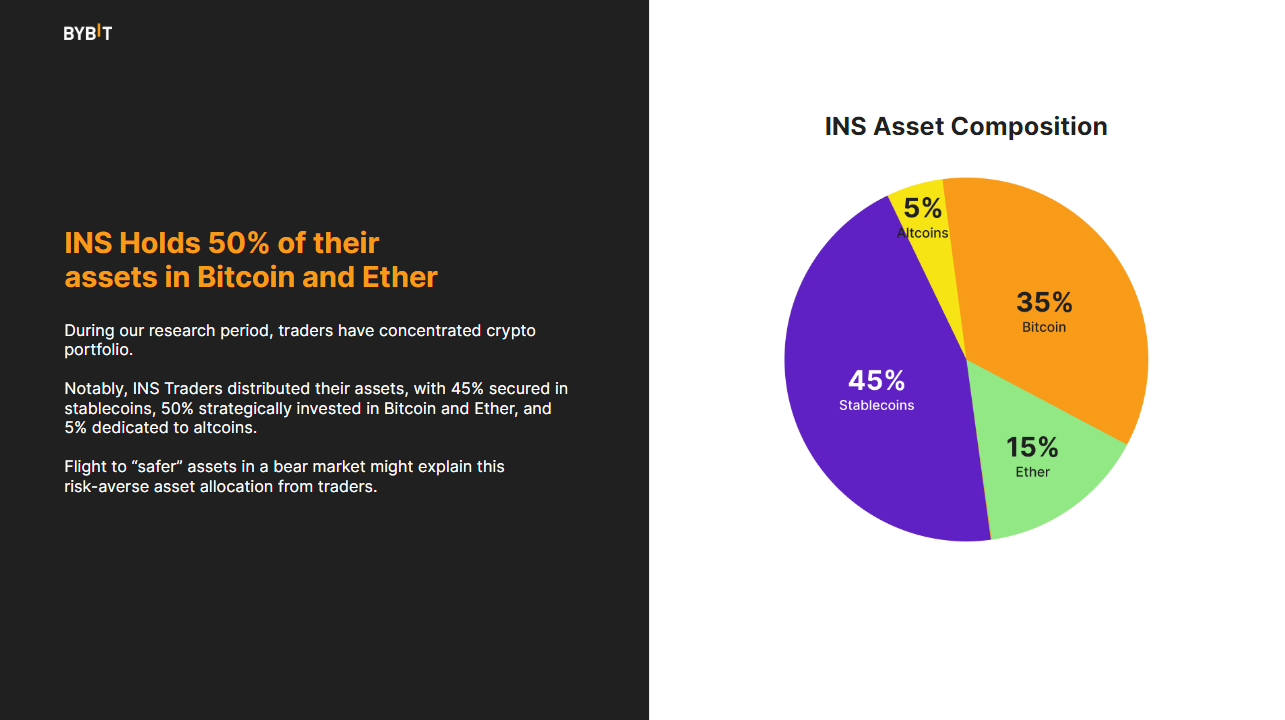

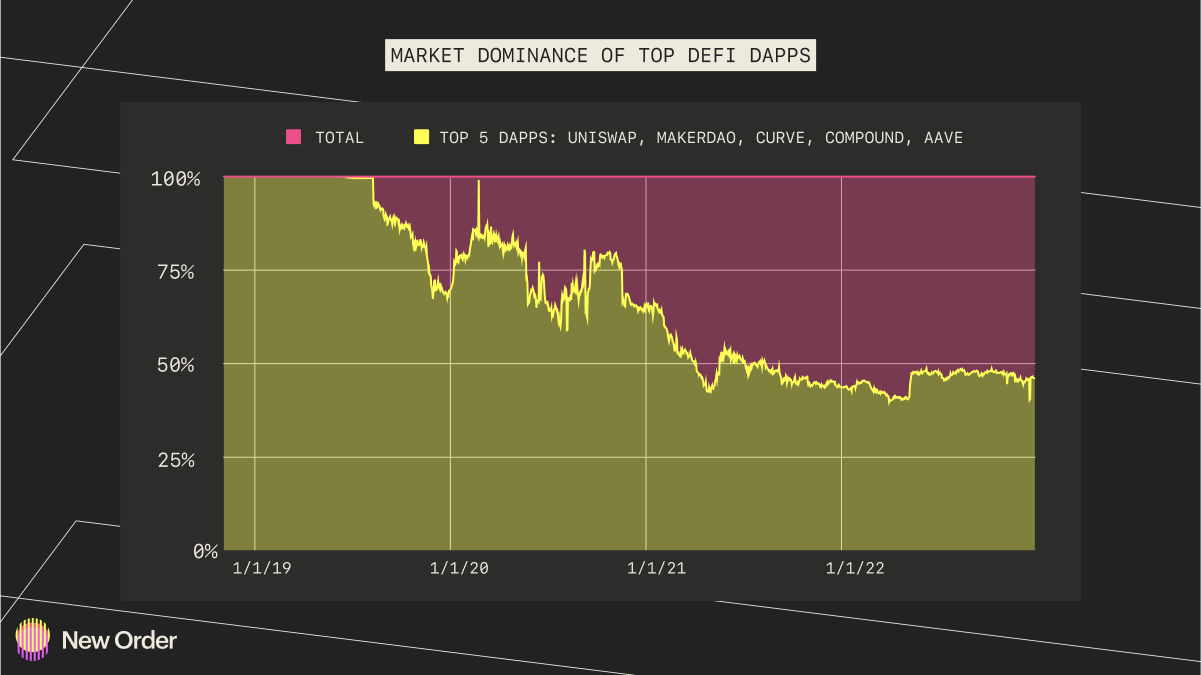

Diversify Across Multiple Stablecoins and Collateral Types

No single asset or protocol is immune from failure, a lesson hammered home by past depegging incidents across both fiat-backed (e. g. , USDC) and algorithmic (e. g. , UST) stablecoins. The best practice? Diversification across different classes:

Top Strategies to Hedge Stablecoin Depeg Risk in 2024

-

Utilize Depeg Derivatives and Prediction Markets: Platforms such as Y2K Finance and Cork Protocol offer structured products and prediction markets that allow investors to hedge or speculate on the probability of a stablecoin depeg. By purchasing depeg protection or shorting the peg, users can offset potential losses if a stablecoin like USDT or USDC loses parity.

-

Purchase Protocol Risk Insurance: On-chain insurance providers like Nexus Mutual, InsurAce, and Unslashed offer coverage against smart contract failures and stablecoin depegs. By paying a premium, investors can insure their assets held in DeFi protocols or stablecoin pools, receiving compensation if a covered depeg event occurs.

-

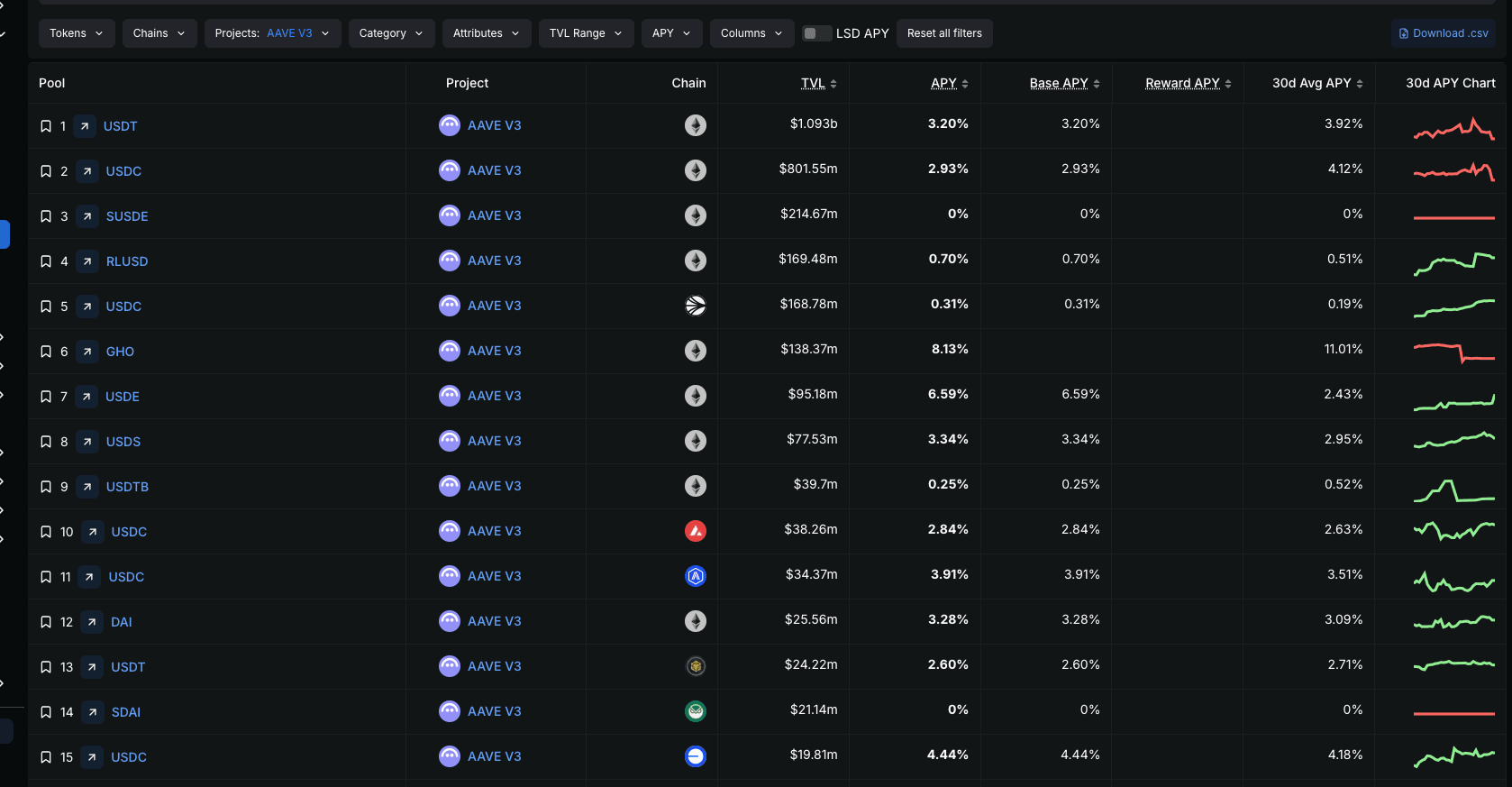

Diversify Across Multiple Stablecoins and Collateral Types: Reduce concentration risk by allocating funds across a mix of fiat-backed (e.g., USDC, USDT), overcollateralized (e.g., DAI), and algorithmic stablecoins. Pair this with diversified DeFi protocols to minimize exposure to any single asset or platform failure. For example, distribute holdings among USDT (Polygon: $1.00), USDC, and DAI across platforms like Aave, Curve, and Balancer.

This approach reduces concentration risk by spreading exposure across centralized issuers (like Circle for USDC), decentralized protocols (like MakerDAO’s DAI), and newer algorithmic models, each with distinct collateralization mechanisms and governance structures.

Diversifying across multiple DeFi platforms further insulates your portfolio from isolated smart contract failures or governance attacks that could trigger broader contagion effects during volatile periods.

While stablecoins like Polygon-bridged USDT remain at $1.00 as of September 23,2025, the market’s memory is long. Investors who lived through the USDC depeg know that a single point of failure can ripple through DeFi at lightning speed. That’s why diversification is more than a buzzword, it’s your first line of defense.

How to Structure a Diversified Stablecoin Portfolio

Effective diversification means allocating capital across fiat-backed, overcollateralized, and algorithmic stablecoins, while also spreading exposure across multiple DeFi protocols. For example, you might split your holdings between USDT (fiat-backed and currently at $1.00), DAI (overcollateralized), and a smaller allocation to an algorithmic stablecoin for yield enhancement, always balancing risk versus reward.

Top Strategies to Hedge Stablecoin Depeg Risk in 2024

-

Utilize Depeg Derivatives and Prediction Markets: Platforms such as Y2K Finance and Cork Protocol offer structured products and prediction markets that allow investors to hedge or speculate on the probability of a stablecoin depeg. By purchasing depeg protection or shorting the peg, users can offset potential losses if a stablecoin like USDT or USDC loses parity.

-

Purchase Protocol Risk Insurance: On-chain insurance providers like Nexus Mutual, InsurAce, and Unslashed offer coverage against smart contract failures and stablecoin depegs. By paying a premium, investors can insure their assets held in DeFi protocols or stablecoin pools, receiving compensation if a covered depeg event occurs.

-

Diversify Across Multiple Stablecoins and Collateral Types: Reduce concentration risk by allocating funds across a mix of fiat-backed (e.g., USDC, USDT), overcollateralized (e.g., DAI), and algorithmic stablecoins. Pair this with diversified DeFi protocols to minimize exposure to any single asset or platform failure. For example, distributing holdings among Curve, Aave, and Uniswap can further enhance portfolio resilience.

This multi-pronged approach ensures that if one stablecoin or protocol encounters trouble, only a portion of your portfolio is affected. It also gives you the flexibility to rebalance as market conditions or regulatory frameworks evolve, key in 2024’s fast-moving landscape.

Strategic Takeaways for DeFi Risk Management in 2024

The tools for hedging stablecoin depeg risk have never been more accessible or sophisticated. Let’s recap the most actionable strategies available right now:

Top Strategies to Hedge Stablecoin Depeg Risk in 2024

-

Utilize Depeg Derivatives and Prediction Markets: Platforms such as Y2K Finance and Cork Protocol offer structured products and prediction markets that allow investors to hedge or speculate on the probability of a stablecoin depeg. By purchasing depeg protection or shorting the peg, users can offset potential losses if a stablecoin like USDT or USDC loses parity.

-

Purchase Protocol Risk Insurance: On-chain insurance providers like Nexus Mutual, InsurAce, and Unslashed offer coverage against smart contract failures and stablecoin depegs. By paying a premium, investors can insure their assets held in DeFi protocols or stablecoin pools, receiving compensation if a covered depeg event occurs.

-

Diversify Across Multiple Stablecoins and Collateral Types: Reduce concentration risk by allocating funds across a mix of fiat-backed (e.g., USDC, USDT), overcollateralized (e.g., DAI), and algorithmic stablecoins. Pair this with diversified DeFi protocols to minimize exposure to any single asset or platform failure.

Utilize Depeg Derivatives and Prediction Markets: Hedge directly against depegs using Y2K Finance or Cork Protocol, these platforms give you real-time pricing on depeg risks and let you offset potential losses if a major event hits.

Purchase Protocol Risk Insurance: Don’t underestimate the value of coverage from providers like Nexus Mutual or InsurAce. For a modest premium, you can protect yourself from catastrophic protocol failures or sudden depegs, a small price for peace of mind in volatile markets.

Diversify Across Multiple Stablecoins and Collateral Types: No one knows which asset could be next to break parity. By spreading funds across different collateral models and platform architectures, you’re building true resilience into your portfolio.

If there’s one constant in DeFi, it’s uncertainty. The investors who thrive are those who plan for the worst, and optimize for the best outcomes using every tool at their disposal.

![]()

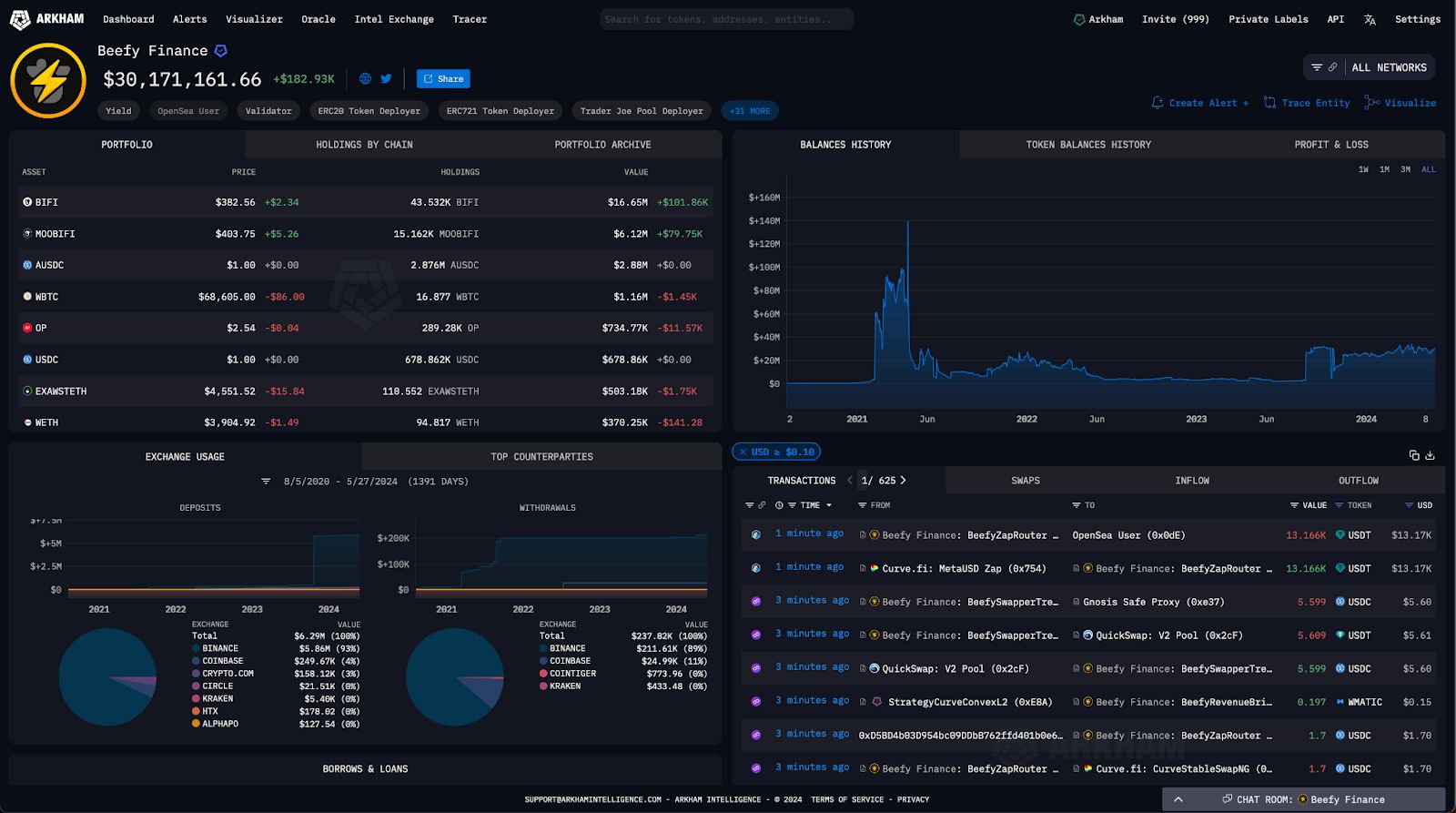

Stay Proactive With Real-Time Monitoring

The final pillar of robust DeFi risk management is vigilance. Monitor real-time price feeds, such as the current $1.00 level for Polygon Bridged USDT, alongside prediction markets that signal rising depeg probabilities. Combine this data-driven awareness with strategic hedges and insurance coverage to minimize surprises.

If you’re ready to explore advanced hedging tactics using on-chain derivatives, check out our step-by-step guide here: How to Hedge Against Stablecoin Depegs Using On-Chain Derivatives.