In the decentralized finance (DeFi) ecosystem, the reliability of oracles is not just a technical concern – it is a foundational pillar upholding billions of dollars in protocol value. When oracles falter, whether due to software vulnerabilities or deliberate manipulation, the consequences can be swift and catastrophic: stablecoin depegs, mass liquidations, and the evaporation of user trust. Recent headlines underscore this reality, with exploits like CVE-2025-61882 and CVE-2025-61884 exposing how even established infrastructure can become an attack vector for sophisticated adversaries.

How Oracle Vulnerabilities Spark DeFi Protocol Failures

Oracles serve as bridges between on-chain smart contracts and off-chain data sources, most critically price feeds. Their security is paramount: a single inaccurate price update can trigger a cascade of incorrect liquidations or enable attackers to siphon funds from lending pools. The October 2025 $19 billion DeFi market meltdown is a stark reminder – systemic risks from overleveraged positions were magnified by unreliable oracle inputs, compounding losses across protocols.

Unlike traditional finance, where centralized data providers are accountable and regulated, DeFi relies on decentralized or semi-decentralized oracle networks. This increases transparency but introduces new vectors for exploitation. Attackers have learned to manipulate these data feeds using flash loans, oracle lag exploitation, and by targeting periods of low liquidity or network congestion.

Real-World Exploits: Anatomy of Oracle Manipulation Attacks

The past twelve months have seen several high-profile exploits leveraging oracle weaknesses:

Major DeFi Exploits Caused by Oracle Vulnerabilities

-

Polter Finance Exploit (November 2024): Attackers manipulated Polter Finance‘s price oracle by exploiting SpookySwap’s BOO token liquidity pools. Using flash loans, they artificially inflated BOO’s price, enabling them to borrow assets far beyond actual collateral value. The exploit stemmed from the oracle’s failure to validate prices against historical data or check for extreme deviations. Learn more

-

Term Finance Oracle Failure (2024): Term Finance lost $1.6 million due to reliance on a single, faulty oracle. The absence of fallback mechanisms led to inaccurate price feeds, causing improper liquidations and asset mispricing. This incident underscored the dangers of single-point oracle dependencies in DeFi. Read the full incident analysis

-

bZx Flash Loan Oracle Attack (February 2020): The bZx protocol suffered a flash loan attack exploiting its price oracle. Attackers manipulated the price feed using a series of trades and flash loans, resulting in a loss of approximately $350,000. This event marked one of the earliest and most notable oracle manipulation exploits in DeFi. Explore the bZx exploit details

-

October 2025 DeFi Liquidation Event: In October 2025, DeFi protocols faced a $19 billion market liquidation, partially triggered by oracle vulnerabilities. Overleveraged positions and inaccurate price feeds led to cascading liquidations, exposing systemic risks tied to unreliable oracle data. See the market impact

-

Harvest Finance Exploit (October 2020): Harvest Finance was drained of over $24 million after attackers manipulated the price oracle for stablecoins through large-volume trades on Curve Finance. The exploit highlighted the risks of using on-chain DEX prices as direct oracle feeds. Read the Harvest Finance post-mortem

Polter Finance Exploit (November 2024): Polter’s reliance on SpookySwap’s liquidity pool for BOO token pricing proved fatal. An attacker used flash loans to temporarily inflate BOO’s market price within the pool. Without historical price checks or deviation guards in its oracle logic, Polter Finance allowed the attacker to borrow assets far exceeding true collateral value, resulting in severe losses for protocol users.

Term Finance Incident: Here, the protocol’s dependence on a single source for pricing data led to $1.6 million in losses. The absence of fallback mechanisms meant that when inaccurate prices were fed into the system – whether due to technical failure or malicious interference – improper liquidations ensued. This highlights why relying solely on one oracle provider remains one of the gravest risks in DeFi architecture.

Systemic Impact: From Stablecoin Depegs to Mass Liquidations

The ripple effects of an oracle vulnerability extend far beyond an isolated incident. When protocols misprice collateral assets or stablecoins due to faulty data feeds, it can trigger forced liquidations at scale and even cause stablecoins to lose their pegs entirely. As detailed in this analysis, attackers have repeatedly exploited these dynamics by manipulating low-liquidity markets right before critical price snapshots are taken by lending protocols.

The infamous bZx exploit in early 2020 was an early warning shot – but since then, attackers have only grown more sophisticated and patient. Recent research reveals that over $59 billion has been drained from DeFi through such exploits over five years, making clear that innovation must be matched with robust risk controls if the sector is to mature safely.

Why Oracles Remain the Achilles’ Heel of Crypto Protocols

The persistent threat posed by oracle vulnerabilities stems from several factors:

- Over-reliance on single sources: Many protocols still depend on one primary data provider without redundancy.

- Lack of real-time validation: Few systems implement cross-checks against historical averages or alternative feeds before executing sensitive transactions.

- Poor monitoring for stale data: Stale prices can be as dangerous as manipulated ones when markets move quickly.

- Complexity in fallback logic: Even when multiple sources are integrated, poorly designed fallback mechanisms can introduce new bugs or attack surfaces.

This landscape demands both technical vigilance and strategic foresight from protocol designers and investors alike. In Part Two we’ll examine proven risk mitigation strategies – including diversified data sourcing and insurance mechanisms – that forward-thinking teams are deploying today.

Proactive Risk Mitigation: Defending DeFi from Oracle-Driven Failures

Effective DeFi risk mitigation against oracle vulnerabilities is not a one-size-fits-all solution. Instead, it requires a layered approach that combines technical safeguards, governance improvements, and insurance mechanisms. The following strategies represent best practices adopted by leading protocols:

Top Risk Mitigation Strategies for Oracle Vulnerability in DeFi

-

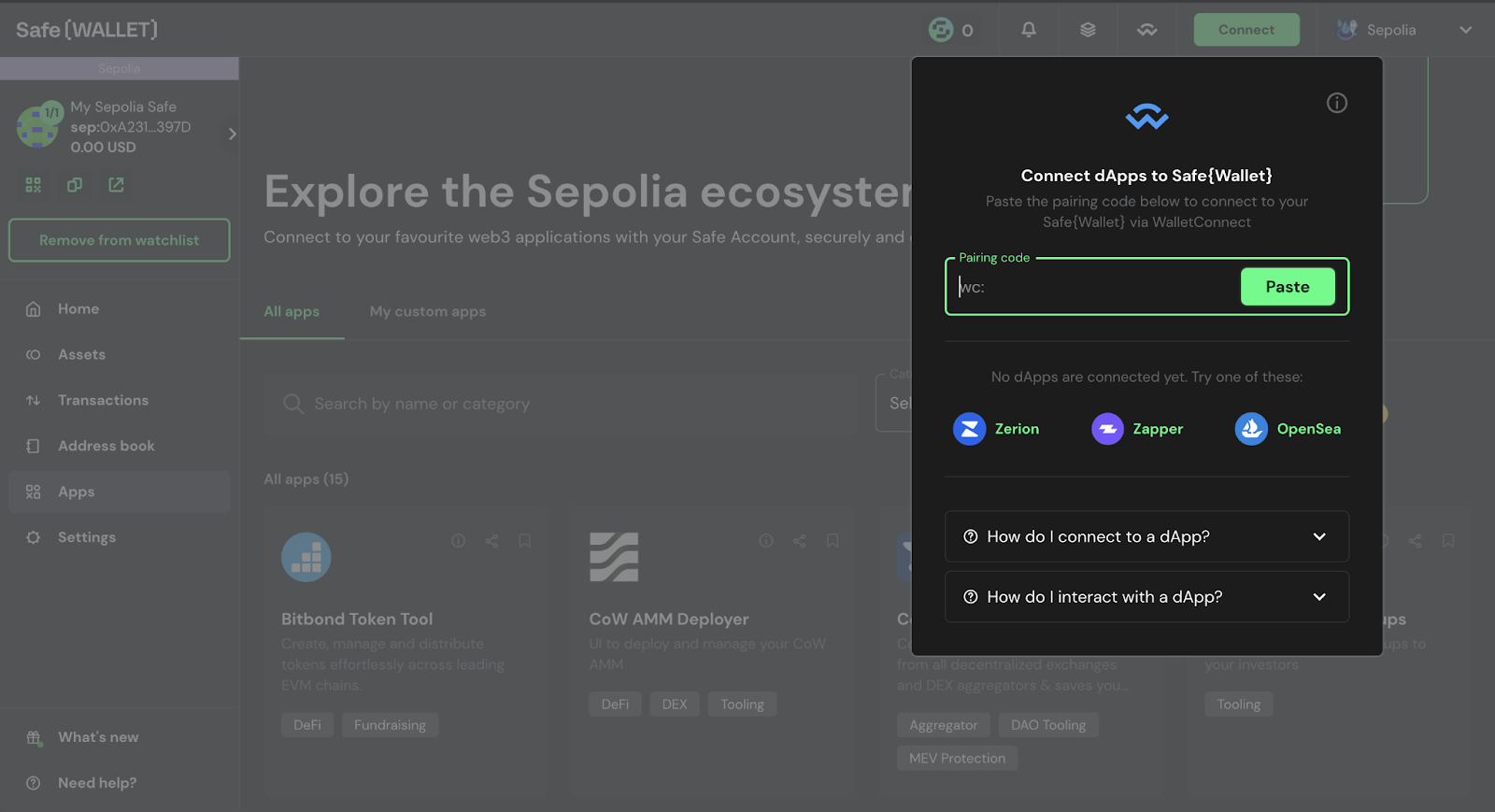

Diversify Data Sources and Oracle Providers: Integrate multiple independent oracle networks—such as Chainlink, Band Protocol, and API3—to avoid single points of failure and enable cross-verification of market data.

-

Implement Time-Weighted Average Prices (TWAPs): Use TWAPs to calculate asset prices over defined intervals, reducing the impact of flash loan attacks and short-term price manipulations.

-

Conduct Thorough Smart Contract Audits: Combine manual code reviews with automated tools from reputable firms like CertiK and Trail of Bits to proactively identify and address vulnerabilities in oracle integration.

-

Implement Multi-Signature Controls: Require multiple trusted parties to approve critical transactions, minimizing the risk of unilateral or malicious actions affecting oracle data or protocol funds.

-

Use Decentralized Oracle Networks: Leverage established decentralized oracles like Chainlink to provide tamper-resistant, reliable data feeds, reducing vulnerabilities associated with centralized oracles.

-

Monitor for Stale Price Data: Deploy automated systems to check the freshness of price feeds, ensuring protocols act only on up-to-date market information and reducing susceptibility to manipulation.

Diversification of Data Sources: Relying on multiple independent oracles significantly reduces the chance that any single manipulated feed can cause protocol-wide failures. For instance, integrating Chainlink alongside custom oracles provides redundancy and enables real-time cross-verification. This strategy also helps protocols withstand targeted attacks on individual data providers.

Time-Weighted Average Price (TWAP) Implementation: By calculating prices over defined intervals, TWAPs smooth out volatile spikes and reduce susceptibility to flash loan-driven manipulation. This mechanism is especially critical during periods of low liquidity or heightened market volatility.

Continuous Monitoring for Stale Data: Automated checks on data freshness are essential. If a price feed lags behind current market conditions, protocols should halt sensitive operations until reliable data resumes. This simple safeguard can prevent cascading liquidations and depegs triggered by outdated prices.

Smart Contract Audits and Multi-Sig Controls: Regular, comprehensive audits help catch logic flaws in oracle integration before they are exploited. Multi-signature requirements for critical contract upgrades or emergency responses can further limit damage from compromised data feeds or admin keys.

Insurance Against Oracle Attacks: As the market matures, protocol insurance products specifically covering oracle manipulation and depeg risks have emerged. These solutions offer users an additional layer of protection and incentivize projects to maintain high security standards. For more on how insurance mechanisms interact with oracle reliability, see this detailed guide.

Learning from the Latest Exploits: What’s Next for DeFi Security?

The rapid patching of CVE-2025-61882 and CVE-2025-61884 illustrates both the responsiveness of security teams and the relentless pace of adversarial innovation in crypto markets. As demonstrated by the Cl0p campaign’s exploits against Oracle EBS, attackers are increasingly targeting foundational infrastructure rather than just application-layer code.

This evolving threat landscape means that DeFi protocol failure scenarios must be modeled not only around direct smart contract bugs but also around upstream risks like oracle outages, data lag, or coordinated manipulation attacks. Sophisticated simulation frameworks and bug bounty programs are now table stakes for serious projects, yet even these measures must be complemented by robust user education about liquidation mechanics and stablecoin peg dynamics.

Investor Takeaways: Safeguarding Your Portfolio

If you’re allocating capital to DeFi protocols, whether as a retail user or institutional investor, understanding each platform’s approach to oracle delays and failures is as important as analyzing its yield curve or TVL growth rate. Ask whether your protocol has implemented redundant price feeds, uses TWAPs, conducts regular audits, and offers insurance options against depeg events.

The bottom line? As long as smart contracts depend on external data, oracle vulnerability in DeFi will remain a systemic risk, and a battleground for both attackers and defenders. By demanding transparency around risk management practices and proactively using available hedging tools, users can help push the ecosystem toward greater resilience.