The explosive growth of decentralized finance (DeFi) has delivered both unprecedented opportunity and risk. As protocols scale, so too does the surface area for exploits, with DeFi protocol hacks now a persistent threat to capital locked in smart contracts. While insurance products have emerged, they often lag behind the evolving sophistication of attacks. Enter crypto prediction markets: an innovative alternative for hedging DeFi risk that leverages market consensus to price the probability of protocol failures in real time.

Prediction Markets: A Dynamic Tool for DeFi Risk Management

At their core, prediction markets are decentralized platforms where participants trade shares based on the outcome of future events. In the context of DeFi, these events might include whether a major lending protocol will suffer a hack by a specified date or if a stablecoin will lose its peg. By aggregating diverse opinions and information, prediction markets can serve as an early-warning system, surfacing collective sentiment about vulnerabilities before they materialize into losses.

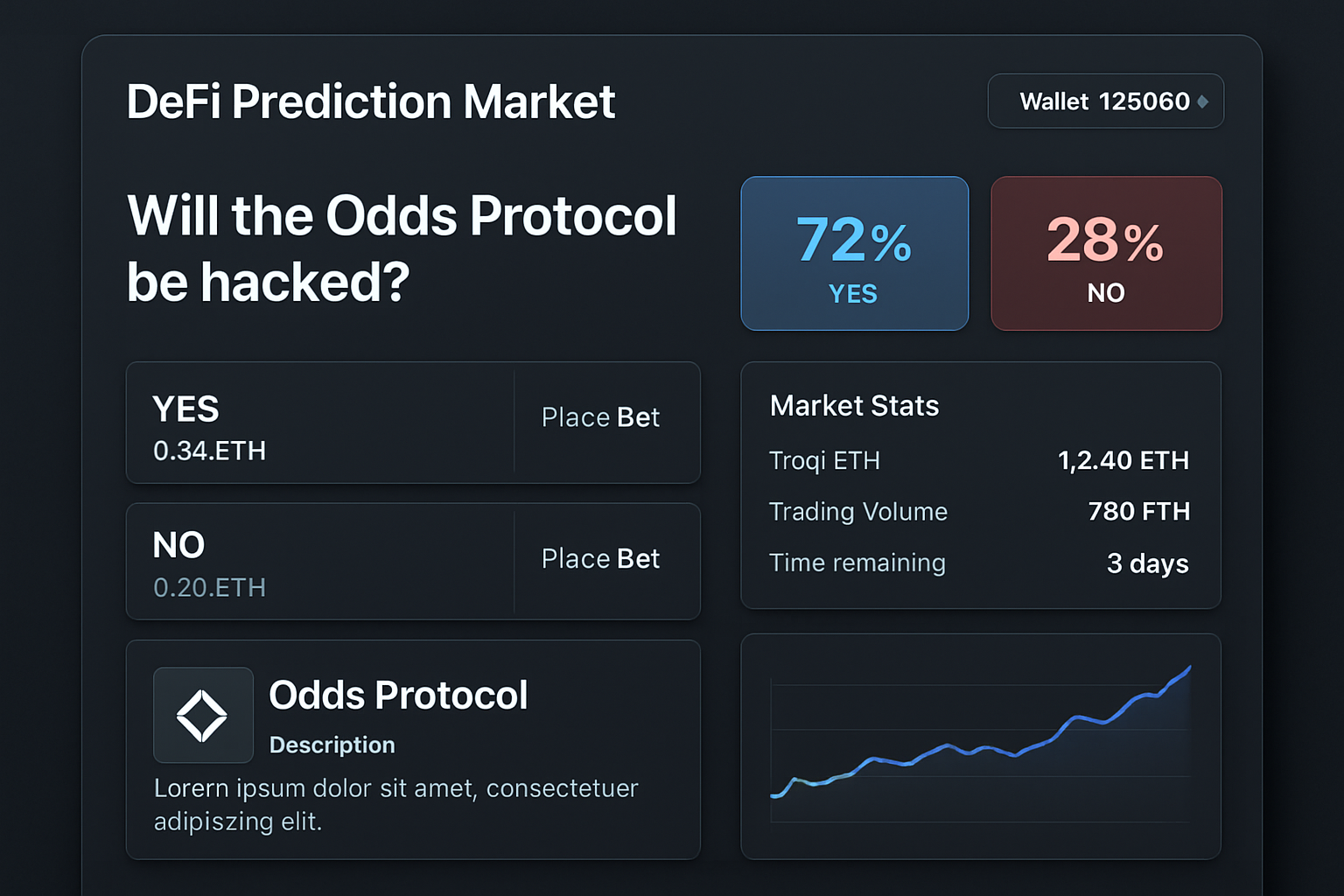

For example, consider an event like “Will Protocol X experience a security breach by December 31st?” Users can buy ‘Yes’ or ‘No’ shares depending on their assessment of the protocol’s security posture. The price of these shares reflects real-time market sentiment and perceived risk, providing actionable data to investors and developers alike.

How Investors Hedge Against Protocol Hacks Using Prediction Markets

The practical application is straightforward yet powerful. Suppose you have significant assets in a particular DeFi lending platform. To hedge against the risk of an exploit, you could purchase ‘Yes’ shares in a relevant prediction market event tied to that protocol’s security. If no hack occurs, your loss is limited to the cost of those shares, a manageable premium akin to insurance. But if an exploit happens and the event resolves as ‘Yes, ‘ your payout from the prediction market helps offset your direct losses from the protocol failure.

This approach offers several advantages over traditional DeFi insurance:

- Speed: Prediction markets settle quickly after event resolution, often faster than claim-based insurance payouts.

- Transparency: All bets are recorded on-chain with open odds and liquidity dynamics visible to all participants.

- No centralized claims process: Payouts are determined by objective event outcomes rather than subjective claims review.

This model is especially attractive when insurance coverage is unavailable or prohibitively expensive for newer or higher-risk protocols.

Market Sentiment as an Early Warning Indicator

The utility of prediction markets extends beyond direct hedging. The pricing dynamics within these platforms act as real-time indicators of shifting risk perceptions in the ecosystem. For instance, if ‘Yes’ shares on “Will Protocol Y be hacked this quarter?” spike in price, it may signal growing concern among informed traders about vulnerabilities, perhaps due to newly discovered bugs or suspicious on-chain activity.

This crowd-sourced intelligence enables proactive risk management: asset managers can adjust exposures or implement additional safeguards when market signals flash red, potentially mitigating losses before an incident occurs.

If you’re interested in exploring further strategies for using prediction markets as part of your crypto portfolio’s defense system, see our practical guide for crypto investors.

Of course, leveraging crypto prediction markets for hedging DeFi risk is not without its own set of considerations. Liquidity remains a central challenge: thinly traded markets can experience significant price swings and may not provide sufficient depth for large positions. Additionally, market manipulation and oracle vulnerabilities can threaten the integrity of outcomes, especially for events that are less objectively verifiable. As with any DeFi tool, prudent due diligence is essential.

Comparing Prediction Markets and Traditional DeFi Insurance

To help clarify where prediction markets stand relative to more established insurance alternatives, consider the following comparison:

Comparison of Prediction Markets vs. DeFi Insurance for Hedging Protocol Hacks

| Feature | Prediction Markets | DeFi Insurance |

|---|---|---|

| Speed | Fast resolution after event outcome is clear; payouts can be automated via smart contracts | Can be slow; requires formal claims process and investigations |

| Transparency | Highly transparent; all bets and outcomes are on-chain and publicly verifiable | Varies; some protocols are transparent, but claims assessments may be opaque |

| Cost | Low entry cost; only pay for shares purchased, but prices can fluctuate with market sentiment | Premiums can be high, especially for high-risk protocols |

| Claims Process | No claims needed; payout is based on event outcome, resolved by oracle or community consensus | Formal claims submission required; may involve lengthy review |

| Coverage Scope | Event-specific; can hedge against a wide range of outcomes, including hacks, regulatory changes, etc. | Typically limited to predefined events (e.g., smart contract bugs, exploits) as covered in the policy |

While DeFi insurance products offer peace of mind through explicit coverage terms and regulatory oversight (in some cases), they often lag in adaptability and can be slow to pay out. Prediction markets, by contrast, thrive on speed and transparency but require users to accept market pricing risk rather than fixed premiums.

Best Practices for Integrating Prediction Markets Into Your Risk Strategy

If you’re considering adding prediction market hedges to your portfolio defense toolkit, keep these best practices in mind:

- Diversify Your Hedges: Don’t rely solely on prediction markets; combine them with protocol audits, insurance products, and dynamic asset allocation.

- Monitor Market Signals: Use price movements in relevant prediction markets as part of your ongoing risk assessment framework.

- Understand Event Resolution: Carefully review how market outcomes are determined, prefer platforms with transparent oracle mechanisms and clear event definitions.

- Assess Liquidity Before Entering Positions: Thin liquidity can erode the effectiveness of your hedge or lead to unfavorable exits.

The evolving landscape of decentralized finance demands agile risk management. By tapping into the collective intelligence of crypto prediction markets, and understanding their unique strengths and limitations, investors gain a new layer of protection against the ever-present threat of protocol exploits. While not a silver bullet, these platforms offer an adaptive complement to static insurance models and traditional derivatives.

Ultimately, the most resilient portfolios will blend multiple forms of risk mitigation: technical due diligence, diversified exposure, traditional insurance where available, and selective use of real-time market-based hedges like those offered by crypto prediction platforms. As these tools mature alongside DeFi itself, expect their role in safeguarding digital assets to grow ever more strategic.