Stablecoins are the backbone of decentralized finance, acting as the primary medium for collateral, settlement, and liquidity across lending protocols and decentralized exchanges. But when a stablecoin depegs – that is, its price deviates significantly from its intended reference asset – it can unleash a chain reaction of liquidations and systemic stress throughout the DeFi ecosystem. These events are not hypothetical: recent incidents have demonstrated how even a minor loss of peg can trigger outsized volatility, forced asset sales, and cascading protocol failures.

How Stablecoin Depegs Set Off Liquidation Cascades

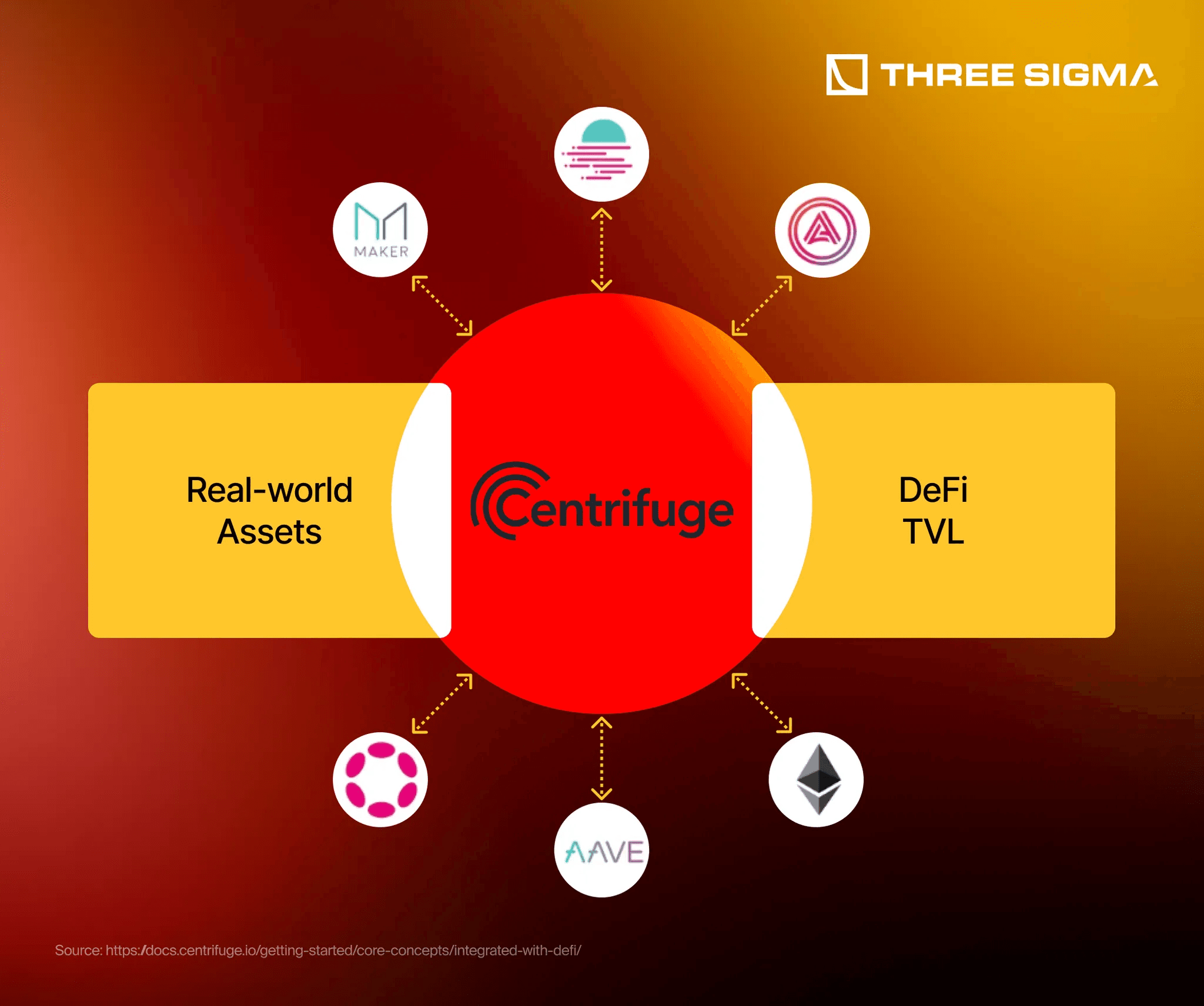

The mechanics behind DeFi cascading liquidations are rooted in automated risk controls. Lending protocols like Aave or Compound require users to overcollateralize their loans. Stablecoins such as USDC or DAI are often chosen as collateral due to their perceived price stability. However, when a stablecoin loses its peg – for example, dropping to $0.97 against the dollar – the value of users’ collateral abruptly shrinks. If this value falls below protocol-mandated thresholds, smart contracts automatically trigger liquidations to preserve solvency.

This forced selling not only crystallizes losses for borrowers but also puts downward pressure on other assets used as collateral throughout interconnected platforms. The result is a liquidation cascade: one depeg event causes multiple protocols to sell off assets simultaneously, amplifying volatility and potentially leading to further depegs or market dislocations.

The Role of Liquidity Crunches and Protocol Interconnectedness

Liquidity crunches exacerbate these risks. When confidence in a stablecoin erodes, users rush to exit positions or withdraw funds from liquidity pools like Curve or Uniswap. This mass exodus drains available liquidity just when it is needed most for orderly liquidations or arbitrage trades. Thin liquidity means larger slippage on trades and makes it harder for protocols to execute liquidations at fair prices – sometimes resulting in underwater positions that threaten protocol solvency.

The risk does not stop at one platform: DeFi’s composable architecture means that assets borrowed from one protocol are often used as collateral elsewhere. For instance, if USDC depegs on Aave and triggers liquidations there, those same USDC tokens might be supporting leveraged positions on another lending platform or DEX pool. This web of dependencies turns isolated shocks into systemic events – precisely why understanding cross-protocol risk propagation is crucial for both users and protocol designers.

Current Market Data: Real-World Impact of Depeg Events

The October 2025 incident involving USDC provides a vivid case study: as the coin briefly fell below $1 due to reserve uncertainty, multiple DeFi platforms saw liquidation volumes spike by double digits within hours. According to Bitget’s analysis, these cascading liquidations left hundreds of wallets with underwater positions across protocols such as Aave v3 and Compound III. The episode underscored how low liquidity can amplify price swings and hinder arbitrageurs’ ability to restore pegs promptly.

Moreover, algorithmic governance systems did not always react quickly enough; some platforms were forced to tighten liquidation thresholds after the fact rather than proactively managing exposure ahead of time. This highlights the importance of robust depeg risk management, including both technical safeguards within protocols and user-level hedging strategies.

Building Resilience: Hedging Strategies Against Stablecoin Failure

No single defense is sufficient against systemic depeg risk; instead, layered approaches offer better protection:

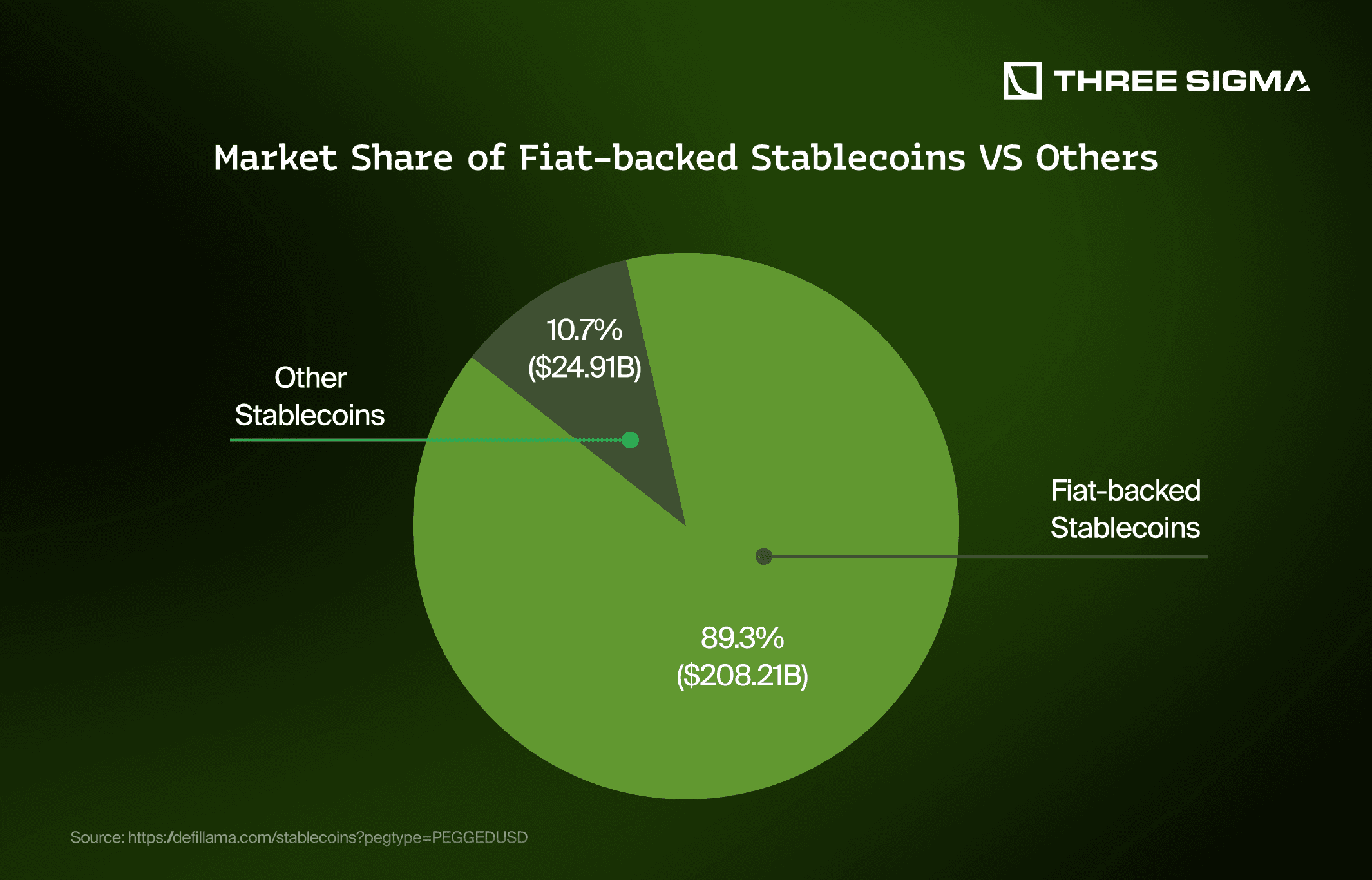

- Diversification: Holding multiple types of stablecoins (e. g. , USDT, USDC, DAI) reduces single-asset failure risk.

- Depeg Protection Options: Platforms like Risk Harbor provide insurance-like products that pay out if specific depeg thresholds are breached.

- Automated Hedging Vaults: Angle Protocol’s vaults dynamically adjust exposure using derivatives and yield farming strategies in response to real-time price movements.

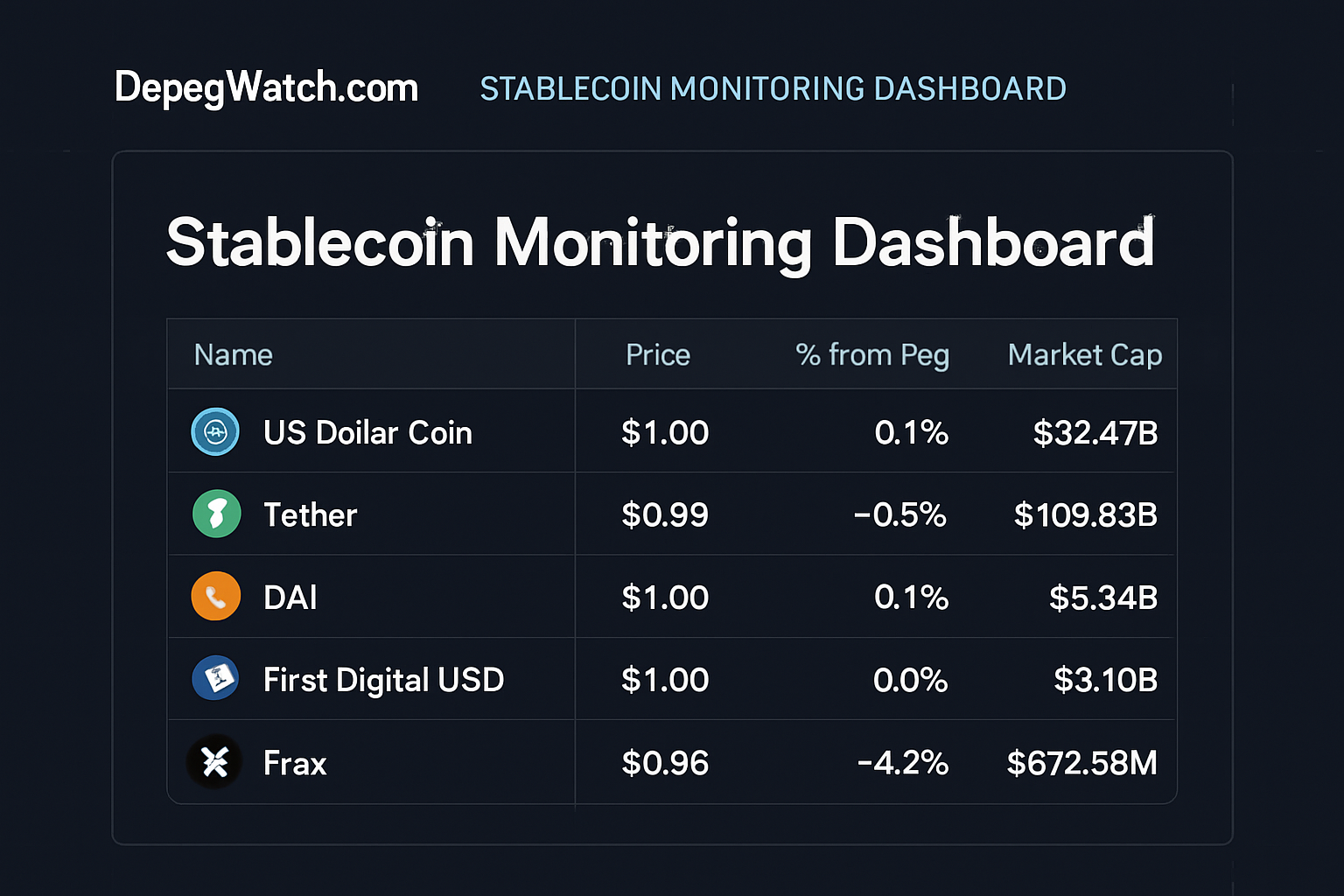

- Real-Time Monitoring: Tools like DepegWatch. com let users set alerts for peg deviations so they can act before full-blown cascades occur.

- Pooled Liquidity Strategies: Providing liquidity on AMMs with impermanent loss protection features can offset minor peg losses through trading fees.

You can explore more about actionable hedging solutions in our detailed guide: How To Hedge Against Stablecoin Depeg Events: Strategies For DeFi Investors.

However, even the most sophisticated hedging strategies require ongoing vigilance. Depeg risks are not static; they evolve as new stablecoins launch, governance models change, and market liquidity ebbs and flows. For example, algorithmic stablecoins may introduce rebase mechanics that can suddenly alter user balances across protocols, potentially triggering integration failures or unexpected liquidations. Liquidity fragmentation across multiple chains and pools can also complicate risk modeling, making it harder to predict where the next cascade might begin.

Layered DeFi Risk Hedging Strategies Illustrated

-

Stablecoin Diversification: Spread exposure across multiple stablecoins such as USDT, USDC, and DAI to minimize the impact of any single depeg event. This approach leverages both centralized and decentralized stablecoins for enhanced risk management.

-

Depeg Protection Options: Utilize DeFi insurance protocols like Risk Harbor and InsurAce to purchase structured coverage. These platforms provide payouts if a stablecoin falls below a set threshold, offering a direct hedge against depegging.

-

Automated Hedging Vaults: Platforms such as Angle Protocol offer automated vaults that dynamically hedge stablecoin exposure using on-chain derivatives and yield strategies, reducing the need for manual intervention.

-

Real-Time Monitoring Tools: Analytics platforms like DepegWatch.com enable users to track stablecoin prices and receive instant alerts on peg deviations, allowing for timely risk mitigation actions.

-

Liquidity Pool Hedging: Provide liquidity to stablecoin pairs on major AMMs such as Curve and Uniswap. These platforms offer features like concentrated liquidity and impermanent loss protection, helping offset minor depeg losses through trading fees.

Operational Considerations for DeFi Users

For both retail and institutional participants, a risk-first approach is essential. This means:

- Stress-testing portfolios against hypothetical depeg events using simulation tools or scenario analysis.

- Regularly reviewing protocol documentation for updates on collateral requirements and liquidation parameters.

- Monitoring systemic risk indicators, such as aggregate stablecoin liquidity or cross-protocol exposure metrics.

- Participating in governance, advocating for sensible liquidation thresholds and emergency response mechanisms within protocols you use.

The interconnectedness of DeFi means that even well-hedged positions can be affected by broader market turmoil. By staying informed with real-time analytics platforms like DepegWatch. com and leveraging insurance or derivatives where appropriate, users can better navigate periods of instability.

Looking Forward: Protocol Design and Community Safeguards

The future of stablecoin depeg risk management will depend on both technological innovation and community-driven governance. Protocols are experimenting with circuit breakers, mechanisms that pause liquidations during extreme volatility, to buy time for arbitrageurs or backstops to restore order. Others are integrating real-time oracle feeds from multiple sources to minimize manipulation risk. Insurance funds are being pooled at the protocol level to absorb losses from rare but catastrophic events.

User education remains paramount. Many liquidation cascades could be mitigated if more participants understood how their collateral is valued and the triggers that could force asset sales. As the ecosystem matures, expect to see greater emphasis on transparency, proactive stress testing, and open-source tooling for risk assessment.

If you’re seeking deeper technical dives or step-by-step guides on implementing these strategies in your portfolio, see our comprehensive resources on DeFi hedging strategies for stablecoin depegs. For ongoing alerts and analytics tailored to your assets, bookmark DepegWatch. com, a systematic edge is your best defense in an unpredictable market.