Liquidation mechanisms are the backbone of decentralized lending protocols, quietly enforcing solvency and trust in DeFi markets. But beneath their surface, a tangle of hidden risks can undermine even the most battle-tested systems, threatening both user portfolios and protocol stability. Let’s peel back the layers on these vulnerabilities and explore what auditors are uncovering in 2025’s fast-evolving DeFi landscape.

Unpacking the Hidden Risks in DeFi Liquidations

If you assume that liquidation logic is simple math, just sell off collateral when debt exceeds a threshold, think again. Real-world code is riddled with edge cases and economic quirks that create opportunities for failure. Here’s where things get complicated:

Hidden Risks in DeFi Liquidation Mechanisms

-

Insufficient Insurance Funds: When a protocol’s insurance fund can’t cover bad debt from failed liquidations, insolvent positions may remain unresolved, threatening protocol solvency until the fund is replenished.

-

Fixed Liquidation Bonuses & Collateral Shortages: If a borrower’s remaining collateral is too low to pay out a fixed liquidation bonus, the transaction may fail, leaving undercollateralized positions open and increasing systemic risk.

-

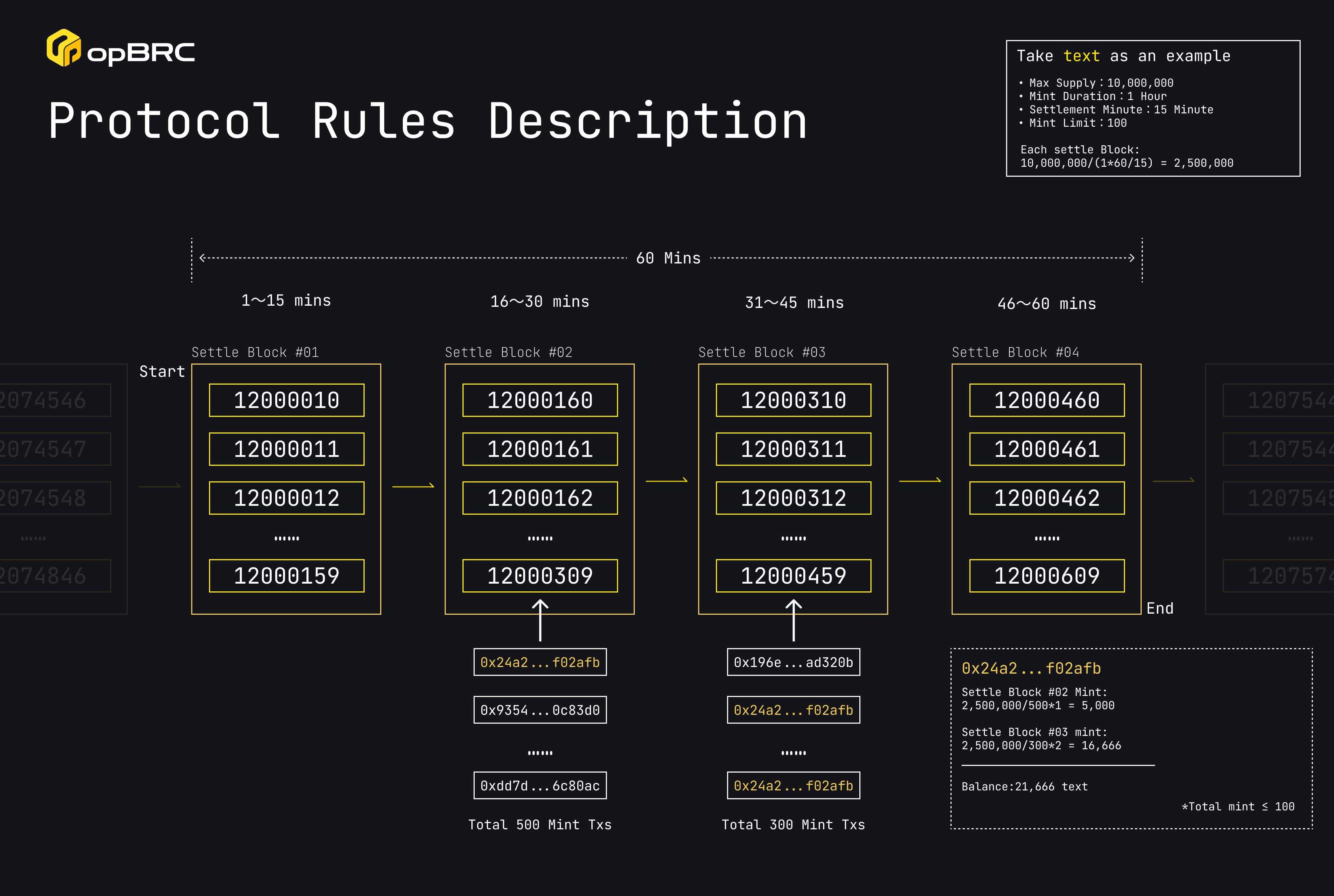

Token Decimal Precision Mismatches: Supporting assets with different decimal places can cause calculation errors in liquidation logic, especially if non-standard tokens are involved, leading to failed or inaccurate liquidations.

-

Oracle Manipulation and Delays: Manipulated or delayed oracle price feeds can trigger unnecessary liquidations or prevent needed ones, exposing protocols to financial loss and systemic instability.

-

Market Volatility & Cascading Liquidations: Sudden price swings can set off mass liquidations, amplifying volatility and causing a domino effect of failures across the protocol and potentially the wider DeFi ecosystem.

-

Smart Contract Vulnerabilities: Bugs or overlooked edge cases in smart contract code can be exploited, allowing attackers to bypass or manipulate liquidation processes, resulting in bad debt and protocol insolvency.

1. Insufficient Insurance Funds: Many protocols rely on insurance funds to mop up bad debt when liquidations can’t cover losses. But if an extreme market move wipes out these reserves, insolvent positions linger, undermining user confidence and leaving the protocol exposed until replenishment occurs. As highlighted by Cyfrin, this scenario is more common than many realize.

2. Fixed Liquidation Bonuses and Collateral Shortages: Protocols typically offer liquidators a fixed bonus to incentivize them to close risky positions. But if a borrower’s remaining collateral isn’t enough to pay out this bonus, the transaction fails, and so does the liquidation process itself. This creates pockets of unliquidated bad debt that can snowball into systemic risk.

3. Token Decimal Precision Mismatches: Supporting multiple tokens with different decimal places sounds trivial, but it’s a notorious source of bugs. If calculations don’t properly account for decimal mismatches (say, between an 18-decimal ETH token and a 6-decimal USDC), liquidation amounts may be miscalculated or rejected outright.

The Role of Oracles: Manipulation and Delay Dilemmas

No matter how robust your smart contract logic is, it’s only as reliable as its price data feed. Oracles act as bridges between real-world prices and on-chain logic, but they’re also prime targets for manipulation or lag during volatile swings.

A manipulated or delayed oracle can trigger premature liquidations (hurting users) or prevent necessary ones (hurting protocol solvency). The infamous oracle delay incidents have shown how quickly trust can unravel when prices go stale at critical moments.

Cascading Failures: When Market Volatility Strikes

DeFi protocols aren’t isolated islands, they’re interconnected through shared assets and liquidity pools. When prices swing hard (think crypto flash crashes), mass liquidations can cascade across protocols, amplifying volatility instead of containing it.

- Cascading Liquidations: A sudden drop in asset price triggers one protocol’s liquidations, which dumps collateral into the market, pushing prices lower still, and triggering more liquidations elsewhere.

- Systemic Contagion: This domino effect doesn’t just impact individual users; it can destabilize entire ecosystems if left unchecked.

This isn’t just theory, it’s been observed in live markets and documented in research like Nadcab’s analysis.

The Auditor’s Perspective: Beyond Code Reviews

Smart contract audits are essential but not sufficient for robust risk management. Economic auditors dig deeper by stress-testing parameters under extreme scenarios, think high slippage events or exotic token edge cases, and simulating how incentives play out under duress.

- Comprehensive Code Audits: Identify logic bugs before they become exploits.

- Market-Aware Analysis: Evaluate how parameters like liquidation bonuses behave during black swan events, not just in normal conditions.

- Diversified Oracle Feeds: Cross-verify price data using multiple independent sources to minimize manipulation risks.

The best protocols now treat audits as ongoing processes rather than one-off events, a philosophy echoed by leading firms like Three Sigma (source).

But even with diligent audits, DeFi liquidation risks persist. The complexity of protocol interactions, the speed of crypto markets, and the ingenuity of attackers mean that new edge cases are always lurking. Let’s break down what separates resilient protocols from those vulnerable to hidden failures.

Mitigating Liquidation Edge Cases: Best Practices for 2025

Protocols serious about risk management are evolving beyond static parameters and surface-level audits. Here’s what auditors and risk engineers recommend for minimizing protocol liquidation vulnerabilities:

Best Practices to Mitigate DeFi Liquidation Risks

-

Conduct Regular, Comprehensive Smart Contract Audits: Engage reputable audit firms like Cyfrin, Trail of Bits, or CertiK to thoroughly review liquidation logic, check for decimal precision errors, and test edge cases that could lead to failed liquidations.

-

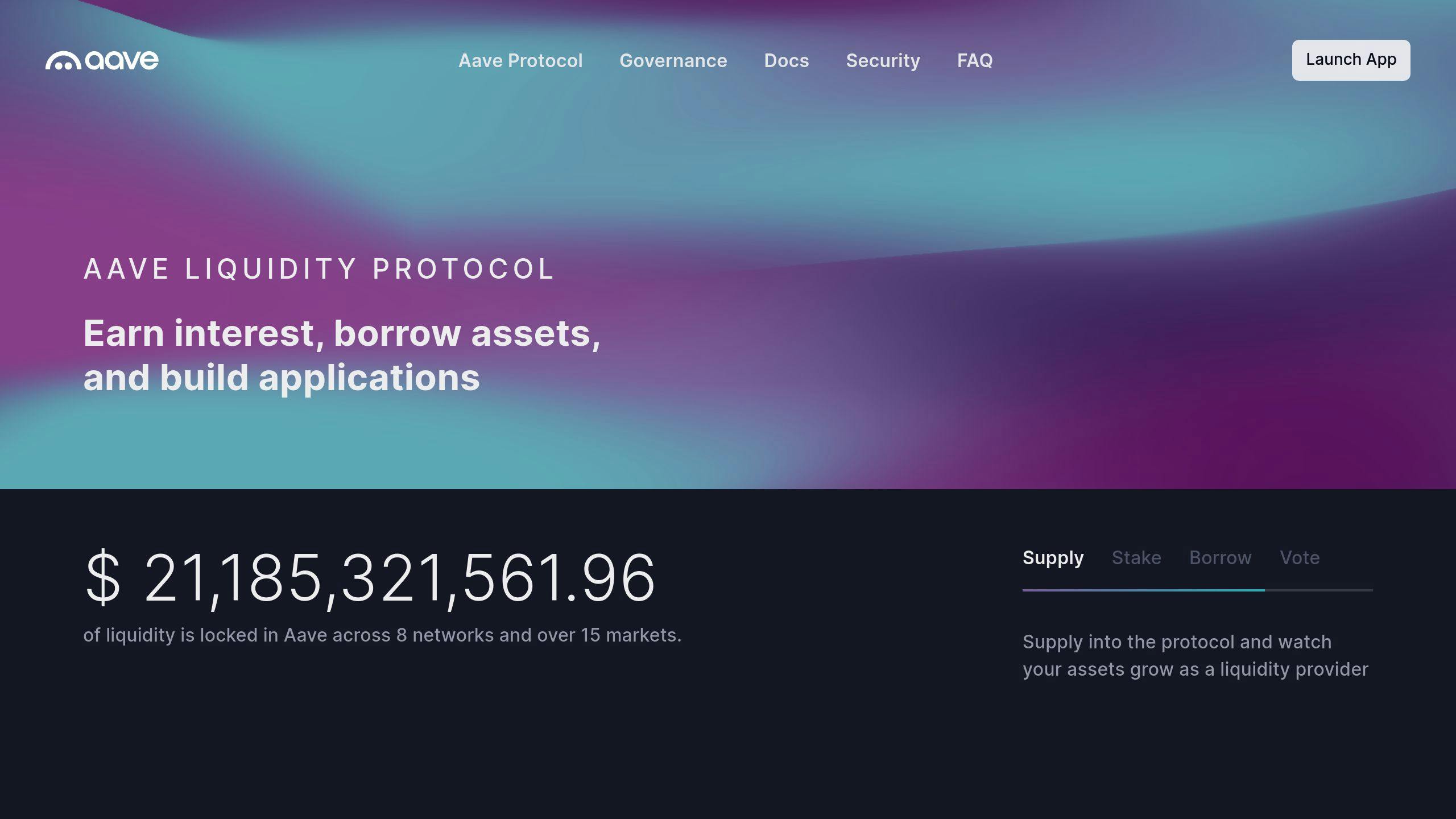

Implement Robust and Redundant Oracle Systems: Use multiple independent price oracles (e.g., Chainlink, Band Protocol) to cross-verify asset prices, minimizing risks from manipulation or delayed feeds.

-

Adopt Dynamic Liquidation Parameters: Design protocols with adjustable liquidation thresholds and bonuses that respond to market volatility and collateral availability, rather than fixed values that may fail in edge cases.

-

Ensure Adequate and Responsive Insurance Funds: Maintain well-capitalized insurance funds (like Nexus Mutual for protocol coverage) and establish mechanisms for rapid replenishment if bad debt exceeds reserves.

-

Monitor and Stress-Test for Market Volatility: Regularly simulate extreme market events and cascading liquidations to identify vulnerabilities and improve protocol resilience before real-world shocks occur.

-

Address Token Decimal Precision Consistently: Standardize and rigorously test handling of tokens with non-standard decimal places to prevent calculation errors that could block liquidations.

-

Engage Economic Auditors for Incentive Analysis: Work with specialized firms like Three Sigma to evaluate economic parameters, ensuring incentives for liquidators remain robust across market conditions.

Dynamic Liquidation Parameters: Rigid, fixed bonuses or thresholds can become liabilities during periods of high volatility or low liquidity. Instead, smart contracts should use dynamic logic that adapts to real-time market conditions and available collateral.

Insurance Fund Stress Testing: It’s not enough to simply have an insurance fund on paper. Protocols need to stress test these reserves under simulated black swan events, think sudden 40% price drops, to ensure solvency even when the unexpected happens.

Token Standards and Decimal Consistency: As more exotic assets get listed as collateral, strict adherence to token standards (and robust handling of decimal mismatches) is crucial. Even a single rounding error can open the door to exploits or failed liquidations.

Multi-Layered Oracle Defenses: Don’t put all your trust in a single oracle provider. Mix on-chain and off-chain feeds, introduce time-weighted averages, and build in circuit breakers that halt liquidations if prices deviate abnormally within a short window.

User Awareness: Protecting Your Portfolio

If you’re a DeFi user, understanding these hidden risks isn’t just academic, it’s essential for portfolio defense. Here are practical steps you can take right now:

- Diversify Collateral: Avoid concentrating your positions in assets with thin liquidity or known oracle manipulation history.

- Monitor Protocol Health: Keep tabs on insurance fund balances and recent audit reports before locking up large amounts of collateral.

- Set Conservative Borrow Limits: Don’t borrow up to the maximum allowed, leave a buffer for price swings and potential oracle delays.

Frequently Asked Questions About DeFi Liquidation Risks

The bottom line? No protocol is immune from liquidation edge cases. But by demanding transparency from teams, reading audit disclosures closely, and staying informed about market-wide risks, both developers and users can tip the odds in their favor.

If you want to dive deeper into specific incidents or risk frameworks shaping today’s landscape, check out resources like Cyfrin’s guide, DepegWatch’s analysis of oracle failures, or Nadcab’s research on cascading liquidations (source). Staying proactive is your best hedge against the next hidden risk lurking in DeFi lending markets.