Stablecoins are often positioned as the bedrock of DeFi and crypto portfolio management, providing a digital asset that mirrors the value of fiat currencies like the US dollar. Yet, as recent events in 2025 have shown, stablecoin depeg risks remain a significant threat to both institutional and retail investors. In April 2025, Synthetix’s sUSD depegged sharply to $0.68, underlining the reality: no stablecoin is immune to instability, and prudent risk management is essential.

Understanding Stablecoin Depeg Risks in 2024

Stablecoins rely on mechanisms such as collateralization, algorithms, and redemption guarantees to maintain their peg. However, these mechanisms can fail under stress. The most common causes of depegging include extreme market volatility, insufficient reserves, algorithmic flaws, regulatory actions, and liquidity crises. Each of these factors can rapidly erode trust and value, triggering sell-offs and amplifying losses across DeFi platforms (Kraken).

The risks extend beyond individual losses. Depegging events can disrupt entire DeFi ecosystems, causing cascading liquidations and undermining confidence in digital assets. For example, when a stablecoin like sUSD trades at $0.68 instead of $1.00, arbitrageurs may be unable or unwilling to restore the peg if liquidity dries up or reserve transparency falters (Cointelegraph).

Top Strategies to Protect Your Portfolio from Stablecoin Depeg

In response to these evolving risks, leading crypto analysts and platforms recommend a focused set of strategies and tools for robust stablecoin risk management in 2024. Here are five actionable best practices every investor should implement:

Top 5 Strategies to Protect Against Stablecoin Depeg Risks

-

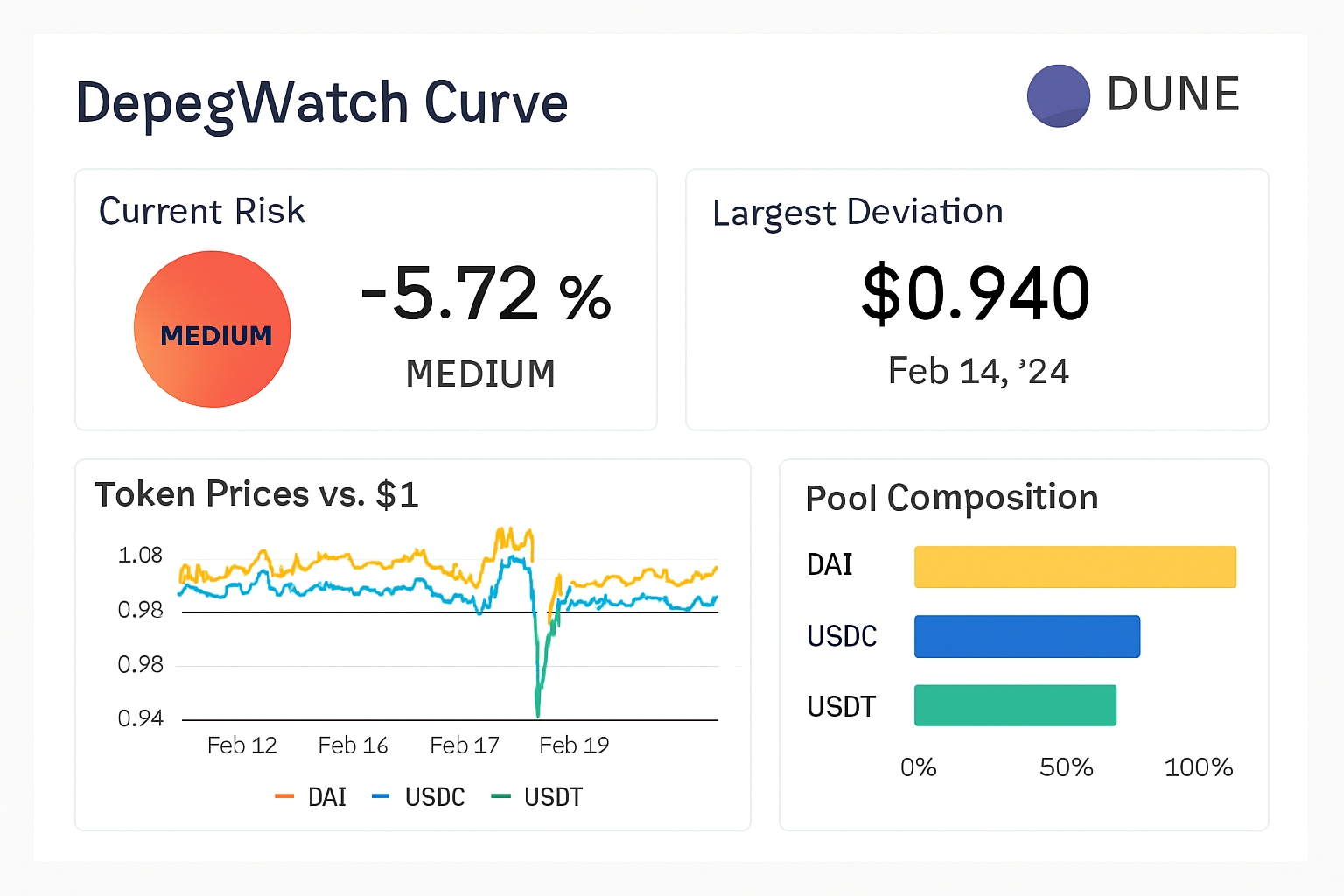

Utilize Real-Time Depeg Monitoring Tools (e.g., DepegWatch, Curve, Dune Analytics): Leverage platforms like DepegWatch, Curve, and Dune Analytics to track stablecoin prices and detect early signs of depegging events.

-

Implement On-Chain Depeg Protection Products (e.g., Etherisc USDC Depeg Insurance, InsurAce): Purchase depeg insurance via platforms like Etherisc or InsurAce to cover potential losses if a stablecoin loses its peg.

-

Regularly Review and Assess Stablecoin Reserve Transparency and Audit Reports: Examine public attestations and third-party audit reports from stablecoin issuers for up-to-date reserve information and risk assessment.

Diversify Stablecoin Holdings Across Multiple Issuers and Mechanisms

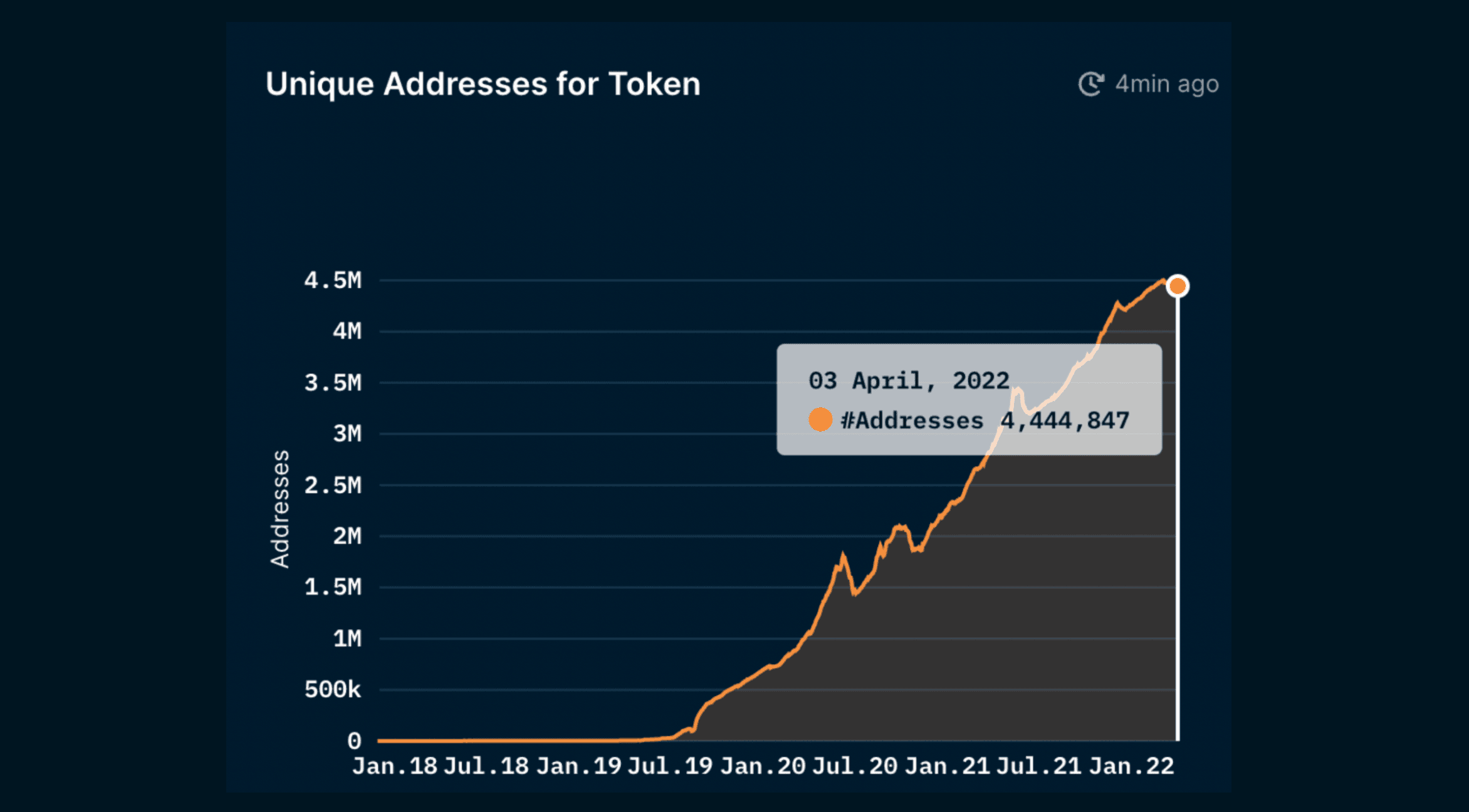

Relying on a single stablecoin exposes your portfolio to issuer-specific risks and technical vulnerabilities. Instead, diversify across different issuers (such as USDC, USDT, DAI) and mechanisms (fiat-backed, crypto-collateralized, algorithmic). This approach reduces the probability that a single point of failure will impact your entire portfolio. Data from recent depegs shows diversified portfolios experience lower drawdowns during crises compared to single-stablecoin exposure (Smart Liquidity).

Utilize Real-Time Depeg Monitoring Tools

Timely awareness is critical. Platforms like DepegWatch, Curve, and Dune Analytics offer real-time monitoring of stablecoin price deviations, liquidity pools, and market depth. These tools enable investors to spot early warning signs of depegging and act before losses escalate. For example, DepegWatch provides customizable alerts for when a stablecoin drops below a specified threshold, empowering users with actionable intelligence.

On-Chain Protection: Insurance and Automated Safeguards

Beyond monitoring and diversification, on-chain protection products have emerged as essential tools for hedging against depeg risk. Protocols like Etherisc offer USDC depeg insurance policies that pay out if USDC falls below a predefined peg level. Similarly, platforms such as InsurAce provide coverage for a range of stablecoins and DeFi protocols, reducing direct exposure to catastrophic events (OpenCover).

The rapid growth of on-chain insurance reflects increasing demand for risk transfer solutions that are transparent and efficient, key attributes for any robust DeFi portfolio hedging strategy.

However, insurance is only as effective as the transparency and solvency of the protocol behind it. This brings us to a critical pillar of stablecoin risk management: regularly reviewing and assessing reserve transparency and audit reports. Top-tier stablecoins publish frequent, detailed attestations or audits of their reserves. By examining these reports, ideally performed by reputable third-party auditors, you can gauge whether a stablecoin is genuinely backed by sufficient, liquid assets. Look for red flags such as opaque reporting, infrequent updates, or a high proportion of non-cash equivalents in reserves. If a stablecoin fails to provide credible proof of reserves, consider reducing your exposure.

Set Automated Alerts and Stop-Loss Orders on Decentralized Exchanges

Even with diversification, real-time monitoring, and insurance, your portfolio remains vulnerable to sudden market shocks. Automated alerts and stop-loss orders on decentralized exchanges (DEXs) offer a final line of defense. By setting predefined thresholds, for example, automatically swapping a stablecoin if it drops below $0.98, you can limit downside risk without relying on constant manual oversight. This is especially critical during periods of high volatility when price swings can be rapid and liquidity may evaporate in seconds.

As stablecoin depeg risks become more widely recognized, the DeFi industry is responding with increasingly sophisticated risk mitigation tools. The combination of diversification, real-time monitoring, on-chain insurance, rigorous reserve assessment, and automated stop-losses forms a multi-layered defense that can substantially reduce your exposure to depegging events.

Ultimately, no single strategy offers complete protection. Instead, robust stablecoin risk management in 2024 requires an integrated approach, leveraging data-driven tools, insurance protocols, and prudent portfolio construction. As we saw with sUSD’s drop to $0.68 in April 2025, the consequences of ignoring these best practices can be severe and immediate.

Staying proactive is paramount. Use platforms like DepegWatch to monitor market conditions, set up automated alerts, and regularly review the health of your stablecoin holdings. When new risk management products emerge, evaluate them carefully, backtest their performance where possible, and never hesitate to rebalance your strategy in response to evolving market dynamics.

The future of DeFi depends on trust in stablecoins. By implementing these five strategies, you put yourself in the strongest possible position to weather volatility and protect your digital assets, no matter what 2024 and beyond may bring.