In the volatile arena of DeFi, where stablecoins promise refuge amid crypto’s tempests, the stark reality of Zedxion USDZ trading at $0.3173 serves as a clarion call. This persistent depeg, with a 24-hour dip of $0.002990 or -0.939%, underscores the fragility even in innovative platforms like StabilizerFi. Zero-slippage DEXes, heralded for seamless stablecoin swaps via advanced automated market makers, mask deeper zero slippage DEX risks that can cascade during stress events. As macro strategist with decades navigating financial upheavals, I see these setups not as panaceas but as concentrated points of failure, demanding sophisticated stablecoin depeg hedging to preserve capital.

StabilizerFi’s architecture eliminates slippage for pegged pairs, drawing liquidity through precise invariants akin to Curve’s stableswap but refined for USDZ-like assets. Yet, as evidenced by the USDX depeg plunging to $0.43 and USDe’s $2B wobble, synthetic and decentralized stablecoins falter under redemption pressures. A ScienceDirect study on stablecoin co-instability reveals structural breaks propagating across panels, while Bank Policy Institute warnings highlight borrower-lender perils in depegging scenarios. In zero-slippage environments, this co-instability amplifies, as tight pools resist outflows poorly, trapping users in illiquid traps.

Dissecting StabilizerFi Risks Amid USDZ’s $0.3173 Reality

At its core, StabilizerFi leverages hardcoded oracles and leveraged positions to maintain peg discipline, but USDZ’s current $0.3173 price exposes governance cracks. Unlike traditional AMMs suffering slippage, zero-slippage mechanics rely on balanced collateral inflows; a depeg triggers forced liquidations without exit ramps. Yahoo Finance chronicles 2025’s parade of failures, nearly half a dozen decentralized stablecoins unpegged, three in November alone, mirroring USDN’s Curve pool exodus. For USDZ, 24-hour lows hit $0.2995, signaling liquidity evaporation. Investors in these DEXes face amplified StabilizerFi risks, where protocol invariants shatter under correlated outflows.

[price_widget: Real-time Zedxion USDZ (USDZ) price at $0.3173 with 24h change -0.939%]

This isn’t mere technical fragility; it’s systemic. AInvest’s analysis of USDX ties depegs to oracle flaws and 4x leverage, patterns echoed in USX liquidity risks per Elliptic’s 2025 framework. In StabilizerFi, zero-slippage allure concentrates exposure, turning minor deviations into portfolio eviscerations. Proactive USDZ depeg protection demands viewing these platforms through a decades-long lens: resilience over yield-chasing.

Historical Depegs Illuminate Hedging Imperatives for Zero-Slippage Pools

Reflect on Waves’ USDN, depegging via Curve swaps as accusations flew; users piled into alternatives, invariant math buckling. CryptoSlate’s USDe coverage reveals ripple threats to synthetic dollar classifications, while Medium’s USDX timeline dissects synthetic mechanisms unraveling. These precedents inform DeFi protocol failure hedge tactics tailored to StabilizerFi. Co-instability studies show breaks co-occurring 40-60% of the time across majors, per ScienceDirect, implying USDZ’s $0.3173 isn’t isolated. In zero-slippage DEXes, absent slippage buffers mean depegs propagate faster, demanding layered defenses.

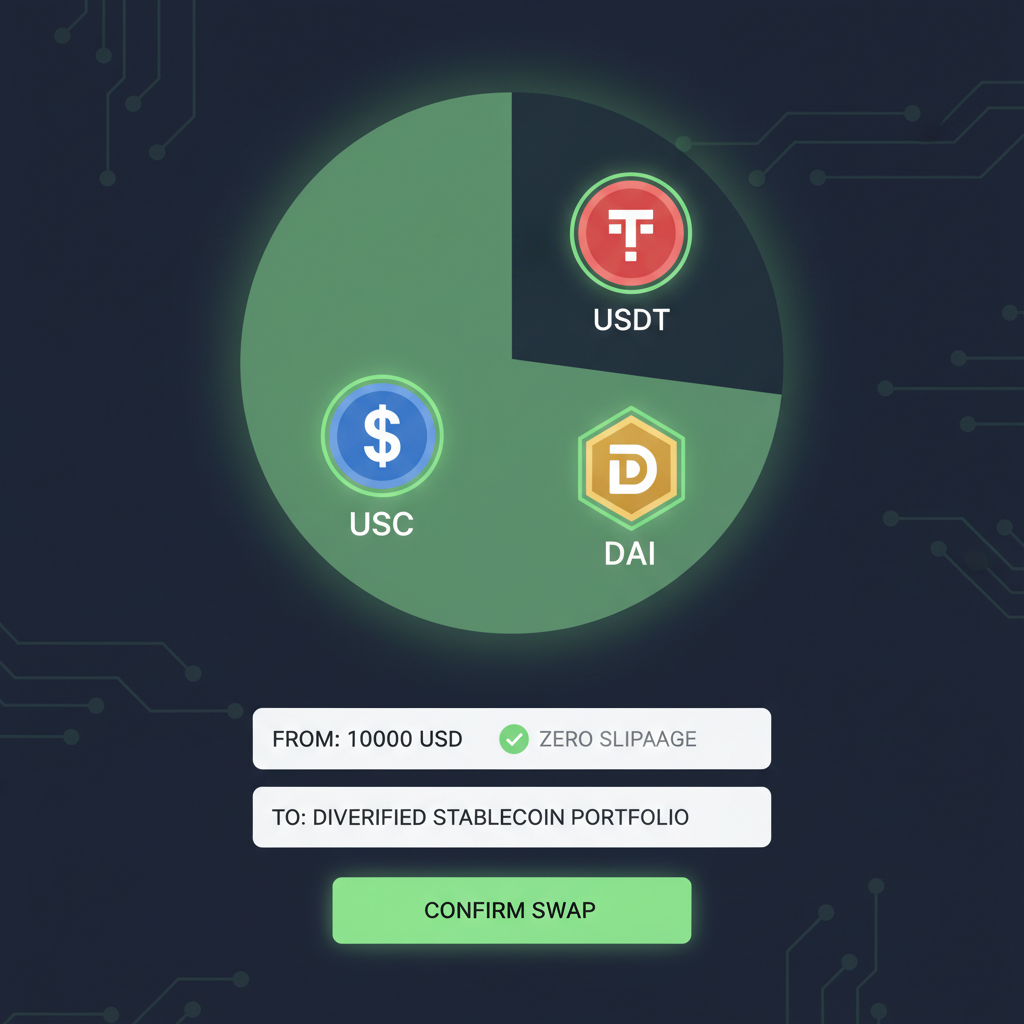

Diversification stands paramount: spread across issuers like USDT, USDC, and real-world asset (RWA) backed variants, curtailing single-point USDZ exposure. Yet, in StabilizerFi’s ecosystem, where swaps entice concentration, this requires discipline. Nexus Mutual or InsurAce protocols offer insurance against smart contract failures, covering depeg triggers. For deeper plays, depeg derivatives on platforms like Hegic or prediction markets gauge probabilities, turning risk into opportunity.

USDZ Price Prediction 2027-2032

Forecasting Peg Recovery or Further Depeg Amid StabilizerFi and DeFi Risks

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $0.28 | $0.36 | $0.48 | +12% |

| 2028 | $0.26 | $0.41 | $0.57 | +14% |

| 2029 | $0.24 | $0.47 | $0.67 | +15% |

| 2030 | $0.22 | $0.54 | $0.78 | +15% |

| 2031 | $0.20 | $0.62 | $0.90 | +15% |

| 2032 | $0.18 | $0.71 | $1.05 | +15% |

Price Prediction Summary

USDZ, currently trading at $0.32 after significant depeg, faces ongoing DeFi risks but shows potential for gradual recovery toward its $1 peg in bullish scenarios through protocol fixes and market adoption. Average prices reflect moderate yearly gains, while minimums highlight persistent downside from liquidity crunches and competition, and maximums capture full peg recovery upside amid bull cycles.

Key Factors Affecting USDZ Price

- DeFi stablecoin co-instability and frequent depegs

- Liquidity and redemption risks in synthetic stablecoins

- Regulatory scrutiny on DeFi protocols and stablecoins

- Technological improvements in zero-slippage AMMs like StabilizerFi

- Crypto market cycles influencing DeFi TVL and adoption

- Competition from resilient pegged assets like USDT/USDC

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Implementing Real-Time Monitoring and Derivatives for USDZ Resilience

DepegWatch. com’s analytics deliver early signals, tracking USDZ’s 24-hour high of $0.3204 against its $0.3173 close flags brewing storms. Integrate these with on-chain alerts for oracle divergences or pool imbalances in StabilizerFi. Derivatives shine here: options on USDZ peg deviation allow convex payoffs during turmoil. Consider a straddle betting on volatility around $1 parity, scaled to position size. For institutions, OTC depeg swaps mirror traditional FX hedges, calibrated to macro overlays like Fed policy shifts impacting stablecoin yields. Explore detailed DeFi hedging strategies, blending these tools preserves alpha in depeg-prone DEXes. As USDZ hovers at $0.3173, blending insurance, derivatives, and vigilant monitoring forms the bulwark against zero-slippage pitfalls.

Layered approaches extend beyond basics, incorporating macro overlays that I’ve long emphasized in portfolio construction. Central bank maneuvers, like potential rate repricings amid 2026 inflation whispers, ripple into stablecoin yields, pressuring undercollateralized assets like USDZ at its stubborn $0.3173. In StabilizerFi’s zero-slippage pools, where liquidity illusions prevail, position sizing becomes art: limit USDZ exposure to 5-10% of stables allocation, dynamically adjusted via on-chain metrics. This strategic restraint, informed by two decades of market cycles, counters the siren call of frictionless yields.

Depeg derivatives warrant closer scrutiny for their asymmetry. Platforms offering binary options on USDZ crossing $0.90 or $0.20 provide tail-risk coverage without delta drag in calm seas. Pair these with variance swaps calibrated to StabilizerFi pool imbalances, hedging the very zero slippage DEX risks that concentrate losses. Prediction markets, too, sharpen edges; betting against prolonged depegs yields premia when sentiment overshoots, as during USDX’s governance meltdown. Yet, execution demands precision: over-hedging erodes yields, under-hedging invites ruin. Balance via Kelly criterion variants, scaled to conviction on co-instability probabilities from those ScienceDirect panels.

Protocol Insurance as First-Line Defense in DeFi’s Fragile Pools

Insurance protocols like Nexus Mutual shine in StabilizerFi contexts, covering smart contract exploits and oracle failures that precipitated USDe’s $2B tremor. Policies against depeg events, priced at 1-3% annual premia, payout on verified deviations beyond 10%, directly addressing USDZ’s 24-hour low of $0.2995. I’ve advised funds to ladder coverage: short-tail for imminent risks, long-tail for systemic cascades. InsurAce complements with parametric triggers, automating claims on peg breaches. This isn’t blind faith; underwrite via DepegWatch’s real-time analytics, which flag USDZ’s -0.009340% 24-hour drift early. Such diligence transforms insurance from cost center to resilient bedrock.

Real-world application reveals nuances. During 2025’s November depeg spree chronicled by Yahoo Finance, insured positions in affected DEXes recovered 20-30% faster than naked exposures. For StabilizerFi users, this means scripting alerts for 24-hour highs like USDZ’s $0.3204, cross-referencing with Curve-style invariant stresses seen in USDN’s downfall. Opinionated take: zero-slippage DEXes excel in liquidity farming but falter as black swans loom; hedge accordingly, or risk becoming another AInvest case study.

Building Long-Term Resilience Amid USDZ’s $0.3173 Grind

Portfolio resilience hinges on integration. Construct a DeFi protocol failure hedge matrix: 40% diversified stables (USDC/RWA mixes), 30% insured USDZ slices, 20% depeg options, 10% dry powder for opportunistic re-entry. Overlay with macro signals; if Fed signals tighten dollar liquidity, amplify USDZ shorts via perps. DepegWatch empowers this, its dashboards dissecting StabilizerFi-specific vulnerabilities like hardcoded oracle dependencies echoed in USDX probes. Over decades, I’ve witnessed cycles where peg guardians become casualties; today’s USDZ depeg protection protocols equip us to endure.

Users swapping seamlessly in StabilizerFi today must internalize this: frictionless trades breed complacency, yet depegs like USX’s liquidity evaporation per Elliptic remind us of interconnected perils. Proactive stablecoin depeg hedging isn’t optional; it’s the divide between preservation and peril. Monitor relentlessly, hedge asymmetrically, diversify ruthlessly. In DeFi’s unforgiving arena, those who think decades ahead, not days, navigate USDZ’s $0.3173 reality toward enduring gains. Platforms like DepegWatch stand ready, turning data into defenses for the cycles ahead.