Stablecoins have long been considered the backbone of DeFi, providing a bridge between traditional finance and crypto. But as recent events have shown, their promise of stability can unravel quickly when market stress or design flaws push them off their peg. The consequences can be severe: investors face sudden losses, protocols may be forced to liquidate positions, and the entire market can experience cascading effects. In response, on-chain depeg insurance has emerged as a critical tool for crypto risk hedging and portfolio protection.

Why Stablecoin Depegs Are Still a Threat in 2025

Despite advances in stablecoin design, the risk of depegging remains real and present in 2025. According to Elliptic’s latest risk assessment, depeg events are not just technical failures but signal deeper cracks in stability mechanisms. Whether it’s USDC’s brief slip from $1 during the Silicon Valley Bank crisis or TerraUSD’s catastrophic collapse, these incidents underscore how quickly confidence can evaporate.

The root causes are varied:

- Insufficient or Illiquid Reserves: If reserves backing a stablecoin are inaccessible or inadequate (as seen with USDC’s exposure to failed banks), redemption pressure can force the price off its peg.

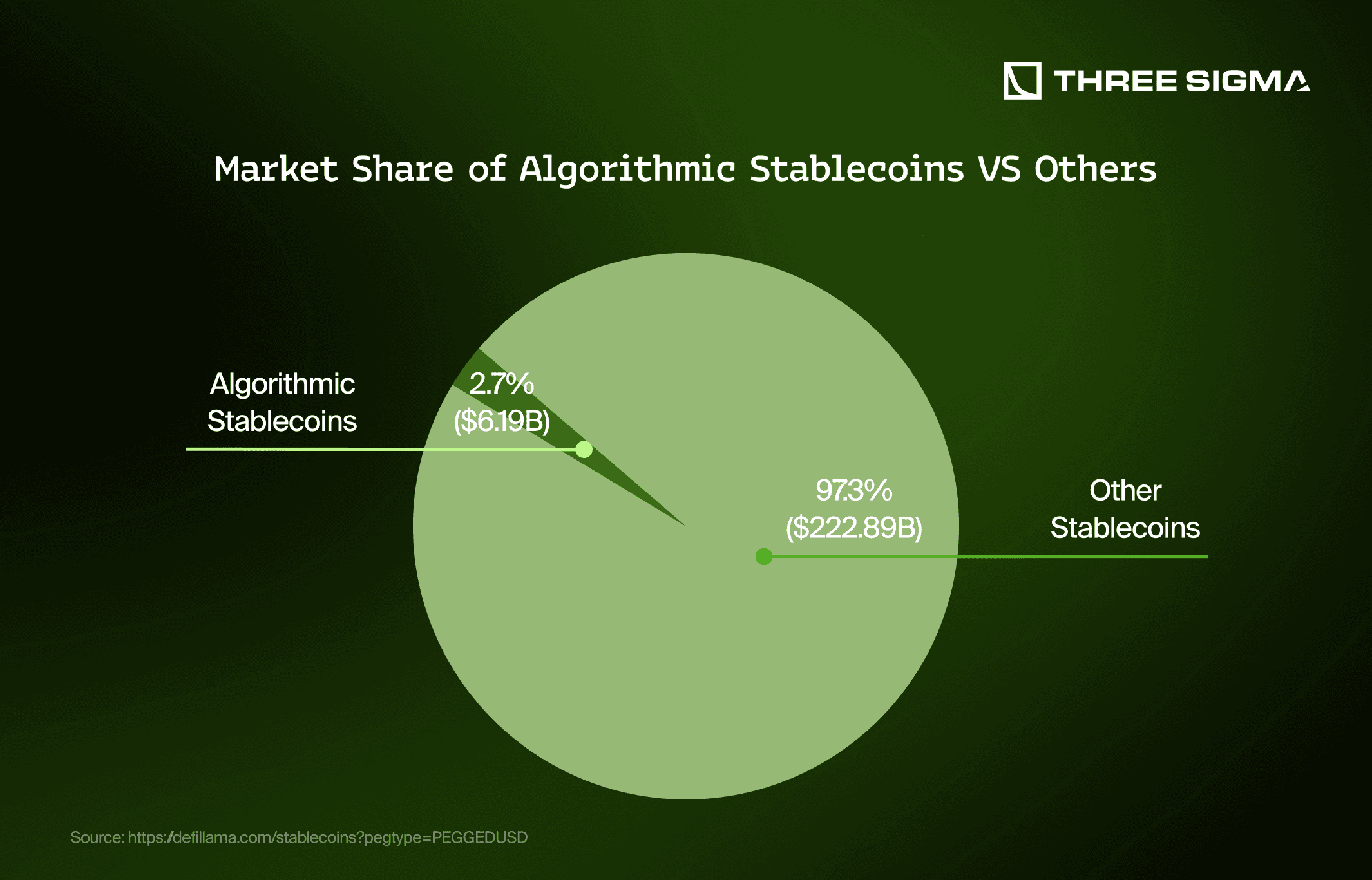

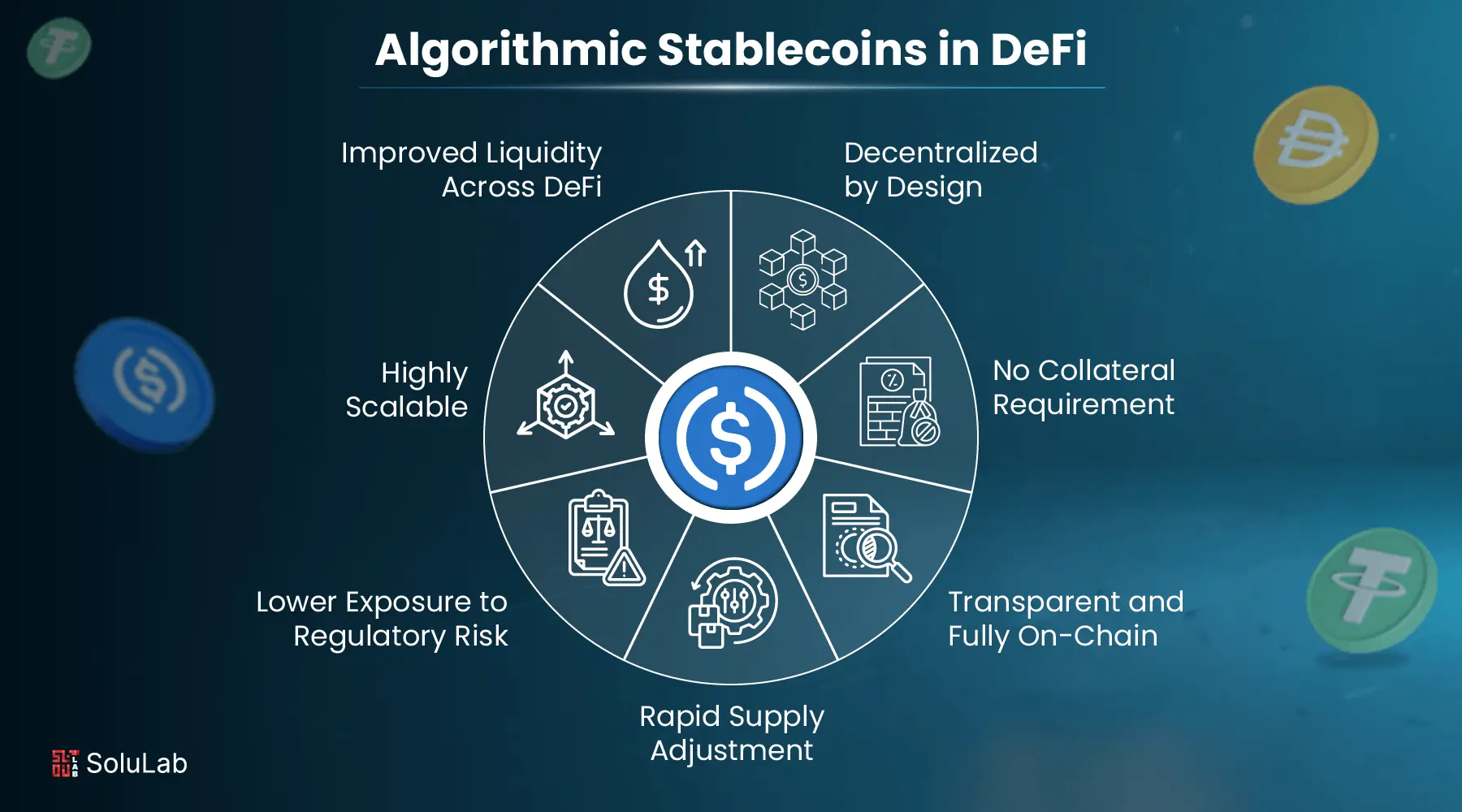

- Algorithmic Design Flaws: Algorithmic stablecoins like UST rely on incentives and market mechanics that may fail under stress, leading to runaway depegs.

- Market Manipulation and Regulatory Shocks: Coordinated attacks or sudden regulatory changes can trigger loss of faith and mass redemptions.

This environment makes stablecoin depeg protection more than just a nice-to-have, it’s quickly becoming essential for anyone managing significant assets on-chain.

The Mechanics of On-Chain Depeg Insurance

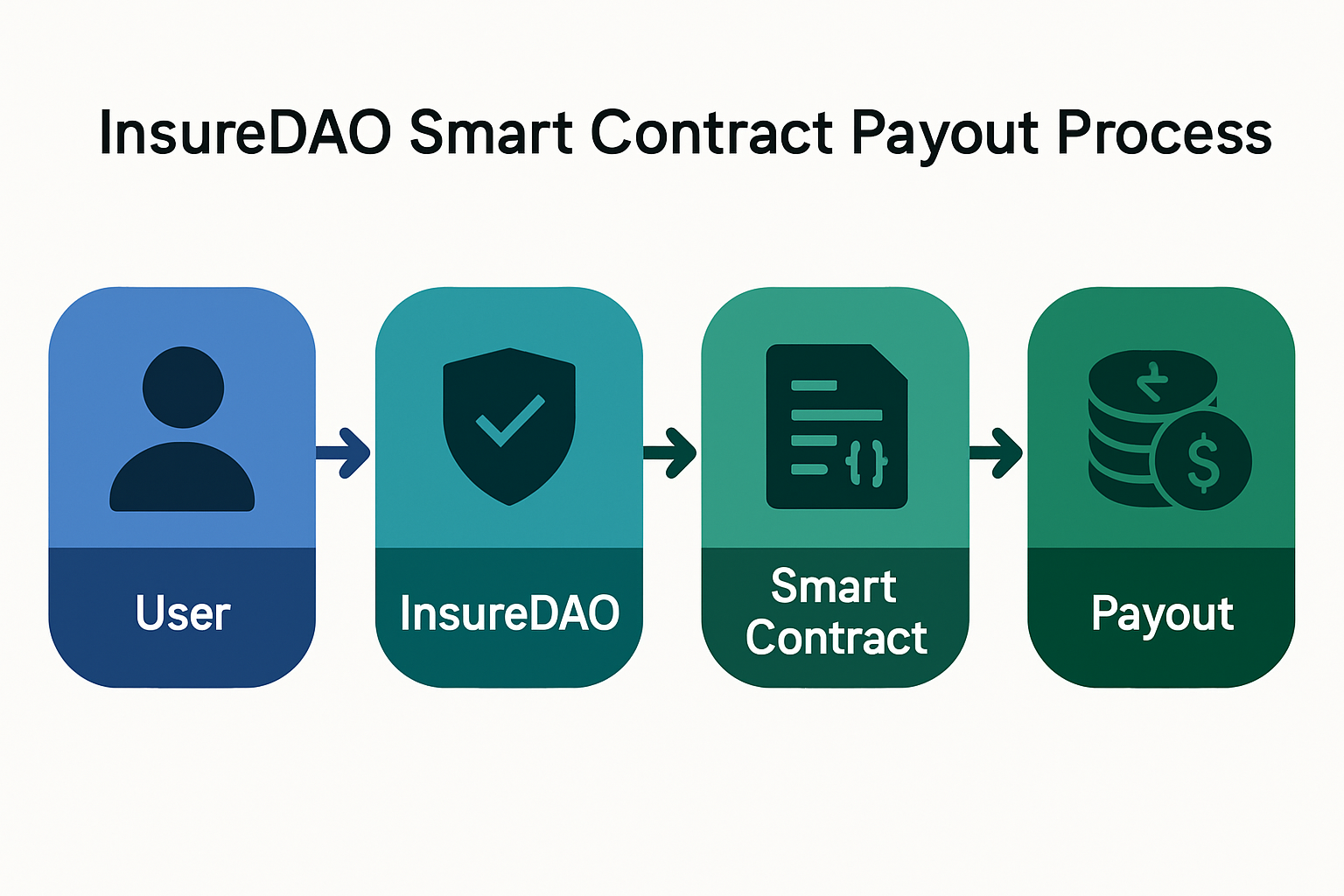

On-chain depeg insurance is designed to provide automated, transparent coverage against stablecoin failures directly within DeFi protocols. Unlike traditional insurance that relies on slow manual claims processes, these solutions use smart contracts to monitor price feeds and trigger payouts instantly when predefined conditions are met.

Key Features of On-Chain Depeg Insurance Protocols

-

Automated, Transparent Payouts: On-chain depeg insurance protocols use smart contracts to automatically assess claims and trigger payouts when a stablecoin deviates from its peg beyond a set threshold. This ensures rapid and transparent compensation, often within days. For example, InsureDAO aims for payouts within two days of a depeg event.

-

No Proof of Loss Required: Unlike traditional insurance, policyholders do not need to submit manual documentation or prove their losses. Payouts are based on objective, on-chain data (such as price feeds), streamlining the claims process and reducing friction for users.

-

Decentralized and Non-Custodial: These protocols operate fully on-chain, meaning users retain control of their funds and interact directly with smart contracts—eliminating the need for centralized intermediaries and enhancing transparency.

-

Hedging Strategies for Liquidity Providers: Some protocols, like InsureDAO, offer integrated hedging mechanisms that allow liquidity providers to short the covered stablecoin using third-party DApps, helping to offset potential losses during depeg events.

-

Coverage for Multiple Stablecoins: Leading protocols such as InsurAce, Unslashed, and Risk Harbor support depeg insurance for a variety of major stablecoins, including USDC, USDT, and DAI, providing broad protection for crypto portfolios.

-

Parametric Insurance Model: Payouts are triggered by predefined, objective parameters (like a stablecoin price falling below a certain threshold for a set period), reducing ambiguity and making the process predictable for all parties.

-

Capital Pools and Risk Sharing: Protocols pool capital from liquidity providers to cover potential claims, distributing risk across participants and increasing the sustainability of the insurance mechanism.

The process typically works like this:

- You purchase coverage for a specific stablecoin (such as USDC or DAI) by locking up funds in an insurance pool.

- If the insured coin trades outside its defined peg range (e. g. , below $0.98 for more than an hour), the smart contract automatically verifies this condition via decentralized oracles.

- Payouts are made swiftly, often within days, without requiring you to prove individual losses. This is known as No Proof of Loss.

This model not only saves time but also eliminates subjective claim assessments or lengthy paperwork. It’s parametric insurance for the permissionless age, fast, fair, and fully auditable by anyone on-chain. For more details on how these systems work in practice, see this comprehensive guide: How Stablecoin Depeg Insurance Works: A Guide for DeFi Users.

Protocols Leading the Way in Stablecoin Protection

A few standout protocols have set benchmarks for what effective USDC depeg insurance looks like:

- InsureDAO: Offers instant payouts with no proof of loss required; liquidity providers can hedge their exposure directly through integrated DApps.

- InsurAce and Risk Harbor: These platforms paid out millions during UST’s collapse, demonstrating real-world utility when disaster struck.

- Etherisc: Recently launched parametric USDC depeg protection that operates entirely on-chain with self-sustaining pools.

The combination of transparency, speed, and automated execution is setting new standards for DeFi risk mitigation, making it possible to protect not just individual portfolios but entire ecosystems from systemic shocks caused by stablecoin protocol failures.

But even the best on-chain depeg insurance protocols have important nuances. Coverage terms can be highly specific: some only protect against price drops below a certain threshold, others exclude depegs caused by regulatory intervention or multi-asset market crashes. This means it’s crucial to read policy details carefully and understand exactly what triggers a payout.

Balancing Cost, Coverage, and Capital Efficiency

Premiums for stablecoin depeg protection are set dynamically based on risk models, pool liquidity, and the perceived stability of the underlying asset. For popular coins like USDC, premiums tend to be lower due to greater historical stability and deeper insurance pools. However, during periods of heightened market stress or after high-profile failures, prices can spike quickly as demand for coverage surges.

There’s also an ongoing debate about capital efficiency. On-chain insurance protocols must hold enough reserves to cover potential claims but overcapitalization can make premiums expensive and limit scalability. Some platforms are experimenting with reinsurance layers or integrating with DeFi lending markets to improve returns on idle capital, innovations that could make crypto risk hedging more affordable in the future.

How Users Are Implementing Depeg Insurance in 2025

Retail users and institutions alike are weaving on-chain depeg insurance into their broader DeFi strategies. For example:

- Diversifying Coverage: Savvy investors split coverage across multiple stablecoins and protocols to reduce single-point-of-failure risk.

- Automating Protection: Integration with portfolio management tools allows users to auto-purchase or renew policies as positions change.

- Lending/Yield Stacking: Some protocols offer bundled products where yield from lending is partially redirected to pay for depeg insurance, effectively building protection into core DeFi activities.

The result? Investors can sleep easier knowing that if a stablecoin slips its peg, even momentarily, they’ll receive rapid compensation without bureaucratic hurdles. This peace of mind is particularly valuable during volatile macro events when confidence in stablecoins is tested most severely.

What’s Next for Stablecoin Insurance?

The landscape continues to evolve rapidly. New entrants like Etherisc are pioneering parametric models that use multiple data sources for even more robust trigger conditions. Meanwhile, regulators are taking a closer look at both stablecoins and DeFi insurance mechanisms, a development that could bring more clarity but also new compliance requirements.

The bottom line: while no system is foolproof, automated on-chain depeg insurance is proving itself as a cornerstone of modern crypto risk management. It empowers users not just to react but proactively hedge against one of DeFi’s most persistent threats.