Stablecoins are the backbone of decentralized finance, offering traders and protocols a reliable bridge to fiat stability. Yet, as we saw with recent depegging incidents, the promise of a 1: 1 peg is not absolute. In 2024, the risk of stablecoin depegs remains a primary concern for both institutional and retail DeFi participants. As regulatory scrutiny increases and market volatility persists, robust risk management is no longer optional, it’s essential. This guide examines four targeted strategies for hedging against stablecoin depeg risk using crypto derivatives, tailored to the realities of today’s DeFi landscape.

Understanding Stablecoin Depeg Risk in 2024

A stablecoin depeg occurs when a coin like USDT or USDC diverges from its $1 target, sometimes briefly, sometimes catastrophically. Causes range from insufficient reserves to sudden regulatory interventions or systemic shocks. The consequences can be severe: traders lose value on their holdings, liquidity pools become imbalanced, and lending protocols face cascading liquidations. According to recent research, diversification and real-time monitoring are critical, but sophisticated hedging tools are now required for true portfolio protection.

Four Effective Strategies to Hedge Stablecoin Depeg with Crypto Derivatives

Top Strategies to Hedge Stablecoin Depegs with Derivatives

-

Short Stablecoin Perpetual Swaps to Hedge Depeg Risk: By taking short positions on stablecoin perpetual swaps (e.g., USDT or USDC) on platforms like Binance Futures or OKX, investors can profit if the stablecoin price drops below its peg, offsetting losses from holding the depegged asset.

-

Utilize Structured Products like Shark Fin and Future Plus for Downside Protection: Structured products offered by exchanges such as Binance Shark Fin and OKX Future Plus provide capital protection with potential for enhanced yield, automatically hedging against moderate price drops or volatility in stablecoins.

-

Deploy Depeg-Specific Vaults or Protocols (e.g., Y2K Finance) for Automated Hedging: Platforms like Y2K Finance offer vaults specifically designed to hedge against stablecoin depegging events, automating risk management and providing payouts if a depeg occurs.

1. Short Stablecoin Perpetual Swaps to Hedge Depeg Risk

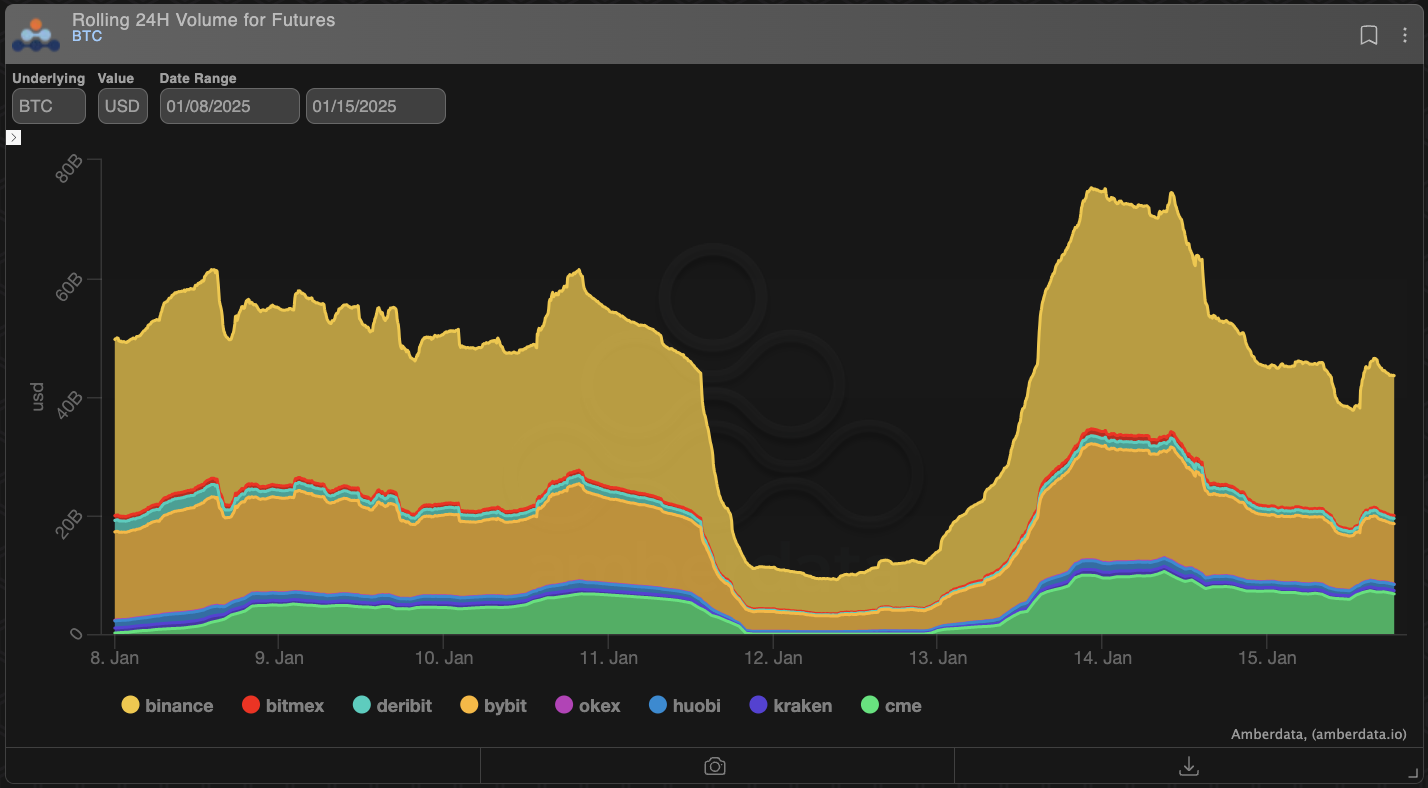

Perpetual swaps on major exchanges now include pairs like USDT/USD and USDC/USD. By shorting these contracts, investors can profit if the stablecoin falls below $1, offsetting spot losses from a depeg event. For example, if USDT drops to $0.98 during a market shock, a well-sized short position on USDT perpetuals will deliver gains that counterbalance the loss in your spot holdings.

This approach is highly liquid and flexible but requires careful margin management and real-time monitoring due to funding rate fluctuations and potential liquidation risks.

2. Purchase Put Options on Major Stablecoins via Derivatives Platforms

Put options provide direct downside protection by giving you the right, but not the obligation, to sell your stablecoins at a fixed price (strike price) even if their market value collapses below $1. In 2024, platforms have expanded offerings for USDT and USDC options contracts with maturities aligned to key regulatory decision dates or anticipated volatility events.

This method allows you to cap your maximum loss at the cost of the option premium, a critical advantage during periods of heightened uncertainty or when holding large amounts of protocol reserves in stables.

Structured Products and Automated Hedging Protocols

The evolution of DeFi has introduced structured products engineered specifically for volatility mitigation, tools once exclusive to traditional finance now accessible on-chain.

3. Utilize Structured Products like Shark Fin and Future Plus for Downside Protection

Products such as Shark Fin and Future Plus offer tailored payouts when underlying assets breach certain thresholds, perfectly suited for hedging against sudden stablecoin depegs. These instruments combine options-like payoffs with automated triggers so that if a stablecoin trades below its peg within a defined window, investors receive enhanced yield or compensation proportional to the deviation.

The flexibility in structuring these products allows users to select risk parameters based on current market conditions, whether bracing for mild volatility or catastrophic failures.

For DeFi participants seeking yield with embedded protection, these structured products bridge the gap between passive income and active risk management. They’re especially compelling for DAOs, treasuries, and sophisticated retail users who wish to automate their hedging while maintaining capital efficiency.

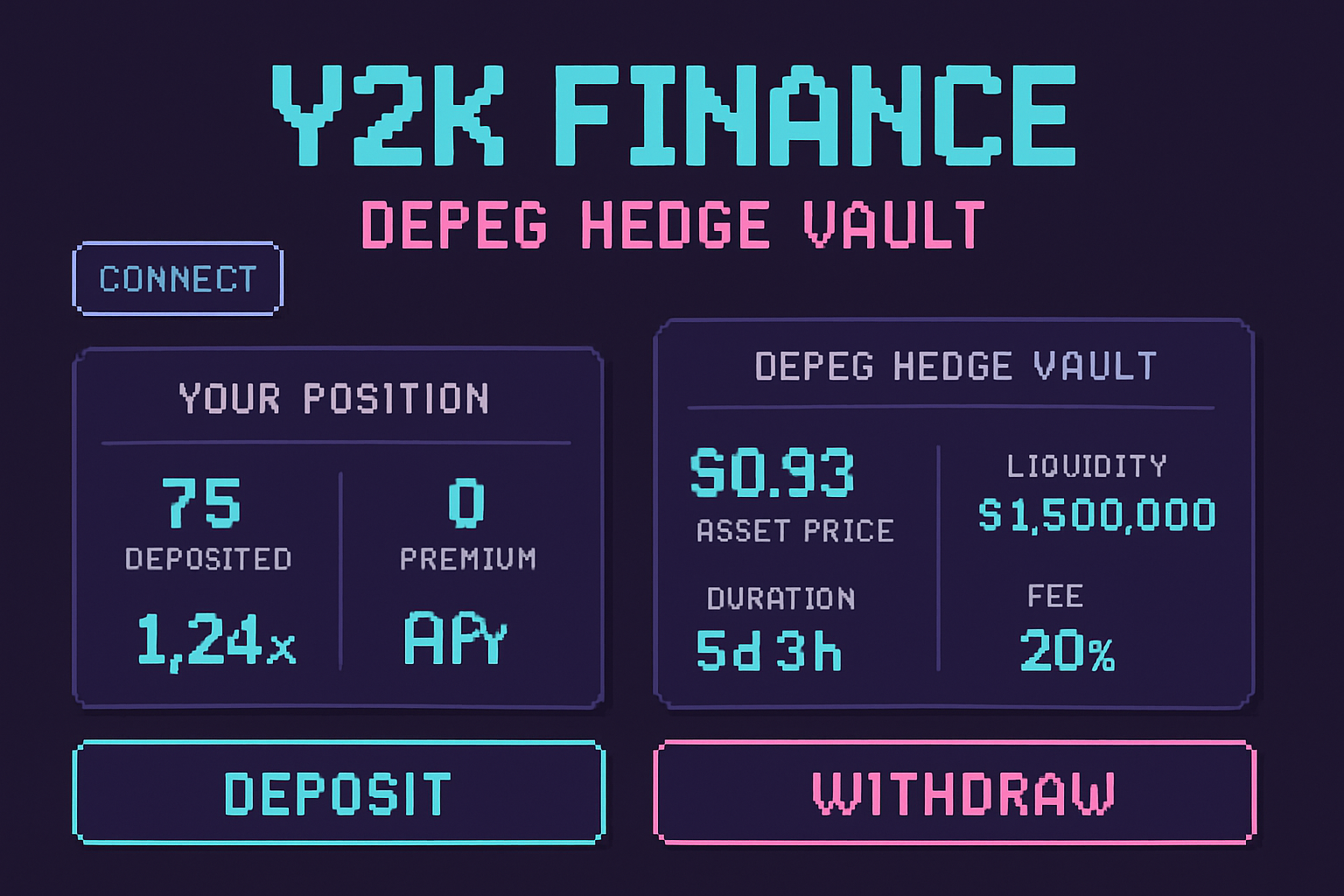

4. Deploy Depeg-Specific Vaults or Protocols (e. g. , Y2K Finance) for Automated Hedging

Protocols like Y2K Finance have pioneered vaults that provide automated coverage against stablecoin depegs. By depositing assets into a depeg-specific vault, users gain exposure to insurance-like payouts if a stablecoin breaches a predefined threshold, say, USDT falling below $0.995 for a set period. The protocol collects premiums from depositors and distributes compensation in the event of a qualifying depeg.

This approach is hands-off and scalable, making it ideal for users who want continuous protection without actively managing derivatives positions. As these vaults evolve, they are increasingly customizable, allowing users to select which stablecoins to cover and what depeg criteria trigger payouts. For more details on how these protocols work in practice, see this deep dive.

Integrating Strategies: Building a Comprehensive Risk Hedge

No single strategy offers complete protection; the optimal approach often involves layering multiple tools based on your risk profile and market outlook. For example:

- Active traders may combine shorting perpetual swaps with put options to hedge both immediate and tail-risk scenarios.

- Passive investors might favor structured products or automated vaults that provide set-and-forget coverage.

- DAOs and treasuries should consider integrating all four strategies, short swaps for liquidity events, puts for regulatory risk windows, structured products for ongoing volatility, and vaults as portfolio backstops.

The key is dynamic allocation: monitor peg stability in real time using analytics platforms like DepegWatch. com so you can adjust exposures as market conditions shift. This data-driven approach ensures you’re not overpaying for protection during periods of calm or under-hedged when volatility spikes.

Key Considerations Before Hedging Stablecoin Depeg Risk

While these derivative tools offer robust protection, they come with costs, option premiums, swap funding rates, or protocol fees can erode returns if not managed proactively. Additionally:

- Counterparty risk: Always assess the solvency and security of derivative platforms or vault protocols before allocating significant capital.

- Liquidity: Ensure sufficient market depth exists for your chosen instruments, especially during high-stress events when spreads widen dramatically.

- Regulatory shifts: Stay alert to legal developments that could impact the availability or enforceability of certain hedging contracts.

The landscape of stablecoin risk is evolving rapidly in 2024, and so are the tools available to defend your capital. By understanding how to short perpetual swaps, buy put options on stables, deploy structured products like Shark Fin/Future Plus, and utilize automated depeg-specific vaults such as those from Y2K Finance, you can construct a multi-layered defense against one of DeFi’s most persistent threats.