Perpetual decentralized exchanges (Perp DEXs) have become a cornerstone of the DeFi ecosystem, offering traders the flexibility of leveraged futures markets without intermediaries. However, the very architecture that makes Perp DEXs appealing also exposes them to unique technical vulnerabilities, most notably, API failures. These breakdowns can quietly erode capital and undermine trust, making them a critical yet often overlooked dimension of DeFi protocol risk.

How API Failures Create Hidden Losses in Perp DEXs

Unlike centralized exchanges where outages are typically front-page news, API failures in decentralized protocols can be subtle but devastating. APIs are the connective tissue for Perp DEX operations: they fetch real-time market data, execute orders, manage margin calls, and update user balances. When these interfaces malfunction, whether due to latency, data feed errors, or outright outages, the resulting disruptions can cascade into substantial hidden trading losses.

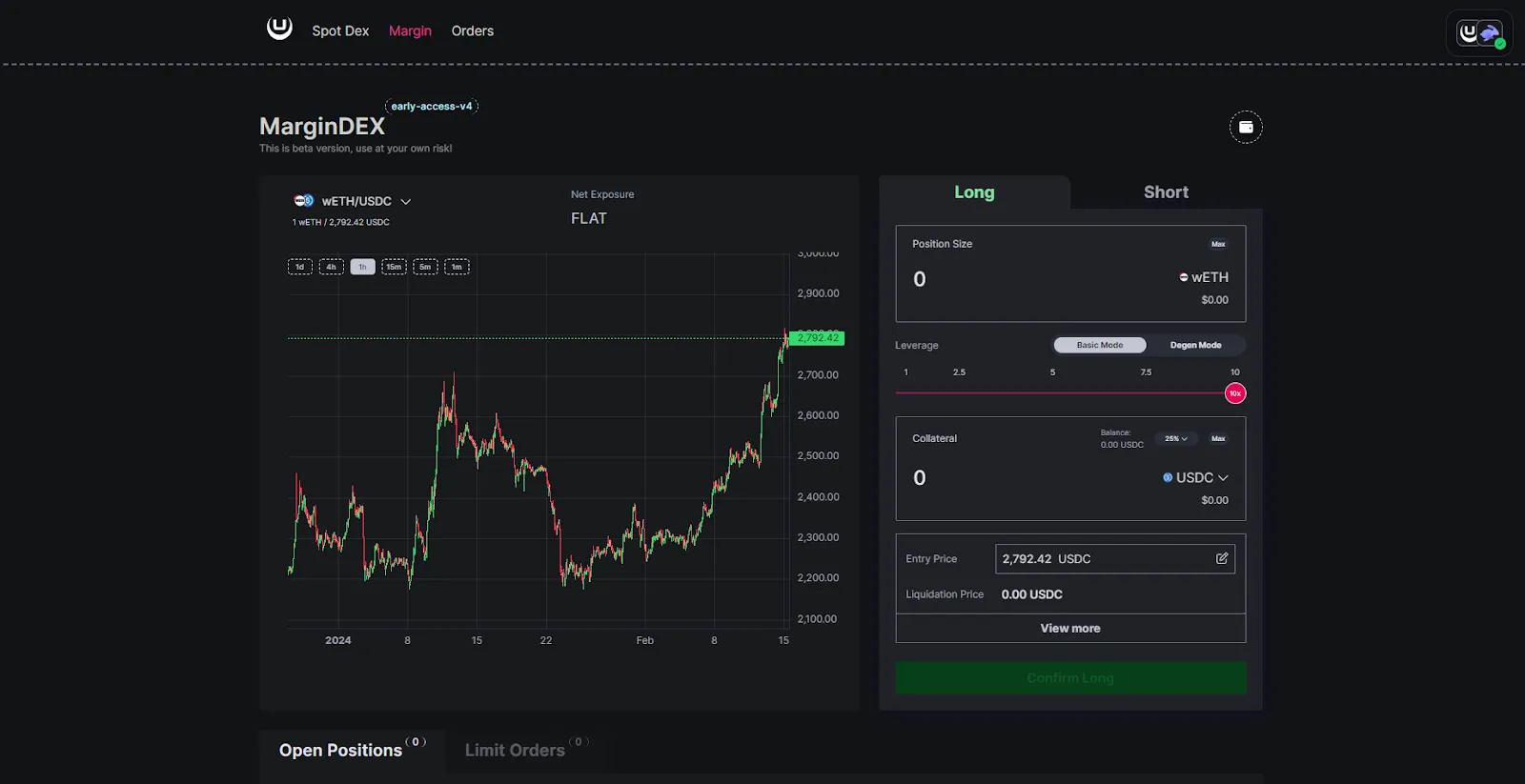

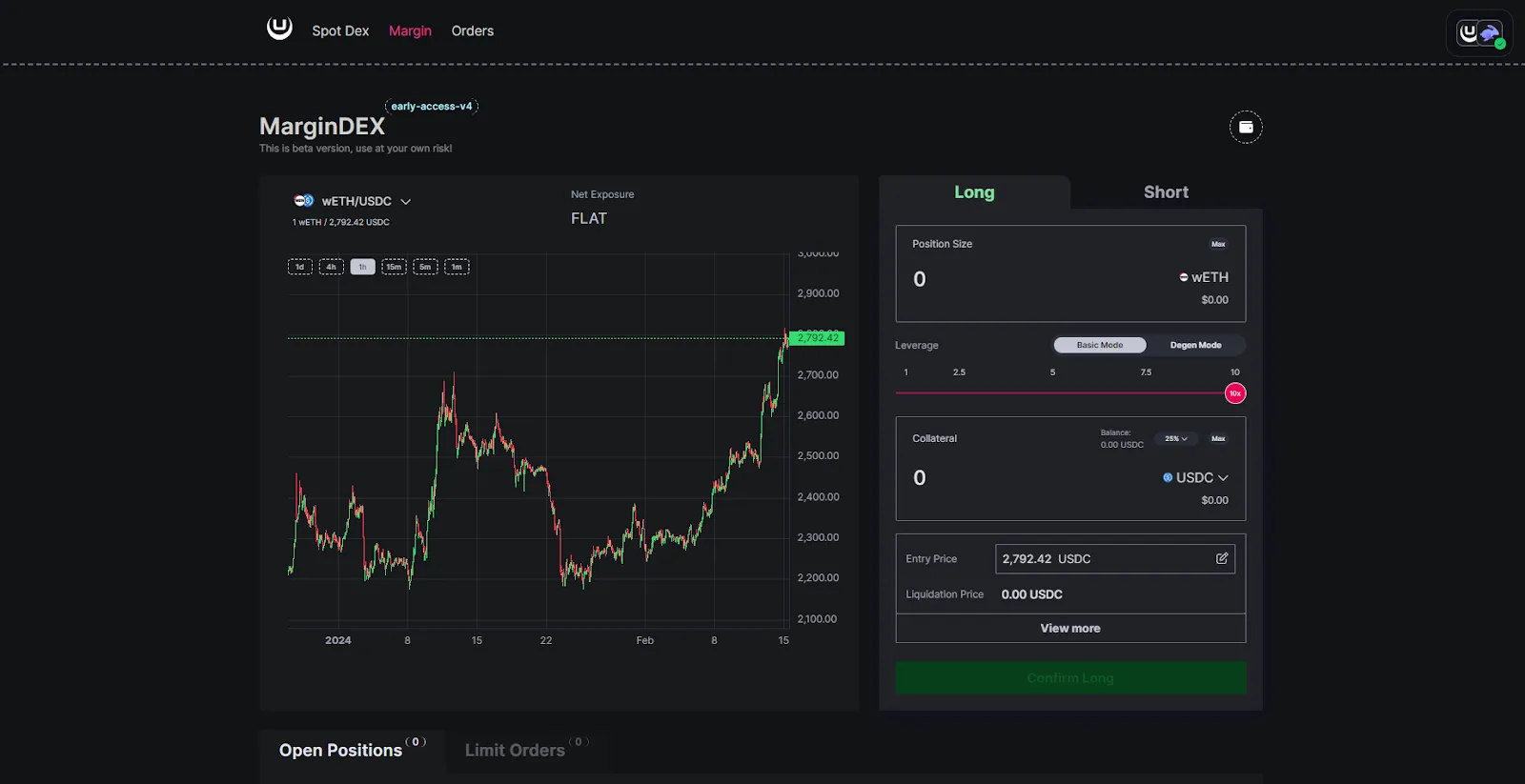

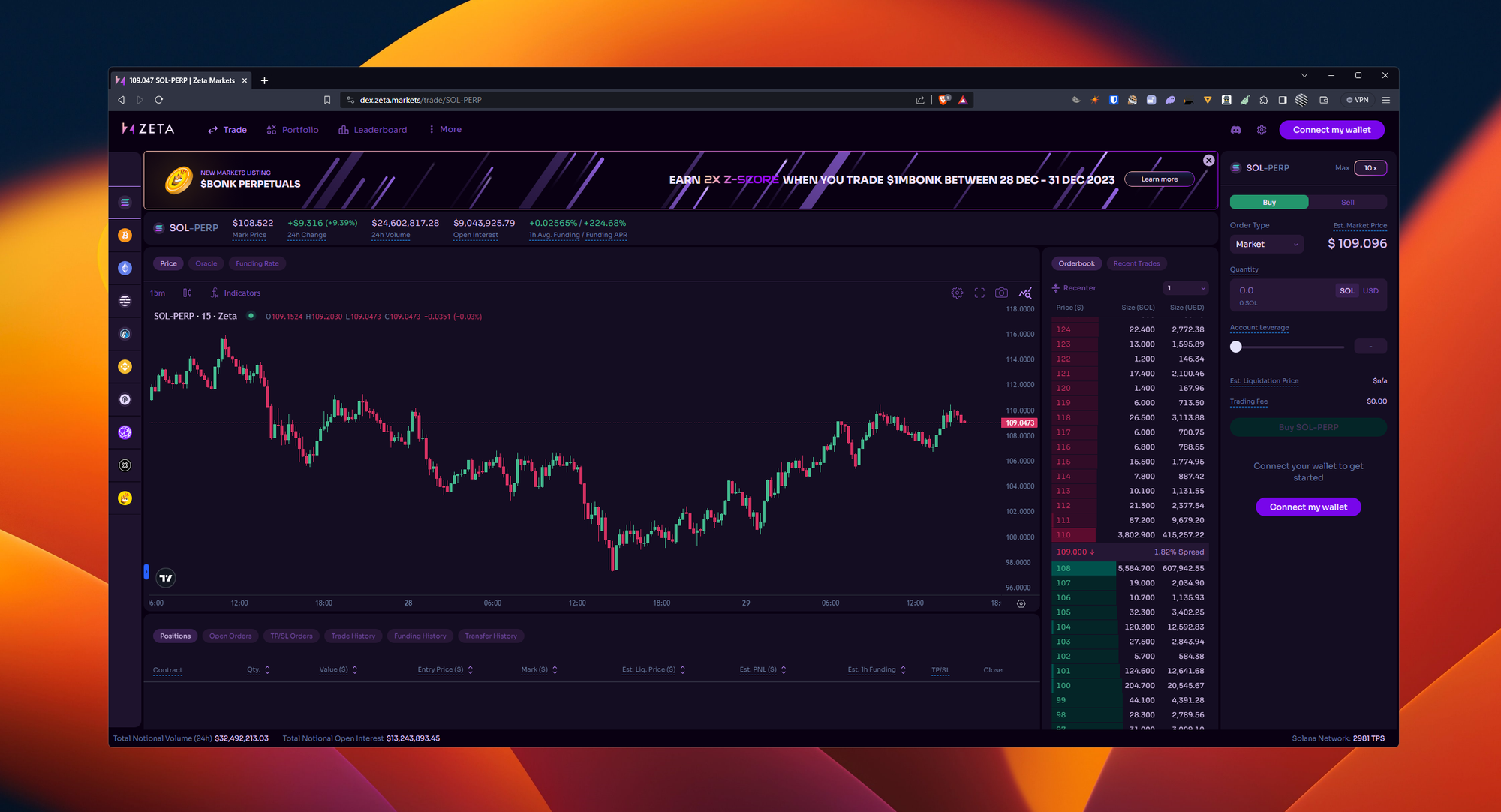

Consider the recent Hyperliquid incident: a 27-minute API outage left traders unable to close positions or adjust margins. As prices whipsawed in volatile markets, users were effectively frozen out, unable to react as liquidation thresholds approached. The result? Unintended liquidations and forced losses that would not have occurred had the API functioned normally (Mitrade). Even after Hyperliquid announced compensation for affected users (ForkLog), the event underscored how quickly technical failures can translate into real financial pain.

Recent Case Studies: Cetus DEX, Dexodus Finance and XPL Manipulation

The risks posed by Perp DEX API failures are not hypothetical, they’re playing out in real time across major platforms:

- Cetus DEX Exploit (May 2025): Cetus Protocol suffered a $260 million loss when attackers manipulated its automated market maker (AMM) price curves by introducing spoofed tokens and exploiting weaknesses in input verification logic. This wasn’t just a smart contract issue, it was exacerbated by unreliable data feeds and insufficient validation at the API layer (de.fi).

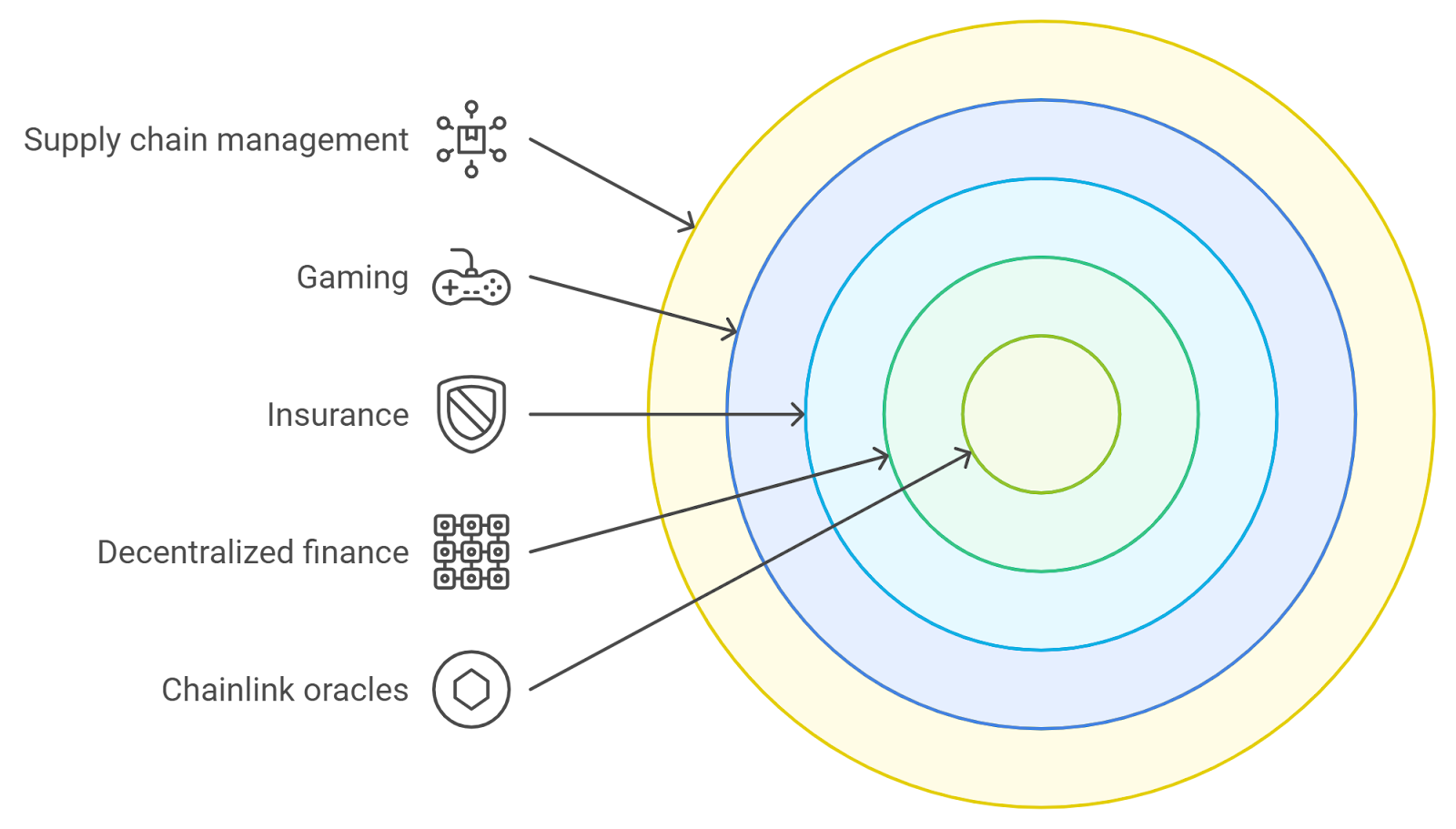

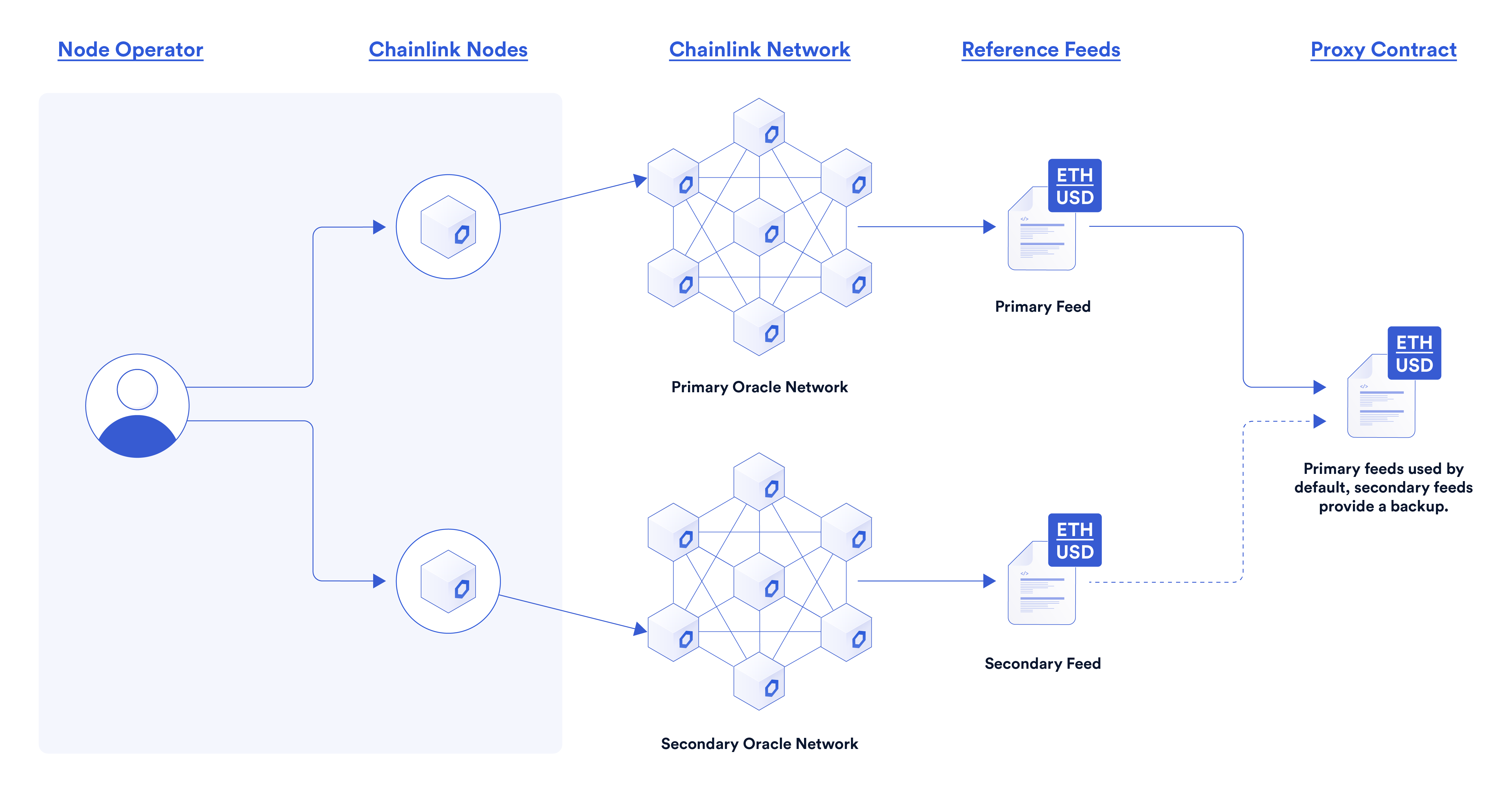

- Dexodus Oracle Exploit (May 2025): Dexodus Finance lost $291,000 when an attacker used stale Chainlink oracle data to manipulate leveraged perpetuals within a single block. The root cause? The protocol’s reliance on outdated price feeds delivered via its API, a textbook example of how decentralized exchange API errors can lead to hidden losses (de.fi).

- XPL Token Manipulation (September 2025): Coordinated whale activity on Hyperliquid and Aster DEXs triggered a 200% surge in XPL’s price within minutes. Retail traders lost $50, 60 million while manipulators pocketed $46 million. Vulnerabilities in liquidity concentration and oracle price updates, both mediated by APIs, enabled cascading liquidations across platforms (ainvest.com).

The Anatomy of Hidden Trading Losses from Technical Failures

The impact of decentralized exchange API errors is rarely confined to direct exploits or outages. More insidiously, these failures create conditions for hidden trading losses that may go unnoticed until after-the-fact:

Five Ways Perp DEX API Failures Cause Hidden Losses

-

1. Inability to Close Positions During Outages: When APIs fail, as seen in the Hyperliquid outage, traders are unable to close or adjust positions. This exposes them to rapid market swings and forced liquidations, resulting in substantial hidden losses.

-

2. Exposure to Stale or Manipulated Price Feeds: API failures can cause DEXs to rely on outdated or manipulated price data, as in the Dexodus Finance exploit. Attackers exploited stale Chainlink data to profit, while unsuspecting traders suffered losses due to inaccurate pricing.

-

3. Unintended Liquidations from Data Discrepancies: API inconsistencies can trigger unintended liquidations. The XPL token manipulation on Hyperliquid and Aster DEXs led to cascading liquidations, causing $50–60 million in losses for retail traders due to price feed vulnerabilities.

-

4. Incorrect Margin and Risk Calculations: API malfunctions may result in incorrect margin requirements or risk assessments. This can leave traders under-collateralized without warning, exposing them to sudden liquidations and hidden financial losses.

-

5. Loss of Trader Trust and Market Liquidity: Repeated API failures erode user confidence, as highlighted by the Hyperliquid incident. This leads to reduced trading activity and liquidity, amplifying slippage and making it harder for users to exit positions without incurring additional losses.

1. Delayed Liquidations: If margin calls are delayed due to an API lag or outage, users may be liquidated at much worse prices than expected.

2. Stale Price Feeds: Outdated oracle data can allow attackers to manipulate settlement prices or trigger artificial volatility spikes.

3. Inaccurate Margin Calculations: Broken APIs may misreport account equity or margin requirements, leading users into positions they cannot support.

4. Blocked Order Execution: When APIs fail mid-trade, open orders may be stuck unfilled or filled at disadvantageous prices.

5. Compromised Risk Controls: Automated safeguards like circuit breakers rely on accurate data; if APIs break down during high volatility events, protective measures may not trigger as intended.

This landscape reveals why robust DeFi risk management strategies must go beyond smart contract audits, they must also address the entire stack of data flows and execution logic underpinning Perp DEX platforms.

Market participants are increasingly aware that hidden trading losses from Perp DEX API failures are rarely reimbursed, even when protocols offer partial compensation. The Hyperliquid case, where users were compensated after a 27-minute freeze, is an exception rather than the rule. Most DeFi protocols lack the resources or governance frameworks to make users whole after technical mishaps. This reality underscores the need for proactive, not reactive, risk management.

Best Practices for Hedging Against Decentralized Exchange API Errors

To adapt to the evolving landscape of DeFi protocol risk, both institutional and retail traders must integrate layered defenses into their strategies. Technical diligence is only one piece of the puzzle; comprehensive protection requires a blend of infrastructure resilience and user action.

Checklist to Protect Yourself from Perp DEX API Failures

-

Monitor Official Status Pages and Channels: Regularly check the official status pages and social media channels (e.g., Hyperliquid Status, Aster DEX Twitter) for real-time updates on API health and outages.

-

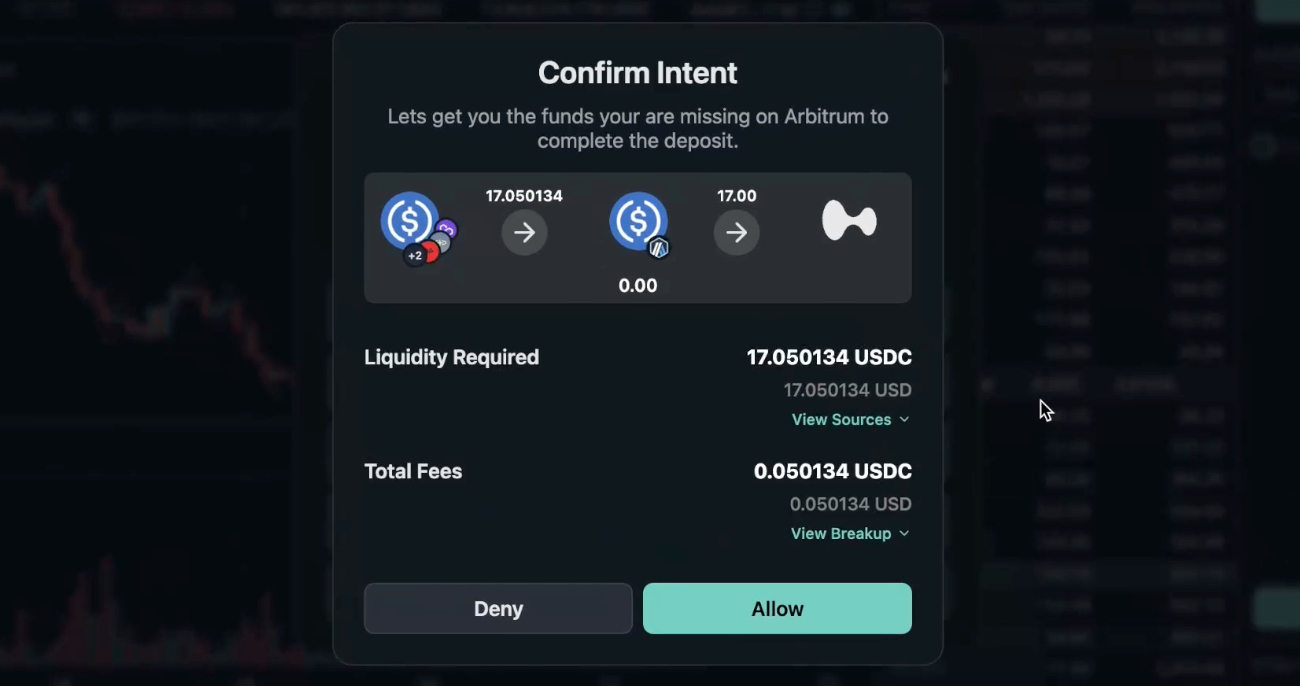

Use Decentralized Oracles for Price Verification: Cross-check on-chain price data using decentralized oracles like Chainlink to confirm the accuracy of displayed prices before executing large trades.

-

Set Automated Alerts for Abnormal Price Movements: Use platforms such as DeFiLlama or DEXTools to set up price and volume alerts, helping you react quickly to suspicious activity or potential API failures.

-

Test Small Transactions Before Committing Large Positions: Before opening or closing significant positions, perform a small transaction to ensure the DEX is functioning properly and API data is up-to-date.

-

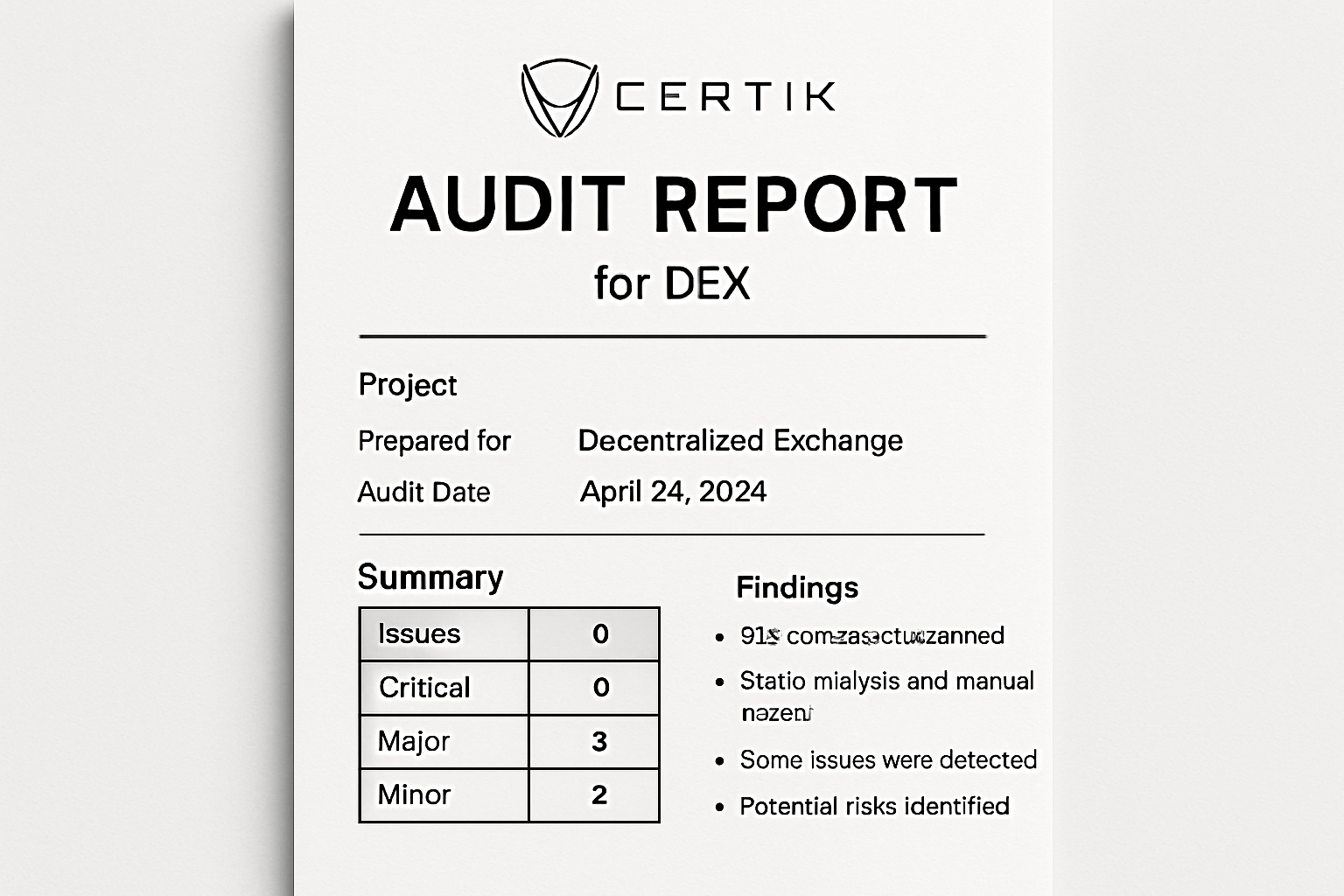

Review Audit Reports and Security Disclosures: Check for recent security audits from reputable firms (e.g., CertiK, Trail of Bits) and review public disclosures for known vulnerabilities in the DEX you use.

-

Understand Circuit Breaker Mechanisms: Familiarize yourself with whether your chosen DEX (such as Aave or UniswapX) has implemented circuit breakers or deviation thresholds to halt trading during anomalies.

-

Stay Informed About Recent Incidents: Read post-mortems and news on recent API failures or exploits (e.g., Cetus DEX and Dexodus Finance incidents) to learn from real-world cases.

-

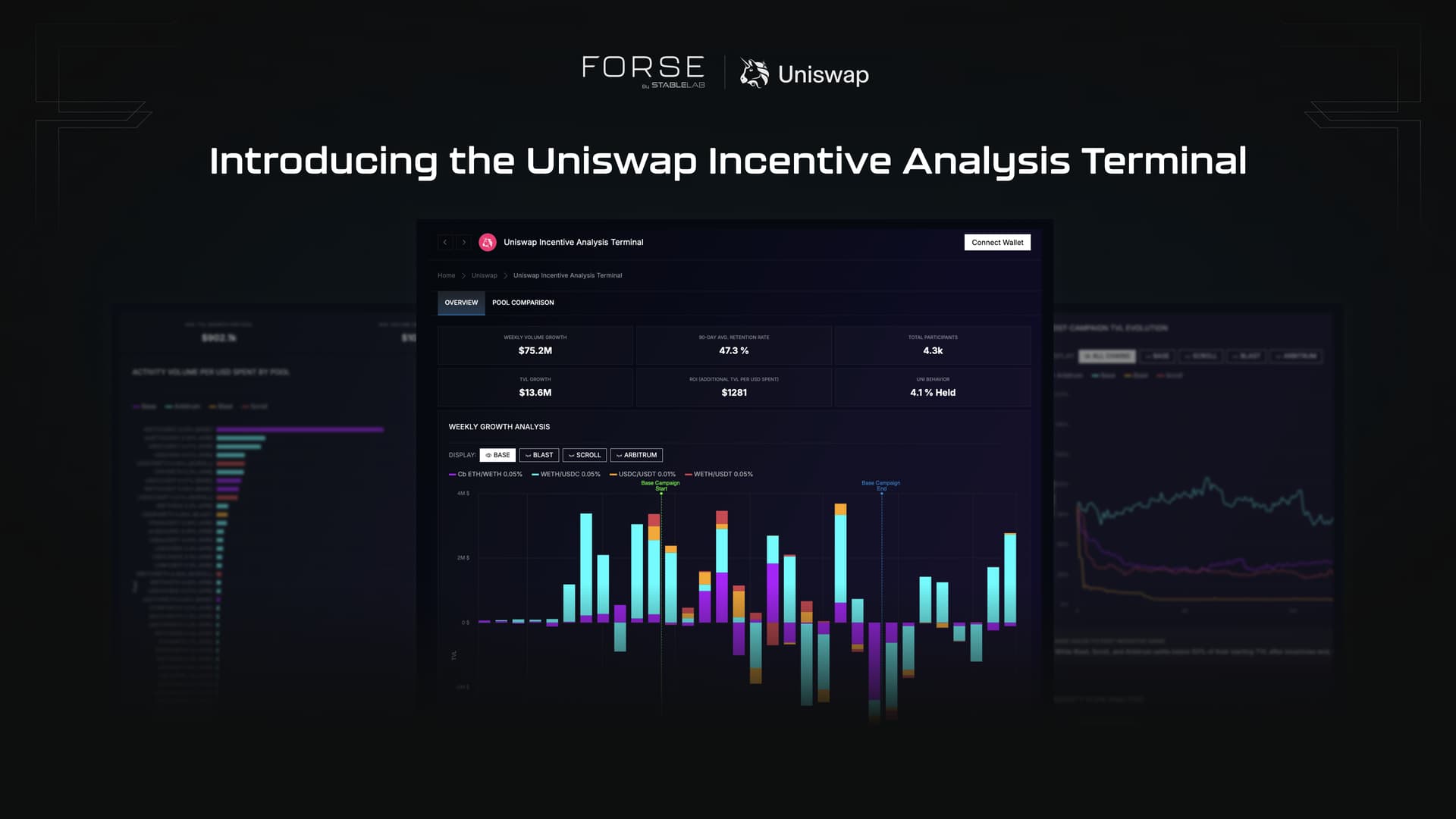

Engage with Community and Governance Forums: Participate in discussions on official forums (like Uniswap Governance) to stay updated on upcoming changes, risk management proposals, and community alerts.

1. Diversify Platform Exposure: Avoid concentrating capital on a single Perp DEX. Distribute positions across platforms with proven uptime records and robust incident response policies.

2. Use On-Chain Monitoring Tools: Leverage real-time analytics platforms that track protocol health, liquidity depth, and unusual network activity. Early detection of anomalies allows traders to adjust exposure before losses compound.

3. Demand Transparent Incident Reporting: Choose platforms committed to rapid communication and transparent post-mortems when outages occur (news.superex.com). Community-driven governance can help ensure accountability.

4. Employ Hedging Products: Consider using derivatives or DeFi-native insurance protocols designed to offset losses from technical failures or depegs. While these products are still maturing, they offer a critical safety net in volatile environments.

Why User Education Is Central to DeFi Risk Management Strategies

The complexity of decentralized exchange API errors means that even technically advanced users can be caught off guard by sudden outages or data inconsistencies. Education initiatives are essential – not just about how Perp DEXs work, but about the specific failure modes that can impact real-world portfolios.

The recent surge in retail interest following events like the XPL manipulation has made clear that community awareness is lagging behind market innovation (simplex.com). Protocol teams must invest in clear documentation, timely risk disclosures, and interactive guides so users can recognize warning signs before capital is at risk.

The Road Ahead: Building Resilient Perpetual DEX Infrastructure

The next generation of DeFi protocols will be defined by their ability to withstand not just market volatility but also technical shocks like API outages and oracle exploits. As seen with Cetus Protocol’s $260 million loss and Dexodus Finance’s $291,000 exploit (de.fi), no amount of innovation can compensate for weak execution layers or poor data hygiene.

Sustainable growth in DeFi will require ongoing investment in redundant APIs, multi-source oracle feeds, regular security audits, and robust circuit breakers that halt trading during extreme anomalies.

If you’re trading on a Perp DEX today, assume that every millisecond matters – both for your strategy and for your risk controls. Hidden losses often emerge not from what you see on-chain but from what you can’t see during an outage or exploit.

The bottom line: a resilient approach to DeFi risk management combines vigilance with diversification and leverages emerging hedging tools as part of every portfolio’s core design.