Stablecoins like USDT and USDC are foundational to DeFi, offering dollar-pegged liquidity for trading, lending, and yield strategies. Yet, as the events of March 2023 highlighted, these assets are not immune to depegging risk. When Circle’s USDC briefly lost its $1 peg due to reserve exposure at Silicon Valley Bank, it exposed a core vulnerability: even the most trusted stablecoins can face sudden price instability. For investors and protocols alike, robust hedging against depeg scenarios is no longer optional, it’s essential.

Understanding Depeg Risk: What Drives USDT and USDC Off-Peg?

The theoretical stability of USDT and USDC depends on full collateralization, transparent reserves, and market confidence. However, several factors can trigger a depeg:

- Banking crises that impact reserve accessibility

- Regulatory shocks or legal actions against issuers

- Market manipulation or liquidity crunches

- Loss of trust following negative news or failed audits

This risk is quantifiable: historical data shows that even a brief deviation from $1 can result in cascading liquidations across DeFi protocols. In this context, hedging tools have evolved rapidly, offering actionable ways to mitigate exposure.

The Top 5 Strategies and Tools for Hedging Against Stablecoin Depeg Events

Top 5 Strategies to Hedge USDT/USDC Depeg Risks

-

Depeg Swaps (e.g., Cork Protocol): Trade specialized derivatives that pay out if USDT or USDC depegs below a set threshold. This allows direct risk transfer and provides a financial payout in the event of a depeg, offering a transparent and market-driven hedge.

-

Y2K Finance Hedge Vaults: Deposit ETH or other assets into Y2K Finance vaults to obtain insurance-like protection against specific stablecoin depeg events. These vaults feature transparent payout structures and clear expiry terms, making risk coverage straightforward and auditable.

-

Stablecoin Diversification Across Multiple Assets: Split your holdings among several reputable stablecoins such as DAI, TUSD, and LUSD, including decentralized options. This reduces exposure to any single depeg event and enhances portfolio resilience.

-

Real-Time Depeg Monitoring Tools (e.g., DepegWatch.com): Utilize analytics platforms that offer live price tracking, on-chain data, and early warning systems for USDT/USDC peg deviations. These tools empower users to act swiftly during periods of instability.

-

Liquidity Pool Hedging on AMMs (e.g., Curve, Uniswap): Provide liquidity to stablecoin pairs like USDT/USDC/DAI on automated market makers. Earn trading fees while leveraging features such as concentrated liquidity or impermanent loss protection to help offset potential depeg impacts.

Below is a curated list of the five most effective approaches currently available for managing USDT and USDC depeg risk in decentralized finance:

1. Depeg Swaps (e. g. , Cork Protocol)

Depeg Swaps are derivative contracts specifically designed for stablecoin risk management. Platforms like Cork Protocol allow users to buy protection against a specific depeg threshold, such as if USDT drops below $0.98. If the event occurs within the contract period, the holder receives a payout proportional to their position size and the degree of deviation.

This approach mirrors traditional credit default swaps but is tailored for on-chain stablecoin events. Pricing reflects both current volatility and market sentiment around issuer solvency. For sophisticated investors seeking direct risk transfer, without relying on centralized insurance, depeg swaps offer both transparency and immediate settlement.

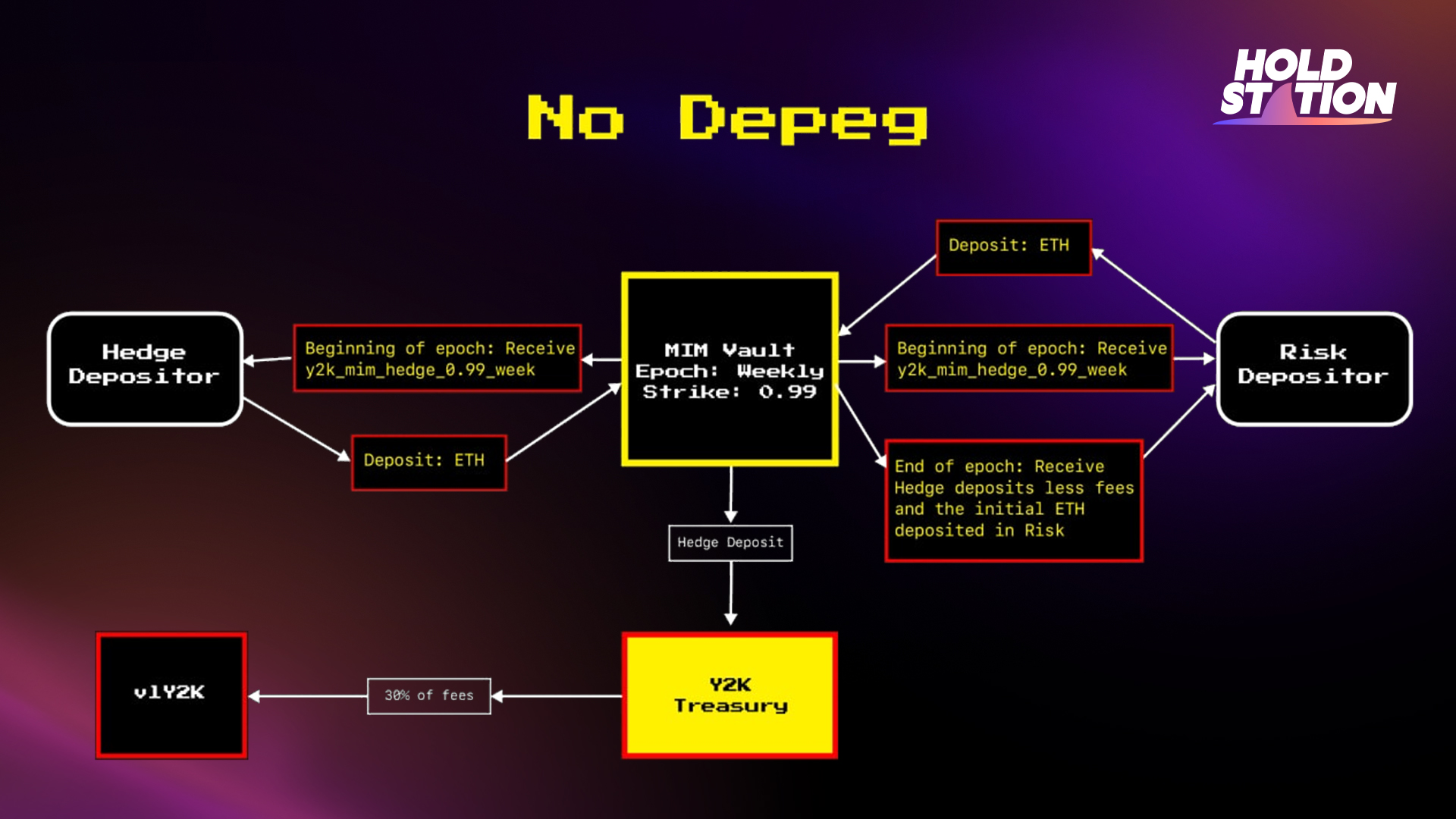

2. Y2K Finance Hedge Vaults

Y2K Finance introduces insurance-like vaults that pool user deposits (often ETH) to back coverage on specific stablecoins.

If a predefined depeg event occurs (for example, if USDC trades below $0.97 at expiry), claimants receive payouts from the vault’s reserves. The system is fully transparent, vault terms, collateralization levels, and payout logic are all visible on-chain, which helps mitigate counterparty risk common in off-chain insurance products.

This model appeals to both passive investors seeking yield (by underwriting coverage) and active users needing protection during periods of heightened volatility or regulatory uncertainty.

3. Stablecoin Diversification Across Multiple Assets

No single stablecoin is immune from systemic shocks; diversification remains one of the most robust defenses against idiosyncratic failures.

- Split holdings among centralized options (USDT/USDC) and decentralized alternatives (DAI, LUSD).

- Add exposure to over-collateralized or algorithmic coins with strong governance records.

- Avoid concentration in any one asset or protocol ecosystem.

This approach reduces tail-risk, if one coin loses its peg due to collateral issues or blacklisting events, diversified portfolios will experience less drawdown overall.

The Role of Real-Time Analytics and Liquidity Pool Hedging

While derivatives and insurance vaults provide explicit protection, robust real-time analytics are the foundation of effective risk management in DeFi. Timely awareness of peg movements and liquidity trends enables both individual users and institutional allocators to act before losses compound.

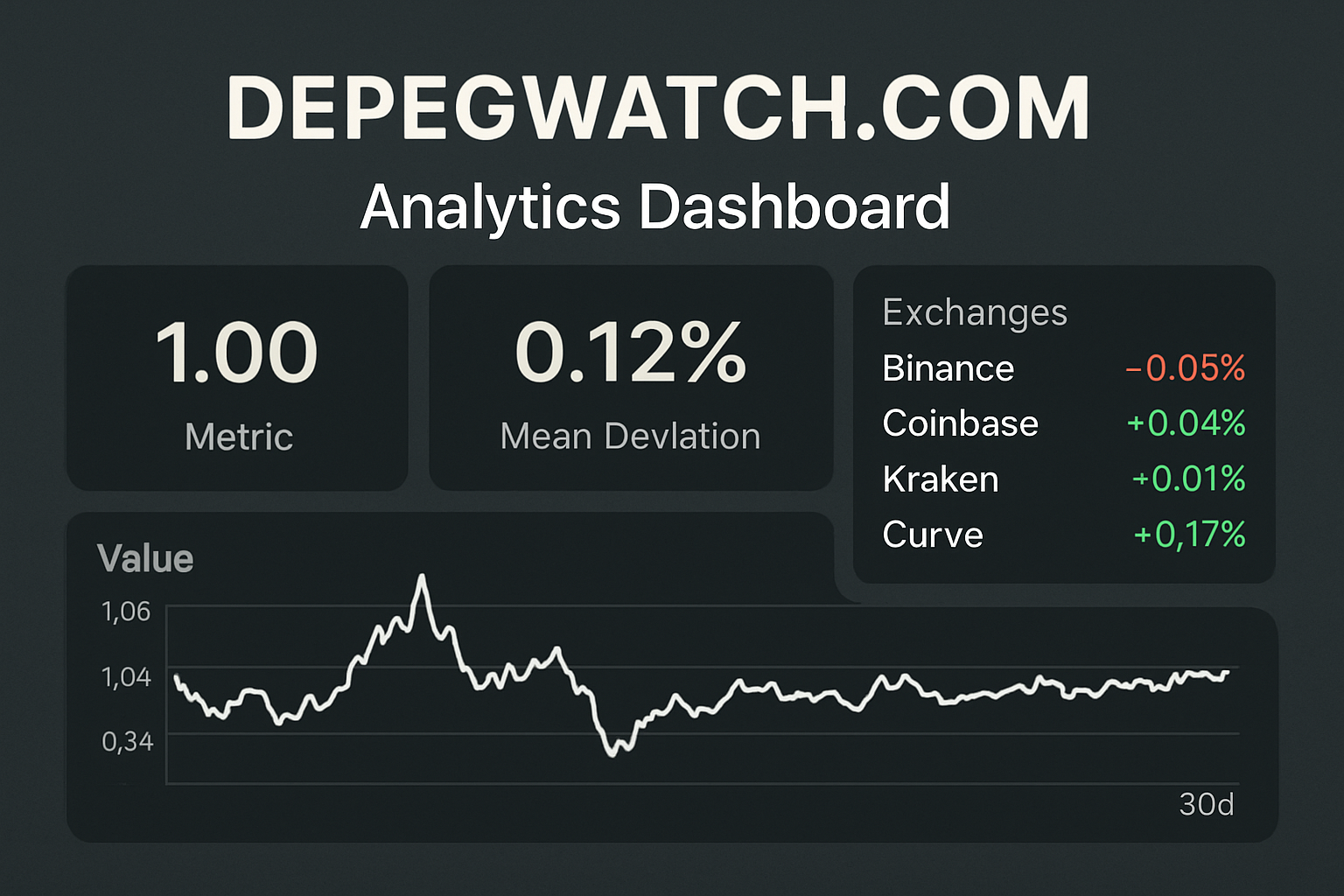

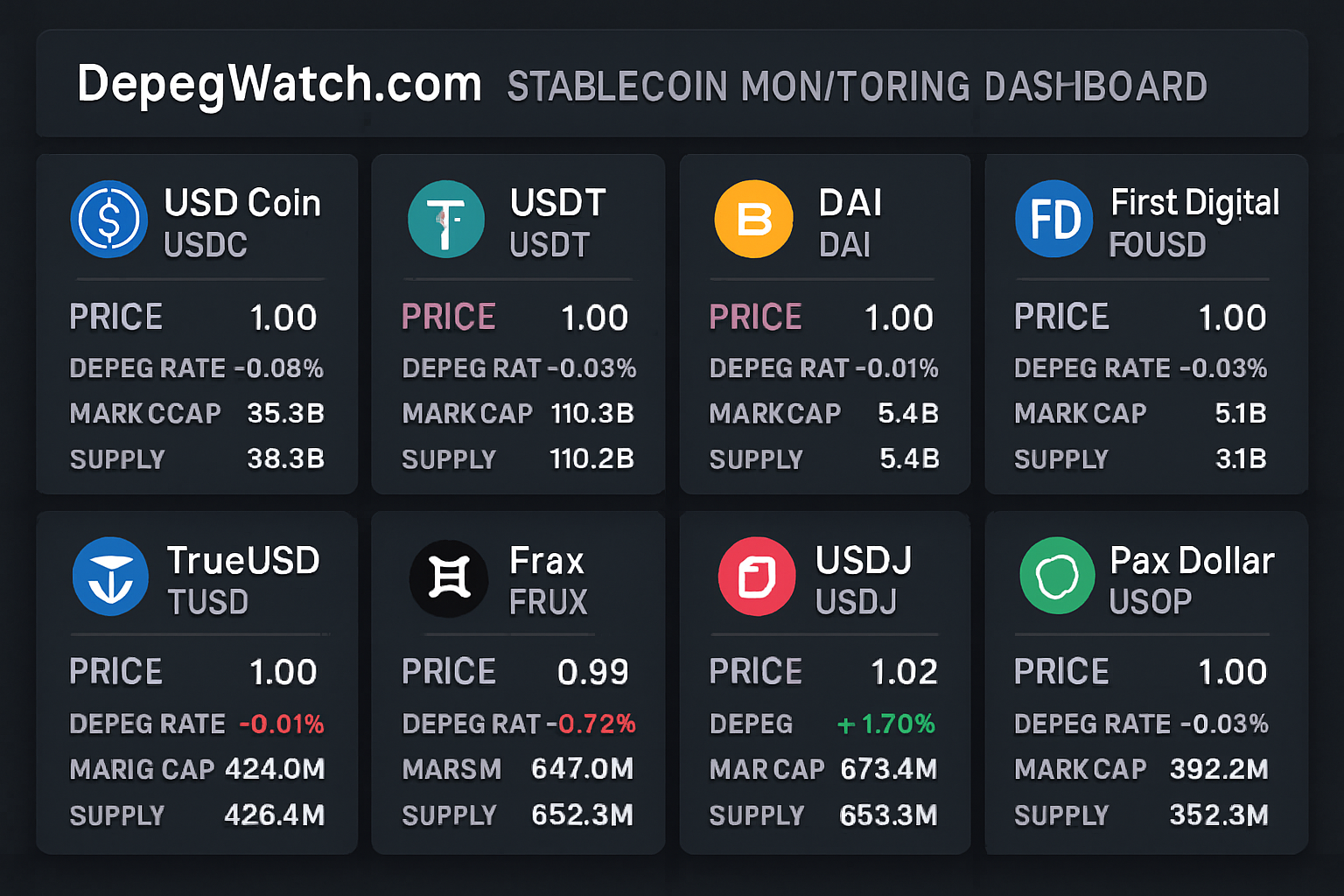

4. Real-Time Depeg Monitoring Tools (e. g. , DepegWatch. com)

DepegWatch. com and similar analytics platforms serve as early warning systems for stablecoin depegging events. These tools aggregate live price feeds, on-chain liquidity data, and historical volatility metrics to flag deviations from the $1 peg. Advanced features include:

- Customizable alerts for specific threshold breaches (e. g. , USDT below $0.995)

- Historical depeg event analysis for backtesting risk models

- Real-time dashboards showing liquidity depth across major AMMs and CEXs

This level of granularity is essential for market makers, protocol treasuries, and retail users alike. By integrating monitoring tools with automated trading or rebalancing scripts, investors can preemptively shift capital or trigger hedges as soon as instability is detected.

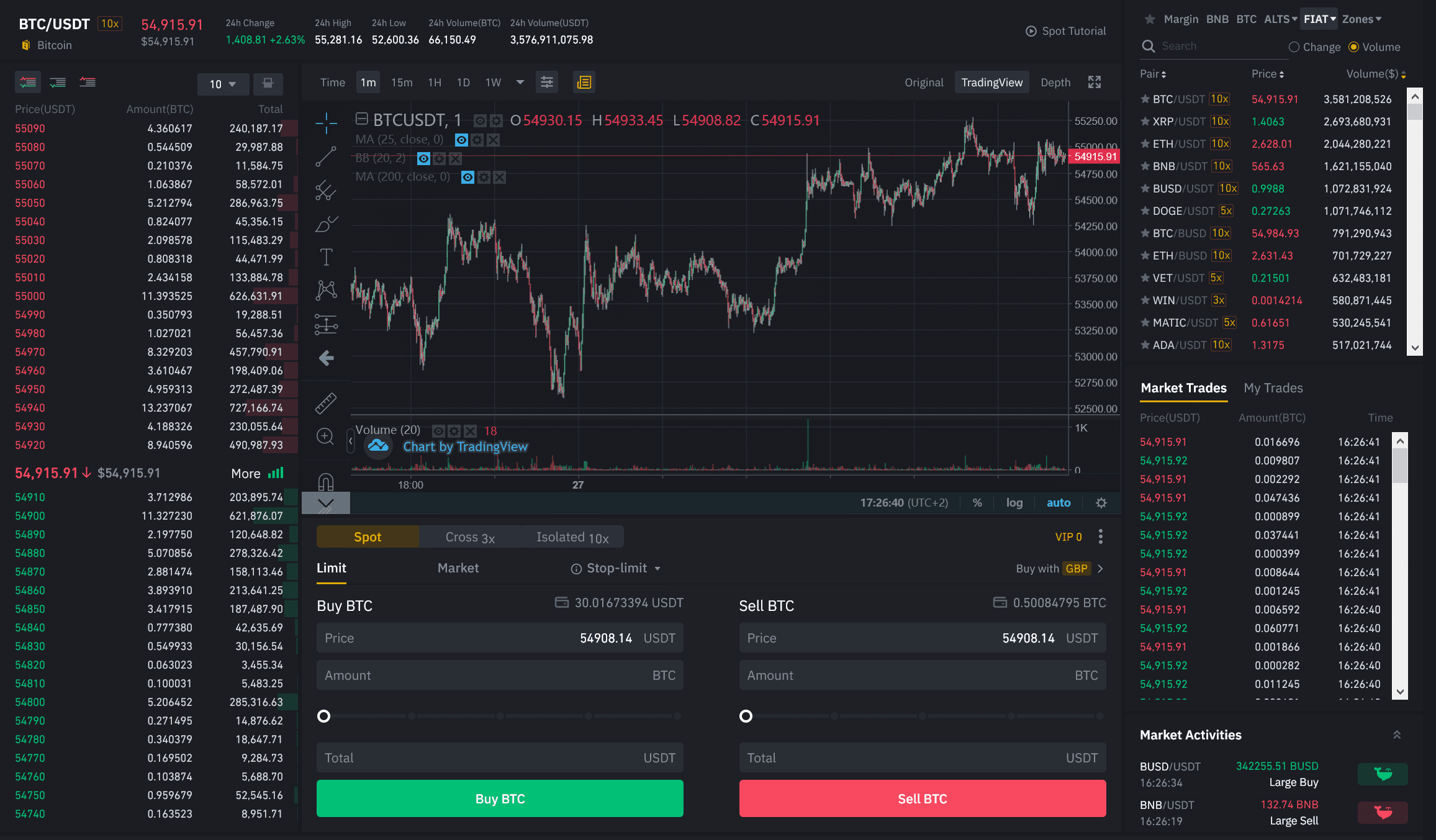

5. Liquidity Pool Hedging on AMMs (e. g. , Curve, Uniswap)

Automated Market Makers (AMMs) like Curve and Uniswap offer a dual-purpose strategy: by providing liquidity to stablecoin pairs such as USDT/USDC/DAI, users earn trading fees that can offset potential losses from minor depegs. Modern AMMs now feature:

- Concentrated liquidity positions, allowing providers to focus exposure around the $1 peg range

- Impermanent loss protection mechanisms, reducing downside during brief dislocations

- Diversification within pools, so that if one stablecoin depegs, only a portion of the capital is affected while fees continue to accrue from arbitrage activity

This approach does not eliminate risk but transforms it: instead of outright loss from holding a single depegged asset, LPs benefit from fee income and have flexibility to exit or rebalance positions dynamically as market conditions evolve.

Putting It All Together: A Holistic Risk Management Framework

No single tool or strategy offers complete protection against USDT or USDC depegging events. The most resilient portfolios combine several approaches:

Top 5 Strategies & Tools to Hedge Stablecoin Depeg Risks

-

Depeg Swaps (e.g., Cork Protocol): Trade derivatives that pay out if USDT or USDC depegs below a set threshold. This enables direct risk transfer and ensures a payout in the event of a depeg, providing a market-driven hedge against stablecoin instability.

-

Y2K Finance Hedge Vaults: Deposit ETH or other assets into vaults that offer insurance-like protection against specific stablecoin depeg events. These vaults feature transparent payout structures and defined expiry terms, allowing users to hedge with clear risk parameters.

-

Stablecoin Diversification Across Multiple Assets: Split holdings among reputable stablecoins such as DAI, TUSD, and LUSD, including decentralized options, to reduce exposure to any single depeg risk. This diversification strategy mitigates potential losses if one stablecoin loses its peg.

-

Real-Time Depeg Monitoring Tools (e.g., DepegWatch.com): Utilize analytics platforms that provide live price tracking, on-chain data, and early warning systems for USDT/USDC peg deviations. These tools enable proactive risk management by alerting users to potential depegging events as they unfold.

-

Liquidity Pool Hedging on AMMs (e.g., Curve, Uniswap): Provide liquidity to stablecoin pairs (USDT/USDC/DAI) on automated market makers to earn trading fees. Use protocol features like concentrated liquidity or impermanent loss protection to help mitigate the impact of a depeg event.

The integration of derivatives (Depeg Swaps), insurance vaults (Y2K), diversified holdings, real-time analytics (DepegWatch. com), and AMM-based hedging creates a multi-layered defense that adapts to evolving market conditions. Each layer addresses different aspects of risk, event-driven payouts, passive mitigation through diversification, proactive response via monitoring tools, and ongoing yield generation with liquidity pools.

The recent history of stablecoins underscores the importance of vigilance: even assets perceived as “risk-free” can experience abrupt dislocations due to exogenous shocks or internal governance failures. As DeFi matures, expect further innovation in hedging products, zero-liquidation loans, structured options on peg stability, and cross-chain insurance markets are already gaining traction.

If you’re seeking deeper insights or practical guides on implementing these strategies in your portfolio, explore our comprehensive resources at /best-hedging-strategies-for-usdt-depeg-events-in-defi.