Stablecoins are the backbone of DeFi, but 2024 has proven that their peg is anything but guaranteed. Whether it’s market volatility, regulatory shakeups, or smart contract bugs, depegging risk is real – and for active traders and institutions alike, robust hedging is non-negotiable. The good news? DeFi derivatives have evolved fast. Today’s toolkit lets you hedge against stablecoin depegs with precision and speed, minimizing portfolio drawdowns when markets go off-script.

Why Hedge Against Stablecoin Depegs in 2024?

Despite regulatory milestones like the GENIUS Act and a maturing onchain yield landscape (Galaxy), stablecoins remain exposed to both systemic shocks and idiosyncratic risks. A depeg event can mean instant losses for lenders, LPs, and anyone using stables as collateral. As S and P Global notes, the effectiveness of stablecoins as safe havens is conditional – not absolute. If you’re holding USDC, DAI, or even newer algorithmic stables, you need actionable risk mitigation strategies that work in real time.

Three Actionable Strategies for Hedging Stablecoin Depeg Risk

Top DeFi Derivative Strategies to Hedge Stablecoin Depegs (2024)

-

Short Stablecoin Perpetuals on Decentralized Derivatives Platforms Leverage platforms like dYdX, GMX, and Synthetix to open short positions on stablecoin perpetual contracts. This strategy allows you to profit if a stablecoin depegs below $1, providing direct downside protection. These platforms offer deep liquidity and advanced order types for precise risk management.

-

Purchase Depeg Protection Options via Protocols like Risk Harbor or InsurAce Protocols such as Risk Harbor and InsurAce offer on-chain options and insurance products that pay out if a stablecoin loses its peg. By purchasing depeg protection, you can hedge against sudden price drops and automate your risk response without active position management.

-

Utilize Automated Hedging Vaults (e.g., Angle Protocol’s Hedging Module) for Dynamic Exposure Management Platforms like Angle Protocol provide automated vaults that dynamically adjust your exposure to stablecoin depegging risk. Angle’s Hedging Module, for example, rebalances positions using derivatives and collateral to minimize losses in volatile markets, making it ideal for both passive and active investors.

Let’s break down three up-to-date strategies every serious crypto investor should have in their arsenal this year:

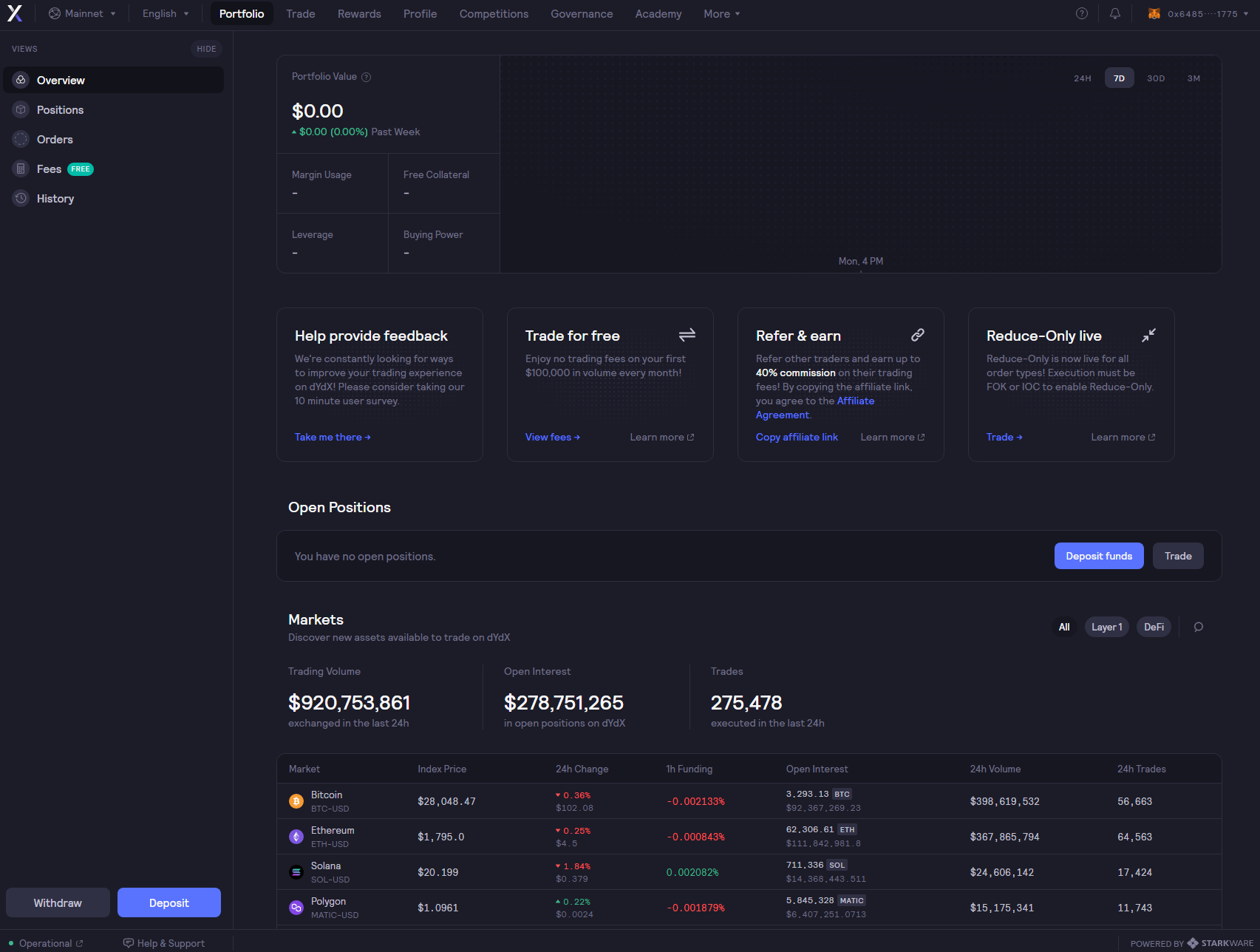

1. Short Stablecoin Perpetuals on Decentralized Derivatives Platforms

If you’re looking for direct exposure to downside risk on a stablecoin (say USDT or USDC), shorting perpetual contracts on platforms like dYdX, GMX, or Synthetix is the fastest route. Here’s how it works: by opening a short position on a stablecoin perp pair, you profit if the coin drops below its peg. This approach is highly liquid and can be automated via bots or scripts for rapid response.

This strategy isn’t just for degens; institutional desks are increasingly using perps to balance treasury risk and hedge lending books. The key? Monitor funding rates and slippage closely – liquidity can dry up fast during crisis events.

2. Purchase Depeg Protection Options via Protocols like Risk Harbor or InsurAce

If you want insurance-style protection with defined downside, look at protocols such as Risk Harbor or InsurAce. These platforms offer options-like coverage that pays out if a specified depeg event occurs (e. g. , USDC trades below $0.97 for more than an hour). By purchasing these options contracts directly through smart contracts, you cap your loss while retaining upside if no depeg occurs.

This approach is ideal for passive holders and DAOs managing large pools of stables; premiums are transparent and payouts are algorithmic – no claims process required. Just make sure to read protocol documentation closely to understand strike thresholds and payout logic.

3. Utilize Automated Hedging Vaults (e. g. , Angle Protocol’s Hedging Module)

The cutting edge of DeFi risk management in 2024? Automated hedging vaults like those offered by Angle Protocol. These modules dynamically adjust your exposure based on real-time price feeds and volatility metrics. Deposit your stables into a vault; the protocol rebalances between long/short derivative positions to keep your net exposure within target bands.

This set-and-forget solution is gaining traction among both retail users seeking simplicity and institutions needing scalable protection across multiple wallets or treasuries. The catch: always verify smart contract audits before deploying significant capital.

Navigating Liquidity and Smart Contract Risks

No matter which strategy you pick – perps, options protection, or automated vaults – risk management doesn’t stop at execution. Liquidity crunches can lead to slippage just when you need protection most; smart contract exploits remain a persistent threat despite improved auditing standards (source). Diversify across protocols where possible and keep collateralization ratios healthy to avoid forced liquidations in volatile markets.

For those running institutional books or managing DAO treasuries, it’s crucial to model out worst-case scenarios. Stress-test your hedges by simulating sharp depegs, sudden liquidity evaporations, and correlated smart contract failures. Even the best-constructed hedge can underperform if you’re caught in a feedback loop of cascading liquidations or if protocol-specific risks are underestimated.

Pro tip: Set up automated monitoring for peg deviations and onchain liquidity depth. Reacting in seconds, not hours, is often the difference between a minor portfolio drawdown and catastrophic loss.

Comparing Strategy Fit: Retail vs. Institutional

Retail users often favor set-and-forget solutions like Angle Protocol’s hedging vaults or purchasing capped-risk options via Risk Harbor. These approaches minimize hands-on management while providing predictable outcomes, ideal for non-professional investors or those looking to automate risk mitigation.

Institutional desks, meanwhile, typically deploy a mix of short perps (for tactical hedging) and customized options coverage layered across multiple protocols. The ability to size positions dynamically and respond to market flows is key for large portfolios, especially when managing exposure across several stablecoins simultaneously.

Top DeFi Derivative Hedging Strategies: Retail vs Institutional

-

Short Stablecoin Perpetuals on Decentralized Derivatives Platforms Best for: Advanced retail traders & institutionsPlatforms like dYdX, GMX, and Synthetix let you short stablecoin perpetuals. By opening a short position on, for example, USDC or USDT perps, you can profit if the stablecoin depegs below $1, offsetting losses on your spot holdings. This strategy offers high flexibility but requires active management and a solid grasp of on-chain leverage and liquidation risks.

-

Purchase Depeg Protection Options via Protocols like Risk Harbor or InsurAce Best for: Retail & risk-averse institutionsProtocols such as Risk Harbor and InsurAce offer structured depeg protection. By buying an option-like cover, you receive a payout if a stablecoin falls below a defined threshold (e.g., USDC drops under $0.99). This approach is user-friendly and requires no active trading, making it ideal for those seeking set-and-forget insurance against depegs.

-

Utilize Automated Hedging Vaults (e.g., Angle Protocol’s Hedging Module) for Dynamic Exposure Management Best for: Passive retail & institutional portfolio managersAngle Protocol and similar platforms provide automated vaults that dynamically hedge against stablecoin depeg risk. These vaults adjust exposure using on-chain derivatives and yield strategies, minimizing manual intervention. This is ideal for institutions and passive investors aiming for continuous, algorithmic risk mitigation without daily oversight.

Key Considerations Before Hedging

- Protocol Audits: Only use derivatives platforms with recent, reputable audits, exploit risk remains non-trivial even in 2024.

- Collateral Management: Over-collateralize positions where possible; forced liquidations during volatility spikes are common failure points.

- Payout Logic: Understand exactly when and how option-based protection pays out, read the fine print on strike triggers and timeframes.

- Diversification: Spread exposure across multiple platforms (dYdX, GMX, Synthetix for perps; Risk Harbor/InsurAce for options; Angle for automation) to avoid single-point-of-failure risk.

Staying Ahead in a Fast-Moving Market

The stablecoin landscape is only getting more competitive, and volatile. Regulatory frameworks like the GENIUS Act may help stabilize some aspects of issuance and reserves but can’t eliminate smart contract risk or black swan market events. As always, speed and precision are your edge: monitor peg health obsessively, review protocol updates weekly, and don’t hesitate to rebalance as conditions change.

If you’re serious about crypto portfolio protection in 2024, integrating these three actionable strategies, shorting perps on leading DEXs, buying depeg protection options via top insurance protocols, and leveraging automated hedging vaults, will put you ahead of most market participants still flying blind into every new depeg scare.

The bottom line? In DeFi’s high-frequency environment, robust risk mitigation isn’t optional, it’s table stakes. The next time stablecoin volatility spikes or headlines warn of a protocol under stress, you’ll be ready with dynamic tools that protect capital rather than just hoping for the best. Stay fast. Stay precise. Hedge smarter, and let others learn the hard way.