Assessing protocol failure risk before investing in DeFi projects is not just smart, it’s essential. The breakneck pace of innovation in decentralized finance brings both opportunity and a unique set of risks that can catch even seasoned crypto investors off guard. Let’s walk through how to make sense of these risks, using frameworks and real-world data to guide your decisions.

![]()

Why Protocol Failure Risk Matters in DeFi

Unlike traditional finance, where regulations and insurance provide some safety nets, DeFi leaves much more responsibility in your hands. Protocol failures can result from smart contract bugs, governance exploits, or market collapses, and history has shown that losses can be swift and severe. According to the Enterprise Ethereum Alliance’s DeFi Risk Assessment Guidelines, understanding these vulnerabilities is step one for any serious investor.

Dissecting the Protocol: What Are You Really Investing In?

The first move is always research. Don’t just skim the website or whitepaper, dig into the protocol’s mechanics, its value proposition, and how it handles user funds. Ask yourself: How does this protocol generate yield? What assets does it interact with? Are there any single points of failure? A clear grasp of these basics helps you spot red flags early.

Pro tip: Platforms like CoinMarketCap’s Academy offer breakdowns on managing DeFi risks that can help structure your due diligence process. For a deeper dive into risk factors, check out their guide here.

Smart Contract Security: The Heartbeat (and Achilles Heel) of DeFi

No matter how slick the UI or impressive the APY, if the smart contracts aren’t secure, your funds are at risk. Here’s what to look for:

Essential Smart Contract Vulnerabilities to Watch For

-

Reentrancy Attacks: This occurs when a smart contract repeatedly calls an external contract before updating its own state, potentially allowing malicious actors to drain funds. Notorious example: The 2016 DAO hack on Ethereum.

-

Logic Errors and Flawed Business Logic: Mistakes in contract logic can lead to unintended behaviors or financial loss. Example: The bZx protocol suffered multiple exploits due to logic flaws in its lending contracts.

-

Unchecked External Calls: When contracts interact with external addresses or contracts without proper validation, they can be exploited. Example: The Harvest Finance attack in 2020 exploited such vulnerabilities to manipulate prices and drain funds.

-

Oracle Manipulation: DeFi protocols often rely on oracles for price data. If these oracles are manipulated, attackers can profit by exploiting inaccurate prices. Example: The Synthetix oracle incident in 2019 led to millions in losses.

-

Access Control Issues: Poorly implemented permissions can allow unauthorized users to perform admin actions, such as pausing contracts or moving funds. Example: The Akropolis protocol was exploited in 2020 due to weak access controls.

-

Integer Overflow and Underflow: Errors in handling numeric values can cause contracts to behave unpredictably. Example: Early versions of ERC-20 tokens were vulnerable to these issues before the introduction of SafeMath libraries.

-

Front-Running and MEV (Miner Extractable Value): Attackers can manipulate transaction ordering for profit, especially in protocols with time-sensitive operations. Example: Sandwich attacks on Uniswap and other AMMs.

-

Flash Loan Exploits: Flash loans allow users to borrow assets without collateral, which can be abused to manipulate markets or exploit contract vulnerabilities. Example: The 2020 dYdX and bZx flash loan attacks.

Has the code been audited by reputable security firms? Is the audit recent and publicly available? Even better: Has the protocol survived real-world stress tests or attempted exploits? Historical transparency around bugs and fixes is a positive sign.

Governance and Centralization: Who Holds the Keys?

A protocol may call itself decentralized, but who really controls it? Assessing governance structures is crucial for understanding both operational resilience and potential admin abuse. Look for protocols that use multi-signature wallets, timelocks on upgrades, and have a diverse set of token holders actively involved in decision-making.

- Admin keys: If a single team or individual can unilaterally upgrade contracts or pause withdrawals, that’s a huge red flag.

- Diversity: Check on-chain voting records. Are whales dominating every proposal?

- Transparency: Are governance decisions documented and discussed openly with the community?

The Role of Market and Financial Risks

No risk assessment is complete without looking at liquidity levels (TVL), trading volumes, collateral quality, and exposure to volatile assets. Lower liquidity often means higher slippage, and higher vulnerability during market shocks. Always ask: How would this protocol weather a sudden downturn?

It’s also worth noting that protocols with robust risk management mechanisms, like circuit breakers, dynamic collateral ratios, and insurance funds, tend to fare better during black swan events. Tools such as the DeFi Score can help you compare risk across protocols by aggregating factors like code audits, liquidity, and governance into a single, digestible metric. For a practical look at these tools in action, see Streamflow’s overview of DeFi risk management.

Frameworks and Checklists: Structure Your Crypto Investment Due Diligence

Don’t rely on gut instinct. Instead, use recognized frameworks to systematize your DeFi project risk assessment. The EEA DeFi Risk Assessment Guidelines offer a comprehensive checklist to walk through technical, financial, operational, and governance risks. Moody’s and Veritas Protocol also provide frameworks for protocol comparison, helpful if you’re weighing multiple investment options.

Remember: No checklist is perfect or exhaustive. Use these tools as a baseline but supplement them with your own research and ongoing monitoring.

Diversification and Hedging: Protecting Your Portfolio from Protocol Failure

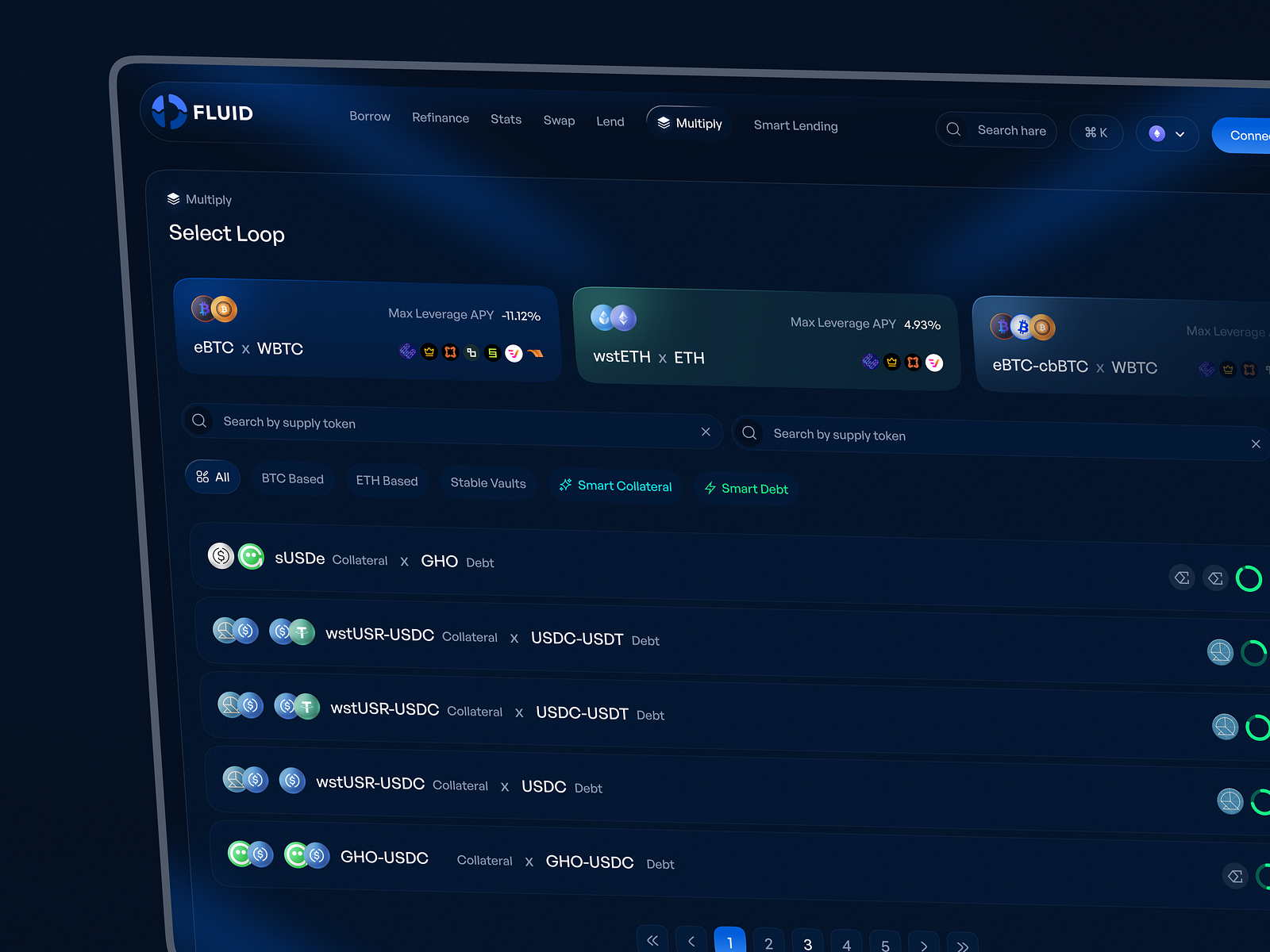

Even the most diligent analysis can’t eliminate all risk. That’s why diversification is so critical. By spreading your assets across different protocols and asset types, you reduce the likelihood that a single failure wipes out your portfolio. Consider allocating capital between lending platforms, decentralized exchanges (DEXs), stablecoins (with careful attention to depeg risks), and yield aggregators.

For an extra layer of security, explore decentralized insurance solutions like Nexus Mutual or InsurAce. These platforms offer coverage against smart contract exploits and other protocol-specific failures, an emerging toolset that’s gaining traction among both retail users and institutions. For more insights on how insurance fits into the DeFi landscape, check out this guide from Hyperliquid: Defi Protocol Risks Guide.

Staying Ahead of Emerging Risks: Continuous Monitoring and Community Intelligence

The only constant in DeFi is change. New vulnerabilities emerge as protocols evolve or as market conditions shift. Staying plugged into community forums, Discord servers, Twitter threads, and real-time analytics dashboards can give you an early warning system for emerging threats.

Top Real-Time DeFi Risk Alert & Community Platforms

-

DeFi Safety Alerts (DeFiSafety.com): This platform provides real-time risk ratings and incident alerts for DeFi protocols, including detailed audit reviews and transparency scores. Their dashboard helps users track protocol safety and recent vulnerabilities.

-

RugDoc: Known for its live alerts on potential rug pulls and scams in DeFi, RugDoc offers a community-driven platform where users can report suspicious projects and review risk assessments before investing.

-

DefiLlama Exploits & Hacks Tracker: DefiLlama’s dedicated section tracks recent DeFi exploits, hacks, and protocol failures in real time, helping investors stay updated on emerging threats.

-

Crypto Twitter (#DeFi, #DeFiRisk, #RugPull): The DeFi community on Twitter is highly active in sharing real-time alerts, discussions, and post-mortems of protocol incidents. Following these hashtags connects you to breaking news and expert insights.

-

Reddit r/defi: This subreddit is a hub for DeFi news, risk alerts, and in-depth community discussion. Members frequently post about ongoing exploits, suspicious activity, and safety best practices.

-

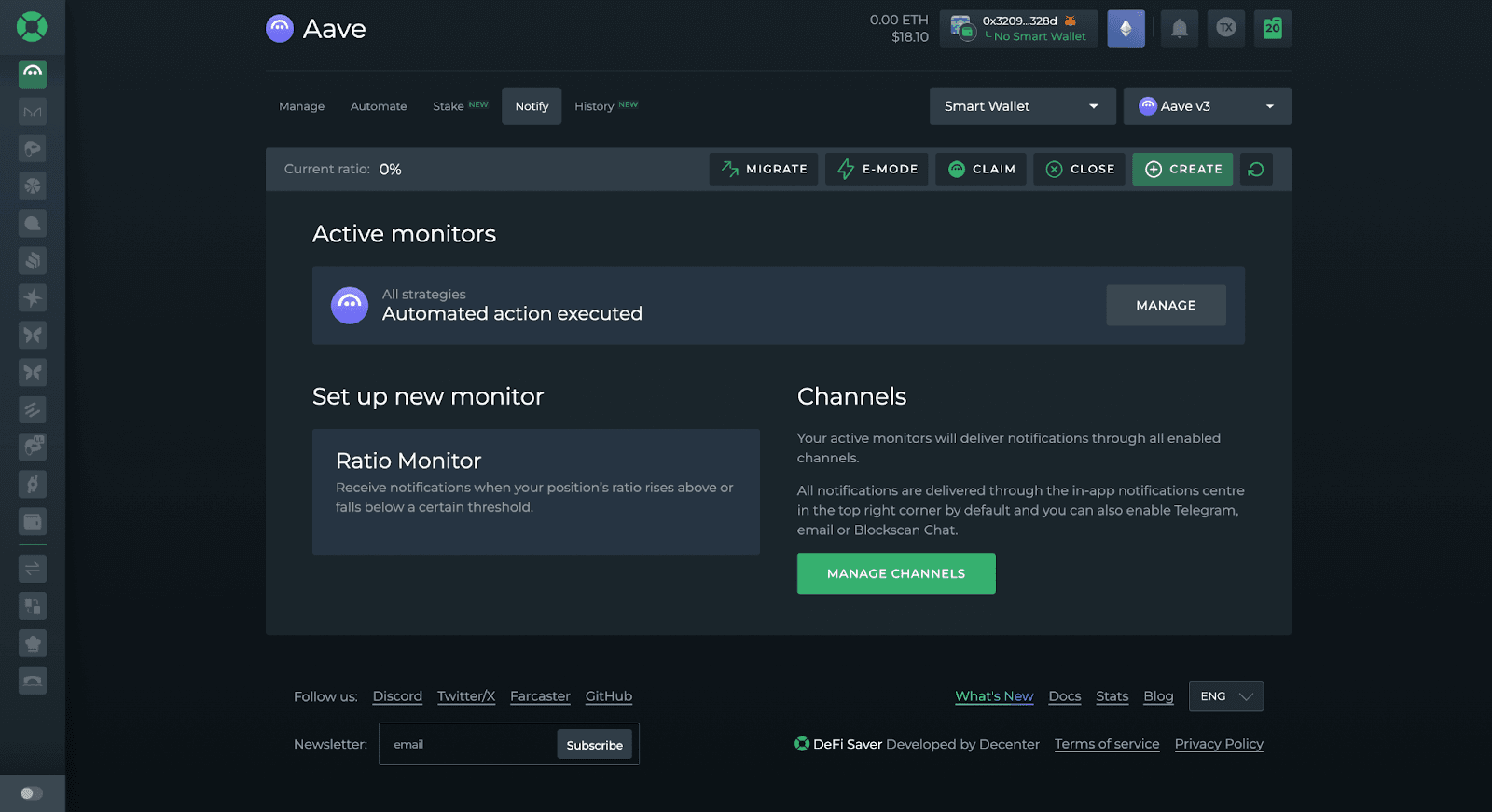

Discord & Telegram Project Channels: Many major DeFi protocols (like Aave, Uniswap, and Curve) maintain official Discord and Telegram groups where team members and users share real-time updates, bug reports, and risk alerts.

-

BlockSec Alert: BlockSec offers a real-time DeFi security monitoring service that detects and broadcasts protocol attacks, suspicious transactions, and contract exploits as they happen.

If you’re not already tracking metrics like TVL fluctuations or governance proposal activity on your favorite protocols, now’s the time to start. Many major incidents are preceded by unusual on-chain activity or heated debates in governance forums.

The bottom line? Assessing protocol failure risk isn’t just about checking boxes before you invest, it’s an ongoing process that rewards curiosity and vigilance. By combining structured frameworks with active engagement in the community and smart hedging strategies, you’ll be much better positioned to navigate the fast-moving world of decentralized finance with confidence.