Retail investors have become a driving force in decentralized finance (DeFi), but with opportunity comes risk. Protocol exploits and smart contract failures have resulted in billions of dollars in losses, making robust asset protection more critical than ever. To help safeguard your crypto portfolio, here are the five most effective and actionable best practices for retail investors to defend against DeFi protocol exploits, based on the latest security research and market realities.

1. Prioritize Protocols with Regular, Independent Smart Contract Audits

The foundation of any secure DeFi investment is a protocol whose smart contracts undergo frequent, independent audits by reputable firms. Audits are not a guarantee against all vulnerabilities, but they dramatically reduce the risk of critical bugs and backdoors. When evaluating a protocol, look for publicly available audit reports and check whether the audits are up to date. Avoid platforms that rely solely on internal reviews or lack transparency about their security assessments.

Resources such as blockspy. org provide valuable insight into recent vulnerabilities and which protocols have demonstrated a strong commitment to ongoing security.

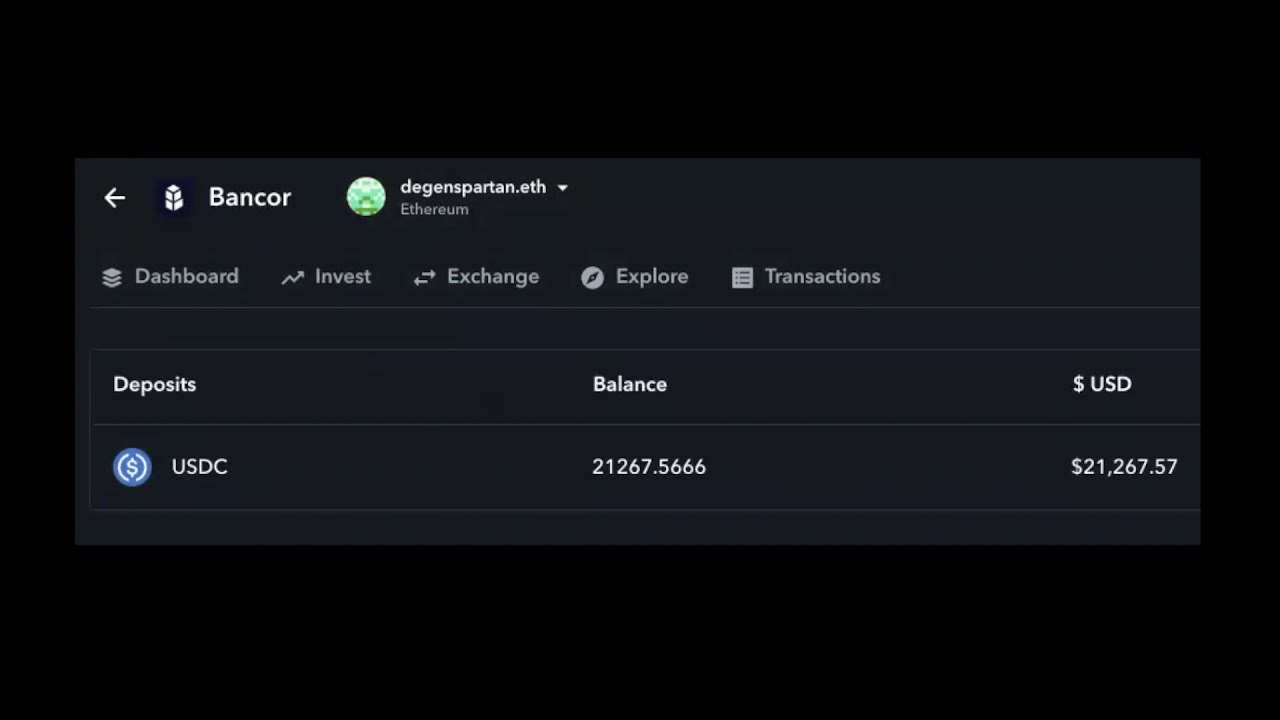

2. Utilize Non-Custodial Wallets with Multi-Signature or Hardware Security

Your wallet is your first line of defense against unauthorized access and theft. Opt for non-custodial wallets where you control your private keys, rather than relying on third-party custodians. Enhance this protection by choosing wallets that support multi-signature (multi-sig) authorization or hardware-based security (such as Ledger or Trezor devices). Multi-sig wallets require multiple approvals before any transaction can be executed, significantly lowering the risk of a single point of failure due to phishing or malware attacks.

For additional guidance on wallet security best practices, review the recommendations at 1950. ai.

3. Diversify Across Multiple Protocols and Stablecoins to Minimize Single-Point Risk

No matter how secure a protocol appears, concentration risk remains one of the biggest threats to retail investor portfolios. By diversifying your assets across multiple DeFi protocols and stablecoins, you reduce your exposure to any single exploit or depeg event. This strategy is especially important given that even well-audited projects can suffer from previously unknown attack vectors or governance issues.

Top Diversification Strategies for DeFi Investors

-

Prioritize Protocols with Regular, Independent Smart Contract Audits: Choose DeFi platforms that undergo frequent audits by reputable firms like ConsenSys Diligence or Trail of Bits. Verified audits help identify vulnerabilities and reduce exploit risks.

-

Utilize Non-Custodial Wallets with Multi-Signature or Hardware Security: Store your assets in wallets such as MetaMask (with hardware wallet integration) or Gnosis Safe for multi-signature protection. Hardware wallets like Ledger and Trezor offer robust offline security.

-

Stay Informed About Protocol Updates, Governance Proposals, and Security Incidents: Follow official channels on Twitter, Discord, and forums like Uniswap Governance to keep up with the latest changes and potential risks.

-

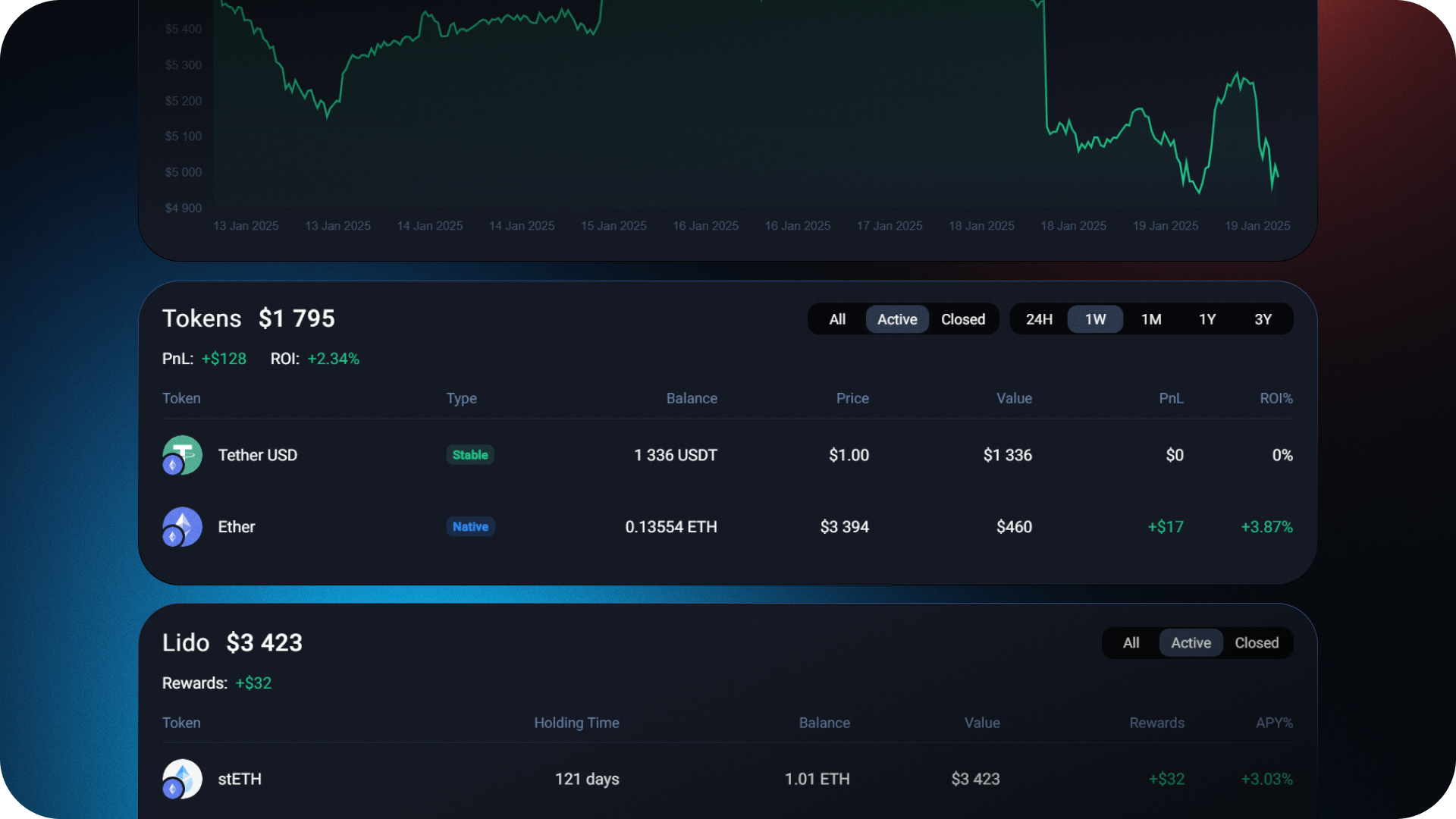

Employ On-Chain Monitoring Tools and Set Up Real-Time Alerts for Suspicious Activity: Use platforms like Zapper, Zerion, and DeFiSafety to track your portfolio and receive instant notifications about unusual transactions or protocol issues.

A balanced approach might include allocating funds among lending protocols, decentralized exchanges (DEXes), yield aggregators, and different stablecoins with independent collateral models. This way, if one platform suffers an exploit or faces insolvency due to market volatility, only a portion of your holdings is at risk rather than your entire portfolio.

4. Stay Informed About Protocol Updates, Governance Proposals, and Security Incidents

The DeFi ecosystem moves quickly – what was secure yesterday may be vulnerable today following an upgrade or governance change. Make it a habit to monitor official protocol channels (Discords, forums, Twitter accounts) for news about upcoming code changes or reported security incidents. Participate in community governance when possible; voting on proposals gives you direct influence over protocol parameters that may impact risk levels.

Proactive information gathering is essential for timely decision-making in fast-moving markets. For example, sudden changes in collateralization ratios or emergency pauses can signal increased risk exposure that warrants immediate action.

To streamline your monitoring, consider subscribing to protocol newsletters or setting up keyword alerts for the projects you’re invested in. Many exploits and vulnerabilities are first reported in community channels long before they hit mainstream crypto media. Staying connected means you’ll be among the first to know if action is required, whether it’s withdrawing funds during a contract upgrade or voting on a proposal that could impact protocol security.

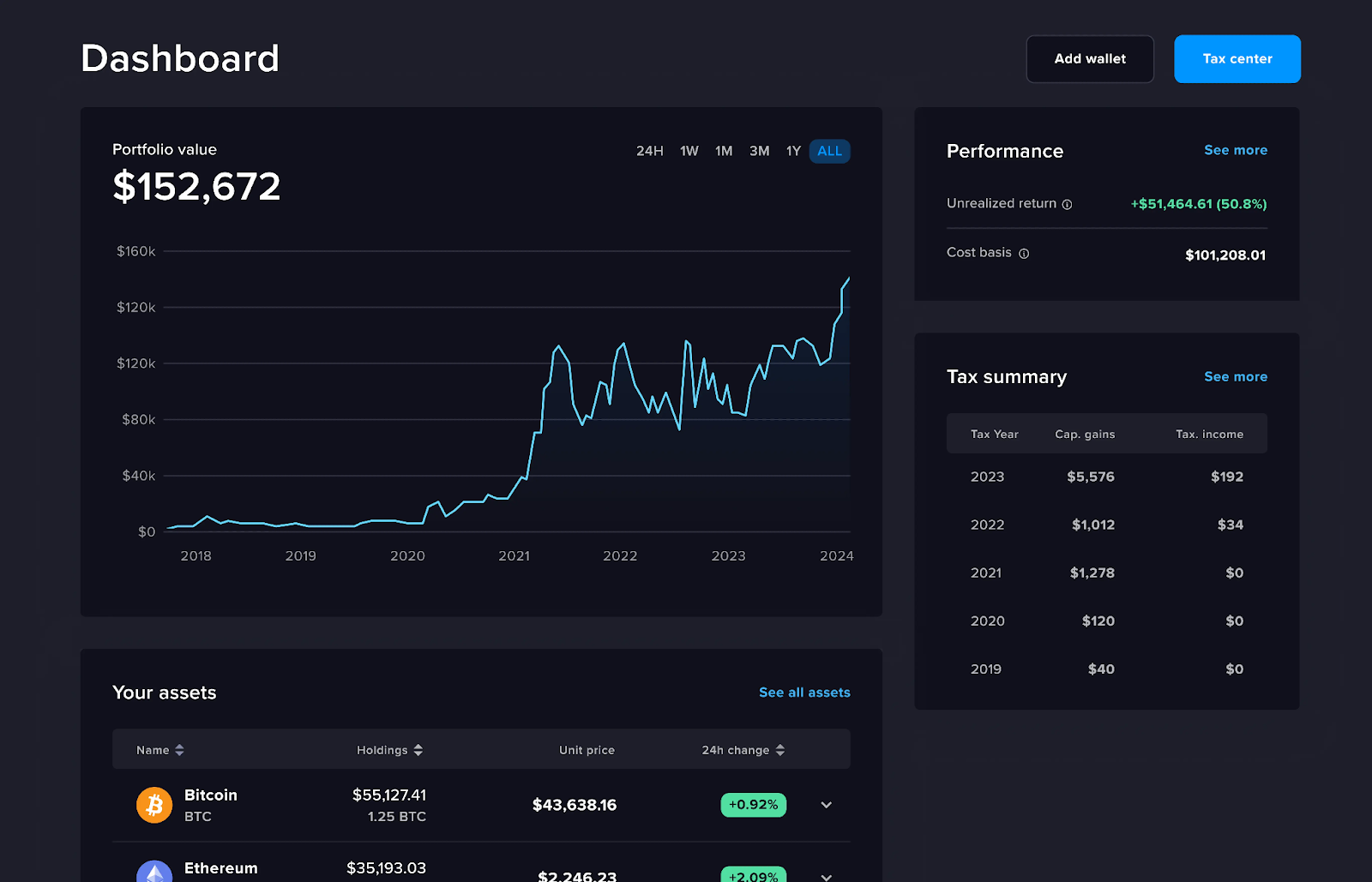

5. Employ On-Chain Monitoring Tools and Set Up Real-Time Alerts for Suspicious Activity

Even with diligent research and diversified holdings, risks remain ever-present in DeFi. That’s why leveraging on-chain monitoring tools is a non-negotiable best practice for retail investor risk protection. Platforms like Zapper, DeFi Pulse, and Zerion allow you to track your positions across multiple protocols in real time, helping you quickly spot irregularities such as unexpected balance changes or paused contracts.

Take it a step further by setting up custom alerts for suspicious activity, such as large outflows from a protocol’s treasury or sudden drops in total value locked (TVL). These can serve as early warning signals that something is amiss. By acting swiftly on these alerts, investors can often exit or hedge positions before losses compound.

Top DeFi Monitoring Tools and Their Core Features

-

Zapper: Portfolio management and real-time DeFi monitoring. Zapper lets users track assets across multiple DeFi protocols, visualize portfolio performance, and receive transaction notifications. Supports integration with major wallets and protocols.

-

DeBank: Comprehensive DeFi portfolio tracker with security insights. DeBank aggregates user balances, transaction histories, and risk metrics across hundreds of DeFi protocols. Features include wallet health checks, protocol risk scores, and real-time alerts.

-

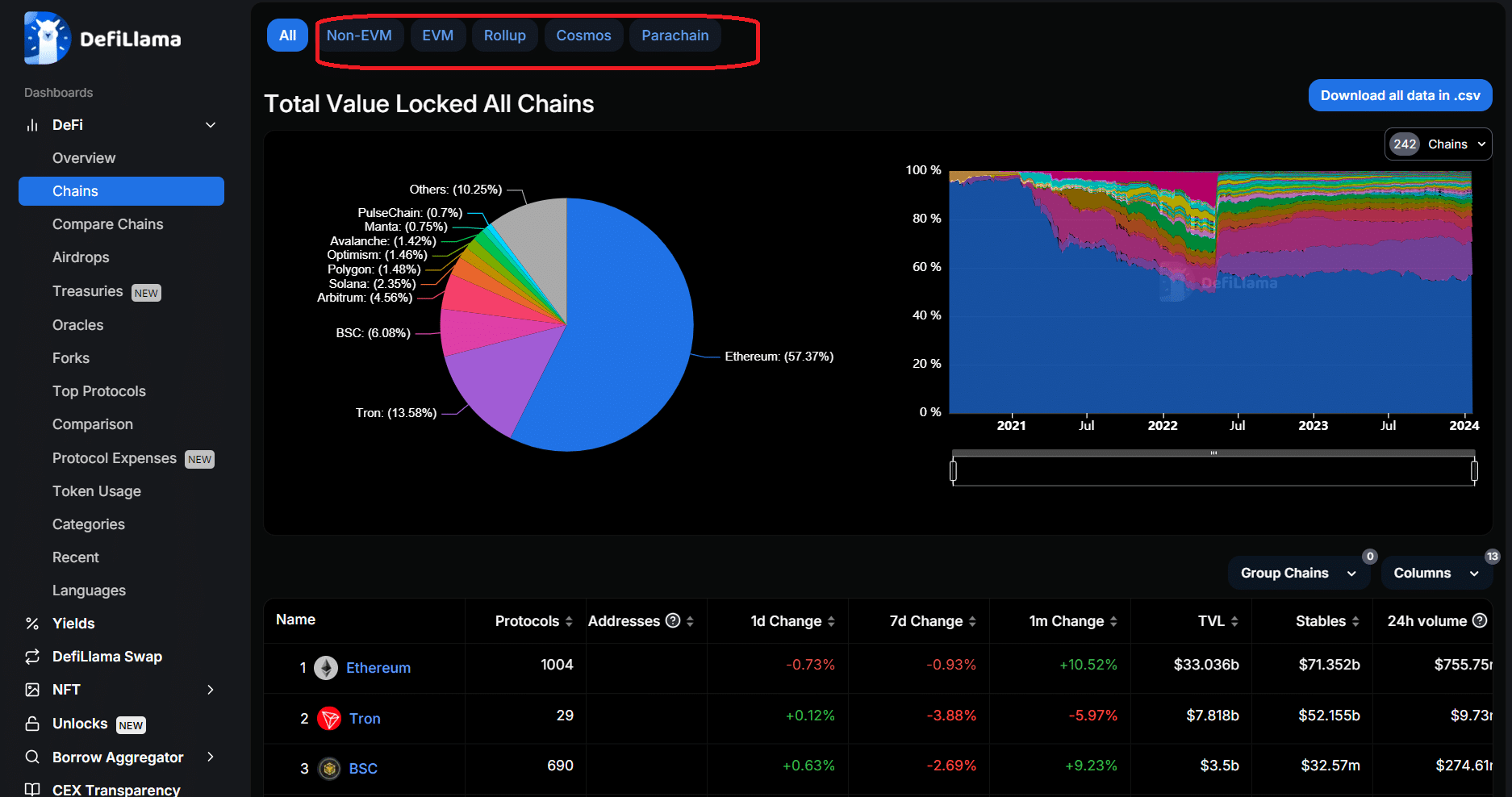

DefiLlama: Protocol analytics and exploit monitoring. DefiLlama provides up-to-date analytics on total value locked (TVL), protocol security incidents, and exploit tracking across major blockchains. Users can monitor protocol health and historical security events.

-

Forta: On-chain threat detection and real-time alerts. Forta offers decentralized monitoring of smart contracts, detecting suspicious activity, exploits, and vulnerabilities. Users can subscribe to alerts for specific protocols or wallets.

-

Hal (by 1inch): Customizable on-chain monitoring and automation. Hal enables users to set up personalized alerts for DeFi events, such as large transfers, governance proposals, or unusual contract activity, helping investors react quickly to potential threats.

If you’re new to on-chain analytics, start with user-friendly dashboards that aggregate wallet balances and protocol exposures into one view. As your experience grows, explore advanced platforms offering automated risk scoring and anomaly detection tailored to DeFi assets.

Building Your Personal Security Stack

Combining these five best practices creates a robust defense-in-depth approach against DeFi protocol exploits:

- Regular audits ensure code quality and transparency.

- Non-custodial wallets with multi-sig or hardware integration reduce theft and phishing risks.

- Diversification limits potential losses from any single failure or depeg event.

- Staying informed allows for rapid response to evolving threats and governance shifts.

- On-chain monitoring provides real-time visibility into your portfolio’s health and emerging risks.

The reality is that no single measure offers complete protection, security is an ongoing process of vigilance, adaptation, and learning from both successes and failures across the ecosystem. Retail investors who implement these strategies are far better positioned not only to avoid catastrophic loss but also to build lasting confidence as active participants in decentralized finance.

If you want more actionable guidance on crypto security best practices or wish to see real-time analytics on protocol exploits, visit our resources at DepegWatch. com. Stay alert, stay diversified, and empower yourself with the tools needed to thrive safely in this dynamic market environment.