In the ever-evolving world of decentralized finance (DeFi), oracles play a silent but critical role in keeping the ecosystem running smoothly. They are the invisible bridges that connect blockchains to real-world data, enabling smart contracts to react to market movements, asset prices, and even off-chain events. But when it comes to stablecoins, assets designed to maintain a 1: 1 peg with currencies like the US Dollar, the accuracy and reliability of oracles become a matter of survival.

Why Oracles Matter for Stablecoin Stability

Stablecoins depend on precise, real-time price feeds to maintain their pegs. For example, Multichain Bridged USDC (Fantom) is currently trading at $0.0488, well below its intended $1 value, a glaring instance where oracle mechanisms and broader protocol risks may be at play. Oracles like Chainlink, which reportedly secure over $51 billion in DeFi assets (source), provide the pricing backbone for these systems.

Their main jobs include:

- Peg Maintenance: Feeding live exchange rates so stablecoins can adjust reserves or trigger interventions if the price drifts from $1.

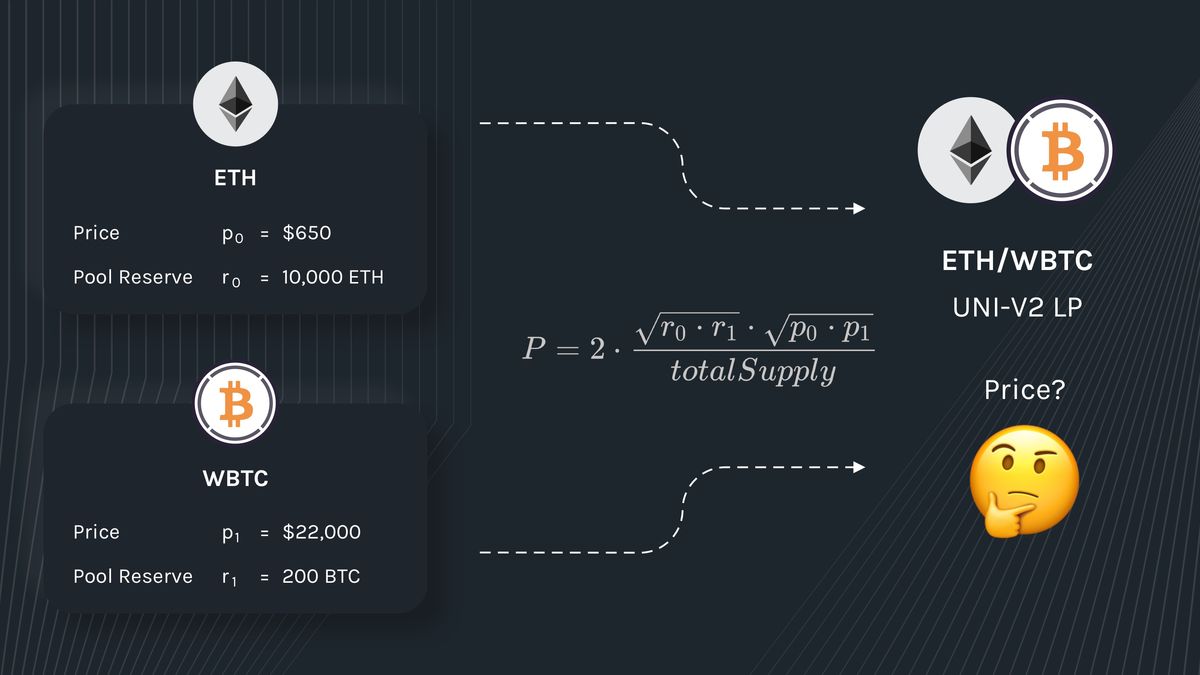

- Collateral Valuation: Assessing if there’s enough crypto backing each stablecoin issued, crucial for protocols like DAI (source).

- Liquidation Triggers: Automatically selling collateral if its value falls too low, preventing undercollateralization and potential depegs.

This oracle-driven automation is what allows DeFi money markets and stablecoins to operate at scale without human intervention, but it’s also what makes them uniquely vulnerable.

The Oracle Problem: A Critical Risk Vector in DeFi

The so-called “oracle problem” refers to the challenge of importing trustworthy data into blockchain environments that are otherwise isolated from the outside world (source). When an oracle fails, whether through technical glitches, manipulation, or delayed updates, the consequences can be swift and severe.

Oracle manipulation attacks, where bad actors exploit weaknesses in how data is sourced or aggregated, have led to millions in losses across lending protocols and stablecoin issuers (source). These attacks often result in false liquidation events or sudden depegs, as seen today with Multichain Bridged USDC (Fantom) remaining stubbornly at $0.0488.

The risks include:

- Single Point of Failure: Relying on just one oracle provider concentrates risk; if that service fails or is compromised, entire protocols can collapse (source).

- Stale Data and Latency: Even brief delays in updating prices can cause cascading liquidations or missed arbitrage opportunities.

- Poor Data Aggregation: Using unreliable sources or insufficient redundancy increases vulnerability to price spoofing attacks.

Multichain Bridged USDC (Fantom) (USDC.e) Price Prediction 2026-2031

Professional outlook based on oracle upgrades, stablecoin recovery scenarios, and evolving DeFi infrastructure

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg. YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.041 | $0.062 | $0.125 | +27% | Gradual recovery if robust oracle upgrades are adopted; lingering distrust keeps prices below $0.20 |

| 2027 | $0.050 | $0.087 | $0.195 | +40% | Decentralized oracles gain traction; improved peg stability; partial re-pegging possible |

| 2028 | $0.065 | $0.120 | $0.280 | +38% | Major DeFi platforms reintegrate USDC.e; regulatory clarity boosts confidence |

| 2029 | $0.078 | $0.160 | $0.390 | +33% | Full multi-oracle adoption; possible relisting on centralized exchanges; increased institutional use |

| 2030 | $0.090 | $0.205 | $0.520 | +28% | If re-pegging mechanisms succeed, price approaches $1; otherwise, remains a discounted asset |

| 2031 | $0.100 | $0.270 | $0.680 | +32% | Best-case: asset regains dollar parity; Worst-case: remains a speculative DeFi token |

Price Prediction Summary

Multichain Bridged USDC (Fantom) (USDC.e) faces a challenging recovery path, highly dependent on the successful implementation of advanced, decentralized oracle solutions and broader DeFi ecosystem trust restoration. While significant upside exists if re-pegging is achieved, risks of persistent discount and volatility remain if oracle and governance issues are not fully resolved.

Key Factors Affecting Multichain Bridged USDC (Fantom) Price

- Adoption of decentralized, multi-oracle systems reducing manipulation risk

- Successful technical upgrades improving reliability of price feeds

- DeFi protocol reintegration and support for USDC.e

- Regulatory developments impacting stablecoin and cross-chain assets

- Market sentiment regarding stablecoin security and past depeg events

- Competition from natively-issued stablecoins and new bridging solutions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Evolving Strategies for Oracle Risk Mitigation in Stablecoins

The industry isn’t standing still. As both institutional and retail investors demand more robust protections against depegs and protocol failures, several mitigation strategies are gaining traction:

Key Strategies to Reduce Oracle Risk in DeFi Stablecoins

-

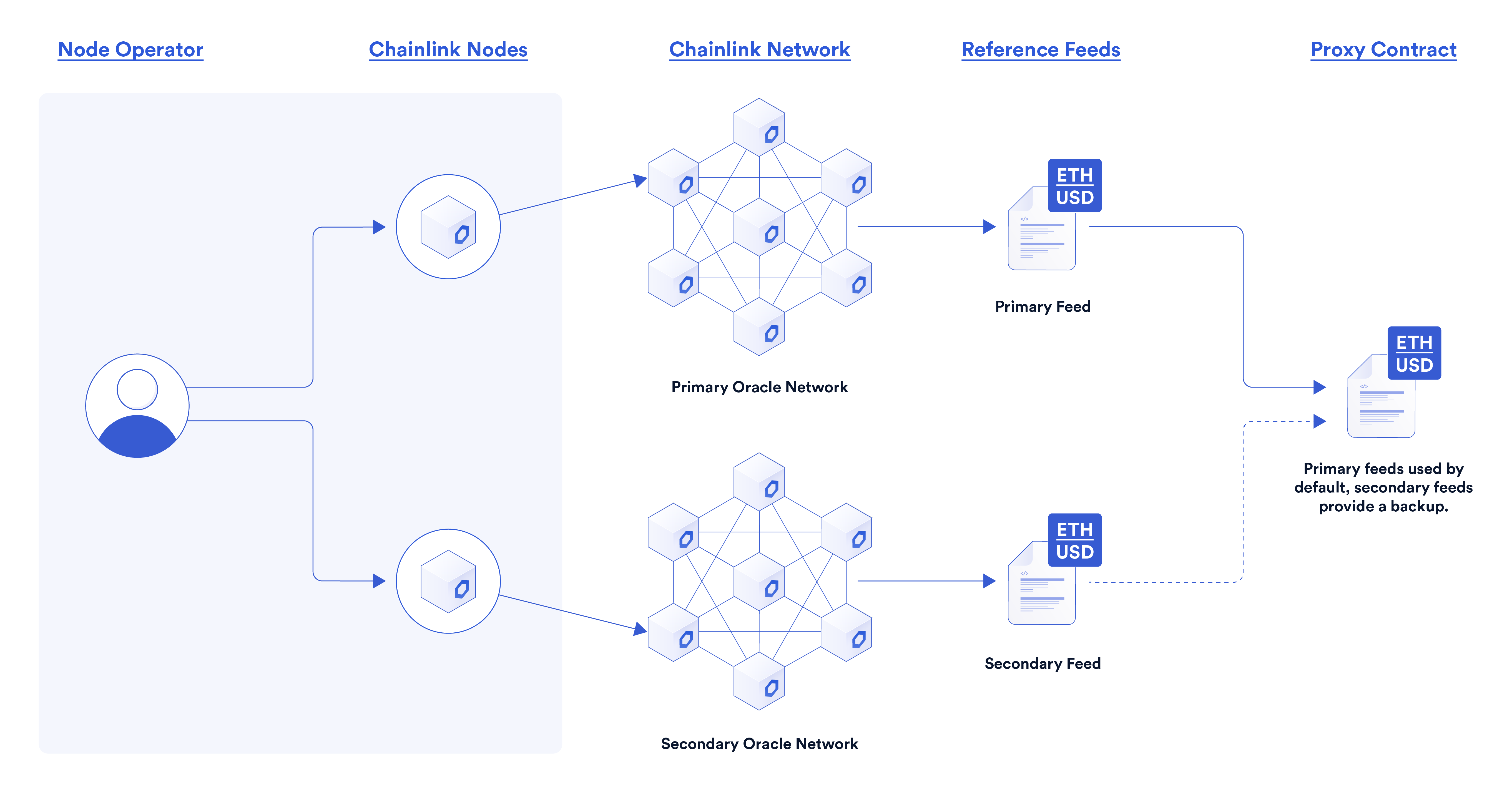

Leverage Decentralized Oracle Networks (e.g., Chainlink, Pyth Network): Using multiple independent data sources and node operators reduces the risk of manipulation and single points of failure, increasing resilience for stablecoins.

-

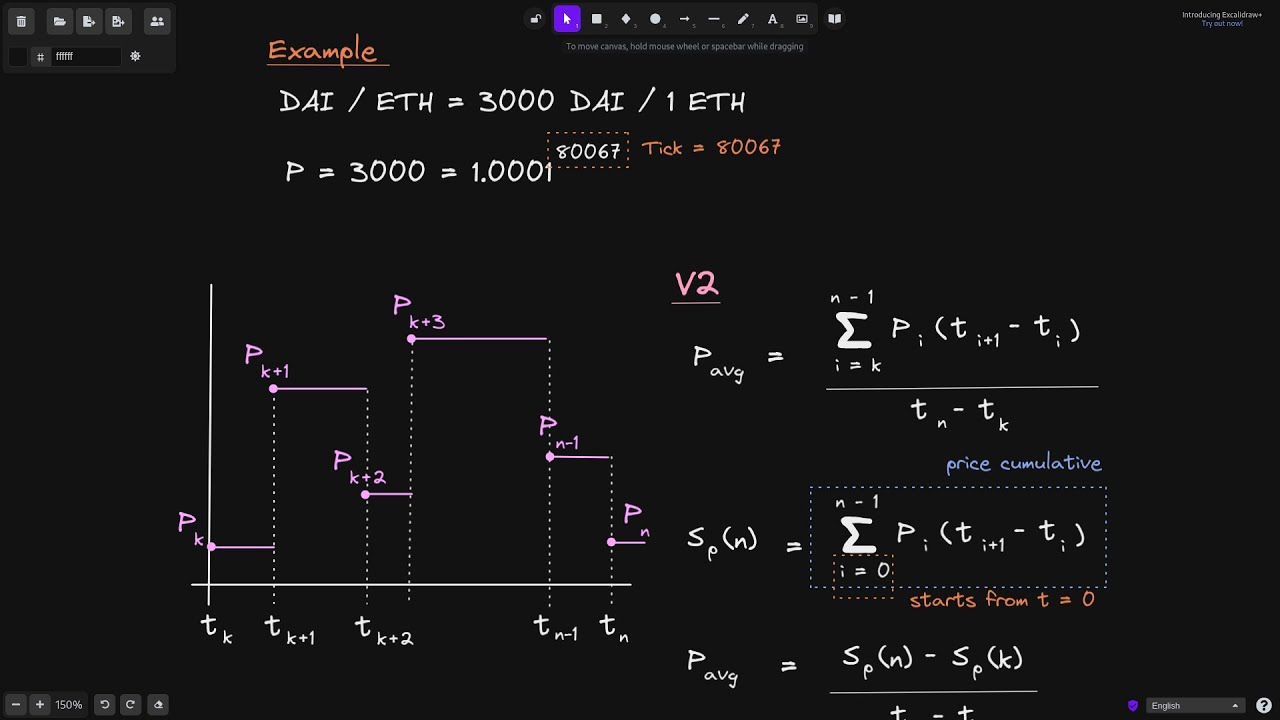

Implement Time-Weighted Average Price (TWAP) Feeds: TWAPs from decentralized exchanges like Uniswap or SushiSwap help smooth out short-term price volatility, providing more reliable and manipulation-resistant price data for stablecoin protocols.

-

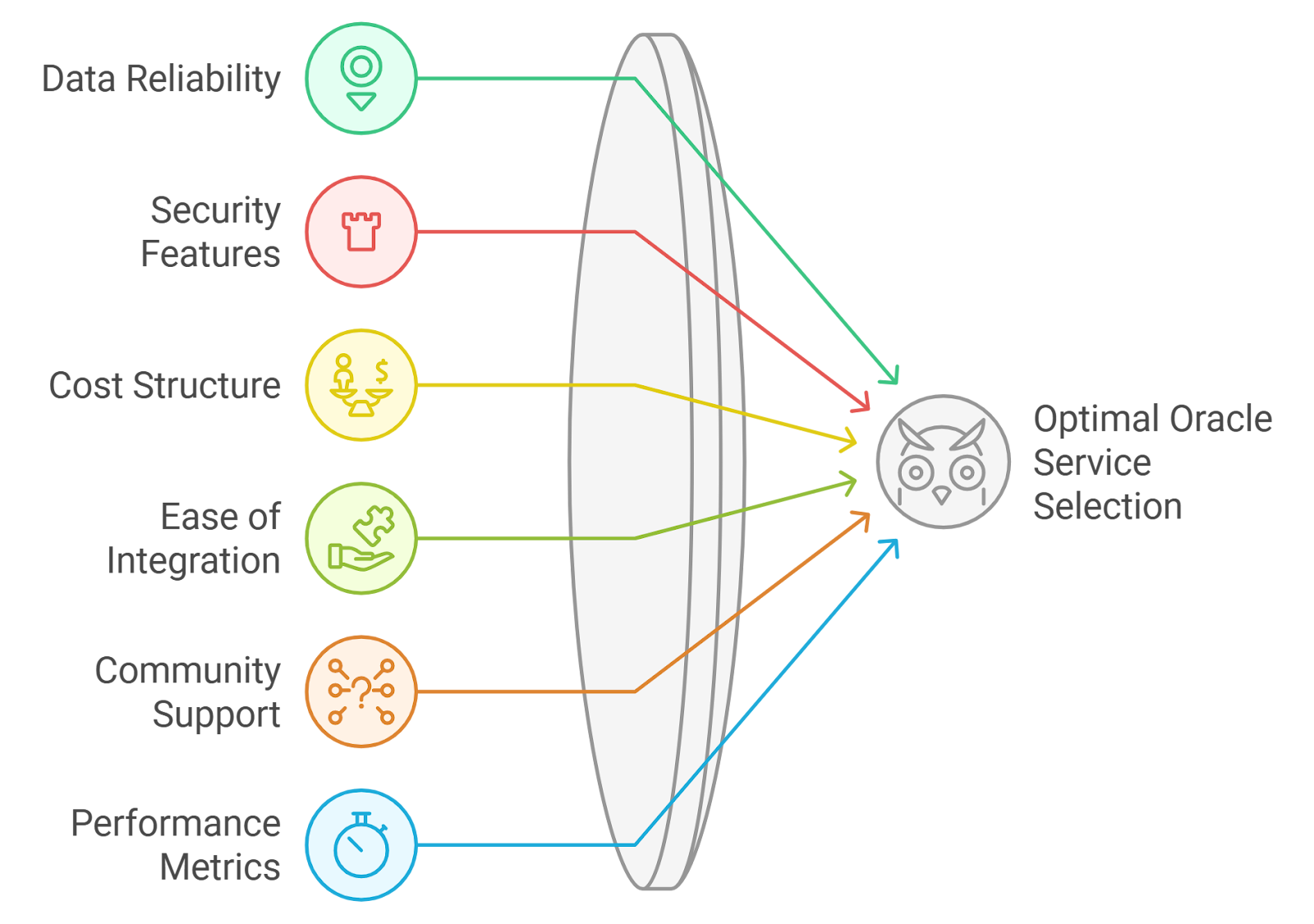

Adopt Multi-Oracle Configurations with Fallback Mechanisms: Combining several oracles (such as Chainlink, Pyth, and RedStone) with automated fallback logic ensures continuous and accurate data, even if one provider fails or is compromised.

-

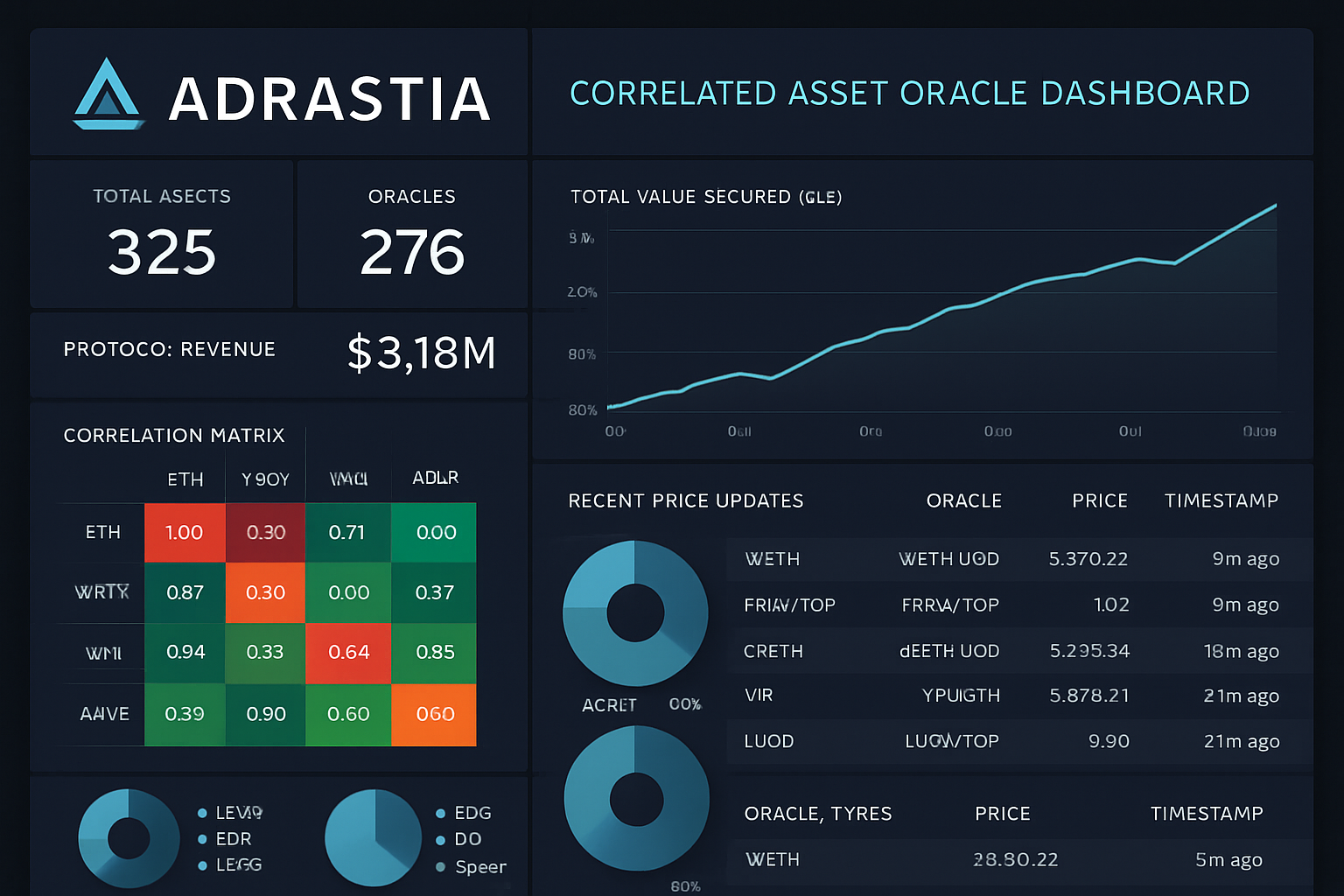

Use Correlated Asset Oracles for Stablecoins: Oracles like Adrastia’s Correlated Asset Oracle require price deviations to persist before updating, helping prevent premature liquidations from temporary depegs.

-

Regularly Audit and Monitor Oracle Performance: Frequent security audits and real-time monitoring of oracle feeds (using platforms like OpenZeppelin Defender) can detect anomalies early and mitigate potential attacks or failures.

A few leading approaches include:

- Decentralized Oracles: Aggregating data from multiple independent sources reduces single-provider risk.

- Time-Weighted Average Prices (TWAP): Smoothing out price volatility by averaging over intervals minimizes flash loan exploits.

- Multi-Oracle Fallbacks: Configuring protocols to switch providers automatically if one fails ensures continuity during outages.

- Correlated Asset Oracles: For pegged assets like stablecoins, requiring persistent price deviations before action helps avoid knee-jerk liquidations during transient volatility (source).

The Stakes: Real Money, Real Risk at $0.0488 Per Token

The current state of Multichain Bridged USDC (Fantom): trading at just $0.0488, with a daily range between $0.0543 and $0.0484, shows how quickly trust can evaporate when oracle mechanisms break down. For anyone holding these tokens or building protocols on top of them, understanding, and actively managing provides oracle risk in stablecoins, as well as broader protocol vulnerabilities, isn’t optional; it’s essential for survival in DeFi’s high-stakes environment.

With billions at stake and user confidence on the line, the DeFi ecosystem is learning some hard lessons about the consequences of oracle failure in DeFi. The Multichain Bridged USDC (Fantom) incident isn’t an isolated event – it’s a wake-up call for anyone relying on algorithmic stability. The price collapse to $0.0488 serves as a stark reminder that even the most sophisticated protocols are only as strong as their weakest external input.

What does this mean for stablecoin users and protocol builders? First, it’s critical to recognize that oracle mitigation strategies must be proactive, not reactive. Once a depeg occurs, especially of this magnitude, damage control becomes exponentially harder. Protocols need to anticipate attack vectors and system failures before they happen.

Building Resilience: Best Practices for Oracle-Driven Protocols

If you’re managing risk in DeFi or designing new stablecoin systems, here are some actionable principles to guide your approach:

Practical Steps to Safeguard Against Oracle Risks

-

Integrate Multiple Decentralized Oracle Networks: Rely on established decentralized oracle providers like Chainlink, Band Protocol, or Pyth Network to aggregate data from diverse, independent sources, minimizing single points of failure and manipulation risk.

-

Adopt Multi-Oracle and Fallback Configurations: Configure protocols to pull data from several oracle sources and establish robust fallback logic—so if one source fails or is compromised, others can maintain accurate price feeds.

-

Utilize Correlated Asset Oracles for Stablecoins: For stablecoin protocols, leverage correlated asset oracles (such as those from Adrastia) that require sustained price deviations before updating, helping prevent premature liquidations during temporary depegs.

-

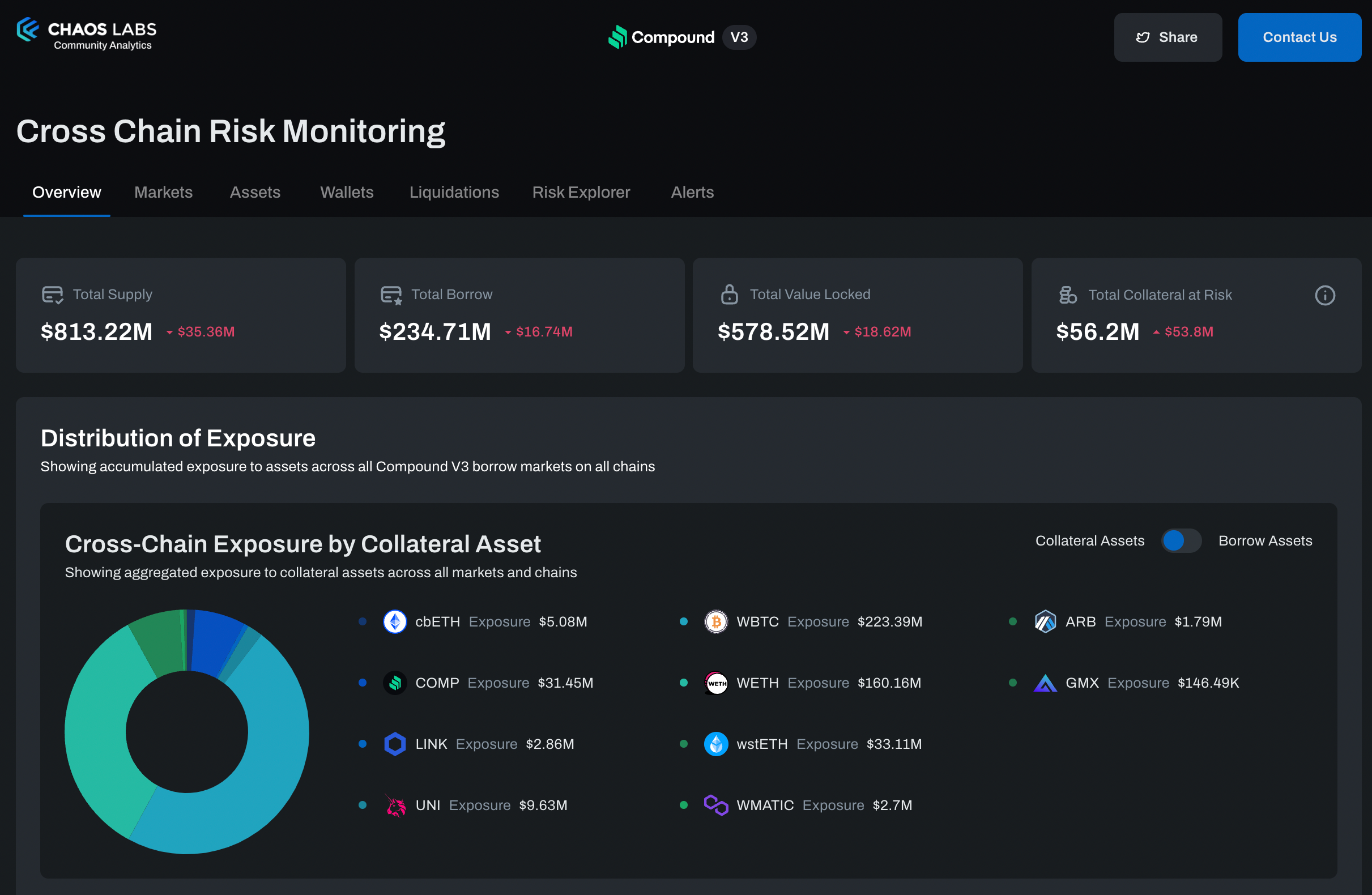

Continuously Monitor and Audit Oracle Performance: Employ monitoring tools like Chaos Labs or Halborn to track oracle accuracy, latency, and anomalies, and conduct regular security audits to identify and patch vulnerabilities.

- Diversify Data Sources: Rely on multiple independent data providers and cross-check prices to spot anomalies quickly.

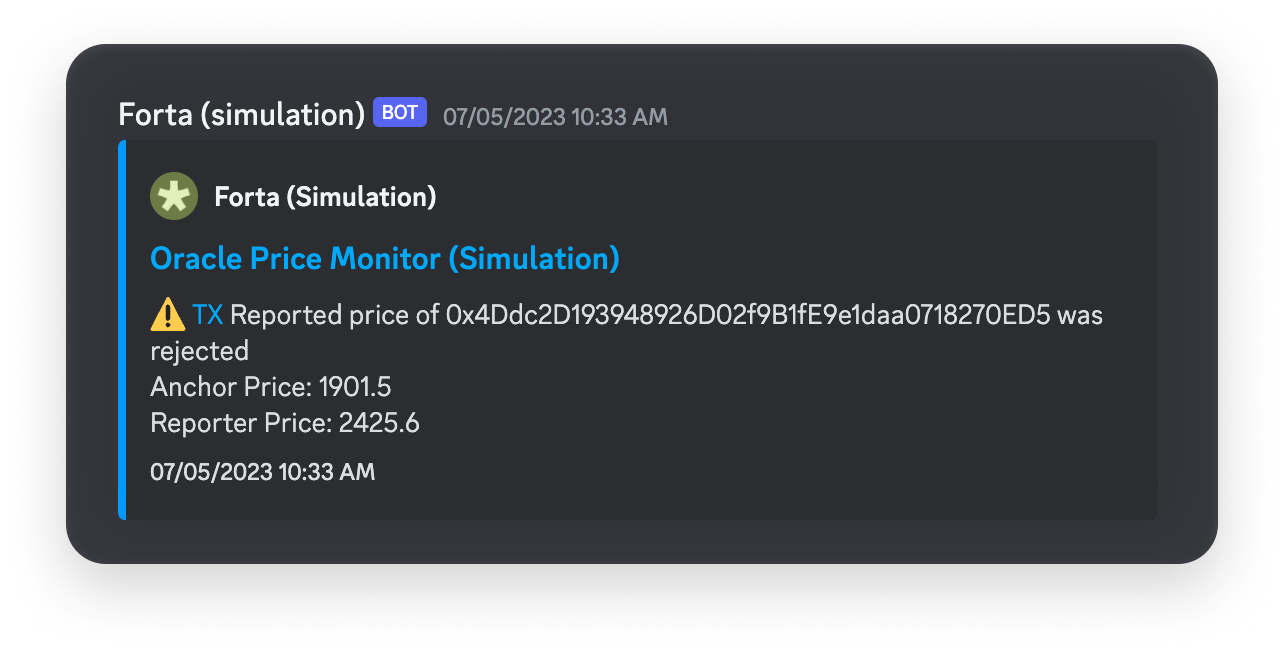

- Automate Monitoring: Use smart contract-based alert systems that flag suspicious deviations in real time.

- Stress-Test Oracle Configurations: Simulate edge cases and manipulation attempts regularly to find weak spots before attackers do.

- Pursue Community Audits: Open-source oracle logic and invite third-party reviews for greater transparency and collective security.

The reality is that there’s no one-size-fits-all solution. Each protocol must evaluate its own risk profile and tailor its oracle architecture accordingly. Some may prioritize speed, others redundancy; all should strive for a balance between decentralization and reliability.

Looking Forward: The Future of Oracles in DeFi

The next generation of oracles will likely feature more robust fallback mechanisms, improved incentives for honest reporting, and tighter integration with on-chain governance. We’re already seeing projects experiment with hybrid models that blend automated feeds with human oversight – an approach that could help bridge the gap between pure code and market intuition.

If you’re holding or using stablecoins today, pay close attention to how your assets’ pegs are maintained. Ask which oracles your protocol relies on, whether there are backup plans if one fails, and how quickly issues can be detected when things go wrong. As we’ve seen with Multichain Bridged USDC (Fantom) at $0.0488, vigilance is not just prudent – it’s necessary.