Within hours of its highly anticipated launch on October 10,2025, the STBL Protocol’s USST stablecoin depegged from its $1 target, plummeting to $0.96 before stabilizing near $0.9776. Despite institutional-grade backing with real-world assets (RWAs) like U. S. Treasuries and a partnership with Ondo Finance for up to $50 million in USDY collateral, USST’s swift depeg has rattled both retail and institutional DeFi participants. As of now, USST’s market cap stands at $967,000, with just 52 holders and $965,000 in Curve pool liquidity. The event is a stark reminder that even RWA-backed launches are vulnerable to market stress and design flaws.

USST’s Day-One Depeg: What Went Wrong?

USST entered the market with promises of transparency, yield-splitting, and robust RWA collateralization. Yet, within its first 24 hours, the protocol faced a liquidity crunch that saw net outflows of $466,000 from its Curve pool and a dramatic drop in its governance token (now at $0.17, down 18%). Analysts have pointed to insufficient launch liquidity and unclear redemption mechanisms as primary triggers for the peg break. This incident underscores the importance of rigorous risk controls during stablecoin launches, especially those leveraging RWAs as collateral.

Five Essential Lessons for DeFi Investors After the USST Depeg

Five Key Lessons from the USST Stablecoin Depeg

-

Prioritize Deep, Diverse Liquidity Pools at Launch: The USST depeg highlighted how insufficient liquidity can accelerate price instability. Investors should favor stablecoins with robust liquidity on major platforms like Curve Finance and Uniswap, ensuring smoother trading and reduced slippage during volatile periods.

-

Scrutinize RWA Collateral Transparency and Redemption Mechanisms: Real-world asset (RWA) backing is only as strong as its transparency and redemption process. Review on-chain proof of reserves (e.g., Chainlink Proof of Reserve) and clear redemption policies, as seen in protocols like Ondo Finance, to assess risk before investing.

-

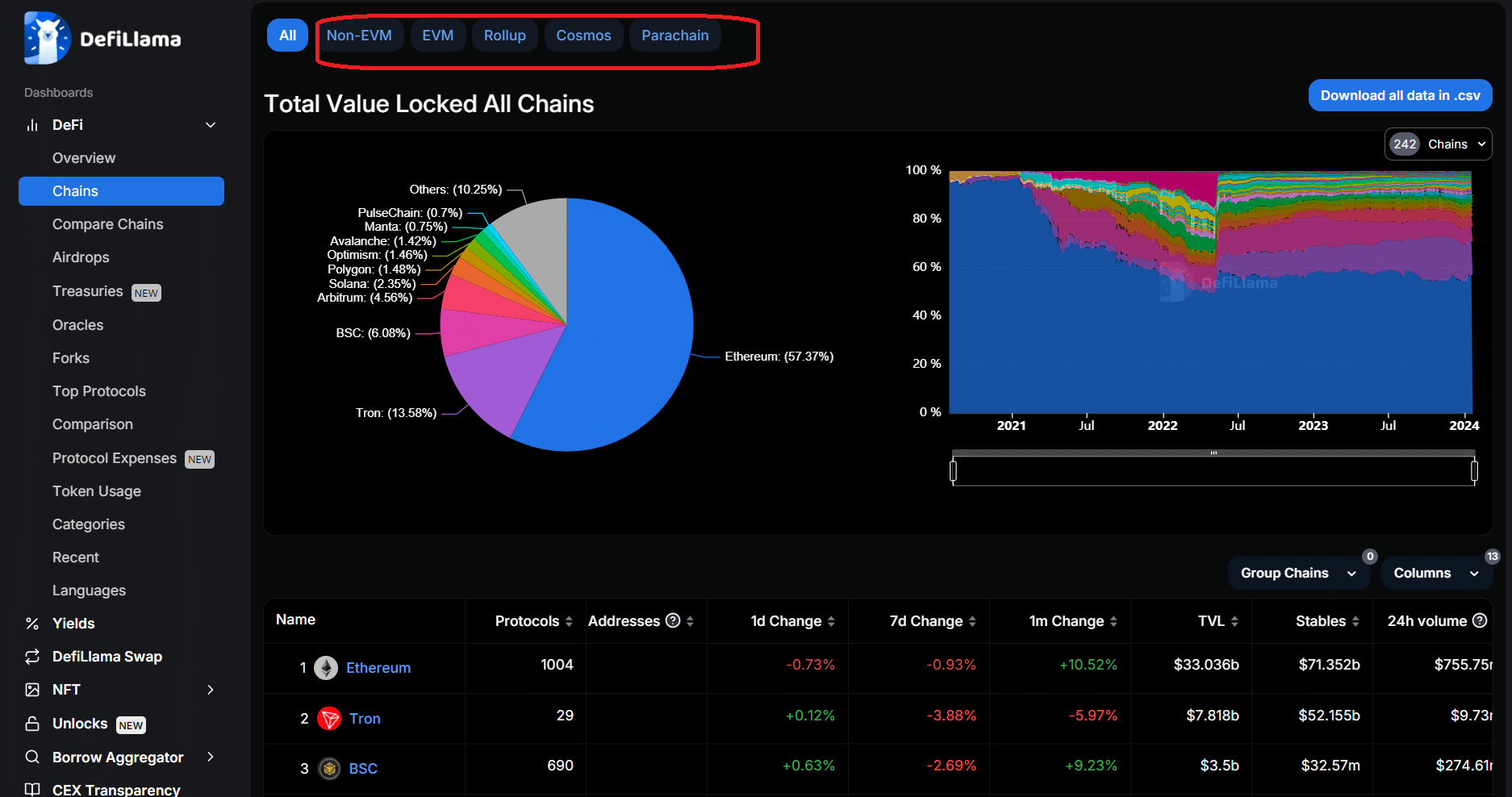

Implement Real-Time Depeg Monitoring and Automated Hedging Tools: Early detection of depegs is crucial. Use platforms like DeFiLlama Stablecoin Dashboard and automated risk tools (e.g., Chaos Labs) to monitor price stability and set up automated hedging or stop-loss strategies.

-

Assess Protocol Resilience to Sudden Market Shocks and Run Risk: Investigate how protocols handle mass redemptions and market stress. Look for stress test results or audits from reputable firms like Trail of Bits or CertiK, and review any published incident reports.

-

Diversify Stablecoin Exposure and Use On-Chain Insurance Products: Avoid overexposure to a single stablecoin. Diversify across established options like USDT, USDC, and DAI. Consider on-chain insurance from platforms such as Nexus Mutual to protect against smart contract and depeg risks.

Let’s break down these lessons in detail:

1. Prioritize Deep, Diverse Liquidity Pools at Launch

Liquidity is the lifeblood of any stablecoin’s peg. USST’s Curve pool, while initially funded to nearly $1 million, saw rapid outflows as early adopters lost confidence. Shallow or concentrated pools make it easier for price slippage to occur during redemptions or panic selling. For investors, it’s critical to assess not just the size but also the diversity of liquidity providers at launch. Protocols should incentivize broad participation across multiple pools and venues to dampen volatility from large trades or coordinated exits.

2. Scrutinize RWA Collateral Transparency and Redemption Mechanisms

USST touted over-collateralization with U. S. Treasuries and a partnership with Ondo Finance for USDY-backed mints. However, questions remain about real-time visibility into collateral reserves and the speed at which users can redeem USST for underlying assets. Investors should demand transparent, on-chain proof of reserves and clear redemption pathways, especially for RWA-backed coins where off-chain processes can introduce delays or uncertainty. Without these assurances, even the best collateral can fail to maintain confidence during stress events.

For a deep dive into the complexities of stablecoin design risks, see the comprehensive analysis by arXiv.

As USST’s early struggle illustrates, robust collateral alone is not enough; transparency and efficient redemption are equally vital to peg stability.

Stay tuned for the second half of our analysis, where we’ll explore automated hedging tools, protocol resilience testing, and portfolio diversification strategies for navigating the evolving landscape of RWA-backed stablecoins.

USST Stablecoin (USST) Price Prediction 2026-2031

Short- and Mid-Term Peg Recovery Scenarios After 2025 Depeg Event

| Year | Minimum Price | Average Price | Maximum Price | Key Scenario/Insight |

|---|---|---|---|---|

| 2026 | $0.92 | $0.98 | $1.01 | Recovery depends on liquidity restoration, RWA backing, and regaining trust; volatility persists |

| 2027 | $0.94 | $0.99 | $1.02 | Improved collateralization and partnerships may restore peg, but adoption risk remains |

| 2028 | $0.96 | $1.00 | $1.03 | Assuming regulatory clarity and successful integrations, peg stability likely; minor deviations possible |

| 2029 | $0.97 | $1.00 | $1.04 | Growing market cap and RWA use may lead to tighter peg; competition from larger stablecoins persists |

| 2030 | $0.98 | $1.00 | $1.05 | If USST achieves institutional adoption, peg stability solidifies; bullish scenario reflects market expansion |

| 2031 | $0.99 | $1.00 | $1.06 | Mature RWA market and regulatory support could see USST trade consistently at or above $1 |

Price Prediction Summary

USST faces a challenging path to full peg recovery following its day-one depeg in 2025. In the short term, price volatility is likely as the protocol addresses liquidity and trust issues. Over the medium to long term (2027-2031), successful implementation of RWA-backed collateral, increased adoption, and favorable regulatory developments could help USST approach and maintain its $1 target, with risks of minor deviations persisting due to competition and evolving market structures.

Key Factors Affecting USST Stablecoin Price

- Liquidity restoration and depth in secondary markets

- Quality and transparency of RWA collateral backing

- Regulatory clarity and stablecoin-specific legislation (e.g., GENIUS Act)

- Adoption by DeFi protocols and institutional players

- Competition from established stablecoins (USDT, USDC, DAI, etc.)

- Partnerships (e.g., Ondo Finance) and ecosystem integrations

- Market sentiment following initial depeg event and risk management improvements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

3. Implement Real-Time Depeg Monitoring and Automated Hedging Tools

One of the most actionable takeaways from the USST event is the urgent need for real-time monitoring of stablecoin pegs. The rapid fall to $0.96 highlighted how quickly sentiment and liquidity can shift, leaving investors with little time to react. Modern DeFi users should leverage on-chain analytics platforms and set up automated alerts for price deviations, liquidity outflows, or abnormal trading volumes. Even more powerful are automated hedging solutions: such as depeg protection derivatives or protocol-integrated insurance, that can trigger protective actions when a peg falters. These tools are becoming essential as stablecoin launches grow in scale and complexity.

4. Assess Protocol Resilience to Sudden Market Shocks and Run Risk

The USST launch demonstrates that even RWA-backed protocols are not immune to classic bank run dynamics. When early holders rushed to exit amid uncertainty, shallow liquidity and unclear redemption processes amplified the depeg. Investors should review stress testing disclosures, audit reports, and circuit breaker mechanisms before allocating capital to new stablecoins. Ask: How does the protocol handle sudden surges in redemptions? Is there a plan for orderly unwind or emergency intervention? As underscored by recent market coverage, run risk remains a critical vulnerability, even with high-quality collateral.

5. Diversify Stablecoin Exposure and Use On-Chain Insurance Products

No single stablecoin, regardless of its design or backing, is completely risk-free. The USST episode reinforces why prudent investors diversify their stablecoin holdings across multiple issuers and architectures (fiat-backed, crypto-collateralized, algorithmic). Additionally, on-chain insurance products, offered by emerging DeFi protocols, allow users to hedge against specific risks like depegs or smart contract failures. These insurance solutions can provide partial compensation in black swan scenarios, helping protect portfolio value even when markets move against expectations.

“Insurance is innovation’s safety net. “: Gavin Mercer

Building Resilience: Navigating RWA-Backed Stablecoins After USST’s Launch

The launch and immediate depeg of USST at $0.9776 serve as a pivotal learning moment for DeFi participants navigating the next wave of RWA-backed stablecoins. By prioritizing deep liquidity at launch, demanding transparency around collateral and redemptions, adopting automated risk management tools, insisting on robust protocol stress testing, and diversifying with insurance overlays, crypto investors can better weather volatility and unexpected protocol failures.

The digital asset landscape is rapidly evolving, and so too must our approach to risk mitigation. Each new incident like USST’s day-one stress test provides valuable data points for building safer DeFi ecosystems where innovation and investor protection go hand in hand.