Stablecoins are the backbone of DeFi, but as recent market turbulence has shown, their so-called “stability” can be illusory. Depegging events – when a stablecoin slips away from its $1 peg – have triggered liquidity crises, forced liquidations, and even systemic shocks. In this rapidly evolving landscape, robust risk management is no longer optional. Institutional and retail participants alike must proactively hedge against stablecoin depeg risk using a mix of insurance, derivatives, and novel on-chain tools.

Understanding Stablecoin Depeg Risk in 2025

Despite advances in collateralization models and regulatory scrutiny, stablecoins remain exposed to market volatility, protocol exploits, and black swan events. A seemingly minor deviation from the $1 mark can quickly spiral into a full-fledged depeg event. The consequences? Loss of user confidence, forced asset sales across DeFi protocols, and cascading liquidations.

Recent history has shown that even major stablecoins like USDC and USDT are not immune. As such, hedging against depeg risk is now a core pillar of stablecoin risk management. Let’s examine three actionable strategies currently used by sophisticated DeFi participants:

Y2K Finance Depeg Protection Vaults: Structured Derivatives for Targeted Coverage

Y2K Finance has emerged as a leader in structured derivative solutions for pegged assets. Their Depeg Protection Vaults allow users to purchase insurance-like coverage or take on risk exposure tied to specific depeg events for major stablecoins (including USDC, USDT, DAI). Users can select vaults based on defined strike thresholds (e. g. , payout if USDC trades below $0.98), duration, and payout parameters.

This approach offers two-sided flexibility: conservative users hedge by buying protection against catastrophic depegs while speculators can sell protection to earn premiums if they believe stability will persist. Payouts are automatic and transparent based on on-chain price oracles at expiry.

Key Benefits and Risks of Y2K Finance Depeg Protection Vaults

-

Y2K Finance Depeg Protection Vaults: Structured derivative vaults that allow users to hedge or speculate on specific stablecoin depeg events (such as USDC, USDT, or DAI). Users can purchase insurance-like coverage or take on risk exposure tied to pre-defined depeg thresholds. Benefits: Offers customizable protection with transparent payouts, automated execution, and coverage for multiple stablecoins. Risks: Payoffs depend on event triggers and vault parameters; users may lose premiums if depeg thresholds are not met, and there is protocol risk inherent to smart contracts.

-

InsurAce Protocol On-Chain Stablecoin Insurance: A decentralized insurance platform providing customizable coverage against stablecoin depegs and protocol failures. Users can protect their assets from smart contract vulnerabilities and loss of peg incidents by purchasing on-chain insurance policies. Benefits: Clear terms, flexible coverage amounts, and audited smart contracts. Risks: Claims are subject to protocol governance and may involve waiting periods; insurance premiums can fluctuate based on market demand.

-

Cork Protocol Depeg Swaps: On-chain swap contracts enabling users to directly hedge against the risk of a stablecoin losing its peg by buying or selling depeg protection. Pricing is determined transparently based on market risk assessments. Benefits: Market-driven pricing, immediate execution, and the ability to hedge or speculate on depeg events. Risks: Complexity of derivative contracts, potential for slippage or liquidity constraints, and reliance on accurate on-chain price feeds.

InsurAce Protocol: On-Chain Insurance Tailored for Stablecoin Risks

InsurAce Protocol provides decentralized insurance coverage that goes beyond just smart contract vulnerabilities – it also includes explicit protection against stablecoin depegs. Users can customize policies by selecting covered assets (such as USDC or DAI), defining payout triggers (e. g. , if a coin trades below $0.97 for a set period), and choosing coverage amounts.

This protocol-native insurance model is particularly attractive for users seeking peace of mind without the complexity of managing derivatives positions. Premiums are paid upfront in crypto assets; claims are processed transparently via smart contracts with community governance involved in dispute resolution.

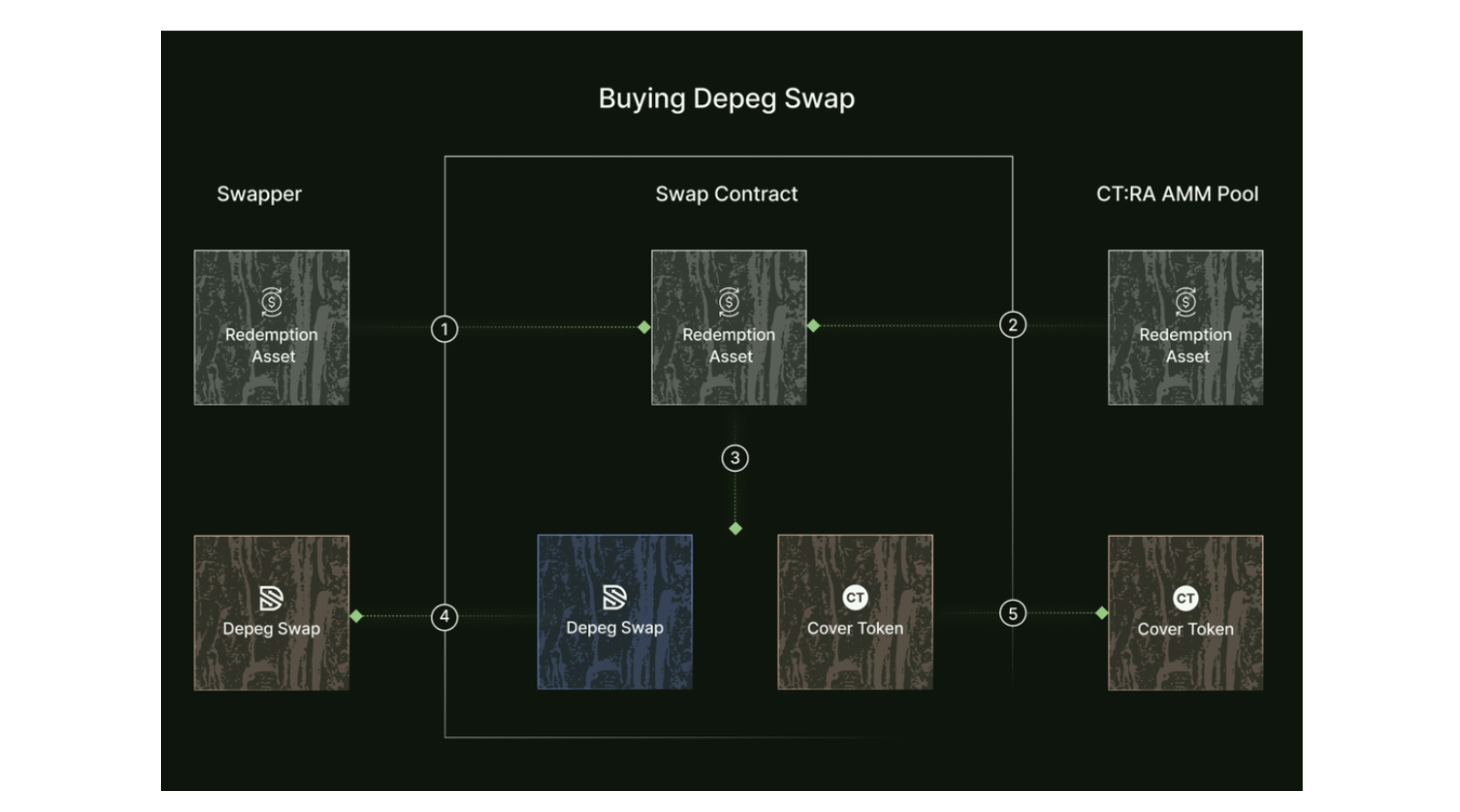

Cork Protocol Depeg Swaps: Direct On-Chain Hedging with Market-Based Pricing

Cork Protocol introduces an innovative instrument: depeg swaps. These are on-chain contracts that let users directly hedge against the risk of a specific stablecoin losing its peg by buying or selling protection at market-driven prices. The swaps pay out if the monitored asset breaches predetermined thresholds (for example, if USDT drops below $0.99).

Cork’s transparent pricing reflects real-time market sentiment about depeg risks – giving both buyers and sellers an efficient way to transfer risk without relying on centralized intermediaries or opaque processes.

Top Strategies & Tools for Hedging Stablecoin Depeg Risk

-

Y2K Finance Depeg Protection Vaults: Structured derivative vaults enabling users to hedge or speculate on stablecoin depeg events (such as USDC, USDT, DAI). Participants can purchase insurance-like coverage or take on risk exposure tied to pre-defined depeg thresholds, with transparent payoffs and settlement based on on-chain price feeds.

-

InsurAce Protocol On-Chain Stablecoin Insurance: A decentralized insurance platform offering customizable coverage against stablecoin depegs and protocol failures. Users can protect their assets from smart contract vulnerabilities and loss of peg incidents, with claims processed transparently via smart contracts.

-

Cork Protocol Depeg Swaps: On-chain swap contracts that allow users to directly hedge against stablecoin depeg risk by buying or selling depeg protection. Pricing is determined by market risk assessments, providing a transparent and flexible alternative to traditional insurance or derivatives.

The Comparative Landscape: Choosing the Right Hedge for Your Portfolio

No single tool fits all scenarios when it comes to hedging stablecoin depeg risks. Y2K Finance vaults offer structured payouts with clear event-driven triggers; InsurAce delivers customizable policy-based coverage; Cork enables nimble hedging with direct market participation.

Each approach presents distinct advantages and trade-offs. For example, Y2K Finance vaults appeal to those seeking transparent, event-based payouts and the flexibility to either hedge or underwrite risk. This dual-sided market structure can enhance liquidity and price discovery for depeg protection, but users must be comfortable with vault mechanics, strike selection, and potential premium losses if the peg holds.

InsurAce Protocol’s insurance model is more accessible for passive users or institutions requiring compliance-friendly coverage. Its smart contract-driven claims process reduces operational risk and provides a degree of regulatory transparency. However, policyholders must pay non-refundable premiums regardless of outcome, and coverage limits or exclusions may apply during extreme market stress.

Cork Protocol’s depeg swaps stand out for their on-chain settlement and real-time pricing. This allows experienced DeFi participants to fine-tune hedges in response to shifting market sentiment, potentially capturing value from volatility spikes or crowding into protection when risk is perceived as low. The flip side: active management is required, and outcomes are highly sensitive to threshold selection and swap expiry timing.

Practical Considerations for DeFi Investors

When integrating these tools into a risk management strategy, investors should weigh several factors:

Checklist: Choosing Your Depeg Hedge Tool

-

Y2K Finance Depeg Protection Vaults: Structured derivative vaults that allow users to hedge or speculate on specific stablecoin depeg events (such as USDC, USDT, and DAI). Users can purchase insurance-like coverage or take risk exposure tied to pre-defined depeg thresholds, with transparent settlement and market-driven pricing.

-

InsurAce Protocol On-Chain Stablecoin Insurance: A decentralized insurance platform offering customizable coverage against stablecoin depegs and protocol failures. Users can protect their assets from smart contract vulnerabilities and loss of peg incidents by selecting coverage terms and paying a premium, with claims processed on-chain.

-

Cork Protocol Depeg Swaps: On-chain swap contracts enabling users to directly hedge against the risk of a stablecoin losing its peg. By buying or selling depeg protection, users gain exposure to depeg events with transparent pricing based on current market risk assessments.

Portfolio composition matters: If your exposure is concentrated in a single stablecoin (e. g. , USDC), targeted depeg protection via Y2K or Cork may be most efficient. For diversified portfolios spanning multiple protocols or chains, InsurAce’s customizable policies could provide broader peace of mind.

Risk appetite also plays a role: Active traders may prefer the dynamic hedging capabilities of Cork swaps or the ability to sell risk in Y2K vaults, while conservative holders might opt for straightforward insurance coverage through InsurAce.

Cost versus benefit must be assessed carefully. Premiums paid on insurance or derivatives can erode returns if depeg events do not occur. Monitoring ongoing swap rates on Cork and vault yields on Y2K helps optimize timing and sizing of hedges relative to perceived market risk.

Looking Ahead: The Evolution of Stablecoin Risk Hedging

The rapid development of protocol-native hedging solutions reflects both the growing sophistication of DeFi users and the increasing complexity of stablecoin markets. As regulatory frameworks mature and new collateral models emerge, we can expect further innovation in how depeg risks are priced, transferred, and managed on-chain.

The bottom line? No portfolio should assume immunity from stablecoin instability. Whether using structured derivatives like Y2K Finance vaults, decentralized insurance via InsurAce Protocol, or direct on-chain swaps through Cork Protocol, proactive hedging is essential for resilient participation in today’s DeFi ecosystem.

If you’re ready to dive deeper into practical strategies for mitigating stablecoin depeg risk, or want hands-on guidance with these tools, see our comprehensive guide at How to Hedge Against Stablecoin Depeg Events: Strategies for DeFi Investors.