Stablecoins are the backbone of DeFi, but their $1 peg is not guaranteed. As recent market events have shown, even the most trusted stablecoins can experience sudden depegs, exposing traders and protocols to outsized losses. In this high-frequency landscape, hedging against stablecoin depeg risk is not optional – it’s mandatory for anyone serious about capital preservation and risk-adjusted returns.

Why Stablecoin Depeg Risk Demands Aggressive Hedging

Stablecoins like USDT, USDC, and DAI are engineered to maintain a 1: 1 value with fiat currencies. Yet, technical failures, regulatory shocks, or liquidity crunches can break the peg in seconds. The fallout? Liquidity dries up, on-chain positions auto-liquidate, and portfolio values crater. S and P Global underscores that stablecoins are not risk-free: market volatility, confidence crises, and systemic shocks can all trigger depegging.

For active crypto investors and DeFi users seeking robust hedging strategies for stablecoins, a multi-layered approach is required. Here’s how you build real protection using current market tools:

Purchase Depeg Insurance via DeFi Protocols

Depeg insurance is now a core pillar of crypto risk management. Protocols like InsurAce, Nexus Mutual, and Sherlock offer insurance products specifically designed to pay out if a stablecoin loses its peg below a defined threshold (e. g. , $0.98 for USDC). This isn’t theoretical coverage; these contracts are underwritten by decentralized pools with transparent claims processes.

The mechanics are simple: you pay a premium to cover your stablecoin exposure for a set period. If a depeg event occurs (as defined in the policy), you’re compensated directly in ETH or another stable asset. This approach is especially relevant for institutional players or DAOs managing large treasuries who need hard guarantees against tail risks.

Utilize Depeg Derivatives and Swaps to Directly Hedge Exposure

The most advanced hedgers are looking beyond insurance toward derivatives engineered for depeg scenarios. Platforms like Cork Protocol and Hedgey have pioneered depeg swaps: synthetic contracts that pay out if (and only if) a target stablecoin falls below its peg by a specific margin within a given time window.

This allows traders to construct direct hedges, for example, buying a swap on USDC with a strike at $0.995 means you profit if USDC trades below that level during the contract’s life. These instruments trade on both centralized venues and permissionless DEXs, offering flexibility whether you’re managing protocol treasury risk or actively trading volatility.

Key Features of Cork Protocol & Hedgey Depeg Derivatives

-

Purchase Depeg Insurance via DeFi Protocols (e.g., InsurAce, Nexus Mutual, Sherlock): Secure your stablecoin portfolio with on-chain insurance products that pay out if a depeg event occurs. These protocols offer customizable coverage and transparent claims processes, letting you hedge against catastrophic losses.

-

Utilize Depeg Derivatives and Swaps (e.g., Cork Protocol, Hedgey) to Directly Hedge Stablecoin Exposure: Trade depeg swaps and options that pay out if a stablecoin falls below its peg. Platforms like Cork Protocol and Hedgey offer flexible contracts, letting you customize strike thresholds and expiry dates for precise risk management.

-

Diversify Stablecoin Holdings Across Multiple Pegging Models (Fiat-backed, Algorithmic, Overcollateralized): Spread risk by holding a basket of stablecoins with different collateralization mechanisms. This diversification reduces exposure to failures in any single model, balancing risk between USDT, USDC (fiat-backed), DAI (overcollateralized), and FRAX (algorithmic).

-

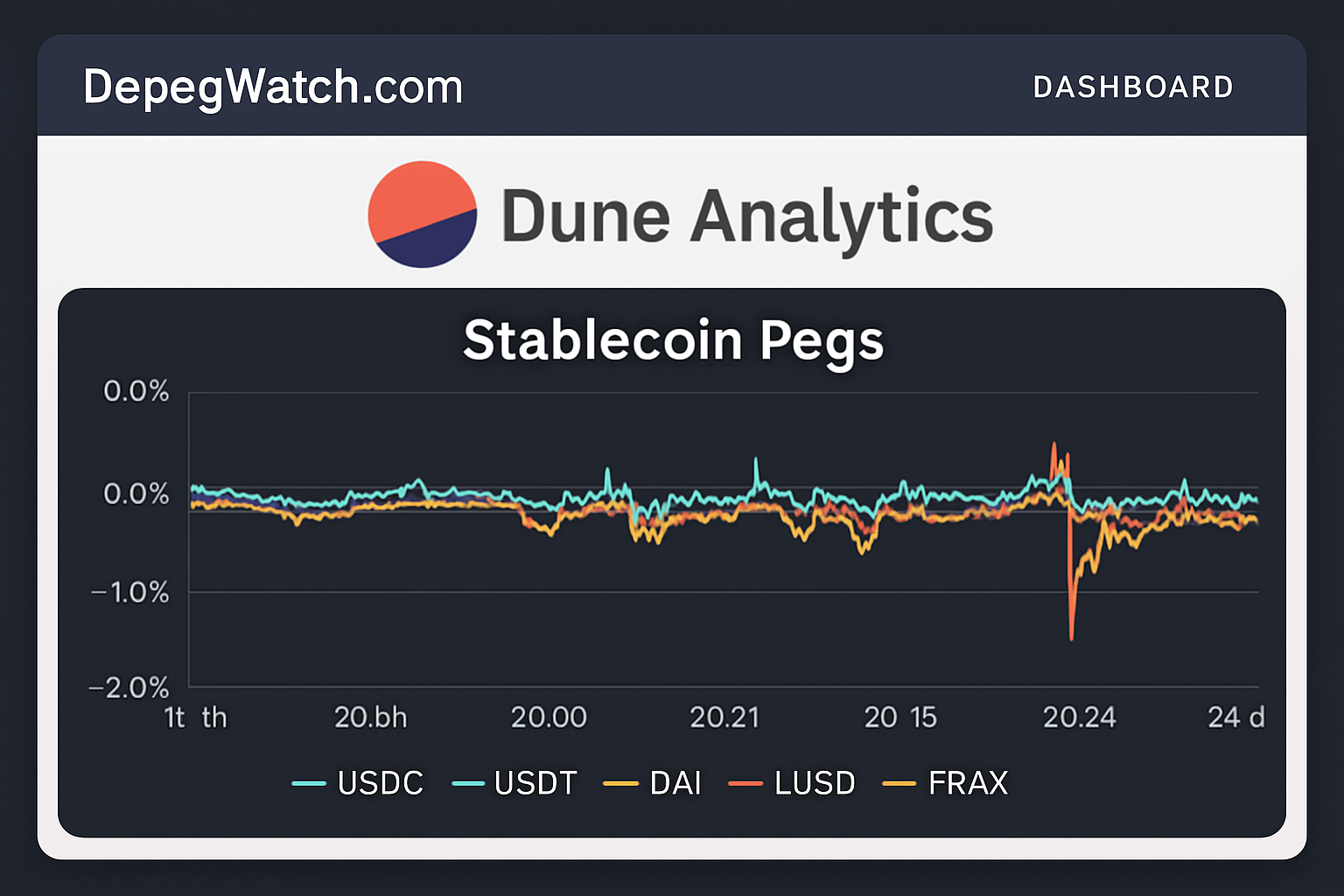

Monitor On-Chain Analytics and Real-Time Depeg Alerts (e.g., DepegWatch.com, Dune dashboards) for Proactive Risk Management: Leverage live dashboards and alert systems to track stablecoin price deviations, liquidity metrics, and protocol health. Early warnings from these tools enable fast, informed responses to potential depegs.

Diversify Stablecoin Holdings Across Multiple Pegging Models

No single stablecoin model is invulnerable, fiat-backed coins face regulatory pressure; algorithmic coins can spiral in bank runs; overcollateralized coins depend on volatile collateral assets. Smart investors diversify across these models:

- Fiat-backed: e. g. , USDT (Tether), USDC (Circle)

- Algorithmic: e. g. , FRAX, crvUSD (Curve)

- Overcollateralized: e. g. , DAI (MakerDAO), LUSD (Liquity)

This diversification minimizes exposure to idiosyncratic risks affecting any one coin or protocol. If one peg slips due to reserves mismanagement or smart contract exploits, losses may be offset by stability in others, keeping your portfolio solvent even during black swan events.

Top Five Stablecoins: Peg Stability Overview (as of 2025-10-07)

| Stablecoin | Current Price | 24h Deviation from $1 | Peg Stability Indicator |

|---|---|---|---|

| USDT (Tether) | $1.00 | $0.00 | 🟢 |

| USDC (USD Coin) | $1.00 | $0.00 | 🟢 |

| DAI | $1.00 | $0.00 | 🟢 |

| TUSD (TrueUSD) | $0.99 | -$0.01 | 🟡 |

| USDP (Pax Dollar) | $1.00 | $0.00 | 🟢 |

Monitor On-Chain Analytics and Real-Time Depeg Alerts for Proactive Risk Management

If you’re not watching the pegs in real time, you’re already behind the curve. Platforms like DepegWatch. com, as well as custom Dune dashboards, aggregate live price feeds across CEXs/DEXs and monitor whale movements or anomalous flows into/out of major stables.

Aggressive monitoring enables proactive moves:

- Selling into alternative stables at first sign of deviation

- Purchasing additional insurance or swaps as volatility spikes

- Avoiding protocols exposed to stressed stables before contagion spreads

Speed is the edge. When a stablecoin’s price ticks even a cent below $1, automated bots and institutional traders are already repositioning. Real-time analytics are not just a luxury, they’re essential to front-run the crowd and avoid being exit liquidity. DepegWatch. com, for example, lets you set custom alerts for USDT, USDC, DAI, and more. Combine this with open-source Dune dashboards tracking wallet flows and on-chain liquidity to spot early warning signs before they hit mainstream news.

Integrating these tools into your daily workflow means you can act before forced liquidations cascade through DeFi lending markets or AMM pools. The most resilient portfolios aren’t reactive, they’re preemptive.

Building a Layered Hedge: Actionable Strategy Recap

Stablecoin Depeg Hedging: 4 Core Strategies

-

Purchase Depeg Insurance via DeFi Protocols: Use platforms like InsurAce, Nexus Mutual, and Sherlock to buy insurance policies that pay out if a stablecoin loses its peg. These protocols offer on-chain coverage for specific depeg events, providing direct protection against losses.

-

Utilize Depeg Derivatives and Swaps: Hedge stablecoin exposure by trading depeg derivatives on platforms like Cork Protocol and Hedgey. These tools let you buy or sell contracts that pay out if a stablecoin trades below a defined threshold, enabling precise risk management.

-

Diversify Stablecoin Holdings Across Multiple Pegging Models: Spread your capital across fiat-backed (e.g., USDC, USDT), algorithmic (e.g., FRAX), and overcollateralized (e.g., DAI, LUSD) stablecoins. This reduces exposure to failures in any single model and enhances resilience against systemic depeg risk.

-

Monitor On-Chain Analytics and Real-Time Depeg Alerts: Stay ahead of depeg events using analytics tools like DepegWatch.com and Dune dashboards. These platforms provide live peg monitoring, price feeds, and automated alerts for proactive risk management.

If you want real protection from stablecoin depeg risk, don’t rely on one approach. Stack these hedges for maximum resilience:

- Buy depeg insurance from InsurAce, Nexus Mutual, or Sherlock to cover catastrophic peg breaks.

- Trade depeg swaps or derivatives on Cork Protocol or Hedgey to profit (or offset losses) from downside volatility in real time.

- Diversify across pegging models: split stablecoin allocations between fiat-backed, algorithmic, and overcollateralized coins to dilute systemic risk.

- Automate monitoring: set up live alerts via DepegWatch. com and Dune so you can pivot instantly when pegs wobble.

This multi-pronged approach isn’t theoretical, each component is live and battle-tested by protocols managing hundreds of millions in TVL. The difference between surviving a depeg event and being wiped out comes down to implementation speed and discipline.

Why Passive Holders Get Burned, and How Active Hedgers Win

The passive approach, simply parking capital in one or two stables, is a recipe for disaster in an environment where regulatory headlines or smart contract exploits can nuke pegs overnight. The active hedger leverages every tool available: insurance for tail risks, swaps for tactical exposure management, diversification for structural resilience, and analytics for instant response.

The market rewards those who treat risk as dynamic, not static. If you’re holding significant stablecoin balances (especially in DeFi), review your hedging stack today:

For deeper dives into specific derivatives mechanics or step-by-step guides on setting up automated monitoring tools, check out our resources at DepegWatch. com. Don’t wait until after the next black swan, build your defense now while spreads are tight and premiums are low.