Stablecoins are designed to provide digital market participants with a reliable, dollar-pegged asset for trading, lending, and yield farming. Yet, the events of the past few years have made it clear: stablecoin pegs are not guaranteed. From the catastrophic collapse of TerraUSD (UST) in May 2022 to the sudden depegging of USDC and DAI during the U. S. banking crisis in March 2023, risk management around stablecoins is now a core requirement for both institutional and retail DeFi users.

In this article, we break down three of the most effective, current tools and strategies for hedging stablecoin depeg risk. Each is grounded in real-world usage and market data, with a focus on practical execution rather than theory.

Y2K Finance Hedge Vaults: Depeg Derivatives for USDT/USDC

One of the most direct ways to hedge against stablecoin depeg events is to use purpose-built derivatives platforms. Y2K Finance offers Hedge Vaults that allow users to take positions on the probability of a depeg event for major stablecoins like USDT and USDC. These vaults function similarly to binary options: users deposit ETH into a vault that pays out if the reference stablecoin trades below a specified threshold (for example, $0.98) during a defined epoch.

During the March 2023 USDC depeg, Y2K’s Hedge Vaults saw record inflows as users sought protection against further downside. The mechanics are transparent: if USDC closes below the trigger price at expiry, Hedge Vault depositors receive payouts funded by Risk Vault participants who bet against depegging. This structure creates a liquid, on-chain insurance market for depeg risk, with pricing determined by market sentiment and supply-demand dynamics.

For more detailed mechanics and step-by-step guides to using Y2K Hedge Vaults, see our dedicated resource: How to Hedge Against Stablecoin Depegs Using DeFi Derivatives in 2024.

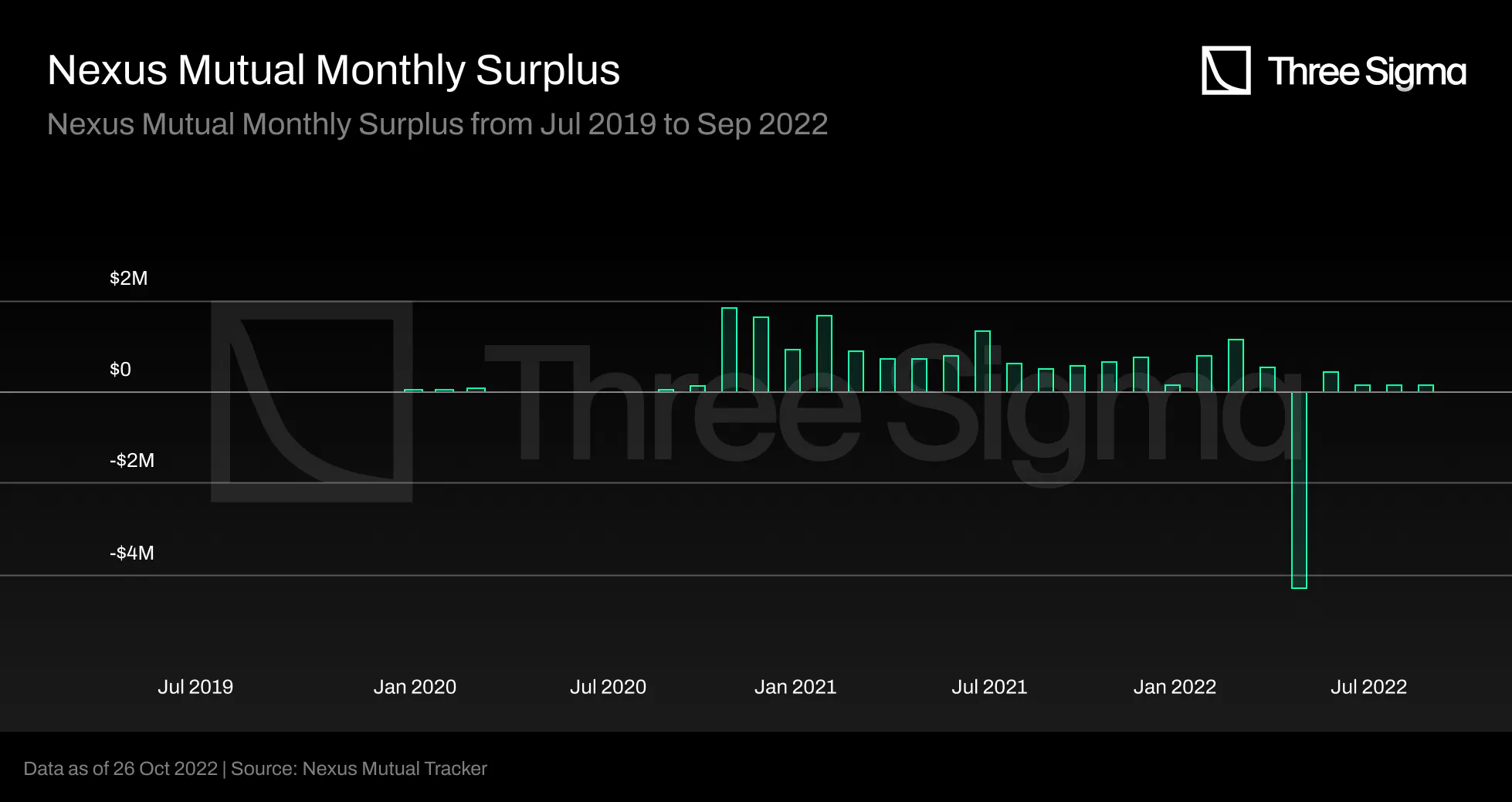

Protocol Risk Insurance: Nexus Mutual and InsurAce

Decentralized insurance protocols such as Nexus Mutual and InsurAce provide another layer of protection for stablecoin holders. These platforms offer coverage against specific risks like smart contract failures or explicit depegging events on supported assets. For example, after the UST collapse, both protocols expanded their offerings to include policies for USDT and USDC depeg risk.

The process is straightforward: users purchase coverage for a set amount and duration. If a qualifying depeg event occurs (e. g. , USDC trading below $0.90 for a specified period), claimants can submit evidence and receive payouts from the protocol’s risk pool. Premiums are dynamically priced based on protocol risk assessment and pool utilization rates.

Nexus Mutual vs InsurAce: Stablecoin Depeg Insurance Compared

-

Nexus Mutual:• Decentralized insurance protocol offering cover for stablecoin depeg events.• Claims assessment is community-driven, with members voting on valid claims.• Coverage includes major stablecoins (e.g., USDT, USDC, DAI) and is customizable by amount and duration.• Payouts are made in ETH or NXM tokens.• Transparency: Open claims history and protocol statistics.

-

InsurAce:• Multi-chain DeFi insurance platform providing stablecoin depeg cover.• Automated claim processing for certain depeg triggers, reducing payout times.• Supports a wide range of stablecoins and DeFi protocols.• Flexible premium options and portfolio-based coverage.• Payouts are typically made in USDT, USDC, or INSUR tokens.

The key advantage here is automation and transparency; claims are processed on-chain with verifiable criteria. However, policyholders must read terms carefully, coverage triggers and exclusions vary by protocol.

Diversified Stablecoin Yield Farming: Real-World Example from Curve 3pool

Diversification remains one of the most robust risk management strategies in DeFi. During the March 2023 banking crisis, when USDC briefly fell as low as $0.87 on some markets, yield farmers using Curve’s 3pool (USDT/USDC/DAI) were able to mitigate losses by holding a basket of stablecoins rather than concentrating exposure in one asset.

This approach leverages automated market makers (AMMs) to rebalance portfolio weights as prices shift. When USDC depegged, 3pool liquidity shifted toward DAI and USDT as users swapped out of the affected coin. While yields temporarily spiked due to increased trading fees and imbalances, those who held diversified LP positions saw less drastic drawdowns than single-stablecoin holders.

Which stablecoin do you trust most after recent depeg events?

Stablecoin depegging events like UST’s collapse and the USDC/DAI depeg have shaken confidence in these assets. Considering recent market events and your own experience, which stablecoin do you currently trust the most to hold its value?

For actionable strategies on constructing diversified yield portfolios, including protocol selection, rebalancing frequency, and risk assessment, refer to our guide: How to Hedge Against Stablecoin Depeg Risk: Strategies for DeFi Investors in 2024.

Beyond the obvious benefit of spreading risk, diversified stablecoin yield farming also allows users to capture higher returns during periods of market stress. For instance, as the Curve 3pool became imbalanced during the USDC depeg, liquidity providers earned outsized fees as traders rushed to arbitrage the price discrepancies. This dynamic illustrates how active management and cross-stablecoin exposure can both protect capital and enhance returns in volatile conditions.

Pro tip: Monitor pool composition and APYs closely during crisis events. Sudden spikes in yield often signal stress in one or more underlying assets. Use on-chain analytics to track which stablecoin is being withdrawn most aggressively, this can provide early warning of further depeg risk.

Practical Considerations for Risk Hedging

Each of these strategies, depeg derivatives, protocol insurance, and diversified farming, comes with its own operational and liquidity considerations. When deploying capital into Y2K Finance Hedge Vaults, for example, be aware of epoch durations, trigger thresholds, and potential slippage on entry and exit. With protocol insurance, always review claim history and payout ratios on Nexus Mutual or InsurAce before purchasing coverage. For yield farming, use tools to track pool health and consider automated rebalancing solutions to minimize manual intervention.

Ultimately, the most resilient portfolios are those that combine multiple hedging approaches. During the USDC depeg, some sophisticated users not only maintained diversified Curve LP positions but also purchased depeg insurance and opened protective positions in Y2K Hedge Vaults. This layered approach allowed them to offset potential losses from one strategy with gains or payouts from another, demonstrating the power of integrated risk management in DeFi.

Summary Table: Key Tools for Hedging Stablecoin Depeg Events

Comparison of Stablecoin Depeg Hedging Strategies

| Strategy/Tool | How It Works | Key Strengths | Potential Drawbacks | Real-World Example |

|---|---|---|---|---|

| Y2K Finance Hedge Vaults | Users deposit ETH or stablecoins into vaults to buy or sell depeg risk via derivatives contracts. If a stablecoin depegs below a threshold, payouts are triggered. | Direct, on-chain hedging against specific depeg events; customizable risk exposure; transparent smart contract execution. | Requires understanding of DeFi derivatives; potential for loss if depeg does not occur; smart contract risk. | Used to hedge USDC depeg risk during the March 2023 banking crisis. |

| Nexus Mutual / InsurAce Insurance | Users purchase insurance policies that pay out if a stablecoin depegs beyond a defined threshold for a set period. | Clear terms and automatic payouts; covers a wide range of protocols and stablecoins; peace of mind for large holders. | Premium costs can be high; claim process may require proof; not all stablecoins covered. | Nexus Mutual and InsurAce offered insurance for USDC and DAI depeg risk after the SVB collapse. |

| Curve 3pool Diversification | Liquidity providers supply a mix of USDT, USDC, and DAI to Curve’s 3pool, earning yield and reducing exposure to any single stablecoin. | Diversifies risk across multiple stablecoins; earns yield from trading fees; highly liquid DeFi pool. | Exposure to systemic risk if multiple stablecoins depeg; impermanent loss; yield can fluctuate. | Many users shifted funds to Curve 3pool during the USDC depeg in March 2023 to mitigate risk. |

For those seeking a systematic framework to evaluate and implement these tools, our advanced guide covers scenario modeling, backtesting, and portfolio optimization for DeFi depeg protection strategies. You can explore deeper technical analysis at How to Hedge Against USDT and USDC Depeg Risks in DeFi.

The landscape of stablecoin risk management continues to evolve rapidly. By leveraging on-chain derivatives like Y2K Finance Hedge Vaults, decentralized insurance solutions such as Nexus Mutual and InsurAce, and diversified yield farming exemplified by Curve 3pool, investors can construct robust defenses against the unexpected, and turn risk management into an active source of yield and alpha.