For all its promise, decentralized finance (DeFi) is still haunted by a paradox: the more flexible and upgradeable its smart contracts, the greater the risk to users. A recent analysis reveals that 73% of DeFi protocols still get upgradeability wrong, exposing user funds to potentially catastrophic failures. As protocols race to innovate, upgradeable smart contracts have become a double-edged sword, offering agility for developers but introducing significant vectors for attack and governance abuse.

Why Upgradeable Smart Contracts Are a Risk Multiplier

At their core, smart contracts are supposed to be immutable, code is law. But in reality, most major DeFi protocols now rely on proxy patterns or similar architectures that allow for contract upgrades after deployment. This flexibility lets teams patch bugs, add features, and respond to threats. However, it also creates new risks:

- Centralized control: Upgrade rights are often held by a small group of admins or governance participants. If their keys are compromised, or if they act maliciously, they can unilaterally alter the protocol logic.

- Technical complexity: Proxy-based systems introduce new layers where bugs can hide. Even minor mistakes in upgrade logic can brick contracts or expose funds to theft.

- Lack of transparency: Users rarely know when upgrades are coming or what changes are being made until it’s too late.

The infamous $2.8 million exploit highlighted by Fuzzland is just one example among many where an overlooked vulnerability during an upgrade process became an open door for attackers (Fuzzland). The lesson: every point of flexibility is also a potential point of failure.

The False Sense of Security in Protocol Governance

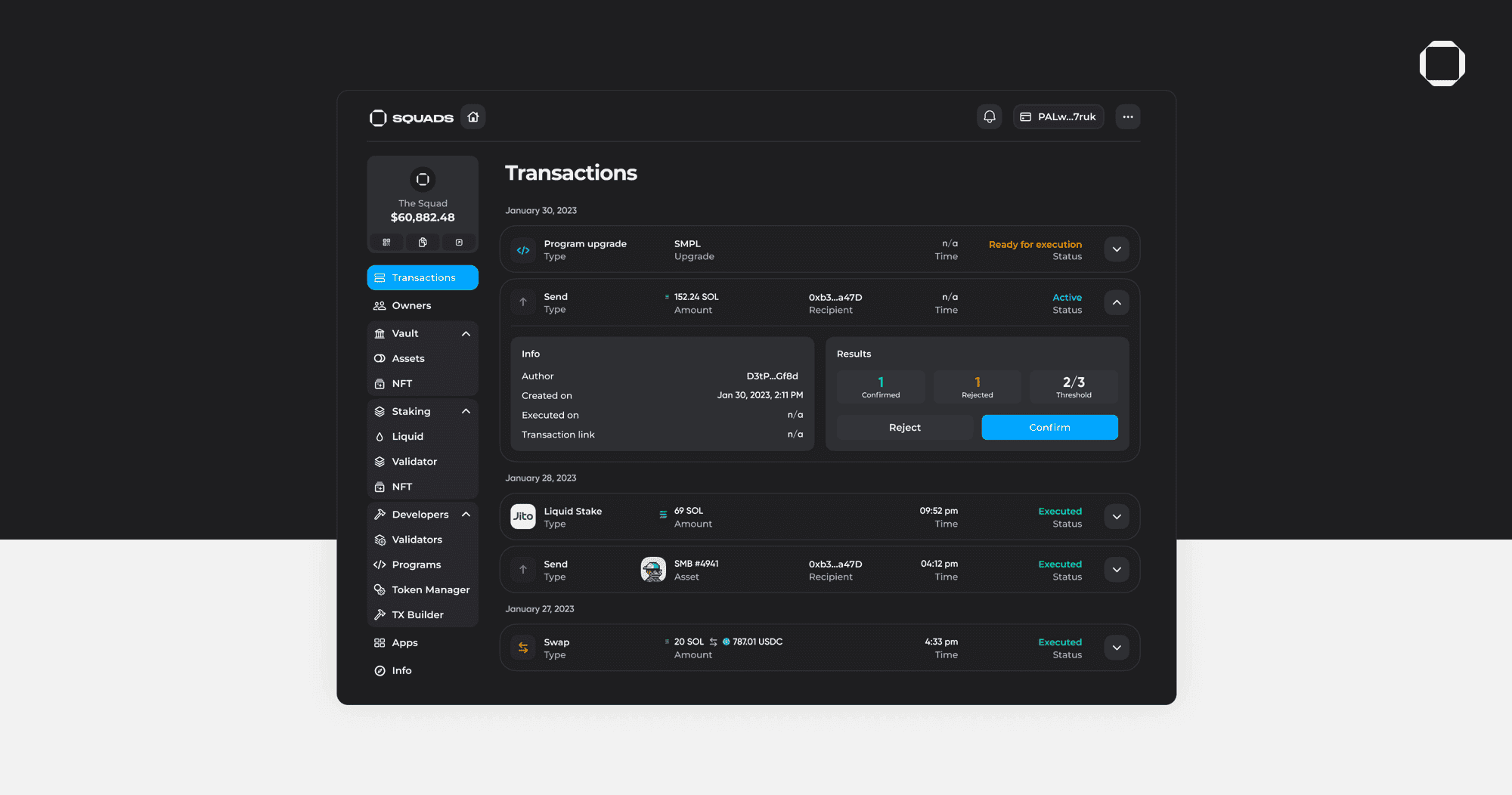

The industry’s answer has often been “decentralized governance. ” In theory, DAOs should democratize control over upgrades, but in practice, power remains concentrated. Many protocols lack transparent on-chain voting or rely on multisig wallets controlled by insiders. According to research from cointeeth. com, this centralization stands in stark contrast to the ethos of trustless finance (cointeeth.com).

This concentration poses two main dangers:

- Malicious upgrades: If governance is captured or colludes with external actors, user assets can be drained through seemingly legitimate upgrades.

- Censorship risk: Admins may freeze funds or block transactions under pressure, either direct (as with regulatory orders) or indirect (via social consensus).

User-perceived security does not always match actual risk exposure. Most users interact with DeFi platforms under the assumption that code cannot be changed arbitrarily, an assumption that breaks down when upgradability isn’t paired with robust checks and balances (ACM Digital Library).

Warning Signs of Risky DeFi Upgrade Paths

-

Centralized Admin Control: If a protocol’s upgrade authority is held by a small group or a single entity—often visible in the contract’s admin or owner address—there’s a heightened risk of unilateral and potentially malicious upgrades. Projects like Compound and Aave have transitioned to decentralized governance to address this, but many protocols still rely on centralized multisigs.

-

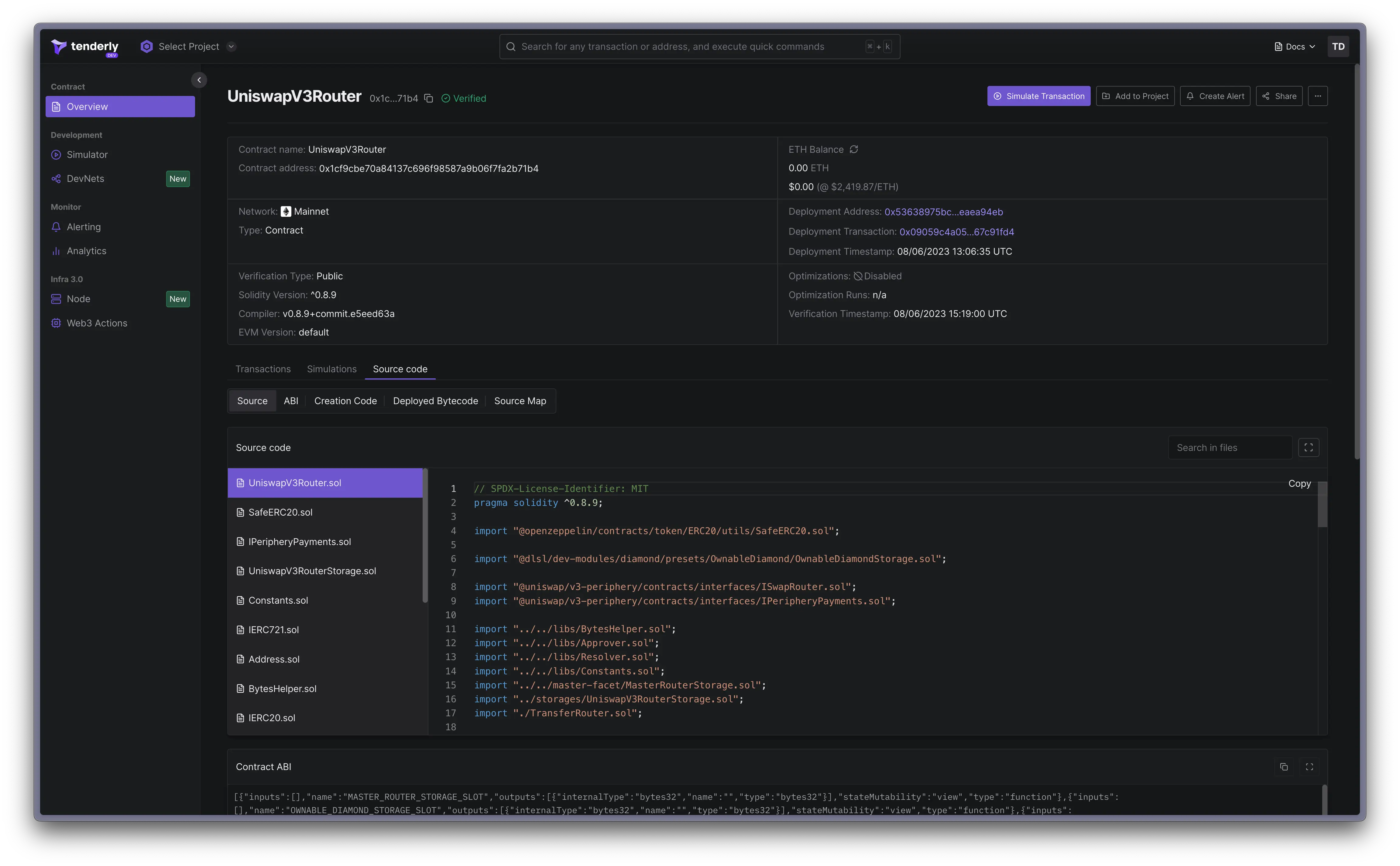

Opaque or Closed-Source Upgrade Logic: When the code governing upgrades is not publicly auditable or is poorly documented, it’s difficult for users to assess the risk of malicious or erroneous changes. Trusted platforms like Curve and Yearn Finance maintain transparent, open-source repositories for all upgrade mechanisms.

-

No Independent Security Audits: Protocols that skip or obscure third-party audits of their upgradeable contracts expose users to unvetted vulnerabilities. Reputable projects publish audit reports from firms such as Trail of Bits or ConsenSys Diligence to bolster user trust.

-

Frequent or Unexplained Upgrades: If a protocol regularly pushes upgrades without clear communication, detailed changelogs, or community involvement, it may signal poor process or attempts to introduce risky changes unnoticed. Top protocols announce upgrades well in advance and provide rationale for each update.

The Technical Debt Behind Every Upgrade Pathway

Beneath the surface, every new feature added via an upgradeable contract increases technical debt and attack surface area. Proxy patterns, while now well-documented, remain complex and error-prone even for experienced teams (MoldStud). The most common pitfalls include:

- Mismatched storage layouts between old and new logic contracts

- Lack of comprehensive testing around edge cases introduced by upgrades

- Poorly implemented access controls on who can trigger upgrades

- No enforced delay between proposing and enacting changes (timelocks)

This technical fragility is not hypothetical; it’s been at the root of multiple high-profile failures across lending markets, staking platforms, and even stablecoin issuers.

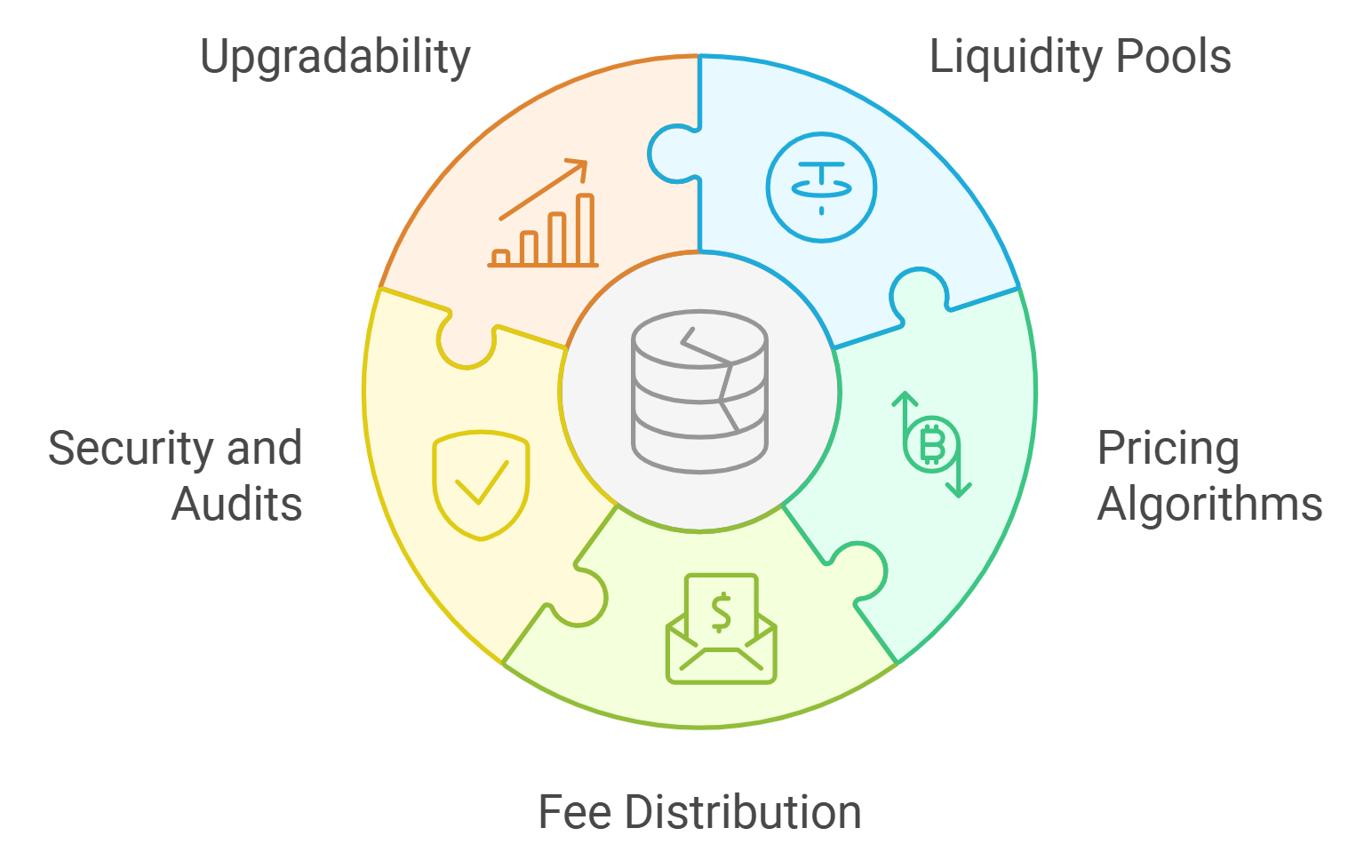

For DeFi users, the question is not whether upgradeable smart contracts are necessary, but how protocols can deploy them without exposing user funds to existential risk. The uncomfortable truth is that most protocols still prioritize developer agility over user protection. This misalignment is the crux of why so many DeFi projects remain one upgrade away from disaster.

Best Practices for Protocol Risk Mitigation

The most resilient DeFi teams are shifting toward a multi-pronged approach to protocol risk mitigation. Here’s what sets them apart:

Best Practices to Reduce DeFi Smart Contract Upgrade Risks

-

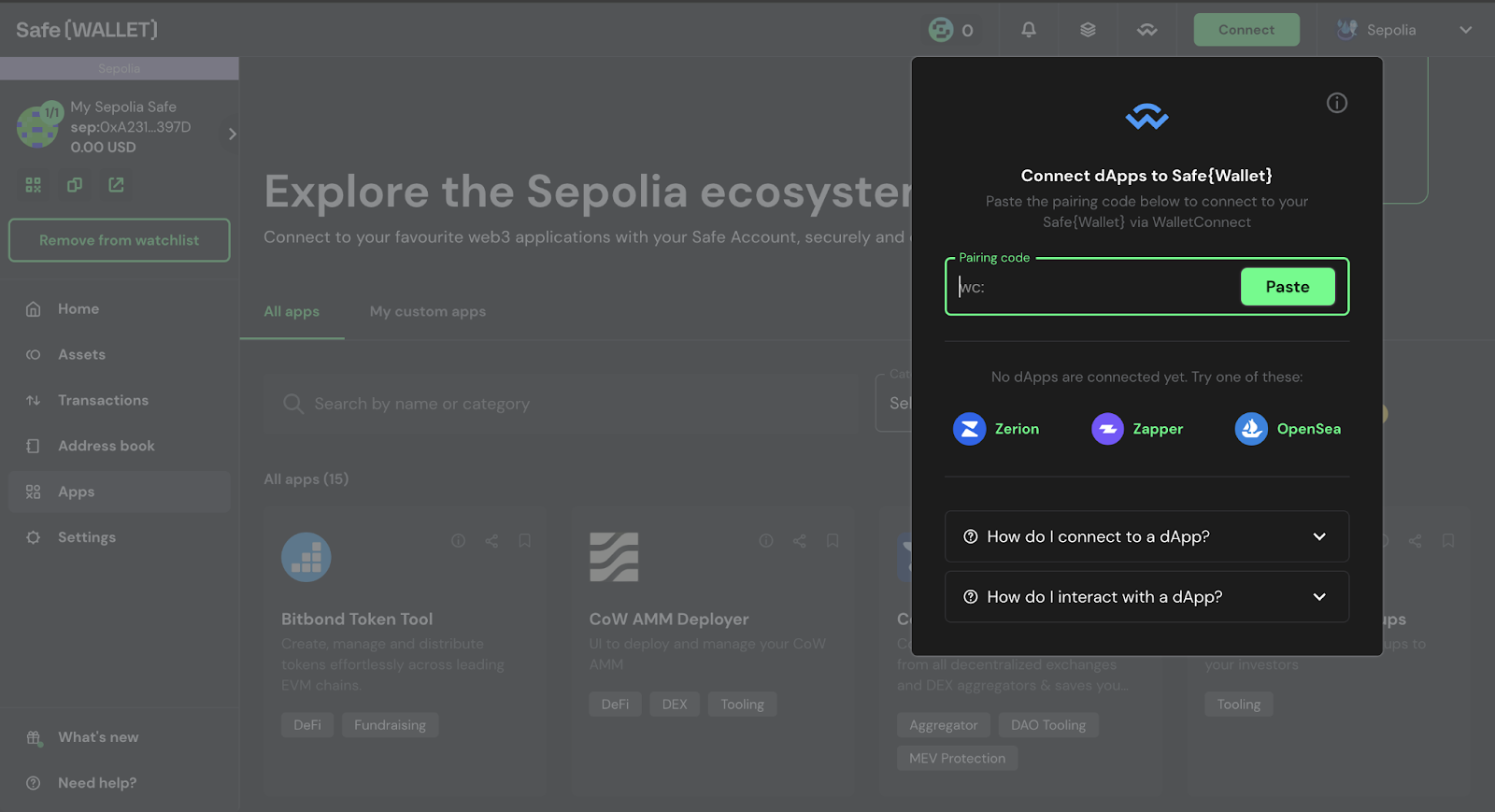

Use Multisignature and Timelock Controls: Require multiple trusted parties to approve upgrades via multisignature wallets (e.g., Gnosis Safe) and enforce timelocks so changes cannot be executed instantly, providing time for community review.

-

Implement Transparent On-Chain Governance: Manage upgrades through decentralized autonomous organization (DAO) frameworks such as Compound Governance or Snapshot, ensuring upgrade decisions are visible and auditable by the community.

-

Conduct Rigorous Security Audits and Formal Verification: Engage reputable audit firms like Trail of Bits or ConsenSys Diligence for comprehensive code reviews, and utilize formal verification tools (e.g., Certora, MythX) to mathematically prove correctness of upgrade logic.

-

Adopt Upgrade Delay Mechanisms: Integrate mandatory delay periods (e.g., 24-72 hours) before upgrades go live, allowing time for public scrutiny and emergency intervention if vulnerabilities are found.

-

Maintain Comprehensive Documentation and Change Logs: Publicly document all upgrades, rationale, and code changes on platforms like GitHub, enabling transparency and easier auditing by the community and independent researchers.

These strategies are not theoretical, they have already helped protocols avoid major losses. For instance, Fuzzland’s Blaz and suite identified and neutralized a $2.8 million threat before it could be exploited, demonstrating that rigorous security tooling and process discipline can make a difference (Fuzzland).

Why 73% Still Get It Wrong

If the solutions are well-known, why do so many protocols fail to implement them? The answer lies in incentives and technical inertia. Upgrades are often rushed to ship new features or patch bugs under pressure. Security reviews and community audits fall by the wayside when market share is at stake. In some cases, governance design itself is an afterthought, leaving multisig wallets with unchecked power over hundreds of millions in user assets.

This persistent gap between best practice and reality means that DeFi user protection remains fragile. For every high-profile exploit that makes headlines, dozens more vulnerabilities lurk in codebases across the ecosystem. The next major protocol failure is rarely a question of if, it’s only a matter of when.

The path forward requires more than just technical fixes; it demands a cultural shift toward transparency, user education, and adversarial thinking at every stage of protocol development.

What Users Can Do: Proactive Crypto Risk Hedging

No amount of developer diligence can substitute for personal vigilance. If you’re allocating capital to DeFi protocols, especially those touting innovative upgradeable architectures, take these steps:

- Demand transparency: Insist on clear documentation of who holds upgrade keys and what processes govern upgrades.

- Monitor governance proposals: Participate in or observe DAO discussions around upgrades; look for evidence of timelocks and public audit windows.

- Diversify risk: Don’t put all your assets into protocols with opaque or centralized control structures. Use crypto risk hedging tools to offset exposure where possible.

The rise of sophisticated insurance products, derivatives for depeg protection, and real-time analytics platforms like DepegWatch has empowered users to take control of their own risk profile. But these tools only work if paired with an understanding of underlying protocol risks, including those hidden behind slick UI/UX and promises of decentralization.

The Road Ahead: Building Trust Through Resilience

The next era of DeFi will be defined by its ability to reconcile innovation with robust security standards. Protocols that treat upgradability as a privilege, not an afterthought, will build lasting trust with users and institutional capital alike.

If you’re evaluating where to deploy capital in the current landscape, scrutinize not just APYs but also upgrade mechanics, governance structures, and incident response history. The protocols poised to survive market cycles will be those that internalize hard lessons from past failures, and design with the assumption that every line of code could become tomorrow’s attack vector.

This is not just about avoiding loss; it’s about building a financial system worthy of long-term confidence, a system where flexibility does not come at the expense of security or user sovereignty.