As of September 30,2025, Tether (USDT) remains a linchpin of the crypto economy, with its price holding steady at $1.00. Yet for both retail and institutional DeFi users, the specter of a USDT depeg – reminiscent of the UST collapse – is an ever-present risk. In this environment, robust hedging strategies are not just prudent but essential for portfolio resilience.

Understanding USDT Depeg Risk in Today’s Market

USDT’s peg to the U. S. dollar is underpinned by Tether Limited’s reserves and market confidence. However, as seen with USDC’s brief depeg in March 2023 after Silicon Valley Bank’s failure, stablecoins are not immune to systemic shocks, regulatory actions, or transparency concerns. The question is no longer whether a depeg could occur – it’s how to prepare for one.

Key takeaway: A single point of failure in your stablecoin exposure can undermine your entire DeFi strategy if USDT loses its peg.

1. Utilize Depeg Derivatives and Structured Products

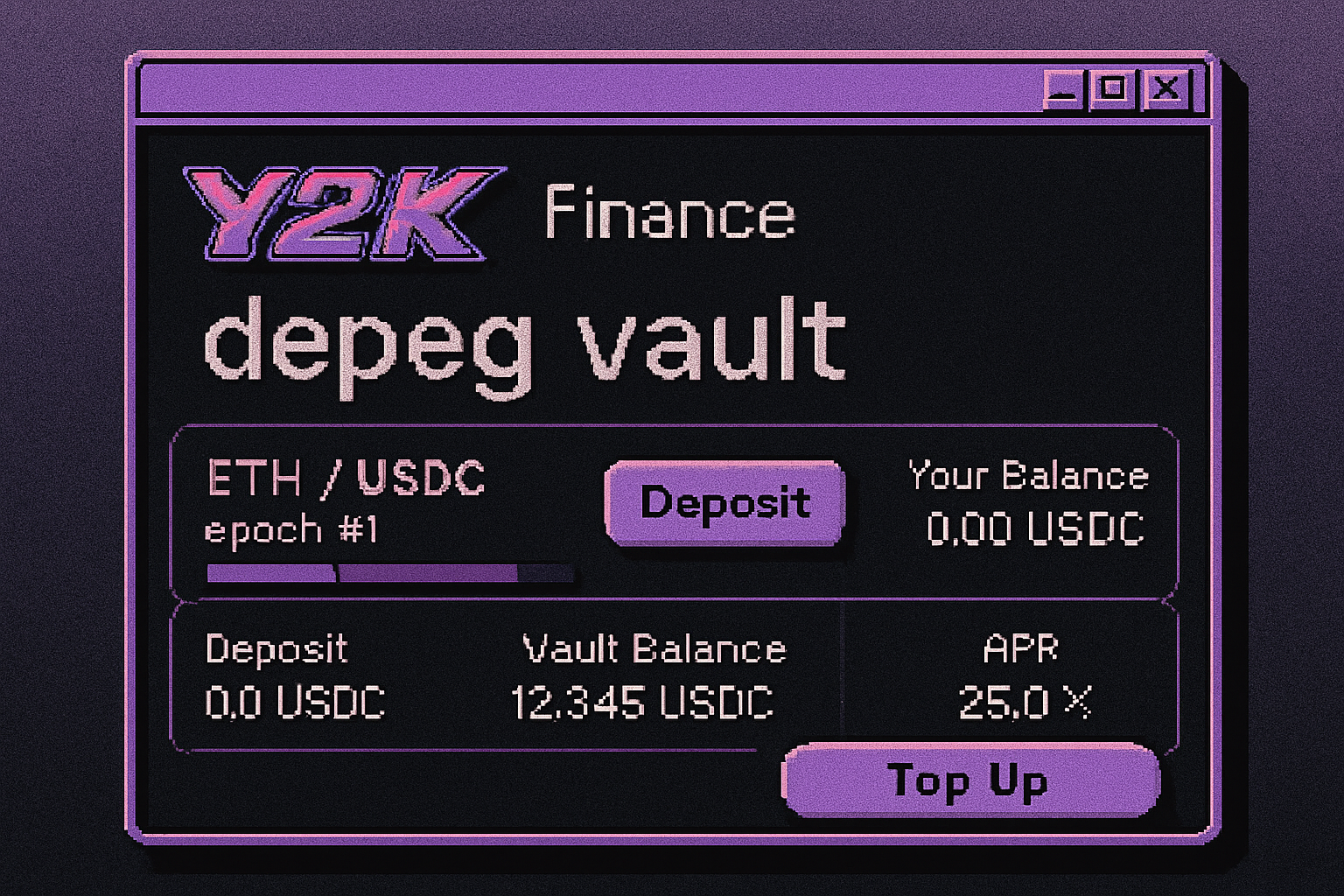

The most direct way to hedge against a potential USDT depeg is by using on-chain derivatives specifically designed for this risk. Platforms like Y2K Finance and Cork Protocol offer purpose-built products that pay out if USDT falls below a predetermined threshold (for example, $0.98). Retail users can buy protection via depeg swaps or participate in hedge vaults; institutions can tailor notional size and strike prices to their specific risk tolerance.

Top Platforms & Strategies for USDT Depeg Hedging

-

Utilize Depeg Derivatives and Structured Products (e.g., Y2K Finance, Cork Protocol): Gain direct exposure to USDT depeg risk by purchasing depeg protection derivatives or participating in hedge vaults that pay out if USDT falls below a set threshold. These on-chain products are purpose-built for stablecoin depeg events, allowing both retail and institutional users to tailor coverage to their risk tolerance.

-

Diversify Stablecoin Holdings Across Multiple Issuers and Blockchains: Reduce single-asset risk by allocating stablecoin exposure among alternatives such as USDC, DAI, TUSD, and LUSD, as well as holding assets on multiple chains. This mitigates the impact of a USDT-specific depeg or protocol failure, ensuring liquidity and value retention even if one stablecoin collapses.

-

Purchase On-Chain DeFi Insurance Policies (e.g., Nexus Mutual, InsurAce): Obtain smart contract-based insurance that covers losses from USDT depegs or protocol failures. These policies can be tailored for specific platforms or assets, providing compensation in the event of a catastrophic loss and complementing other hedging strategies.

This approach is highly customizable: you can select coverage periods that align with upcoming regulatory events or market catalysts. Payouts are typically automatic upon breach of the depeg condition, providing rapid liquidity when you need it most.

2. Diversify Stablecoin Holdings Across Multiple Issuers and Blockchains

No matter how sophisticated your hedging tools are, concentration risk remains a silent killer in DeFi portfolios. By allocating your stablecoin exposure across alternatives like USDC, DAI, TUSD, and LUSD, you reduce reliance on any single issuer or governance model. Going further, distributing assets across multiple blockchains (Ethereum mainnet, Polygon, Arbitrum) adds another layer of redundancy against protocol-specific failures or chain-level outages.

- Diversification doesn’t eliminate risk entirely but ensures that even if USDT collapses, you retain liquidity and value elsewhere.

- This strategy is actionable for both retail wallets and institutional treasuries; rebalancing can be automated via smart contracts or managed through multi-sig setups.

Tether (USDT) Price Prediction 2026-2031: Stablecoin Peg Scenarios

Professional outlook on USDT price stability and depeg risks for DeFi users

| Year | Minimum Price (Bearish Scenario) | Average Price (Expected) | Maximum Price (Bullish Scenario) | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.97 | $1.00 | $1.02 | 0% | Peg remains stable, minor volatility from regulatory news |

| 2027 | $0.95 | $0.99 | $1.03 | -1% | Slight increase in competition and regulatory scrutiny; isolated depeg events possible |

| 2028 | $0.90 | $0.98 | $1.04 | -1% | Rise of decentralized stablecoins; potential for short-lived depegs during market stress |

| 2029 | $0.92 | $0.99 | $1.05 | +1% | Improved transparency and reserves; USDT regains trust after previous volatility |

| 2030 | $0.94 | $1.00 | $1.06 | +1% | Wider adoption in emerging markets stabilizes demand |

| 2031 | $0.96 | $1.00 | $1.07 | 0% | Mature stablecoin ecosystem; USDT maintains relevance despite evolving landscape |

Price Prediction Summary

USDT is expected to largely maintain its $1.00 peg over the next six years, with periodic volatility driven by regulatory developments, transparency concerns, and competition from decentralized stablecoins. Minimum price predictions account for possible depeg events, though these are anticipated to be short-lived due to market mechanisms and hedging strategies. Maximum scenarios reflect periods of renewed confidence or market flight-to-safety. Overall, USDT’s status as a leading stablecoin is likely to persist, but users should remain vigilant and consider hedging strategies against rare but impactful depeg risks.

Key Factors Affecting Tether Price

- Regulatory scrutiny and legal actions against Tether

- Transparency and frequency of reserve audits

- Emergence and adoption of decentralized stablecoins (e.g., DAI, LUSD)

- Liquidity and market depth on major exchanges

- Adoption of robust DeFi hedging instruments and insurance protocols

- Technological improvements in stablecoin issuance and redemption mechanisms

- Macroeconomic events affecting fiat-backed reserves (e.g., banking crises)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

3. Purchase On-Chain DeFi Insurance Policies

If you want true peace of mind – especially as an institution with fiduciary obligations – consider purchasing smart contract-based insurance policies from providers like Nexus Mutual or InsurAce. These products allow you to specify coverage for losses stemming from USDT depegs or protocol failures; claims are typically processed via decentralized governance mechanisms or automated triggers tied to on-chain data feeds.

Top DeFi Insurance Protocols for Stablecoin Depeg Risk

-

Utilize Depeg Derivatives and Structured Products (e.g., Y2K Finance, Cork Protocol): Access purpose-built on-chain products like Y2K Finance and Cork Protocol to hedge against USDT depeg events. These platforms offer depeg protection derivatives and hedge vaults that pay out if USDT falls below a set threshold, allowing users to tailor coverage to their risk appetite and gain direct exposure to depeg risk.

-

Diversify Stablecoin Holdings Across Multiple Issuers and Blockchains: Reduce single-asset risk by allocating your stablecoin portfolio across alternatives such as USDC, DAI, TUSD, and LUSD, and by holding assets on multiple blockchains. This strategy helps ensure liquidity and value retention even if USDT suffers a depeg or protocol failure, providing a buffer against systemic shocks.

-

Purchase On-Chain DeFi Insurance Policies (e.g., Nexus Mutual, InsurAce): Obtain smart contract-based insurance from leading protocols like Nexus Mutual and InsurAce. These policies can cover losses from USDT depegs or protocol failures, providing tailored protection and compensation in the event of a catastrophic loss—an essential complement to other hedging strategies.

This layer of protection complements other strategies by providing direct compensation in catastrophic scenarios where even diversified portfolios suffer correlated losses across multiple assets.

It’s important to recognize that on-chain insurance has matured rapidly, with policies now tailored for both retail and institutional needs. For example, Nexus Mutual’s stablecoin cover can be structured to compensate users if USDT trades below a set threshold (such as $0.98) for a defined period. InsurAce offers similar flexibility, allowing users to select the stablecoins and protocols they wish to insure, along with customizable coverage limits.

Pro tip: Pairing depeg derivatives with insurance policies creates a dual-layered defense, one pays out on volatility events, the other on outright losses. This redundancy is especially valuable during market-wide stress.

Risk Management in Practice: Building a Resilient DeFi Portfolio

Strategic hedging isn’t about prediction, it’s about preparation. Start by assessing your current exposure: what percentage of your portfolio sits in USDT? How much is concentrated on a single chain or protocol? Then implement the following actionable steps:

- Allocate capital to depeg derivatives: Use Y2K Finance or Cork Protocol to purchase coverage that matches your risk horizon and portfolio size.

- Diversify across stablecoins and chains: Don’t just split between USDT and USDC, include decentralized options like DAI or LUSD, and consider bridging assets across Polygon, Arbitrum, or other robust networks.

- Layer in insurance: Select tailored policies from Nexus Mutual or InsurAce that specifically address protocol failures or stablecoin depegs relevant to your holdings.

Remember that no single strategy is bulletproof. The most resilient portfolios layer these approaches: direct hedges via derivatives, broad diversification, and insurance as the final safety net. Regularly review allocations as market conditions evolve, especially if regulatory winds shift or if you see unusual activity in Tether’s reserves reports.

Navigating Volatility at $1.00: Why Proactive Hedging Matters

With USDT’s price steady at $1.00, complacency can be tempting. But history shows that stability is often fleeting when confidence falters, especially under systemic stress or regulatory scrutiny. By proactively deploying these three hedging pillars, depeg derivatives, diversification, and on-chain insurance, you transform tail risks into manageable exposures rather than existential threats.

If you’re seeking deeper guidance on constructing a robust DeFi defense against the next potential depeg event, explore our comprehensive resource at /best-hedging-strategies-for-usdt-depeg-events-in-defi.