Stablecoins are the backbone of DeFi, but their promise of a $1.00 peg is constantly stress-tested by market volatility, protocol exploits, and systemic fragility. As of now, Polygon Bridged USDT (USDT) is trading at exactly $1.00 with zero deviation in the last 24 hours – a snapshot of stability that belies deeper structural risks lurking beneath the surface. The question every serious DeFi participant should be asking: How do we future-proof stablecoins against the next depeg event?

Why Traditional Stablecoin Models Are Vulnerable

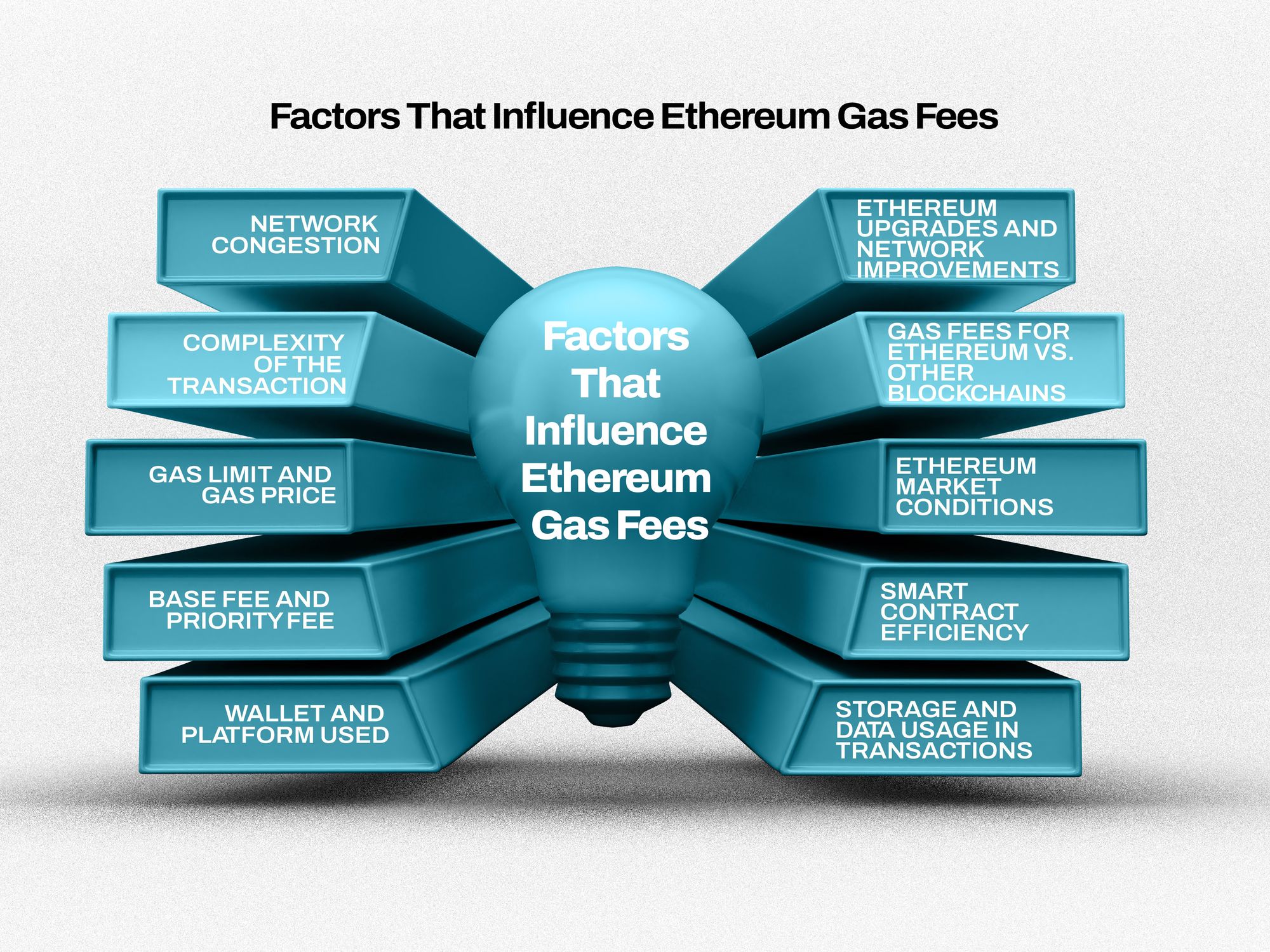

The core design of most stablecoins – including USDT and USDC – relies on issuing tokens across multiple blockchains (Ethereum, Tron, Polygon, etc. ), each with its own consensus rules, fee structures, and bridge dependencies. This fragmentation introduces critical attack vectors: bridge hacks, inconsistent collateralization reporting, and dependency on external gas tokens for transfers. For example, users moving USDT on Ethereum must manage both USDT and ETH for gas fees; if ETH spikes or congests, stablecoin usability suffers.

According to Cointelegraph, depegs can occur due to insufficient collateralization or sudden loss of trust – factors amplified by fragmented liquidity and technical friction between chains.

USDT-Native Blockchains: A Paradigm Shift for Risk Mitigation

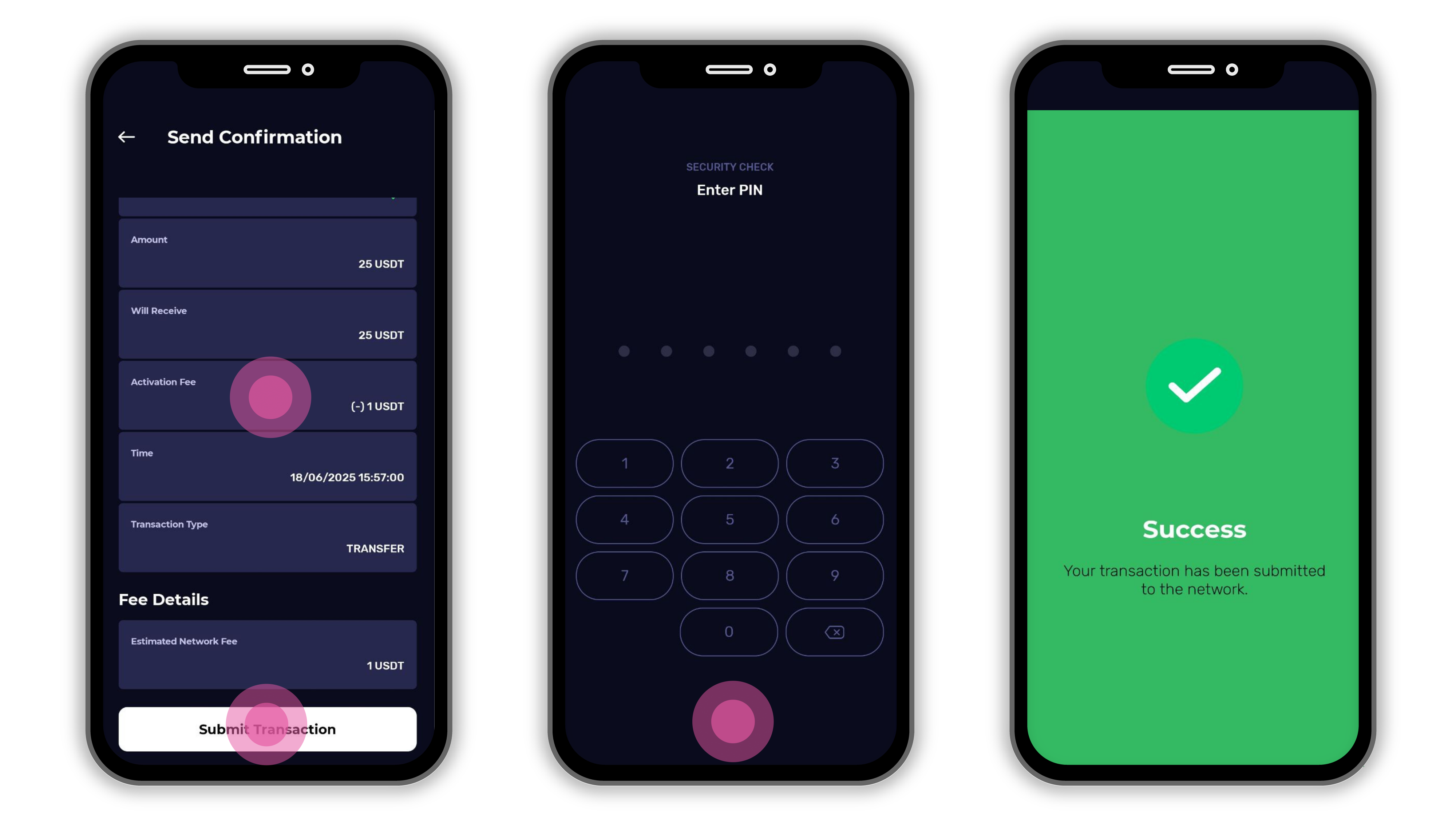

Enter Stablechain and other USDT-native blockchains. Unlike legacy Layer 1s where stablecoins are just another token standard (ERC-20, TRC-20), these new platforms are engineered from the ground up for stablecoin-centric operations. They eliminate the dual-token problem by making USDT itself the native asset for gas fees and settlement. The result? Gas-free transfers, sub-second settlement times, and a single-asset interface that drastically reduces user error and operational risk.

Tether’s move to launch native rails on Bitcoin via RGB protocol is another signal that stablecoin issuers see value in tighter integration with underlying infrastructure (source). By leveraging client-side validation and removing reliance on external bridges or wrapped assets, these protocols aim to close off key vectors for depegging attacks.

The Mechanics Behind Enhanced Stability

Collateralization transparency is radically improved with native blockchains. Every unit of USDT issued can be tracked directly within the chain’s ledger without ambiguity from cross-chain bridges or synthetic representations. This means real-time proof-of-reserves becomes feasible at the protocol level – not just through third-party attestations – giving traders actionable data to monitor peg health.

The governance layer also gets an upgrade. With decentralized voting mechanisms built into Stablechain’s architecture, adjustments to risk parameters or emergency interventions can be executed swiftly by stakeholders themselves rather than waiting on centralized teams. This agile response loop is essential when seconds count during market shocks.

Tether (USDT) Price Stability Prediction Across Blockchains: 2026-2031

Projected USDT Price Ranges Considering USDT-Native Blockchain Adoption and Depegging Risk Mitigation

| Year | Minimum Price (Bearish Scenario) | Average Price (Expected) | Maximum Price (Bullish Scenario) | Year-over-Year Change (%) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.01 | +0.0% | USDT-native blockchains begin mainstream adoption; slight depeg risk remains on legacy chains |

| 2027 | $0.985 | $1.00 | $1.015 | +0.0% | Increased transparency and collateralization; minor depeg events possible during high volatility |

| 2028 | $0.99 | $1.00 | $1.02 | +0.0% | USDT-native chains dominate issuance; depeg risk significantly reduced except during systemic crypto shocks |

| 2029 | $0.99 | $1.00 | $1.02 | +0.0% | Regulatory clarity and global adoption; rare, brief depegs during black swan events |

| 2030 | $0.99 | $1.00 | $1.025 | +0.0% | USDT widely integrated in DeFi and payments; robust infrastructure keeps peg highly stable |

| 2031 | $0.99 | $1.00 | $1.03 | +0.0% | USDT achieves near-cash equivalence in digital markets; max price reflects rare upside premium in liquidity crunches |

Price Prediction Summary

USDT is expected to maintain a stable $1.00 average price across 2026-2031, thanks to advances in USDT-native blockchains that directly address depegging risks. Minimum prices reflect rare, short-lived depeg scenarios, while maximum prices account for brief periods of heightened demand or market stress. The overall outlook is one of increasing stability, with the peg holding firm in most market conditions.

Key Factors Affecting Tether Price

- Adoption of USDT-native blockchains (e.g. Stablechain) reducing technical and operational depeg risks

- Enhanced collateralization, transparency, and real-time audits boosting user confidence

- Decentralized, responsive governance models enabling swift response to market events

- Regulatory developments in the US, EU, and Asia affecting stablecoin usage and trust

- Integration with DeFi, payments, and cross-chain protocols expanding USDT utility

- Competition from other stablecoins (USDC, DAI, CBDCs) and technological innovations in the sector

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

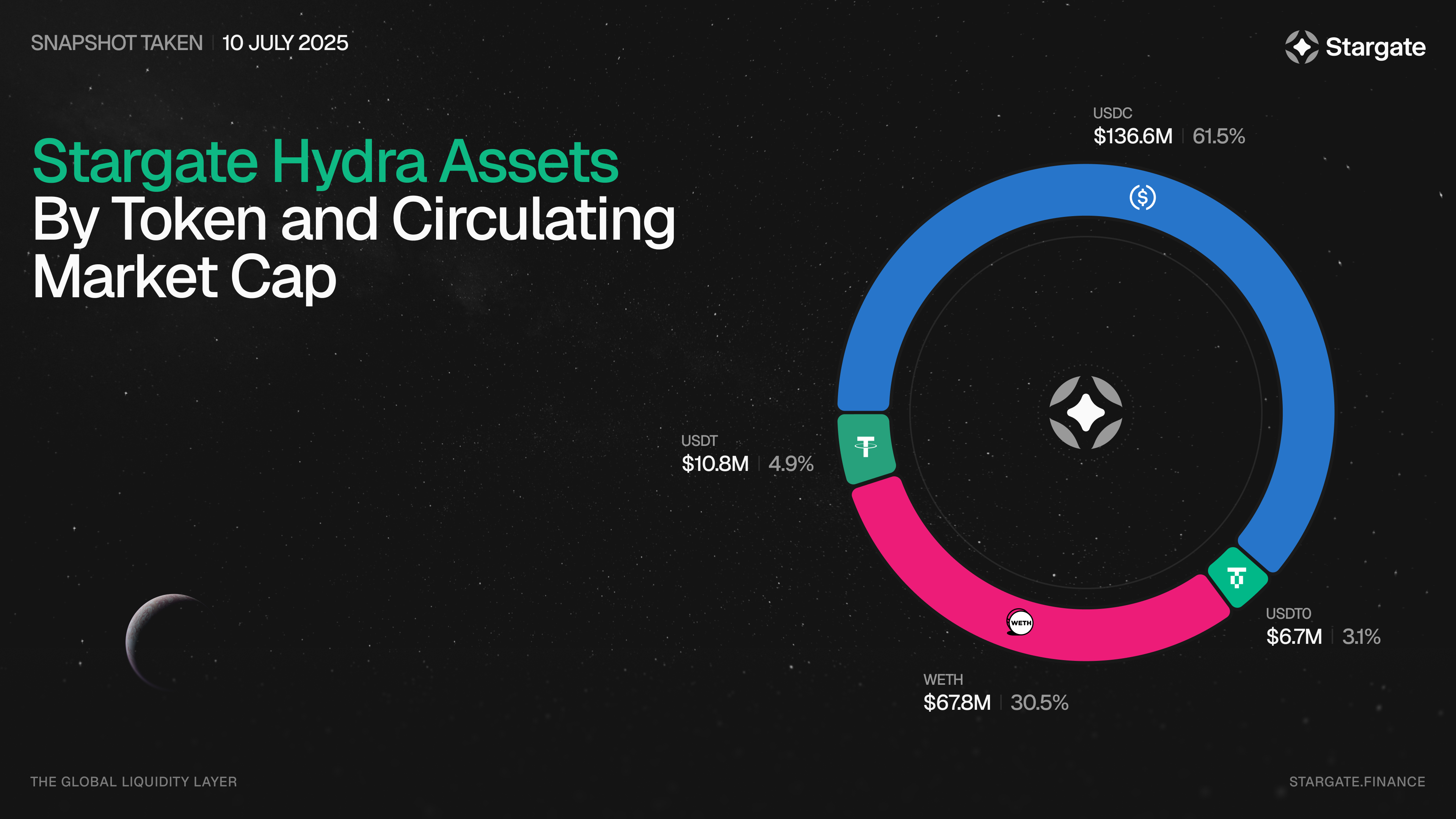

Liquidity Aggregation and Protocol Composability

A major driver behind previous depeg cascades was fragmented liquidity pools across DeFi protocols (reference). On Stablechain-style networks where all dApps natively use USDT as their base asset, liquidity becomes unified rather than siloed, making it much harder for isolated runs or lending liquidations to snowball into broader peg breaks.

Key Risks: Multi-Chain Stablecoins vs USDT-Native Chains

-

Collateral Fragmentation: Traditional multi-chain stablecoins like USDT and USDC are issued across multiple blockchains (Ethereum, Tron, Polygon), creating fragmented collateral pools. This can obscure reserve transparency and increase depeg risk during market stress.

-

Bridge Vulnerabilities: Multi-chain stablecoins rely on cross-chain bridges (e.g., Wormhole, Multichain), which are frequent targets for exploits. Bridge hacks have led to major depegging events and loss of user funds.

-

Fee Volatility & Gas Management: On legacy chains, users must manage both stablecoin and native gas tokens (e.g., ETH, TRX, MATIC). Spikes in gas fees can delay transactions and create arbitrage opportunities that threaten the peg.

-

Unified Collateral & Transparency: USDT-native blockchains like Stablechain integrate collateral management directly into the protocol, enabling real-time, on-chain verification of reserves and reducing opacity.

-

Elimination of Bridge Risk: Native chains remove the need for external bridges, drastically reducing the attack surface for exploits and ensuring stablecoin transfers remain secure within a single ecosystem.

-

Predictable, Low-Cost Transfers: Platforms like Stable offer gas-free USDT transfers and sub-second settlement, removing fee volatility and supporting consistent stablecoin usability—even during network congestion.

-

Resilience to Market Runs: With integrated governance and liquidity management, USDT-native chains can respond rapidly to market stress, reducing the risk of destabilizing runs seen in fragmented multi-chain models.

This isn’t just theory, the operational improvements are measurable:

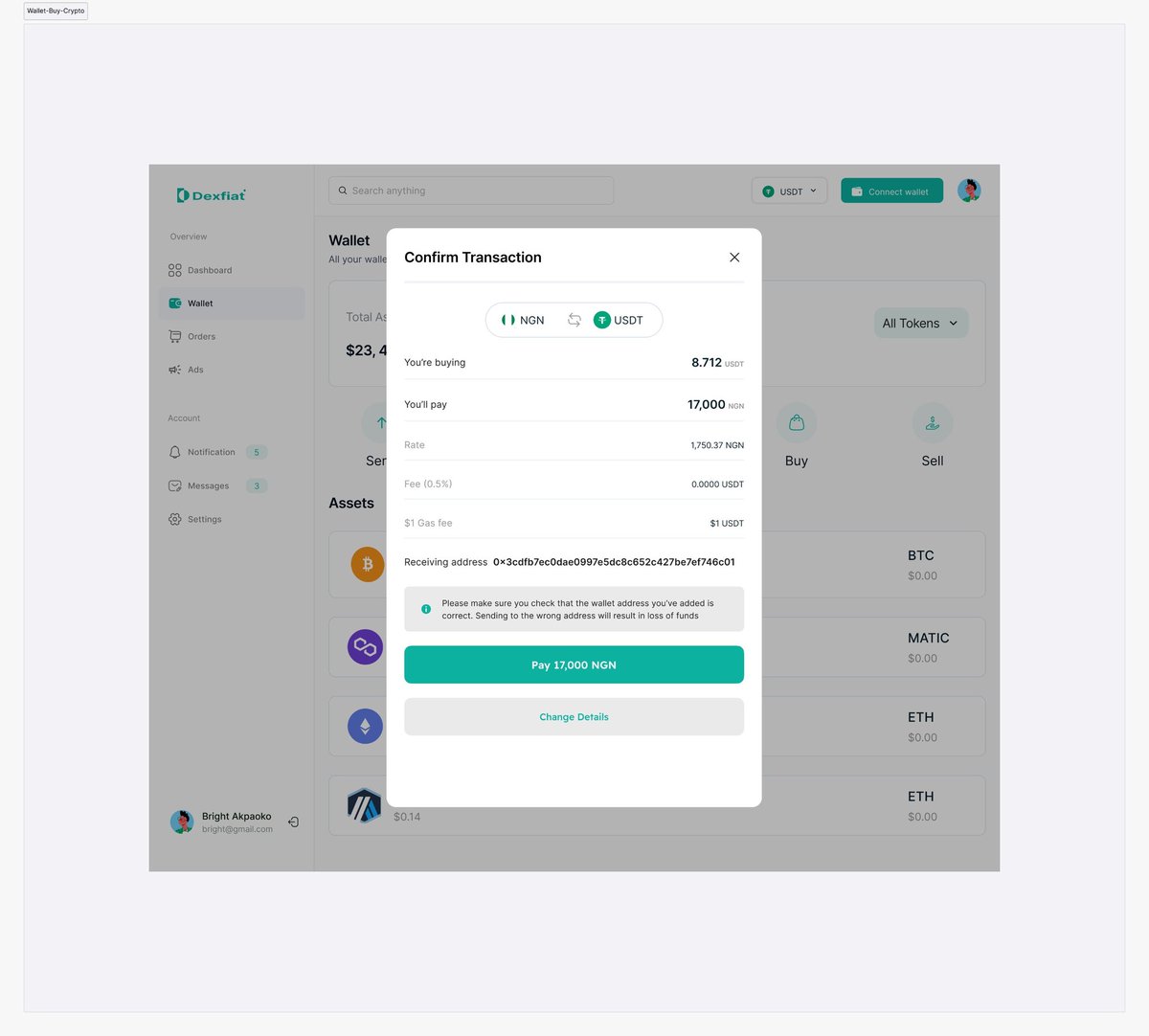

- No more surprise gas fee spikes: All transactions settle in native USDT

- No bridging risk: Elimination of wrapped assets slashes exploit vectors

- Simplified UX: Onboarding retail users becomes frictionless with single-token logic

- Aggressive composability: Protocols can integrate directly atop native rails without translation layers slowing execution

But the real edge comes in how these USDT-native chains like Stablechain empower active risk management. When every DeFi protocol, lending market, and DEX settles natively in USDT, you unlock a feedback loop for instant, on-chain risk analytics. If outflows spike or liquidity dries up in a particular sector, the data is visible and actionable, no more waiting for off-chain oracles or delayed bridge attestations. That’s a seismic shift for traders who need to hedge depeg exposure in real time.

Gasless Transfers and Real-Time Settlement: The New Standard

Gas-free USDT transfers aren’t just a UX win, they’re a protocol-level defense against depeg spirals triggered by network congestion or fee volatility. When users don’t have to scramble for native gas tokens (ETH, TRX, MATIC), there’s no forced selling pressure on USDT during network stress events. The entire stablecoin economy becomes more resilient because transfer friction is eliminated at the source (theblock.co). Sub-second settlement closes the window for front-running and sandwich attacks that can destabilize pools during high volatility.

Consider the current price of Polygon Bridged USDT (USDT) at $1.00. In traditional ecosystems, even minor congestion can cause slippage or delays that threaten this peg. On Stablechain-style rails, deterministic settlement means less room for arbitrageurs to exploit latency, every $1.00 transfer remains exactly that.

Protocol Risk Hedging in DeFi: What Changes?

With native stablecoin rails, DeFi protocols gain new tools for automated risk hedging:

- Built-in circuit breakers: Protocols can pause markets instantly if abnormal flows threaten the peg

- On-chain insurance triggers: Automatic payouts if USDT deviates from $1.00 by predefined thresholds

- Liquidity monitoring bots: Continuous surveillance of pool depth and utilization rates across all dApps

This is next-level protocol risk management, one that moves from reactive damage control to proactive stability engineering.

What Comes Next? Composability Meets Security

The composability of native stablecoin blockchains will catalyze a new wave of DeFi primitives: derivatives settled directly in USDT with zero bridging risk, flash loans with atomic settlement guarantees, and insurance products that pay out instantly when peg deviations are detected, all built atop a singular liquidity layer.

Key Advantages of Building DeFi on Stablechain

-

Direct USDT Integration: Stablechain is purpose-built for USDT, enabling seamless, gas-free stablecoin transfers without the need for native gas tokens like ETH or TRX. This eliminates friction and reduces user error.

-

Minimized Depeg Risk: By anchoring USDT issuance and settlement natively, Stablechain reduces reliance on third-party bridges and minimizes exposure to smart contract exploits that have historically caused depegging on legacy chains.

-

Sub-Second Settlement: Stablechain offers sub-second transaction finality for USDT, dramatically improving DeFi protocol responsiveness compared to congested legacy networks like Ethereum.

-

Transparent Collateralization: Native integration allows for real-time, on-chain verification of USDT collateral, increasing transparency and user trust—key factors in maintaining price stability at $1.00 (latest USDT price).

-

Stable and Predictable Fees: Unlike legacy chains with volatile gas fees, Stablechain is designed for predictable, minimal transaction costs, making DeFi more accessible and cost-effective for users.

-

Enhanced Security and Governance: Stablechain leverages robust consensus and decentralized governance tailored for stablecoin operations, enabling rapid response to market threats and protocol upgrades.

The upshot? For both institutional desks and retail users, hedging stablecoin depeg risk shifts from an afterthought to an integrated feature set. No more duct-taping together bridges, collateral managers, and gas wallets, Stablechain-style infrastructure bakes security into every transaction.

Action Steps for Investors and Protocol Builders

- Monitor real-time proof-of-reserves dashboards: Use chain-native analytics to track peg health minute-by-minute.

- Diversify across natively integrated protocols: Favor dApps built directly atop Stablechain-style rails over legacy bridged solutions.

- Deploy automated hedging strategies: Use composable derivatives or insurance products that settle instantly when volatility strikes.

- Stay informed about governance proposals: Participate in votes that shape protocol-level risk parameters, speed matters in volatile markets.

The future of stablecoin security is unfolding now, and it’s being written by those who move fastest to adopt native solutions engineered for resilience. As always: speed and precision win when volatility returns.