In decentralized finance, oracles are the critical bridge between on-chain smart contracts and off-chain price data. Yet, this reliance introduces a subtle but potent risk: when oracles lag or malfunction, DeFi protocols can be blindsided by unexpected liquidations and systemic shocks. Recent events have made it clear that oracle risk in DeFi is not just theoretical – it is a present and material threat to both protocol solvency and user capital.

Oracles: The Hidden Fault Line Beneath DeFi Stability

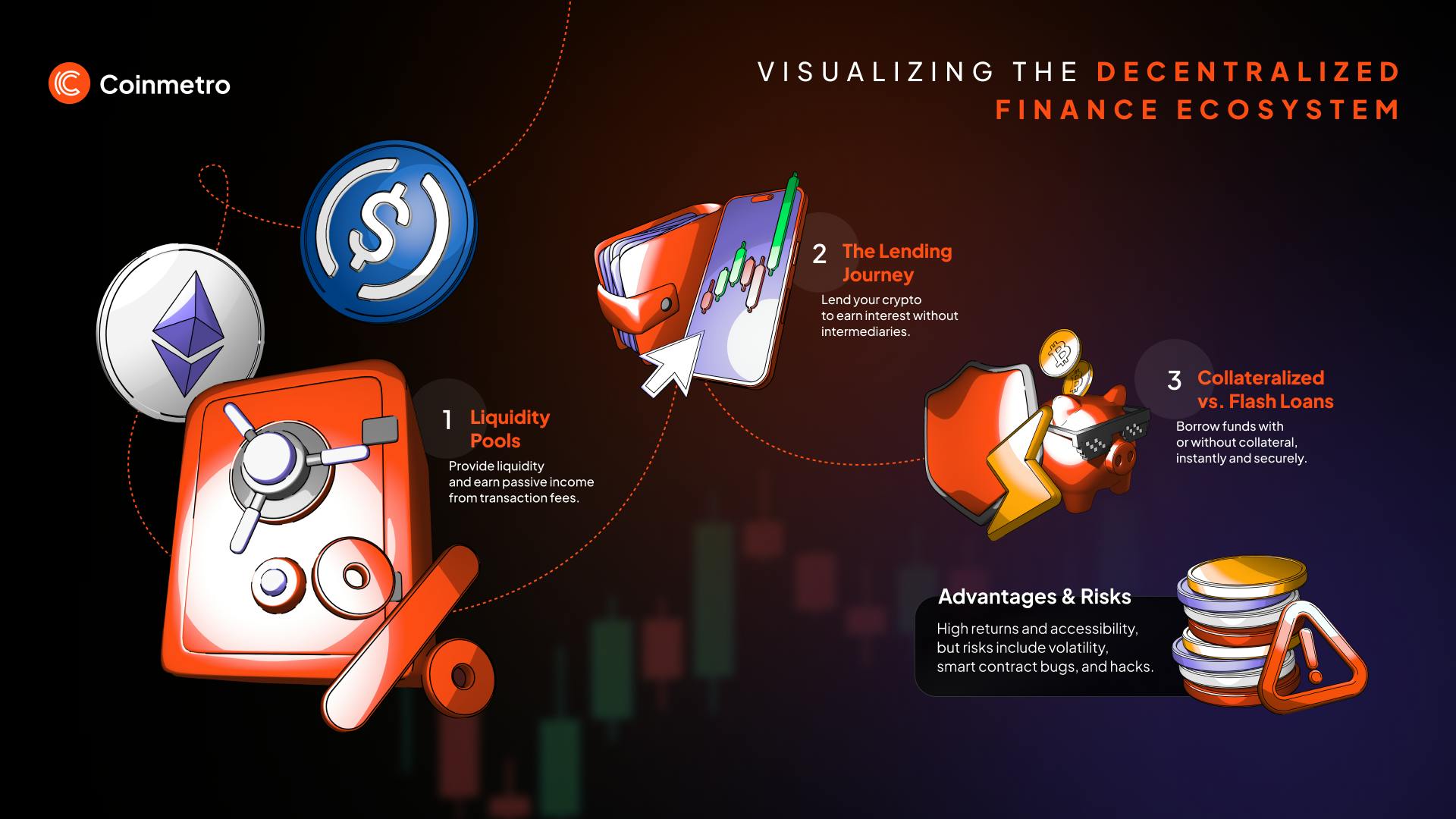

Oracles aggregate asset prices from multiple sources before pushing them on-chain. Their main job is to ensure that collateral valuations, loan-to-value ratios, and liquidation triggers remain accurate even during volatile markets. But what happens when this backbone falters?

The answer came into sharp focus on May 29,2025, when a Chainlink oracle malfunction delivered an incorrect price feed for the deUSD stablecoin on Avalanche. In just minutes, over $500,000 was forcibly liquidated as smart contracts acted on faulty data. The event reignited debate about whether current oracle designs are robust enough for the scale and complexity of modern DeFi.

How Oracle Delays Morph Into Liquidation Traps

The risks posed by delayed or failed oracles are both direct and insidious. When prices arrive late or are manipulated upstream, smart contracts may liquidate healthy positions or overlook under-collateralized ones until it’s too late.

Real-World DeFi Losses Caused by Oracle Issues

-

Chainlink Oracle Malfunction on Avalanche (May 2025): On May 29, 2025, a Chainlink price feed error for the deUSD stablecoin on the Avalanche blockchain reported incorrect price data. This malfunction triggered forced liquidations totaling over $500,000 in losses within minutes, highlighting the systemic risks posed by oracle reliability lapses. [Source]

-

Synthetix Oracle Failure (June 2019): The Synthetix protocol suffered a major incident when its off-chain oracle provider submitted erroneous price data, resulting in the accidental creation of over $1 billion in synthetic assets. Although the funds were eventually recovered, the event exposed the critical risks of relying on a single off-chain data source for DeFi protocols. [Source]

-

MakerDAO Black Thursday (March 2020): During the March 2020 crypto market crash, Ethereum network congestion caused significant oracle delays for MakerDAO. As a result, many vaults became under-collateralized and were liquidated at zero bids, leading to over $8 million in user losses and highlighting the dangers of oracle lag during periods of extreme volatility. [Source]

Inaccurate Liquidations: If an oracle reports outdated prices during rapid market swings, positions that should be safe can be flagged as under-collateralized. This causes unnecessary liquidations – a loss for users who did everything right.

Under-Collateralization: Conversely, if price updates are delayed while markets crash, some vaults remain open even as their collateral value collapses below safe thresholds. This exposes protocols to bad debt and systemic risk.

Cascading Failures: One protocol’s liquidation event can spark a domino effect across interconnected platforms. As highlighted by recent research (arxiv. org), these chain reactions amplify tail risks throughout the ecosystem.

The Anatomy of an Oracle-Induced Liquidation Event

To appreciate the mechanics at play, consider this scenario: A stablecoin like Dai experiences a brief price spike due to manipulated oracle data (as documented by the Bank for International Settlements). Protocols relying blindly on that feed will trigger mass liquidations even if the underlying collateral remains sufficient at true market prices.

This is not just hypothetical – similar patterns were observed during the March 2020 crypto crash when network congestion caused MakerDAO vaults to become under-collateralized simply because price updates couldn’t arrive fast enough (DefiDollar Docs). The result: users lost funds not from market moves but from infrastructure failures hidden deep within protocol plumbing.

Beyond the headline-grabbing figures, the core issue is that oracle failure in DeFi protocols is often invisible until losses are realized. Unlike traditional finance, where circuit breakers and human oversight can intervene, DeFi systems execute liquidations automatically based on whatever data the oracle provides, accurate or not. This makes delayed liquidation DeFi events both sudden and difficult to reverse.

The silent risk compounds as more protocols interconnect. A single oracle mishap can propagate through lending markets, synthetic assets, and even DEX liquidity pools. A manipulated or lagging price feed doesn’t just affect one set of positions; it can ripple across the ecosystem as collateral valuations are recalculated en masse. The resulting forced sales depress asset prices further, creating a feedback loop that accelerates liquidations elsewhere. This is systemic risk in real time.

Building Resilience: Practical Steps for DeFi Liquidation Risk Mitigation

So how do protocols, and users, hedge against these hidden threats? The answer lies in layered defense strategies that blend technical improvements with user-focused insurance products:

5 Actionable Ways to Mitigate Oracle Risk in DeFi

-

Implement Redundant Oracle Networks: Use multiple, independent oracle providers (such as Chainlink, Band Protocol, and API3) to cross-verify price feeds, reducing reliance on a single data source and minimizing the impact of individual oracle failures.

-

Deploy Staleness Detection Mechanisms: Integrate automated checks that flag and reject outdated or unresponsive price data, ensuring smart contracts only act on timely and accurate information. This can prevent liquidations triggered by lagging oracles.

-

Integrate Emergency Shutdown Procedures: Enable protocol-level emergency shutdowns, as seen in MakerDAO’s Emergency Shutdown, to halt operations and protect user funds during severe oracle disruptions.

-

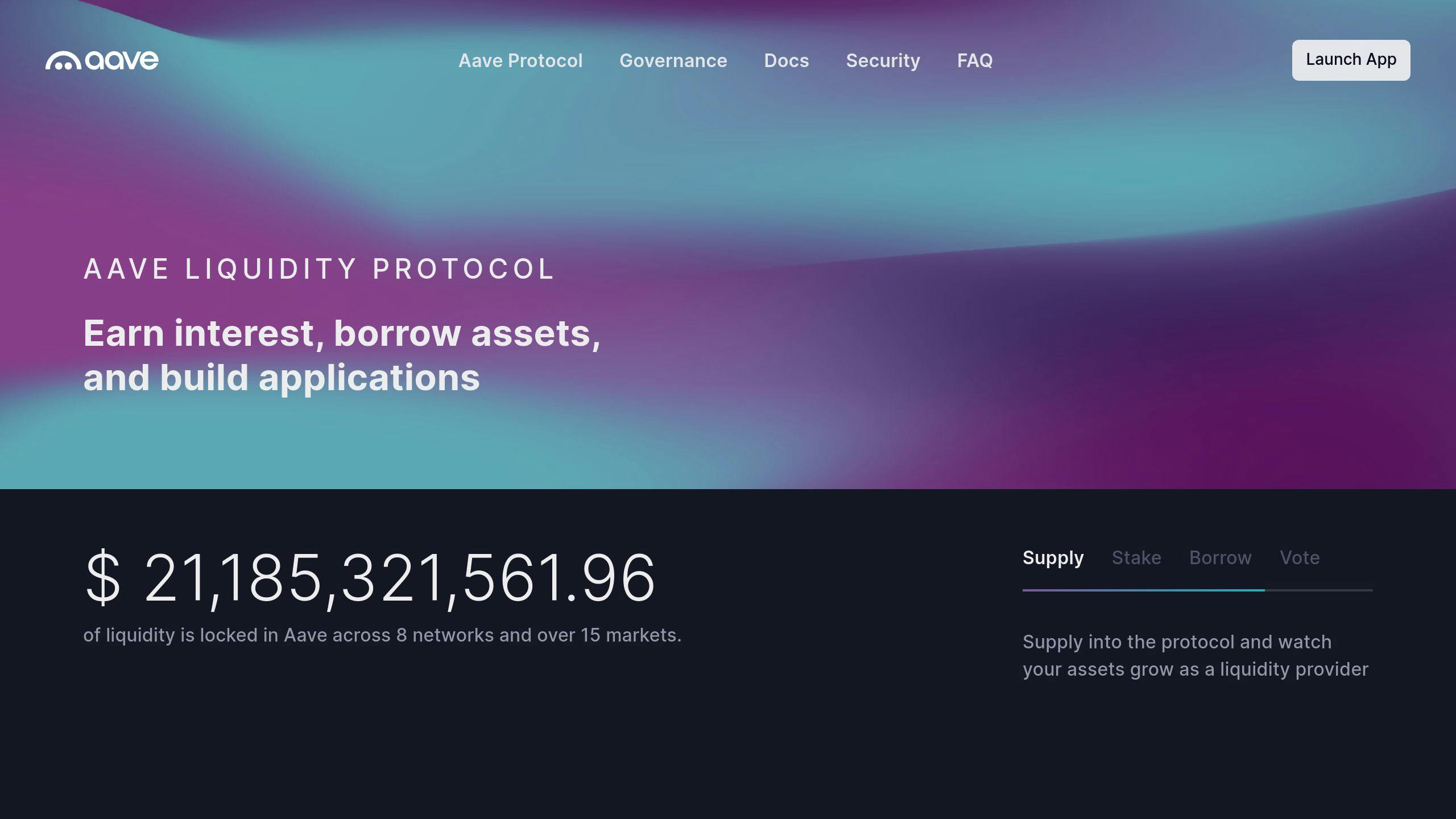

Utilize DeFi Insurance Solutions: Leverage established insurance protocols like Nexus Mutual and InsurAce to cover losses from oracle failures and unexpected liquidations, enhancing user protection.

Redundant Oracles: By aggregating data from multiple independent sources and requiring consensus before updating prices on-chain, protocols can minimize single-point-of-failure risk. This approach is gaining traction among blue-chip platforms seeking to harden their infrastructure against manipulation or downtime.

Staleness Detection and Emergency Shutdowns: Smart contracts can be programmed to recognize when price feeds become stale or deviate significantly from expected ranges. In such cases, automated circuit breakers or emergency shutdowns can pause liquidations until accurate data resumes (DefiDollar Docs). While disruptive in the short term, these measures protect user funds from erroneous mass liquidations.

User-Focused Insurance Products: For investors seeking direct protection, new forms of DeFi protocol failure insurance are emerging. These products compensate users for losses resulting from documented oracle failures or delayed liquidation events, offering a financial safety net where technical solutions may fall short.

The Evolving Role of Risk Analytics

The next frontier in safeguarding DeFi is real-time risk analytics. Platforms like DepegWatch are developing dashboards that monitor oracle health metrics and alert users when feeds lag behind market prices or exhibit suspicious volatility patterns. By empowering both protocol teams and end-users with timely information, these tools make it possible to act before a minor delay escalates into a major loss event.

[price_widget: Real-time price widget displaying current deUSD stablecoin value]

The future of decentralized finance hinges on addressing these hidden risks head-on. As capital flows into increasingly complex protocols and cross-chain ecosystems, robust oracle risk DeFi management will define which platforms endure, and which fall victim to silent killers lurking beneath their codebase.