As of September 21,2025, Tether (USDT) is trading at a steady $1.00, with no recent volatility in its pegged value. Yet, the DeFi community remains acutely aware that even the most established stablecoins are not immune to depegging risks. Events like the June 2023 USDT sell-off, triggered by large holders on Curve, serve as stark reminders: robust hedging strategies are essential for both institutional and retail users seeking to protect their portfolios from sudden value shocks.

Understanding USDT Depeg Risk in DeFi

Stablecoins underpin much of decentralized finance, but their promise of price stability is only as strong as their underlying collateral and market trust. A USDT depeg – when Tether trades below its intended $1.00 value – can cascade through lending markets, DEX liquidity pools, and collateralized positions. For risk-conscious investors, proactive hedging is not just prudent; it’s fundamental.

Below we explore five proven strategies for managing USDT depeg risk in DeFi. Each method is tailored to today’s market context and regulatory climate, offering actionable tools for both everyday users and sophisticated market participants.

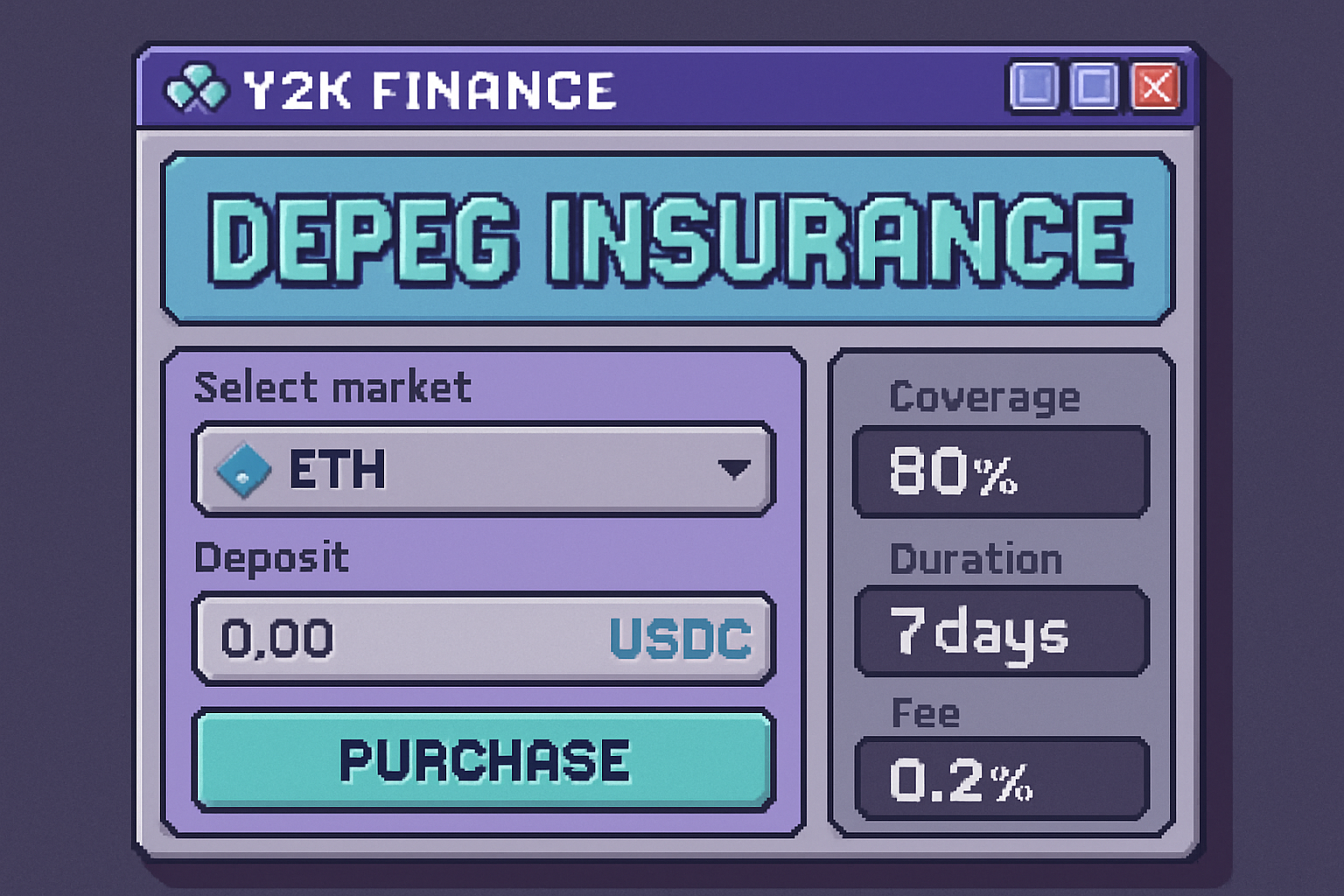

1. Purchase USDT Depeg Insurance via Protocols like Y2K Finance or InsurAce

Depeg insurance has emerged as a primary line of defense against stablecoin instability. Protocols such as Y2K Finance and InsurAce allow users to purchase coverage that pays out if USDT falls below a specific threshold (for example, $0.98). This approach is particularly effective for those with substantial exposure to USDT in lending protocols or liquidity pools.

The key advantage here is automated risk transfer. Instead of manually monitoring markets around the clock, insured parties receive compensation when pre-defined depeg events occur – providing peace of mind during turbulent periods.

Top 5 Hedging Strategies for USDT Depeg Risk in DeFi

-

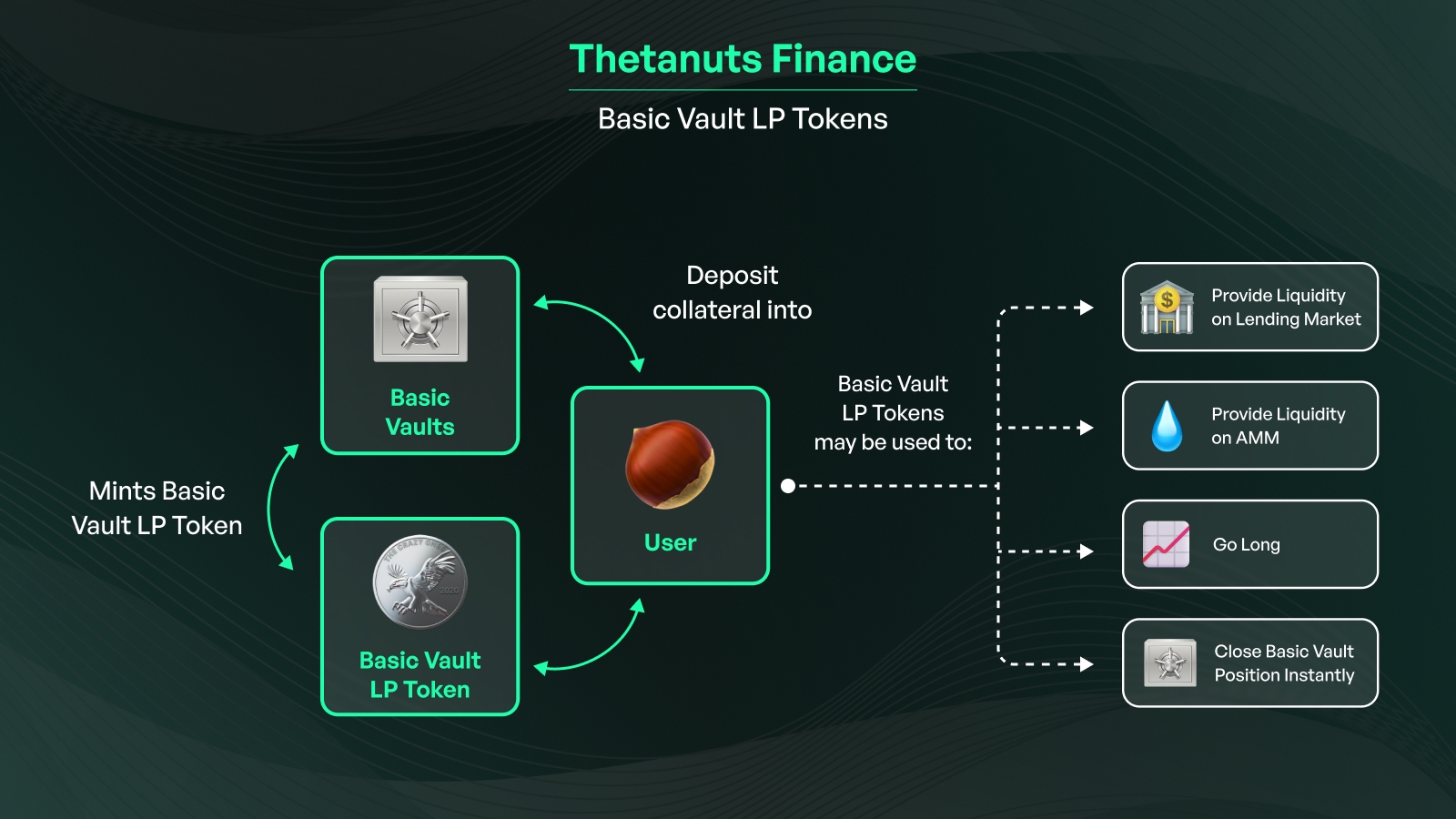

Purchase USDT Depeg Insurance via Protocols like Y2K Finance or InsurAce: These DeFi insurance platforms offer specialized coverage against stablecoin depeg events, allowing users to hedge USDT exposure by purchasing protection that pays out if USDT falls below its peg.

-

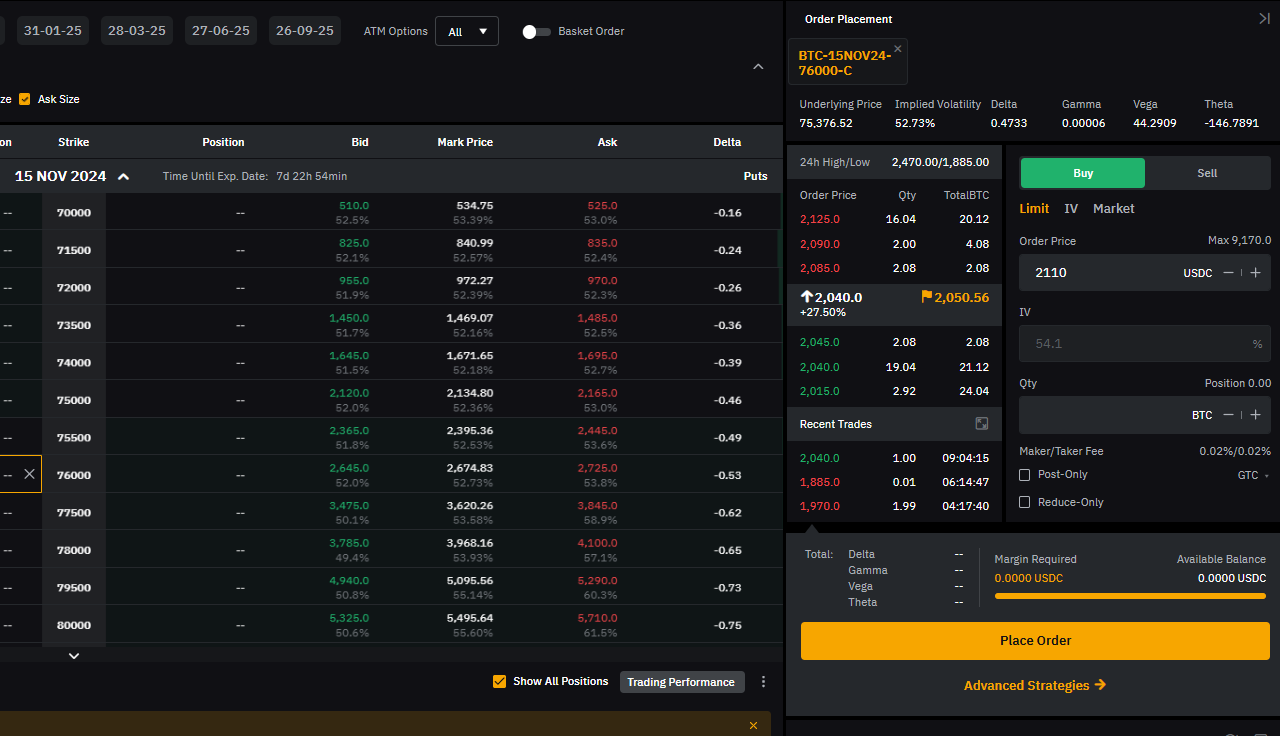

Utilize Put Options on USDT or USDT Trading Pairs (where available) to Profit from Downside Moves: Options protocols occasionally offer put options on USDT or related pairs, enabling users to hedge against price drops by locking in the right to sell USDT at a predetermined price.

-

Monitor On-chain Analytics and Automated Alerts for Early Depeg Signals and Rapid Rebalancing: Leverage on-chain analytics tools and set up automated alerts (e.g., via Dune Analytics, DeFiLlama, or ParaSwap) to detect early signs of depegging and rebalance portfolios swiftly to minimize losses.

2. Short USDT Using Perpetual Swaps on Decentralized Derivatives Platforms (e. g. , dYdX, GMX)

If you anticipate a potential drop in USDT’s value, shorting with perpetual swaps offers direct downside protection. Platforms like dYdX and GMX enable users to open leveraged short positions against USDT or related trading pairs. Should a depeg event occur – even briefly – profits from these shorts can offset losses incurred elsewhere in your portfolio.

This method requires careful position management and an understanding of funding rates and liquidation risks inherent to perpetual contracts. However, it remains one of the most responsive tools available for active traders facing imminent market stress.

3. Utilize Put Options on USDT or USDT Trading Pairs (Where Available)

Put options provide asymmetric protection: by paying a premium upfront, you gain the right (but not the obligation) to sell USDT at a set price should its value decline below $1.00. While liquidity for direct USDT options remains limited compared to major cryptocurrencies like BTC or ETH, some platforms have begun offering structured products tailored to stablecoin hedging needs.

This strategy appeals to those seeking capped downside exposure without committing capital to margin requirements or facing liquidation risks typical of futures markets.

Tether (USDT) Price Prediction 2026-2031: Stablecoin Peg Outlook

A professional forecast of USDT price stability, considering DeFi hedging strategies and potential depeg risks.

| Year | Minimum Price | Average Price | Maximum Price | % Change (from $1 Peg) | Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.97 | $1.00 | $1.02 | -3% to +2% | Stable with brief depeg risk during market volatility |

| 2027 | $0.96 | $1.00 | $1.03 | -4% to +3% | Increased regulatory scrutiny; minor depegs possible |

| 2028 | $0.95 | $1.00 | $1.04 | -5% to +4% | Competition from CBDCs and new stablecoins; transparency focus |

| 2029 | $0.96 | $1.00 | $1.03 | -4% to +3% | Improved collateralization and market infrastructure |

| 2030 | $0.97 | $1.00 | $1.02 | -3% to +2% | Mature stablecoin market, high liquidity |

| 2031 | $0.98 | $1.00 | $1.02 | -2% to +2% | Widespread DeFi adoption, robust hedging tools |

Price Prediction Summary

USDT is expected to maintain its $1.00 peg on average through 2031, with occasional short-term depegging events driven by market stress, regulatory changes, or competition. Hedging strategies and diversification will be crucial for DeFi users to manage risk. Minimum price predictions reflect potential brief depegs, while maximums account for rare trading premiums during liquidity crunches.

Key Factors Affecting Tether Price

- Regulatory developments in the US and globally affecting stablecoin issuers

- Transparency and frequency of USDT reserve audits

- Emergence and adoption of competing stablecoins (e.g., USDC, DAI, PYUSD) and CBDCs

- Liquidity levels on major exchanges and DeFi platforms

- Advancements in DeFi hedging tools and protocols

- Investor sentiment and market cycles, especially during crypto downturns or bull runs

- Incidents of large-scale redemptions or market manipulation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Diversify Stablecoin Holdings Across Multiple Assets

Diversification remains one of the oldest yet most reliable approaches in risk management theory – and it holds true for stablecoins as well. By spreading holdings across assets such as DAI, USDC, LUSD (each with distinct collateral models), you reduce single-asset failure risk if Tether experiences volatility or regulatory headwinds.

The effectiveness of this method was evident during previous market disruptions when certain algorithmic or fiat-backed stablecoins temporarily lost their pegs while others maintained stability due to robust collateralization mechanisms.

Read more about diversification strategies here.

Maintaining a diversified basket of stablecoins also supports more flexible liquidity management. For example, if USDT begins to slip below $1.00, users can quickly rebalance into assets like USDC or DAI, which may be less affected by the specific event impacting Tether. This approach is especially valuable for DeFi protocols and DAOs managing large treasuries, as it reduces the risk of systemic contagion from a single-asset failure.

5. Monitor On-chain Analytics and Automated Alerts for Early Depeg Signals

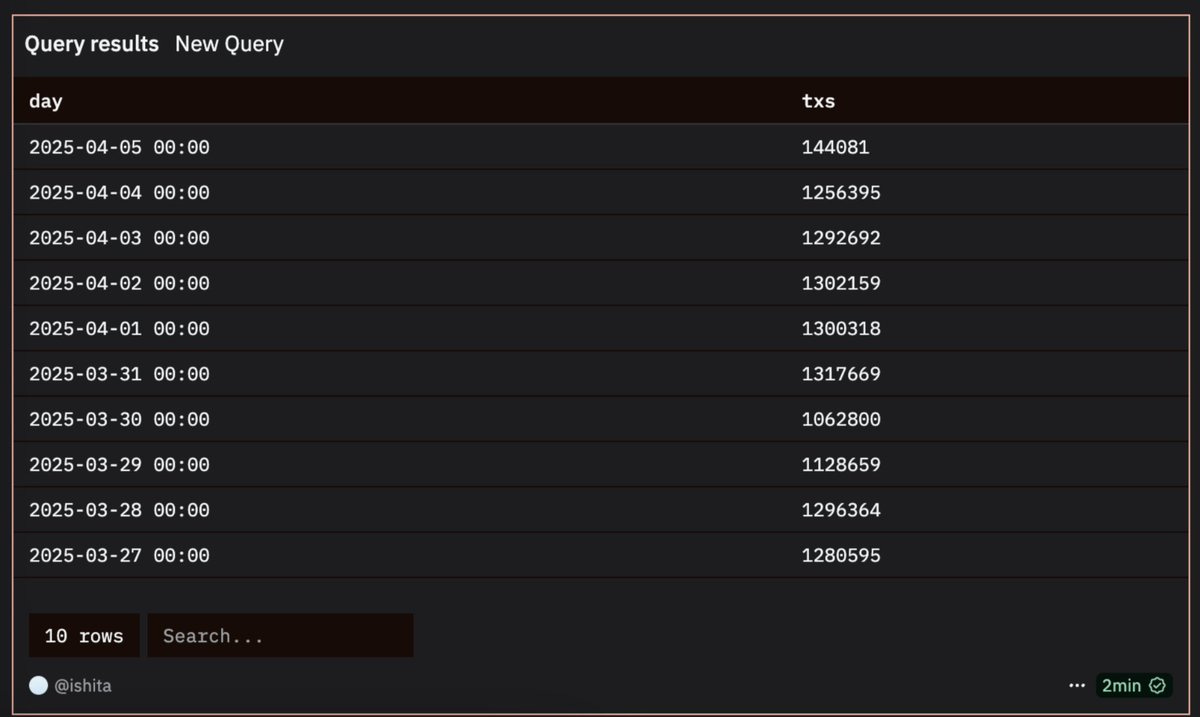

Rapid detection is critical when hedging against depegging events. By leveraging on-chain analytics platforms and setting up automated alerts, traders can gain early warning of unusual flows or sharp price movements in USDT pools. Tools such as Nansen, Dune Analytics, and custom bots track whale transactions, liquidity shifts on DEXs, and changes in lending protocol collateral ratios.

For instance, a sudden spike in USDT withdrawals from Curve or Aave could signal market stress before it’s reflected in price. Automated alerts allow users to respond instantly, whether by executing hedges, rebalancing portfolios, or triggering insurance claims, minimizing potential losses from rapid depegs.

“The best defense against stablecoin depegs is always vigilance, data-driven decisions beat panic every time. “

Integrating Hedging Strategies: A Practical Checklist

Step-by-Step Checklist for USDT Depeg Hedging

-

Purchase USDT Depeg Insurance via Protocols like Y2K Finance or InsurAce: Acquire dedicated depeg insurance coverage to protect against losses if USDT falls below its peg. These protocols offer customizable coverage terms and payouts triggered by on-chain price feeds.

-

Utilize Put Options on USDT or USDT Trading Pairs (where available) to Profit from Downside Moves: Purchase put options on platforms offering USDT or USDT pair options to gain from price declines. While less common, these instruments provide a defined-risk hedge against depegging.

-

Monitor On-chain Analytics and Automated Alerts for Early Depeg Signals and Rapid Rebalancing: Use tools like Dune Analytics, DeFiLlama, or Nansen to track USDT liquidity, trading flows, and price deviations. Set up automated alerts to act quickly if early signs of depegging emerge.

Even with current market stability (USDT at $1.00), the importance of proactive risk management cannot be overstated. Combining these five strategies creates a multi-layered hedge:

- Insurance protocols provide peace of mind for passive holders.

- Derivatives (shorts and options) allow active traders to profit or offset losses during volatility.

- Diversification spreads risk across multiple asset classes.

- Analytics tools ensure you’re never caught off guard by sudden market changes.

The regulatory landscape remains fluid; ongoing due diligence regarding both protocol solvency and regional compliance is essential. As always, tailor your approach to your portfolio size, risk tolerance, and technical expertise. For further guidance on stablecoin regulation and global trading strategies, refer to this comprehensive resource from Phemex: Stablecoin Regulation and Global Liquidity Trading Strategies (2025).

The future of DeFi hinges on robust risk mitigation frameworks that empower users to stay ahead of systemic shocks. With the right toolkit, and an unwavering commitment to staying informed, you can navigate even the most turbulent markets with confidence.