Impermanent loss remains one of the most misunderstood and potentially costly risks for DeFi liquidity providers. If you’re supplying assets to automated market makers (AMMs) like Uniswap, Balancer, or Curve, you’ve likely heard stories of LPs earning high yields but ultimately losing value compared to simply holding their tokens. The good news? You don’t have to accept impermanent loss as an unavoidable cost of participating in DeFi. Today’s advanced tools and risk management strategies can help you actively hedge and mitigate this risk while still capturing yield opportunities.

Understanding Impermanent Loss: Why It Matters in 2025

At its core, impermanent loss is the difference between the value of your assets if you had simply held them versus what they’re worth after providing liquidity. This occurs when the relative prices of your pooled tokens diverge. As DeFi matures, protocols have rolled out innovative features and hedging products that empower LPs to take control over this risk, no matter if you’re managing a $1,000 portfolio or a $10 million vault.

The following up-to-date strategies are at the forefront for anyone seeking an impermanent loss hedge in today’s market:

4 Actionable Strategies to Hedge Impermanent Loss in DeFi

-

Utilize Concentrated Liquidity Ranges on Uniswap v3 or Similar AMMs: Platforms like Uniswap v3 allow liquidity providers to set custom price ranges for their liquidity. By focusing liquidity within specific price bands, you can maximize fee earnings and reduce exposure to impermanent loss during volatile market swings.

-

Diversify Across Multiple Pools and Low-Volatility Asset Pairs: Spread your capital across several liquidity pools, especially those with highly correlated or stable assets (like USDC/USDT on Curve). Diversification balances risk and can help offset losses from one pool with gains from another.

1. Utilize Concentrated Liquidity Ranges on Uniswap v3 or Similar AMMs

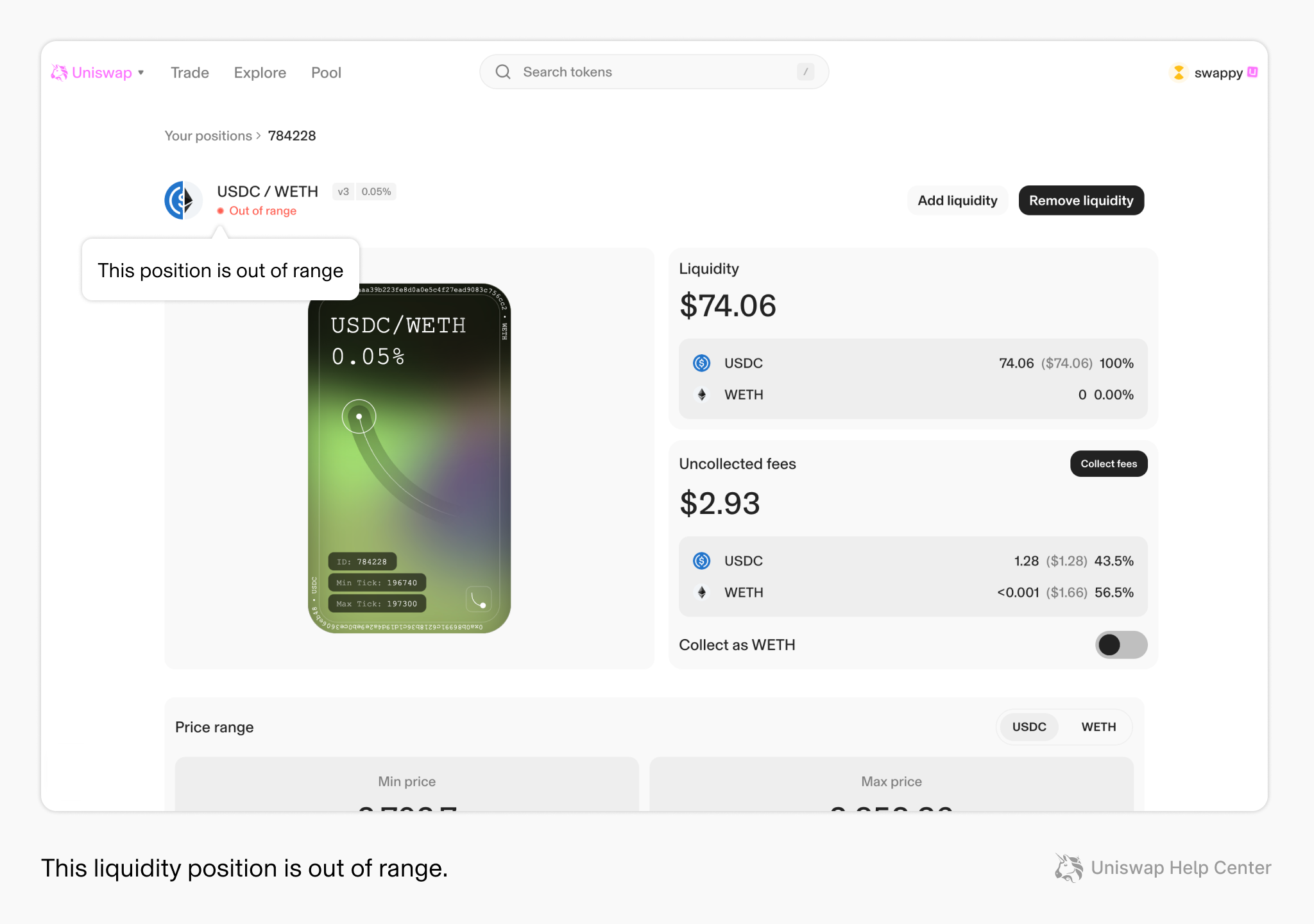

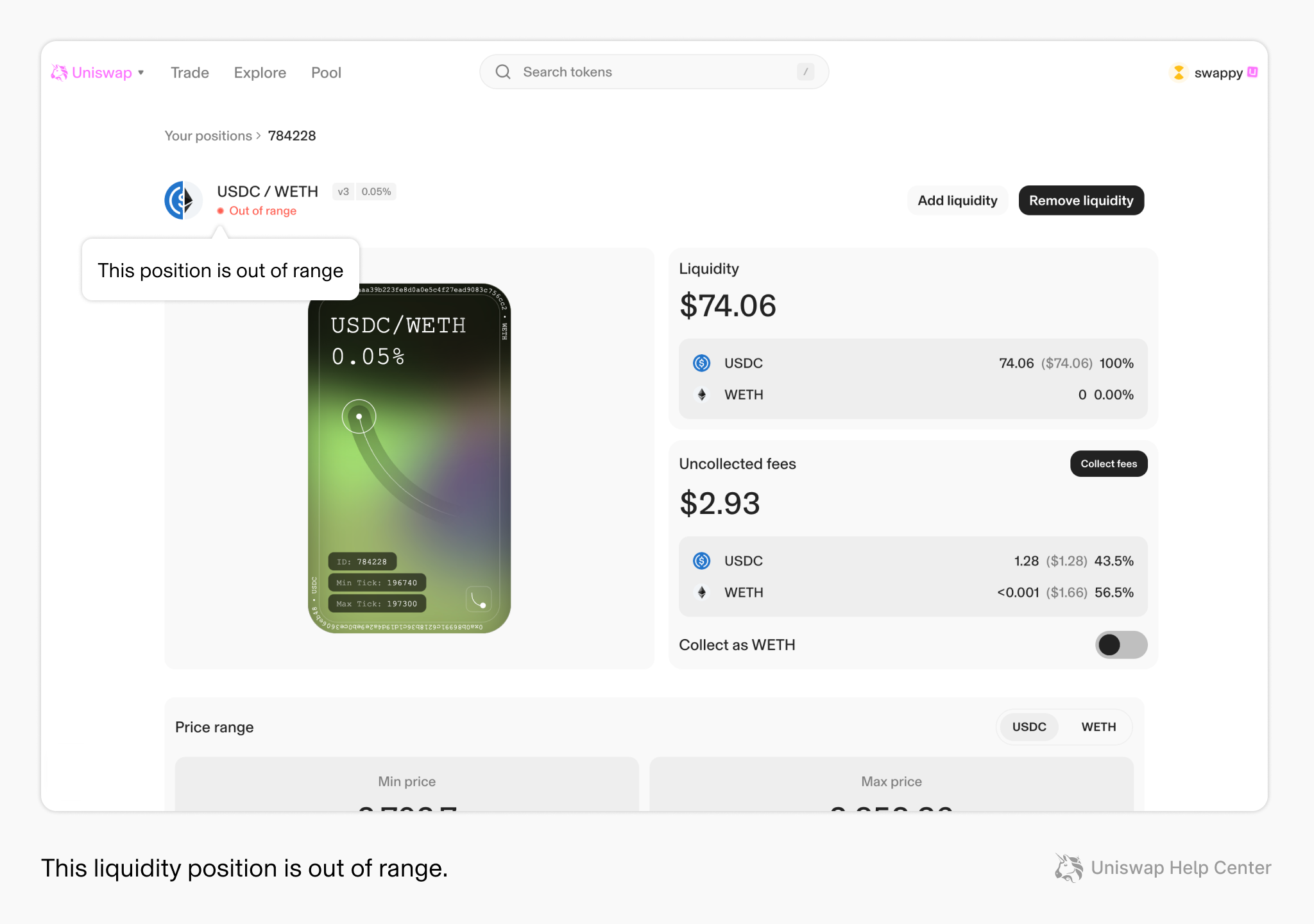

Uniswap v3 revolutionized liquidity provision by introducing concentrated liquidity ranges. Instead of spreading your capital across all possible price points, you can now specify a price band where your funds are active. This means higher capital efficiency and greater fee earnings, but it also requires more active management.

By narrowing your range to reflect expected price action (for example, setting a USDC/ETH range close to current market prices), you reduce exposure when assets move outside that band, thereby limiting potential impermanent loss. However, if prices move sharply outside your chosen range, your position may be converted entirely into one asset, so monitoring and adjusting ranges is essential.

This approach is especially effective when paired with analytics tools that monitor volatility and historical price movements. For more insights on how concentrated liquidity works in practice, see discussions on Reddit’s r/defi.

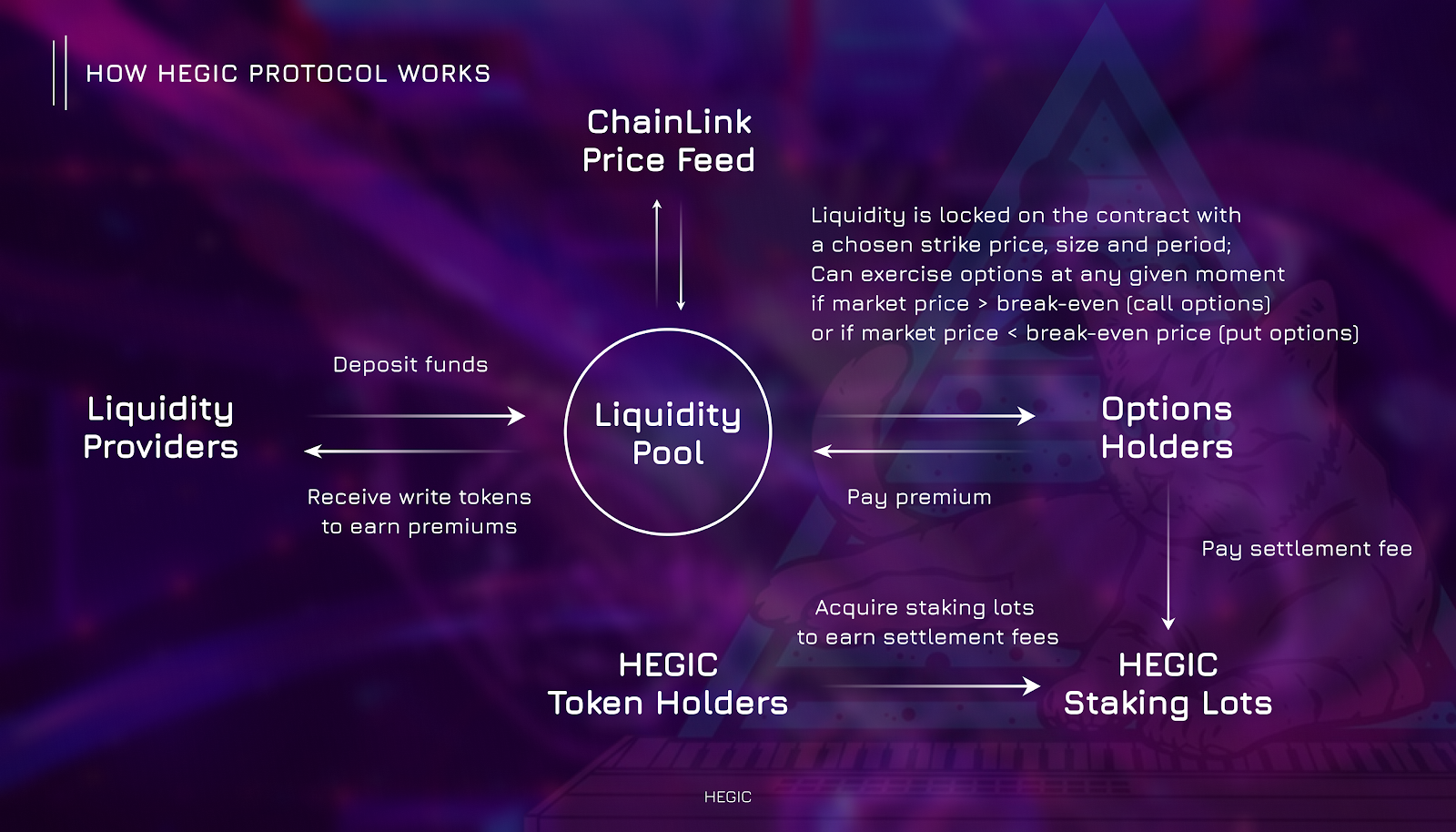

2. Hedge with Perpetual or Options Derivatives Against Pool Assets

The next evolution in DeFi risk management strategies: using derivatives such as perpetual futures or options contracts to offset potential losses from price divergence within your pool pair. For example, if you’re providing ETH/USDC liquidity and are concerned about ETH dropping relative to USDC, you could purchase a put option or open a short perpetual position on ETH.

This approach creates an external hedge, if ETH’s price falls and impermanent loss increases within the pool, gains from your short position can compensate for those losses. Platforms like Opyn (with their Squeeth product) and MEV Capital have pioneered these solutions for both retail and institutional LPs (MEV Capital’s IL-hedge LP strategy). Automated options-based hedges are also emerging as plug-and-play integrations with major DEXes.

The key is matching the size and timing of your derivative positions with the exposure in your LP tokens, a process increasingly streamlined by analytics dashboards and automated protocols.

3. Diversify Across Multiple Pools and Low-Volatility Asset Pairs

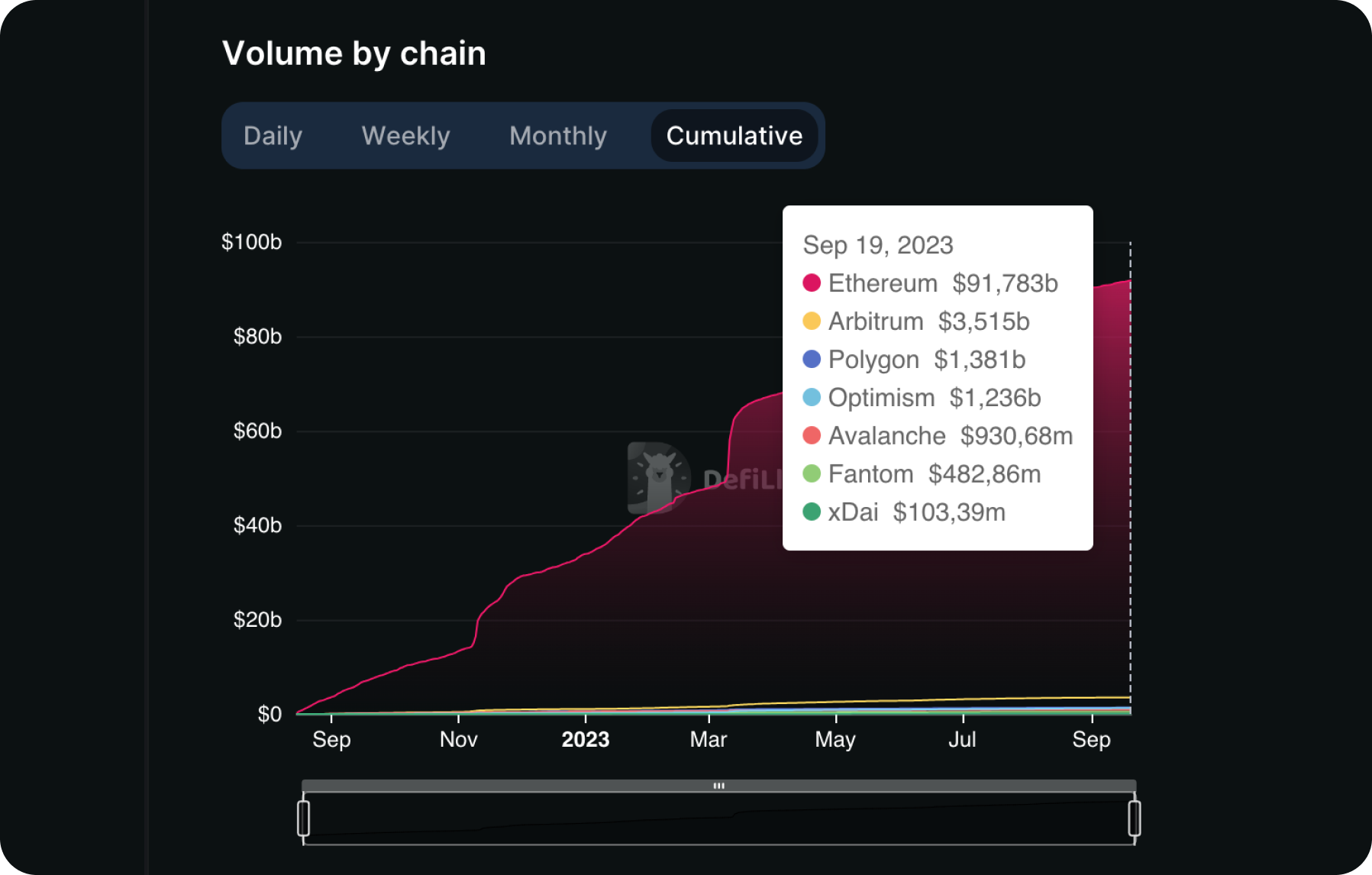

No single strategy eliminates all risk, but diversification remains one of the most effective ways to manage it across volatile markets. By allocating capital across multiple pools, especially those featuring low-volatility or highly correlated pairs like USDC/USDT, you can smooth out the impact of sharp moves in any one asset.

This doesn’t just mean picking different AMMs; it means thoughtfully selecting pools where historical data shows minimal divergence between token values over time. Stablecoin pools are favorites here due to their reduced likelihood of major price swings, and thus lower impermanent loss exposure (see this analysis on LinkedIn). Spreading risk also means being prepared for protocol-specific risks; always review smart contract audits before committing substantial funds.

Active diversification can also be enhanced by dynamic allocation strategies. For instance, you might rebalance your portfolio periodically, shifting capital from pools experiencing high volatility to those with more stable returns. This approach is especially valuable during periods of market uncertainty, where asset correlations can change rapidly. Remember, while diversification helps reduce overall risk, it does not guarantee profits, so always monitor the performance of each pool and remain agile in your allocations.

4. Leverage Protocols Offering Impermanent Loss Protection or Dual Rewards

As DeFi matures, a growing number of protocols are introducing built-in impermanent loss protection mechanisms or offering dual rewards to offset potential losses. These solutions work in several ways: some protocols provide insurance-like coverage that reimburses LPs for a portion (or all) of their impermanent loss after a set period, while others distribute additional tokens as rewards that can help balance out any losses.

For example, Bancor and similar platforms have implemented IL protection features that gradually cover your losses the longer you remain an LP. Meanwhile, dual reward systems on protocols like SushiSwap or Balancer allow you to earn both trading fees and protocol-native tokens, potentially making up for impermanent loss through extra yield. However, these benefits often come with conditions such as lock-up periods or specific staking requirements, so always read the fine print before committing.

Top DeFi Protocols for Impermanent Loss Protection & Dual Rewards

-

Utilize Concentrated Liquidity Ranges on Uniswap v3 or Similar AMMs: Uniswap v3 and protocols like PancakeSwap v3 let liquidity providers set custom price ranges, focusing capital where it’s most effective. This advanced feature helps maximize fees and reduces impermanent loss by limiting exposure to volatile price swings.

-

Diversify Across Multiple Pools and Low-Volatility Asset Pairs: Spreading liquidity across several pools—especially those with correlated or stablecoin pairs like USDC/USDT on Curve Finance—helps reduce exposure to impermanent loss from any single asset’s price movement.

-

Leverage Protocols Offering Impermanent Loss Protection or Dual Rewards: Platforms such as Bancor and Stargate Finance provide built-in impermanent loss protection or dual rewards, compensating LPs for potential losses and boosting overall returns.

It’s important to weigh the trade-offs: While IL protection can provide peace of mind, it may come at the cost of lower base yields or increased exposure to protocol-specific risks. Carefully evaluate whether the added security aligns with your broader portfolio goals.

Putting It All Together: Building Your Impermanent Loss Hedge

The best defense against impermanent loss is a proactive and educated approach. By combining these four strategies, utilizing concentrated liquidity ranges on Uniswap v3 or similar AMMs, hedging with derivatives against pool assets, diversifying across multiple pools and low-volatility pairs, and leveraging protocols that offer IL protection or dual rewards, you can tailor a risk management plan suited to your own risk tolerance and yield objectives.

The DeFi landscape continues to evolve at breakneck speed. Tools for hedging impermanent loss are becoming more sophisticated by the month, but they require ongoing learning and engagement from liquidity providers. Stay informed about new products and best practices by following leading DeFi analysts on social media platforms.

If you’re ready to take control of your DeFi liquidity provider risk, start by assessing which combination of these approaches fits your strategy, and don’t be afraid to experiment in small amounts before scaling up exposure.

Quick Reference Table: Four Key Impermanent Loss Hedging Strategies

Summary of Impermanent Loss Hedging Strategies for DeFi Liquidity Providers

| Strategy | How It Works | Example | Key Considerations |

|---|---|---|---|

| Utilize Concentrated Liquidity Ranges on Uniswap v3 or Similar AMMs | Provide liquidity within a specific price range to maximize fee earnings and reduce exposure to price swings outside the chosen range. | Uniswap v3: Set liquidity for ETH/USDC only between $1,800 and $2,200. | Requires active management; risk if price moves out of range; higher fee potential. |

| Hedge with Perpetual or Options Derivatives Against Pool Assets | Use derivatives (options, perpetuals) to offset potential losses from price divergence in the pool. | MEV Capital: Combine tight-range LP positions with ETH put options to hedge downside. | Additional costs for hedging; requires understanding of derivatives; may reduce net yield. |

| Diversify Across Multiple Pools and Low-Volatility Asset Pairs | Spread capital across different pools and focus on pairs with high price correlation (e.g., stablecoins) to minimize risk. | Provide liquidity to USDC/USDT and DAI/USDC pools on Curve or Uniswap. | Reduces risk but may lower returns; still exposed to protocol risks. |

| Leverage Protocols Offering Impermanent Loss Protection or Dual Rewards | Use platforms that offer IL insurance or extra incentives to offset potential losses. | Bancor or Thorchain: Protocols with built-in IL protection or dual token rewards. | May have lock-up periods or protocol-specific risks; check terms for protection. |

If you want deeper dives into each tactic or hands-on tutorials for building an impermanent loss hedge, explore our expert guides at DepegWatch. com. And remember: In DeFi as in all investing, knowledge is the best hedge.