Decentralized finance has entered a new era in 2024, with protocol risk insurance solutions now considered essential for anyone serious about digital asset protection. As DeFi matures and capital inflows surge, so does the sophistication of attack vectors and systemic risks. From smart contract exploits to stablecoin depegs and exchange hacks, the range of threats is broad and evolving. Fortunately, a robust ecosystem of DeFi insurance protocols has emerged to empower users with innovative ways to hedge against such hazards.

Why Protocol Risk Insurance Is Critical in DeFi

The decentralized nature of DeFi means that users are directly exposed to technical failures, governance attacks, oracle manipulation, and other black swan events. While audits and bug bounties help reduce vulnerabilities, they cannot eliminate risk entirely. Protocol risk insurance fills this gap by providing financial compensation in the event of covered losses, transforming catastrophic incidents into manageable setbacks rather than existential threats to your portfolio.

Below is a curated list of the top 11 protocol risk insurance solutions for DeFi users in 2024. Each protocol offers unique features and coverage models designed for a diverse array of risks:

Top 11 Protocol Risk Insurance Solutions for DeFi in 2024

-

Nexus Mutual is a pioneer in decentralized insurance, offering coverage against smart contract failures, exchange hacks, and other DeFi risks. Members use NXM tokens for governance and claims, with over $9 million in claims processed. Current NXM price: $99.69.

-

InsurAce Protocol provides multi-chain insurance coverage across Ethereum, BNB Chain, and more. It protects users from smart contract exploits, stablecoin de-pegging, and exchange hacks, all governed by a DAO for transparency and efficiency.

-

Unslashed Finance offers decentralized insurance with instant liquidity and tokenized policies. It covers custody risks, oracle failures, and exchange hacks, allowing users to trade or transfer insurance as needed.

-

Bridge Mutual is a peer-to-peer insurance platform enabling users to buy or sell coverage for DeFi protocols, stablecoins, and exchanges. It operates without KYC, aligning with DeFi privacy standards.

-

Sherlock delivers smart contract audit coverage and protocol insurance, focusing on underwriting and monitoring risks for leading DeFi projects. Sherlock leverages expert auditors and a decentralized claims process.

-

Tidal Finance enables customizable insurance pools for DeFi protocols, letting liquidity providers earn rewards. Users can select specific risks to insure, benefiting from competitive premiums and flexible coverage.

-

Solace is a decentralized coverage protocol for DeFi liquidity providers and market makers. It emphasizes automated claims, intelligent risk assessment, and high capital efficiency to protect users from smart contract exploits.

-

Etherisc builds decentralized insurance applications for various use cases, including flight delay and crop insurance. Its open-source protocol supports community-driven risk pools and transparent claims handling.

-

Uno Re is a decentralized reinsurance platform that lets users invest in and purchase insurance products for DeFi risks. It features a dynamic risk assessment model and a marketplace for insurance policies.

-

Armor.fi offers pay-as-you-go DeFi insurance without membership requirements. Integrating with protocols like Nexus Mutual, Armor.fi provides flexible, user-friendly coverage for a range of DeFi risks.

-

Opium Insurance leverages the Opium derivatives protocol to create customizable, on-chain insurance products. It enables users to hedge against smart contract failures and other DeFi-specific risks through decentralized markets.

1. Nexus Mutual ($99.69): The Pioneer in Decentralized Insurance

Nexus Mutual continues its reign as the flagship decentralized insurance platform, offering members coverage against smart contract failures across major DeFi protocols. With its NXM token currently priced at $99.69, Nexus Mutual operates as a mutual where policyholders are also stakeholders, aligning incentives for robust risk assessment and claim validation. Over $9 million in claims have been paid out since inception, underscoring the protocol’s reliability and community trust.

Nexus Mutual’s model is notable for its rigorous claims process and dynamic pricing based on assessed protocol risks. Members must undergo KYC verification to participate fully; however, integrations with platforms like Armor. fi have broadened access via non-custodial wrappers.

2. InsurAce Protocol: Multi-Chain Coverage at Scale

InsurAce Protocol distinguishes itself by providing multi-chain protection across Ethereum, BNB Chain, Polygon, Avalanche, and more. It covers smart contract exploits, stablecoin depegs, a growing concern, and exchange hacks at competitive premiums thanks to its DAO-governed capital pools (source). InsurAce’s flexible product offerings allow both retail users and institutional investors to tailor their coverage according to portfolio composition.

The platform’s rapid claims processing engine leverages decentralized voting while maintaining transparency through public audit trails. This mix of efficiency and openness has made InsurAce a go-to solution for cross-chain asset managers seeking comprehensive protection without sacrificing cost-effectiveness.

3. Unslashed Finance and Bridge Mutual: Peer-to-Peer Models Redefined

Unslashed Finance brings instant liquidity to the world of crypto insurance by allowing tokenized policies that can be traded or transferred on secondary markets. Its capital-efficient pools cover not just smart contracts but also custody risks and oracle failures, critical as composability between protocols increases systemic exposure.

Bridge Mutual, meanwhile, enables direct peer-to-peer coverage purchases without KYC requirements, a boon for privacy-focused users (source). Users can both provide capital to earn yields or purchase bespoke coverage against exploits affecting specific assets or protocols. Bridge Mutual’s discretionary mutual model fosters community-driven underwriting while keeping premiums competitive through decentralized governance.

4. Sherlock: Smart Contract Security Meets Insurance

Sherlock stands out by blending protocol risk insurance with advanced smart contract auditing. The platform leverages a network of security experts and automated tools to proactively monitor covered protocols, aiming to catch vulnerabilities before they escalate into exploits. Sherlock’s insurance pools are capitalized by stakers who earn yields for underwriting risk, while claims are validated through a transparent process involving both technical review and community voting. This dual approach not only reduces loss frequency but also fosters a culture of continuous risk assessment within DeFi itself.

5. Tidal Finance: Customizable Mutual Cover Pools

Tidal Finance offers users the ability to create or join customizable insurance pools targeting specific DeFi protocols or asset classes. Liquidity providers can select which risks to underwrite, earning rewards proportional to the risk and coverage provided. This modular design results in highly competitive premiums and flexible coverage options for both retail and institutional participants. Tidal’s discretionary mutual model ensures that claim decisions are made collectively by pool members, aligning incentives for prudent underwriting and timely payouts.

6. Solace: Automated Claims and Capital Efficiency

Solace brings automation to the forefront of protocol risk insurance with its intelligent claims processing engine and capital-efficient coverage pools. By focusing on DeFi liquidity providers and market makers, Solace addresses the acute need for rapid protection against smart contract exploits that can cascade through interconnected protocols. Its emphasis on seamless user experience, combined with robust actuarial modeling, makes it a strong contender for those seeking hands-off yet reliable hedging solutions.

7. Etherisc: Open-Source Insurance Infrastructure

Etherisc takes a unique approach as an open-source framework for building decentralized insurance products. Rather than operating as a single protocol, Etherisc provides the infrastructure and templates needed for communities or projects to launch custom insurance offerings, ranging from crop insurance to flight delay protection and DeFi-specific risks. This flexibility promotes innovation in coverage design while maintaining auditability and transparency at every stage.

8. Uno Re: Risk Reinsurance on Blockchain

Uno Re introduces blockchain-native reinsurance into DeFi, allowing protocols and insurers to offload part of their risk exposure onto a broader pool of capital providers. This layered approach enhances solvency across the ecosystem while enabling users to participate in reinsurance markets traditionally reserved for institutional players. Uno Re’s decentralized governance ensures that risk assessment remains adaptive as new threats emerge in the crypto landscape.

9. Armor. fi: Flexible Coverage Without Membership Barriers

Armor. fi revolutionizes accessibility by offering pay-as-you-go insurance with no membership prerequisites or KYC requirements, ideal for users wary of commitment or privacy concerns (source). Armor. fi integrates directly with major DeFi platforms, letting users purchase coverage seamlessly as they interact with dApps like Aave or Compound. By abstracting away governance complexities, Armor. fi lowers barriers for everyday users seeking straightforward protection.

10. Opium Insurance: Derivatives-Based Risk Hedging

Opium Insurance, powered by Opium Protocol, leverages derivatives markets to offer bespoke coverage products, including protection against stablecoin depegs and catastrophic protocol failures. Users can purchase tokenized insurance contracts tailored to specific event triggers, enabling granular risk management strategies not possible with traditional pooled models. Opium’s approach appeals especially to sophisticated traders looking to hedge complex exposures across multiple protocols.

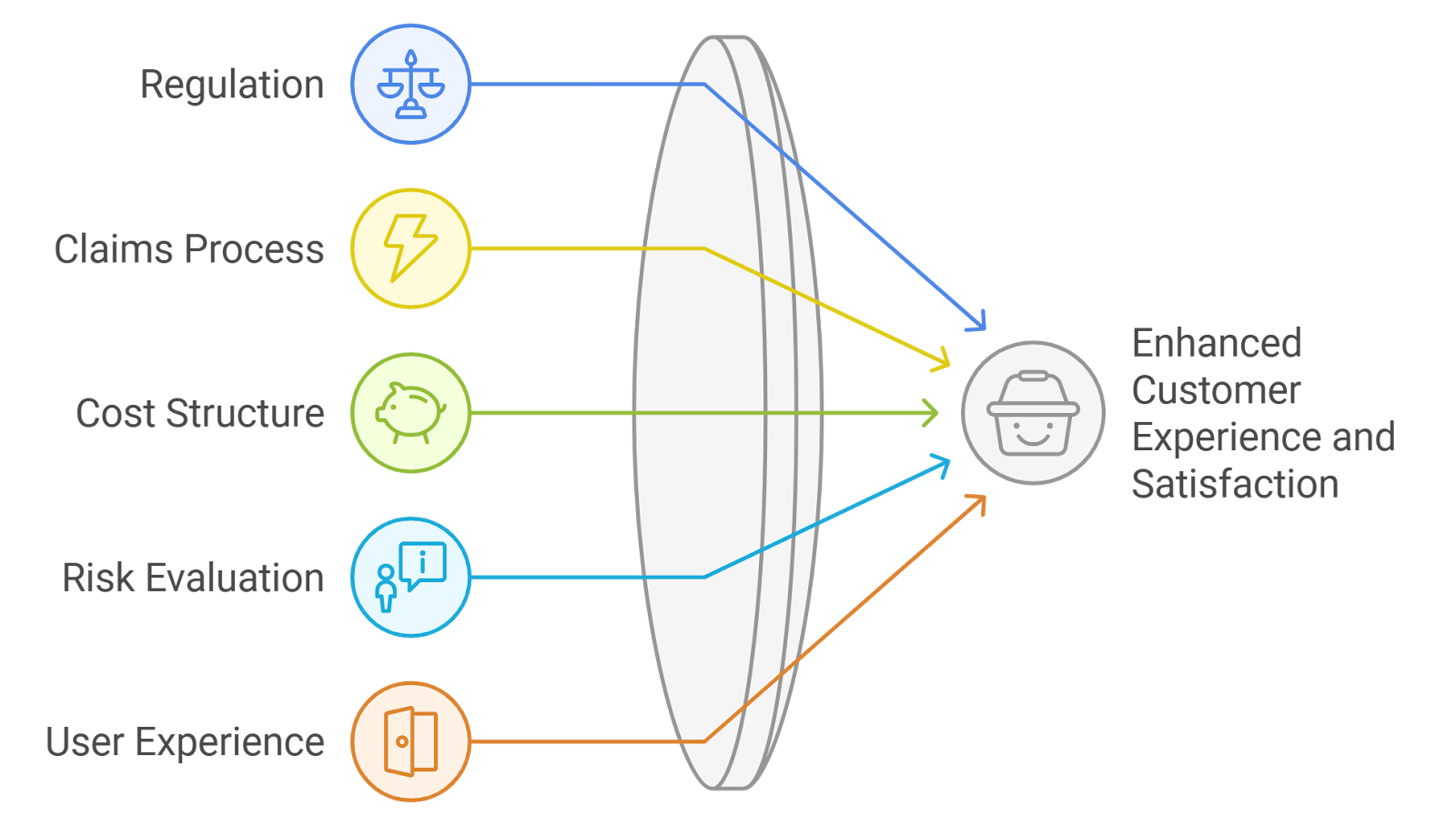

The Strategic Advantage: Why Diversification Matters in Protocol Risk Insurance

No single solution is universally optimal; each protocol excels under different market conditions and user needs. Diversifying your coverage across multiple platforms, such as combining Nexus Mutual’s robust smart contract cover with InsurAce’s cross-chain flexibility or Armor. fi’s ease-of-use, can significantly enhance portfolio resilience. As attack vectors evolve, so too should your hedging strategy: regularly review your exposures relative to your chosen protocols’ claim histories, governance quality, and financial health.

Which DeFi insurance protocol do you trust most in 2024?

With so many innovative DeFi insurance solutions available, we want to know which protocol you rely on to protect your digital assets against smart contract failures, hacks, and other risks. Cast your vote and see which platform the community trusts most!

The Road Ahead: Trends Shaping Protocol Risk Insurance in 2025

The next wave of innovation will likely focus on seamless integrations (think one-click cover at point-of-use), parametric triggers powered by real-time data feeds, and increased composability between coverage products, enabling more granular hedging against niche risks like oracle failures or governance attacks.

As capital efficiency improves through reinsurance (Uno Re) or dynamic pricing (Nexus Mutual), expect premiums to become more competitive even as claim volumes grow.

Ultimately, protocol risk insurance is fast becoming table stakes for serious DeFi participation. Whether you’re an institutional allocator or an individual yield farmer, leveraging these top solutions is not just prudent, it’s essential for thriving amid uncertainty in decentralized finance.