Stablecoins are the backbone of DeFi, but in 2025, their stability is anything but guaranteed. With more than 600 depeg events for major fiat-backed stablecoins in 2023 alone (Moody’s), the need for real-time stablecoin analytics tools has never been greater. Whether you’re running high-frequency strategies or safeguarding institutional capital, early detection of depeg risk is mission critical. Let’s break down the top five platforms that deliver actionable data and proactive risk signals to keep your portfolio ahead of the curve.

Chainlink Data Feeds: The Foundation of Price Integrity

Chainlink Data Feeds are the industry standard for decentralized price oracles, powering everything from lending protocols to on-chain insurance triggers. These feeds aggregate price data from multiple exchanges and data providers, delivering real-time, tamper-resistant price updates directly to smart contracts. When a stablecoin like USDC or DAI slips even a fraction below its peg, Chainlink’s feeds reflect it instantly, enabling automated hedging, liquidations, or protocol-level responses within seconds.

The reliability of Chainlink’s infrastructure is why so many DeFi protocols use it as their first line of defense against depegs. For traders and risk managers, integrating Chainlink feeds means you’re always working with up-to-the-second market prices, not laggy centralized APIs that can miss flash events.

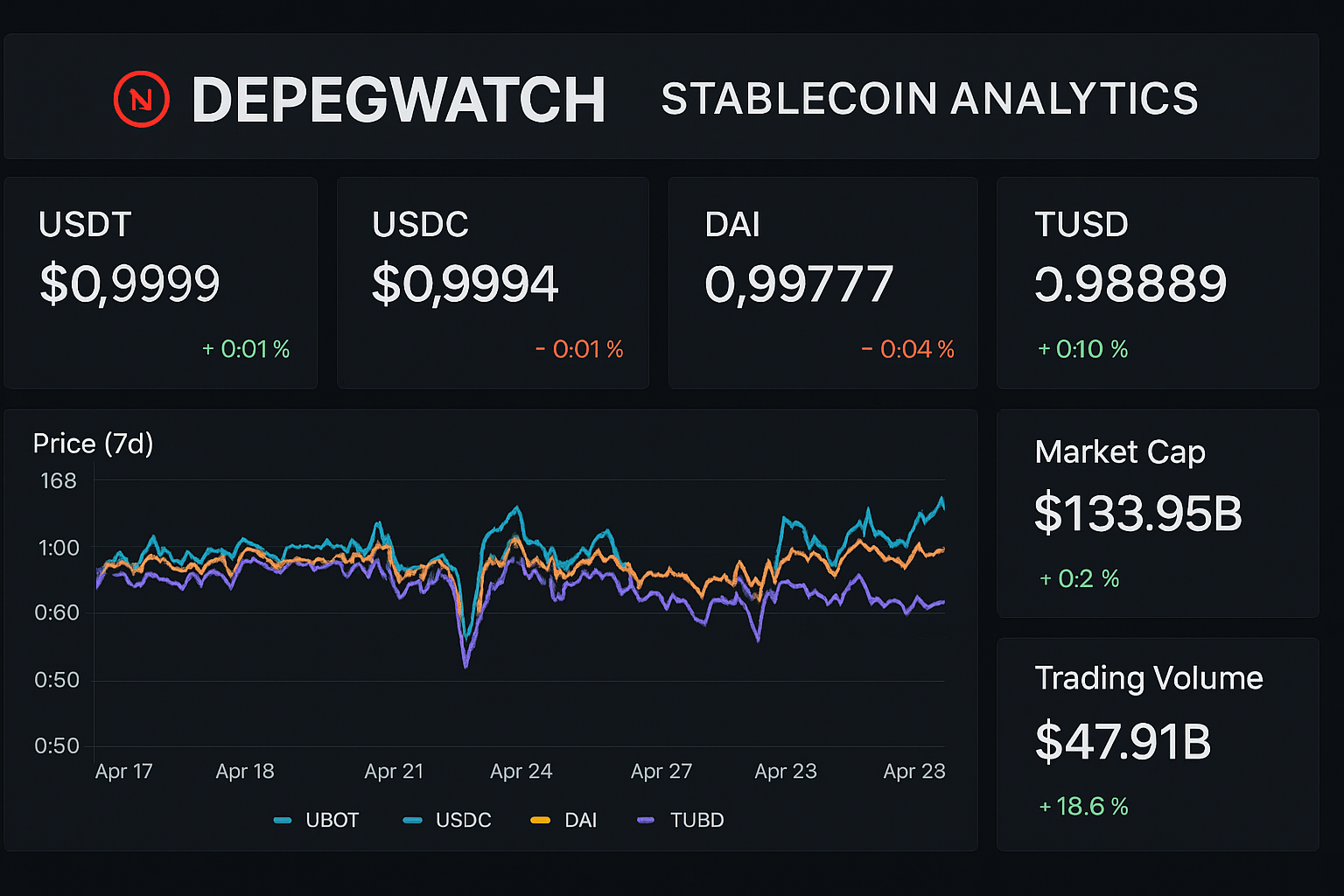

DepegWatch Real-Time Stablecoin Analytics Dashboard: Precision Monitoring in Action

The DepegWatch Real-Time Stablecoin Analytics Dashboard is built for speed and granularity. It monitors every major stablecoin across all leading blockchains and DEXs, surfacing anomalies in price, volume, reserve shifts, and liquidity depth as they happen. The dashboard’s alerting engine flags deviations from $1.00 pegs down to sub-cent precision, so you can react before slippage widens or panic spreads through the market.

The platform overlays technical indicators with on-chain reserve audits and market depth visualizations, making it easy to spot vulnerabilities whether you’re trading manually or running bots. In volatile conditions where seconds matter, this level of transparency is non-negotiable.

Credio Network Stablecoin Risk Assessment Suite: Holistic On-Chain Risk Intelligence

Credio Network’s Stablecoin Risk Assessment Suite goes beyond surface-level price tracking by incorporating seven critical risk indicators: issuance/redemption flows, reserve management quality, market structure analysis, operational incidents, governance changes, regulatory status shifts, and smart contract audit trails.

This suite delivers a composite risk score for each monitored stablecoin, giving both retail users and institutional desks a quantifiable framework for exposure management. If an issuer’s redemption window narrows or reserves trend negative relative to circulating supply, Credio surfaces these signals well before they hit headlines or trigger mass redemptions.

Top 5 Real-Time Stablecoin Analytics Tools in 2025

-

Chainlink Data Feeds (Price Oracles): Delivers real-time, tamper-resistant price data for stablecoins across major blockchains. Chainlink’s decentralized oracle network ensures high-frequency updates on stablecoin prices, market depth, and liquidity, providing early warning signals for depeg events. Widely integrated into DeFi protocols for robust risk management.

-

DepegWatch Real-Time Stablecoin Analytics Dashboard: Specialized in real-time depeg risk monitoring, DepegWatch aggregates stablecoin price feeds, market depth, and historical depeg incidents into a single dashboard. Users receive instant alerts when stablecoins deviate from their peg, with visualizations for liquidity, volume, and exchange activity.

-

Credio Network Stablecoin Risk Assessment Suite: Offers a comprehensive risk framework with seven key indicators, including issuance/redemption activity, reserve management, market conditions, and governance. The suite provides real-time dashboards and predictive analytics to identify vulnerabilities and emerging depeg risks across stablecoins.

-

Moody’s Digital Asset Monitor: Integrates institutional-grade analytics for stablecoin health, tracking price stability, reserve transparency, and depeg incidents. Moody’s platform features real-time insights and risk scoring, supporting both regulatory compliance and strategic DeFi decision-making.

-

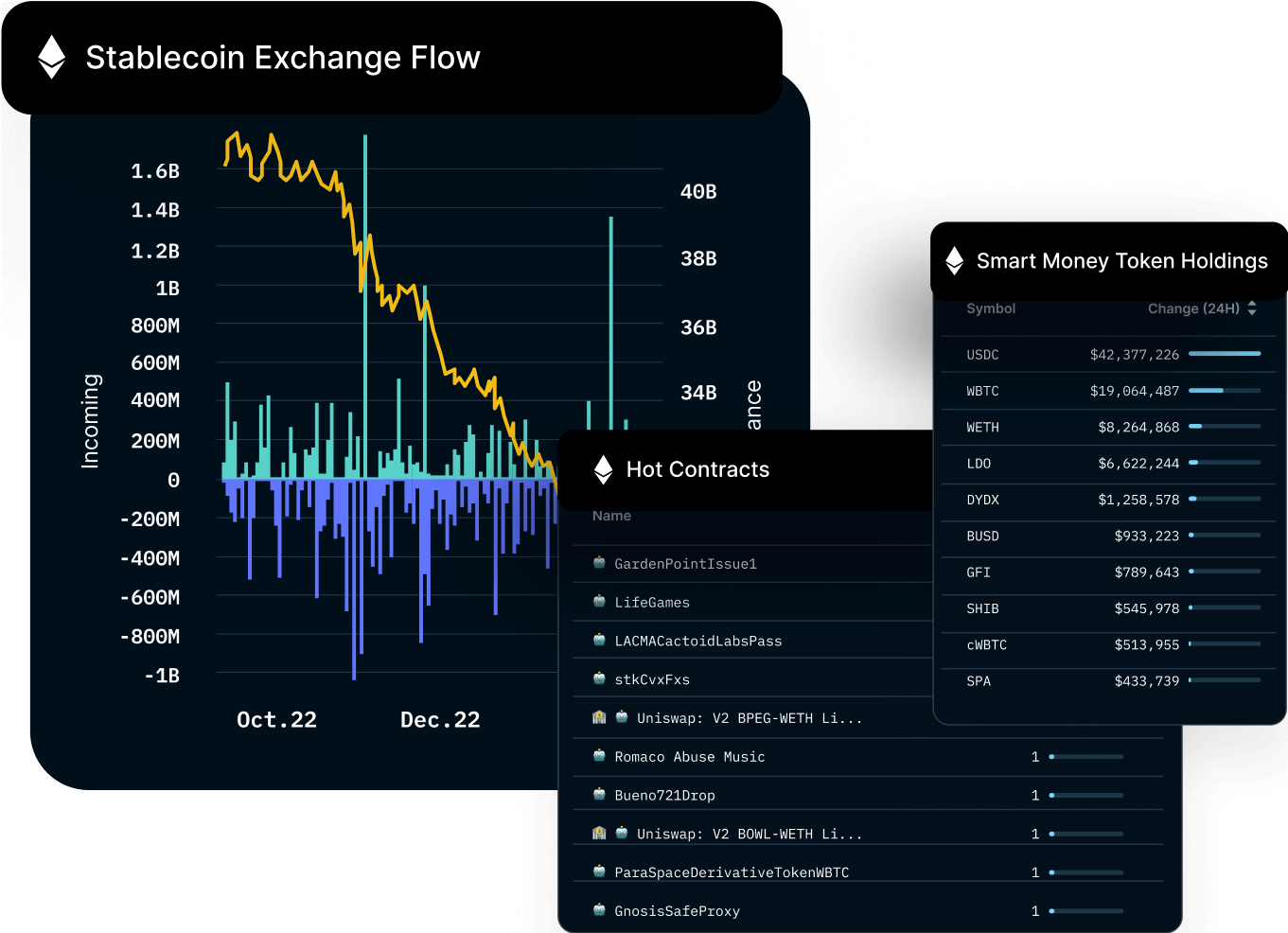

Nansen On-Chain Stablecoin Tracker: Provides granular, on-chain analytics for stablecoin flows, wallet activity, and market sentiment. Nansen’s tracker enables users to monitor large transactions, exchange inflows/outflows, and whale movements—all critical for anticipating depeg risk and liquidity shocks.

Moody’s Digital Asset Monitor: Macro Perspective Meets Real-Time Alerts

Moody’s Digital Asset Monitor (DAM) combines traditional financial rigor with crypto-native data streams to deliver continuous surveillance over fiat-backed and algorithmic stablecoins alike. DAM tracks peg adherence history (including all 600 and documented depegs), real-time market depth across CEXs/DEXs, reserve reports from issuers, and ecosystem-wide liquidity flows.

This tool transforms raw blockchain data into actionable risk insights at both asset-specific and systemic levels, enabling sophisticated hedging strategies tailored to evolving market stressors.

Nansen On-Chain Stablecoin Tracker: Wallet Flows and Whale Movements Decoded

Nansen’s On-Chain Stablecoin Tracker delivers unparalleled visibility into wallet-level inflows/outflows, including movements by whales and large institutions that often precede volatility spikes or structural peg breaks. By combining wallet labeling with flow analytics across Ethereum mainnet and L2s (plus Solana/Tron), Nansen helps users anticipate liquidity crunches before they manifest as visible price dislocations.

If you’re serious about front-running depegs rather than reacting after the fact, Nansen is an essential part of any modern risk stack.

Bringing these platforms together gives traders and institutions a multi-dimensional toolkit for real-time stablecoin risk management. The synergy is clear: Chainlink Data Feeds provide the raw, tamper-proof pricing backbone; DepegWatch’s dashboard overlays that data with hyper-responsive anomaly detection; Credio Network quantifies multi-factor risk in a digestible score; Moody’s DAM contextualizes micro-movements within macro market structure; and Nansen exposes the behavioral signals that often precede market-wide stress.

Let’s distill how these analytics tools can be leveraged for actionable hedging:

- Automated Hedging: By integrating Chainlink oracles and DepegWatch alerts into smart contracts, users can trigger instant swaps or collateral shifts the moment a peg deviates, no manual intervention required.

- Preemptive Liquidity Management: Nansen’s wallet flow data lets you spot large redemptions or whale withdrawals before they impact secondary markets, giving you time to adjust positions or unwind risky exposures.

- Granular Risk Scoring: Credio Network’s composite scores simplify complex on-chain data into a single metric, ideal for dashboard monitoring or automated portfolio rebalancing rules.

- Macro Stress Testing: Moody’s DAM helps simulate systemic shocks, such as mass redemptions or regulatory events, by mapping historical depegs and current liquidity depth across all major venues.

Why Real-Time Matters: Seconds Save Millions

The pace of depeg events is only accelerating. In high-volatility regimes, stablecoin prices can slip from $1.00 to $0.90 or lower in under a minute. Relying on delayed CEX APIs or manual tracking is a recipe for slippage and loss. The top analytics tools discussed here are engineered for speed, delivering sub-second updates, predictive alerts, and deep context so you can move capital before the crowd reacts.

This isn’t just about avoiding catastrophic losses from black swan events. It’s about capital efficiency: optimizing yield farming strategies by monitoring peg health in real time, reducing over-collateralization in lending protocols when confidence is high, and scaling back exposure instantly when risk indicators flash red across multiple platforms.

Integrating Analytics Into Your Workflow

The real edge comes from integration. Most leading platforms offer robust APIs and webhooks, hook them directly into your trading bots, portfolio dashboards, or treasury management systems. Set custom alert thresholds based on your risk appetite: whether it’s a one-cent deviation on USDC or an anomalous spike in whale outflows flagged by Nansen. For institutional desks, combining Moody’s macro monitoring with Credio Network’s granular scoring creates a dynamic early warning system that can be adapted to any governance mandate.

Ultimately, the future of stablecoin safety isn’t trust, it’s verification at machine speed. In 2025 and beyond, winning strategies will come down to who has the fastest access to clean data, who can parse signal from noise instantly, and who automates their response before the rest of the market catches up. With Chainlink Data Feeds anchoring price integrity, DepegWatch delivering precision monitoring, Credio Network scoring holistic risk, Moody’s DAM mapping systemic threats, and Nansen decoding wallet flows, the infrastructure for proactive stablecoin defense is already here.