In the current landscape of digital asset risk management, the debate over crypto volatility hedges is more nuanced than ever. As portfolio managers and DeFi users grapple with unpredictable price swings, two instruments dominate the conversation: perpetual contracts and options. Both are pivotal in hedging against adverse market movements, yet their mechanics, costs, and risk profiles diverge in ways that can dramatically impact your strategy.

Perpetual Contracts: Flexibility Meets Leverage

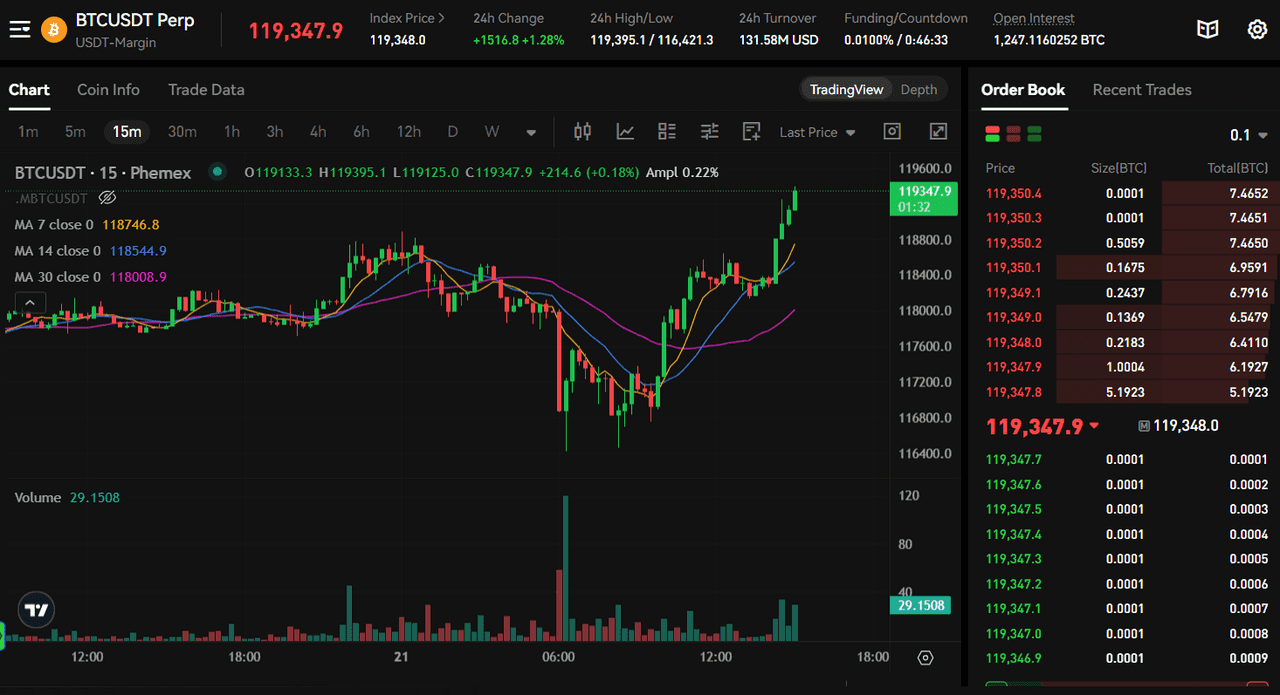

Perpetual contracts, or perpetual swaps, have become a mainstay on major crypto exchanges due to their unique structure: they never expire. This means you can maintain a position as long as you meet margin requirements. The absence of an expiration date allows for continuous hedging or speculation, an attractive feature for both institutional desks and active traders.

The key mechanism keeping these instruments aligned with spot market prices is the funding rate. At regular intervals (often every eight hours), traders on one side of the contract pay those on the other, depending on whether the contract price is above or below spot. This dynamic incentivizes price convergence but introduces variable costs that can eat into returns, especially during periods of extreme volatility or when market sentiment skews heavily bullish or bearish.

Leverage is another hallmark of perpetuals. With margin requirements often as low as 1-5%, traders can amplify both gains and losses significantly. For example, hedging a $10,000 Bitcoin position might require only a fraction of that amount as collateral (source). However, this leverage also exposes users to liquidation risks if markets move sharply against their position, a real concern in crypto’s fast-moving environment.

Options: Defined Risk for Strategic Hedging

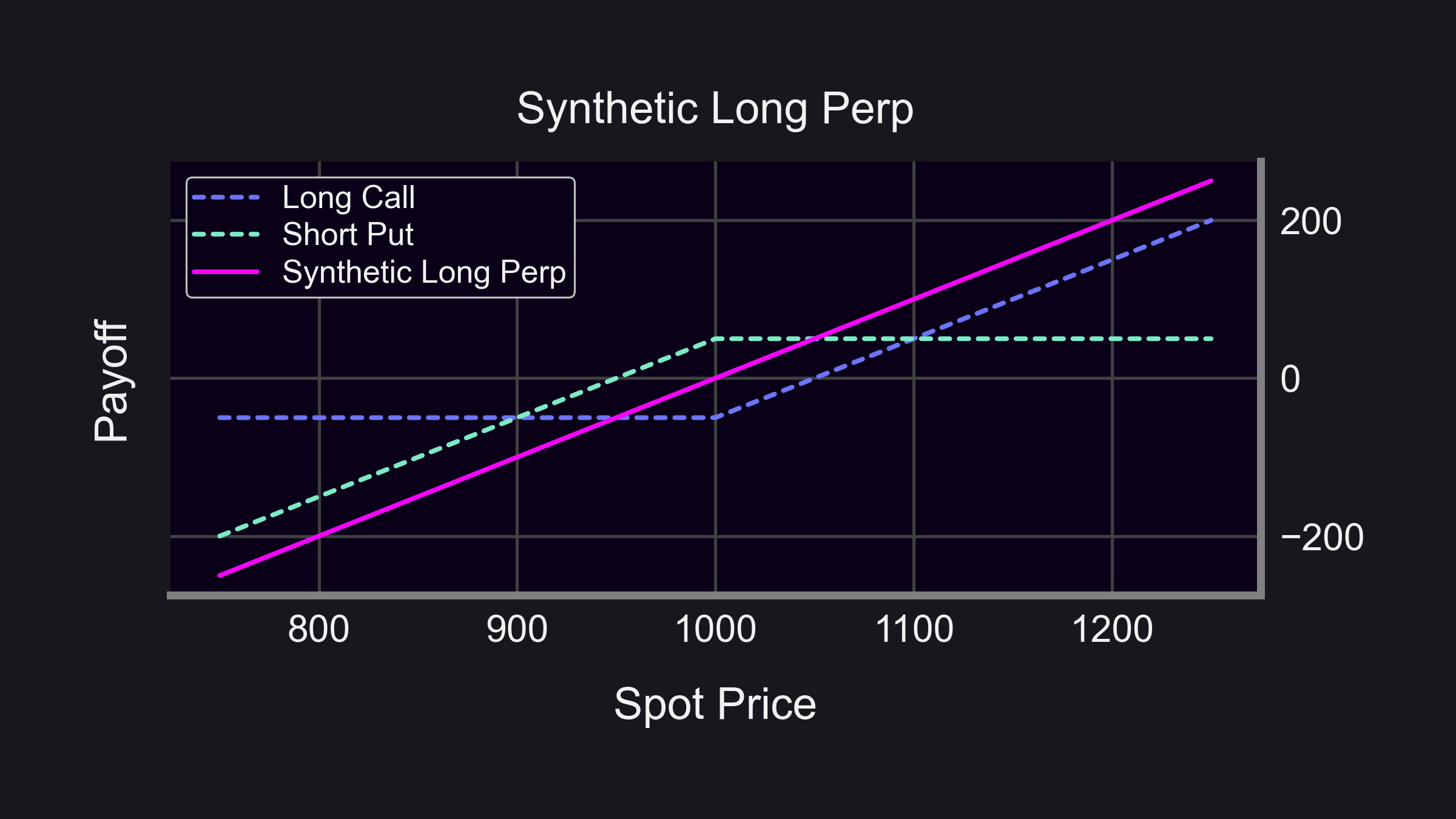

Options contracts offer a fundamentally different approach to risk management. By purchasing an option (either a call or put), you acquire the right, but not the obligation, to buy or sell an asset at a predetermined price within a set timeframe. This structure creates an asymmetric payoff: your potential loss is limited to the premium paid for the option, while upside (for buyers) remains theoretically unlimited.

This defined risk profile makes options particularly attractive for hedgers seeking protection against tail events, think sudden depegs or protocol failures that could wipe out unhedged positions. A popular strategy like the protective put lets you cap downside while retaining upside exposure, a crucial advantage during periods of heightened uncertainty across DeFi protocols and stablecoins.

The complexity of options pricing (involving variables like implied volatility and time decay) means these instruments require deeper expertise to deploy effectively. Liquidity can also vary widely depending on strike prices and expirations, though leading venues have seen marked improvements in recent months (source). For sophisticated investors willing to navigate this complexity, options unlock powerful tools for both directional bets and advanced hedging strategies like spreads and collars.

Key Differences: Perpetual Contracts vs. Options in Crypto

-

Expiration Date: Perpetual contracts have no expiration date, allowing positions to be held indefinitely, while options have a fixed expiration date that defines when the contract can be exercised.

-

Obligation vs. Right: Perpetual contracts require traders to buy or sell at market price when closing a position. Options give holders the right, but not the obligation, to buy (call) or sell (put) the asset at a predetermined price.

-

Risk Profile: Perpetual contracts expose traders to unlimited potential gains or losses depending on leverage and price movements. Options buyers face limited loss (the premium paid), while sellers may have unlimited risk.

-

Leverage and Capital Requirements: Perpetual contracts offer high leverage, enabling larger positions with less capital upfront. Options provide leverage through premium payments, typically requiring lower initial capital for buyers.

-

Cost Structure: Perpetual contracts involve variable funding rates paid between long and short positions. Options require an upfront premium, which is the maximum loss for buyers.

-

Complexity: Perpetual contracts are generally easier to understand and trade. Options involve greater complexity due to factors like the Greeks (delta, gamma, etc.) and various strategies.

-

Liquidity: Perpetual contracts are highly liquid on major exchanges (e.g., Binance, Bybit). Options liquidity varies by strike price and expiration, but is generally lower than perpetuals in crypto markets.

Comparing Hedging Effectiveness in Today’s Market Conditions

The decision between perpetuals vs options crypto hinges on your objectives:

- If you need continuous exposure with high liquidity: Perpetuals excel due to deep order books and no expiry constraints.

- If your priority is capping losses: Options provide clarity, the maximum you can lose is your upfront premium.

- If cost predictability matters: Options deliver fixed costs at entry; perpetuals’ funding rates fluctuate unpredictably over time.

- If you’re managing protocol failure risks: Options strategies (such as puts) let you hedge catastrophic downside without needing to sell core holdings, essential for long-term DeFi participants.

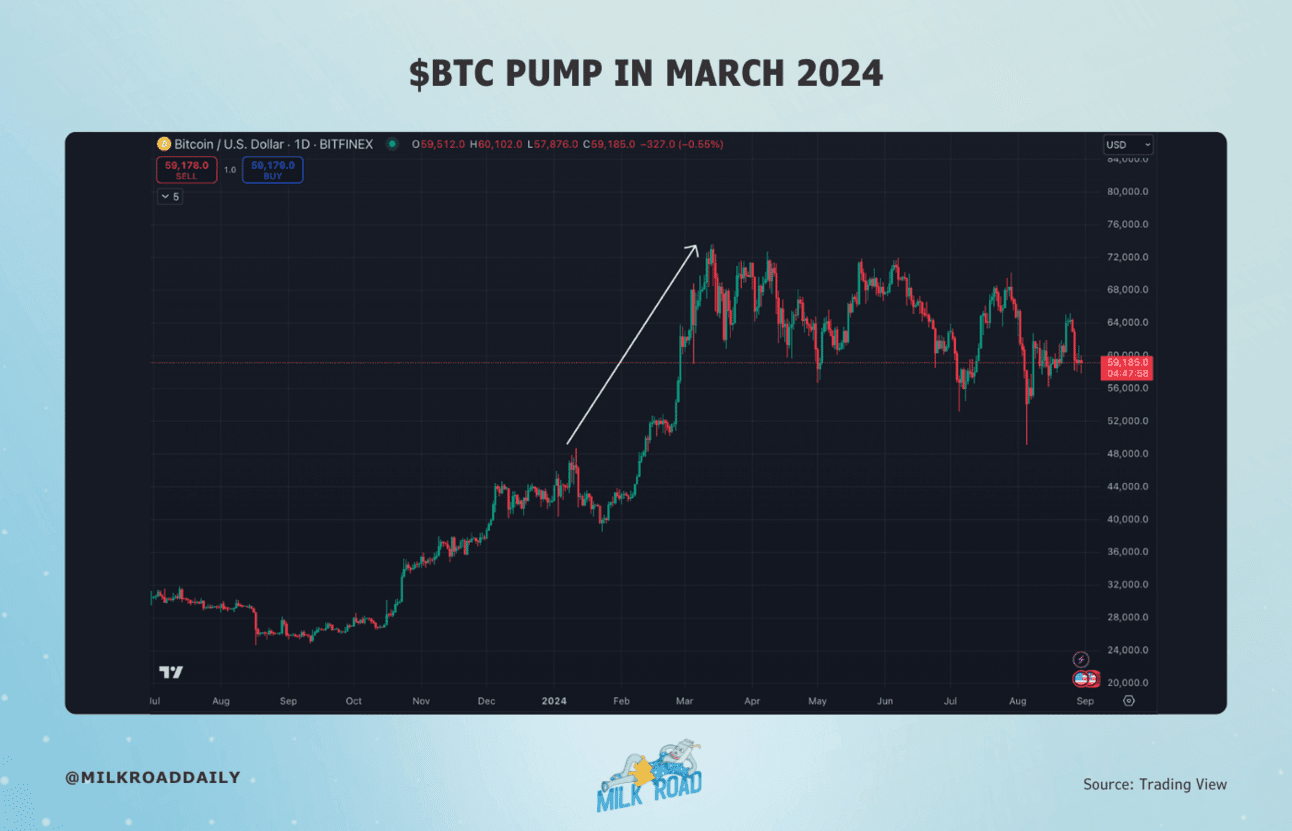

This comparative framework becomes even more relevant when considering sudden depegs or smart contract exploits, the very scenarios where robust DeFi risk management tools are essential. As we move deeper into 2025’s volatile market cycles, understanding these nuances will be critical for safeguarding capital while maintaining strategic flexibility.

Market participants are increasingly leveraging both instruments in tandem, constructing layered hedges that combine the continuous coverage of perpetual contracts with the defined risk of options. For instance, a portfolio manager might hold a perpetual short to offset long spot exposure while simultaneously purchasing out-of-the-money put options as insurance against extreme downside events. This hybrid approach balances cost efficiency with disaster protection, particularly valuable in an era where stablecoin depegs and protocol failures can unfold overnight.

However, no strategy is without trade-offs. While perpetuals offer unmatched liquidity on major pairs and the ability to adjust positions instantly, they demand constant monitoring and margin management. Sudden price swings can trigger liquidations before options-based hedges even come into play. Conversely, options require upfront premium payments and may suffer from slippage or illiquidity at less popular strikes or expiries, factors that can erode their effectiveness if not carefully managed.

Strategic Considerations for DeFi Users

For DeFi users and institutional allocators alike, the choice between perpetuals vs options crypto often comes down to time horizon, capital efficiency, and operational bandwidth:

- Short-term traders may gravitate toward perpetuals for their real-time flexibility and leverage.

- Long-term investors, especially those exposed to protocol-specific risks or stablecoin depegs, frequently prefer options for their ability to lock in protection over defined periods.

- Risk-averse participants, such as treasuries or DAOs safeguarding reserves, often allocate a portion of capital to both instruments, perpetuals for ongoing market alignment and options for black swan protection.

Navigating funding rate volatility: During market stress, funding rates on perpetual contracts can spike dramatically, sometimes exceeding the annualized cost of comparable option premiums. Monitoring these dynamics is essential for effective risk budgeting.

The evolution of DeFi risk management tools now enables retail users to access sophisticated strategies once reserved for institutional desks. Automated vaults, structured products built atop both perpetuals and options, are democratizing access to robust hedging frameworks, empowering users to defend against market shocks without constant manual intervention.

Top Tips for Hedging Crypto Volatility: Perpetuals vs. Options

-

Assess Your Risk Tolerance: Options limit losses to the premium paid, making them ideal for risk-averse traders. Perpetual contracts carry unlimited loss potential and require strict risk controls.

-

Consider Time Horizon: Perpetual contracts have no expiration date, allowing for flexible, long-term hedges. Options are best for defined timeframes due to their fixed expirations.

-

Evaluate Cost Structures: Options require an upfront premium, which is your maximum loss as a buyer. Perpetuals involve ongoing funding rates that can add up over time, especially in volatile markets.

-

Match Instrument to Market Conditions: Options excel in volatile markets, enabling strategies like protective puts or straddles. Perpetuals are more effective for directional bets or when you expect steady trends.

-

Check Liquidity and Platform Reputation: Use established exchanges like Binance, OKX, or Deribit for deep liquidity and robust risk management tools when trading either instrument.

The Bottom Line: Adapting Hedging Playbooks Amid Rising Uncertainty

No single instrument offers a panacea against crypto’s notorious volatility. The optimal hedge depends on your unique risk tolerance, investment objectives, and operational constraints. As digital asset markets mature, and as high-profile depegs or protocol incidents remind us of persistent tail risks, combining the strengths of both perpetual contracts and options is emerging as best practice among sophisticated allocators.

The future will favor those who proactively tailor their playbooks using data-driven analysis and adaptive strategies. Whether you’re defending against sudden price collapses or seeking tactical alpha in turbulent conditions, mastering these tools will be central to long-term resilience in decentralized finance.